Everyone knows that penny-pinching may help handle our budgets and stretch these hard-earned {dollars}. However some issues are important, like staying wholesome. However that doesn’t cease frugal people from making blunders and neglecting their well-being simply to avoid wasting more money. Need to uncover some widespread methods thrifty individuals may danger their well being for some dough? People in a web based group share some; listed here are 12 of our favorites.

1. Ignoring Important Well being Verify-ups

Life can get busy, and typically we postpone issues that needs to be a prime precedence. With regards to your well being, skipping these essential check-ups is unwise. Overlooking medical appointments is a giant no-no, if not for another cause than you’ll spend far more on treating one thing that might have been prevented.

2. Not Investing in Good Mattresses

Uncomfortable mattresses and bedding can imply poor sleep, and lack of high quality sleep could make you cranky and unable to pay attention. The consequences of power sleep deprivation prolong past simply feeling drained.

Analysis has proven that extended sleep deficiency is related to dementia, coronary heart illness, diabetes, and weight problems. Moreover, it will probably compromise your immune system, contribute to despair and stress, and even trigger ache.

3. Utilizing Low-High quality Footwear

Ever heard the saying, “Don’t low-cost out on something that goes between you and the ground”? That features chairs, beds, and particularly sneakers. Sacrificing your consolation and well being for a number of further bucks isn’t price it. One individual writes, “The shoe factor is so essential.” They discovered the onerous manner, ending up with “tendinitis in each toes, straight affecting my high quality of life for years” as a result of skimping on sneakers. They wouldn’t thoughts spending that further $100 now.

4. Making an attempt Dangerous DIY Tasks

Making an attempt dangerous duties with out correct coaching or energy can result in catastrophe. Take electrical work, as an example. Many individuals attempt to save a buck by doing electrical work with out expertise.

Certain, some DIY can work for minor duties when you’re assured. Nevertheless, a failure can have catastrophic penalties relating to main duties. Rent a licensed, insured skilled for the massive stuff. And bear in mind to ask for proof of insurance coverage!

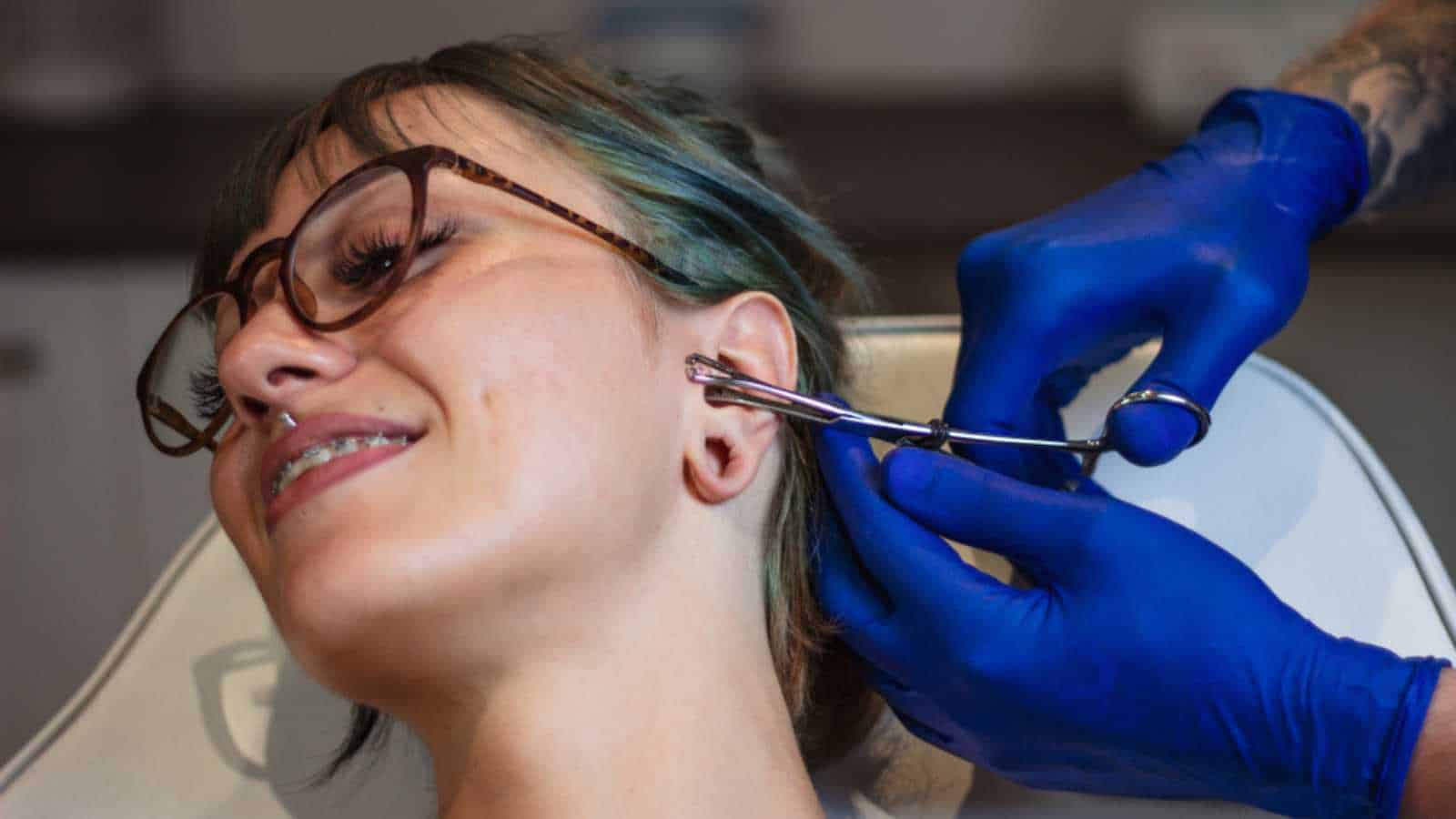

5. Cut price Piercings Aren’t Value It

Should you’re a piercing fanatic, keep away from locations that compromise security for financial savings. Analysis exhibits poorly achieved piercings can result in nasty infections — not well worth the couple of dollars saved.

Go for knowledgeable; their costs are barely larger than jewellery at “finances” parlors. Their “free piercings, simply purchase the jewellery” deal? It’s intelligent advertising, nevertheless it’s not well worth the danger.

6. Not Taking Preventive Measures

Prevention is at all times higher than remedy. Give it some thought — taking preventive measures like sustaining your oral hygiene with common brushing, flossing, and mouthwash is far more reasonably priced than coping with hefty dental payments afterward.

After a watch examination, take into account trying out on-line distributors. They’re a budget-friendly possibility cheaper than a conventional optometrist go to. Additionally, don’t underestimate the facility of routine blood work and easy workouts like strolling. These small steps can go a protracted solution to stop potential well being points.

7. Consuming Low-cost Junk Meals

This phrase holds a ton of reality along with your weight loss program. Consider meals as your final preventive drugs. We’re not saying maintaining a healthy diet will grant you immunity from each ailment.

Nevertheless, chowing down on junk meals units you up for a parade of well being points. Choosing a nutritious weight loss program isn’t only a fad; it’s a strong selection to enhance your well-being.

8. Neglecting Self Care

Recognizing when to deal with your self and your family members is crucial. Even when you’re a reigning frugality champion, there’s a degree the place attempting to deal with every little thing solo can go away you drained and burnt out. Certain, saving and investing are essential steps towards monetary safety.

However a life well-lived is sprinkled with little luxuries. A satisfying life entails savoring a flowery dinner out or indulging in a well-deserved getaway at times. There needs to be a steadiness of frugality/saving after which spending.

9. Shopping for Outdated Vehicles

Accumulating basic, vintage, or classic autos is a singular ardour. Nevertheless, there’s a superb line between appreciating timeless wheels and skimping on an outdated, worn-out jalopy. Trendy automobiles are designed with top-notch security options.

Need to cruise the streets? Your security ought to take the driving force’s seat. Don’t let penny-pinching steer you in the direction of extra headache than horsepower. That trusty ’95 Camry could also be budget-friendly, however “splurging” on a 2012 mannequin means investing in developments in expertise and security.

10. Not Paying for a Fitness center Membership

Lighter exercise classes are okay in case your aim is solely to spice up your well being. Should you’re all about bulking up or tackling intricate routines, that’s when the sport modifications. Making an attempt complicated exercises sans skilled steering is dangerous enterprise.

Having an teacher or rubbing shoulders with skilled lifters is like having a GPS in your exercise. Making an attempt intense routines solo may result in muscle tears or joint mishaps.

11. Skipping Breakfast

Skipping meals isn’t unique to the frugal folks. We get it. However typically, attempting to economize results in skipping meals. And guess which meal usually will get the snub? Sadly, right this moment’s hustle and bustle has pale the breakfast custom into the background.

Individuals don’t notice skipping breakfast is like taking a highway journey with out filling the fuel tank. No breakfast equals a sluggish engine and a drop in productiveness and might invite power ailments like diabetes and weight problems. Over time, your reminiscence and coronary heart may very well be dealt a not-so-favorable hand.

12. Dwelling in Borderline Harmful Situations

Discovering an reasonably priced house is undoubtedly a victory, however with hire costs hovering, there’s usually a catch. Should you’re paying peanuts, likelihood is you’re waving goodbye to one thing important.

Think about this actual discuss: “I reside in such a nasty space proper now, however my hire is so low-cost. Crime is so excessive, although, that I’m at all times on alert. I can’t go outdoors at evening, and it’s loud and trashy,” one particular person shares. Your security and well-being are the VIPs of the present. Sacrificing your peace and happiness to save lots of a couple of dollars on hire isn’t a good trade-off.

35 Confirmed Methods to Save Cash Each Month

Many individuals imagine it’s unattainable to economize. Or, they suppose saving $20 or $50 a month received’t quantity to a lot. Each are incorrect. There are lots of easy money-saving suggestions that may add as much as large financial savings. You simply have to start out one, then one other, to extend your financial savings.

Methods to Save Cash Each Month

21 Superior Passive Earnings Concepts

Passive earnings is a wonderful solution to construct wealth. Fortunately, many concepts solely require a bit of cash to start out. Pursue these choices to develop actual wealth.

Greatest Passive Earnings Concepts to Construct Actual Wealth

How one can Watch School Soccer Video games With out Cable

You don’t want a dear cable contract to observe reside faculty soccer video games. You may watch your favourite crew and save large cash. Listed below are the highest methods to do it.

Methods to Stream School Soccer Video games With out Cable

11 Jobs That Pay $20+ an Hour and Don’t Require a Diploma

A school diploma is terrific, nevertheless it’s not at all times essential to earn a very good residing. Seek the advice of this information to determine different methods to earn not less than $20 an hour with no faculty diploma.

Jobs That Pay $20 an Hour and Don’t Require a Diploma

How one can Construct an Emergency Fund

Having a fully-funded emergency fund is the gold normal of private finance. Nevertheless, it’s not at all times straightforward to realize. Observe these steps to start out and develop one that offers you peace of thoughts.

How one can Construct an Emergency Fund

This thread impressed this publish.

Associated