Cheapskates typically get a nasty rap. Should you look intently at how they reside, you’ll discover many smart monetary rules. Listed below are 12 issues cheapskates by no means do this you must keep away from as nicely.

Spending Emotionally

All of us have dangerous days, and all of us have occasions to rejoice. A cheapskate spends judiciously, not emotionally. Working towards the previous is the highway to saving cash. The latter results in losing cash, and sometimes debt.

Paying Full Retail

A frugal individual understands that full value shouldn’t be for them. As a substitute, they search for gross sales, use coupons, or another technique to save on their purchases. We’re smart to do comparable.

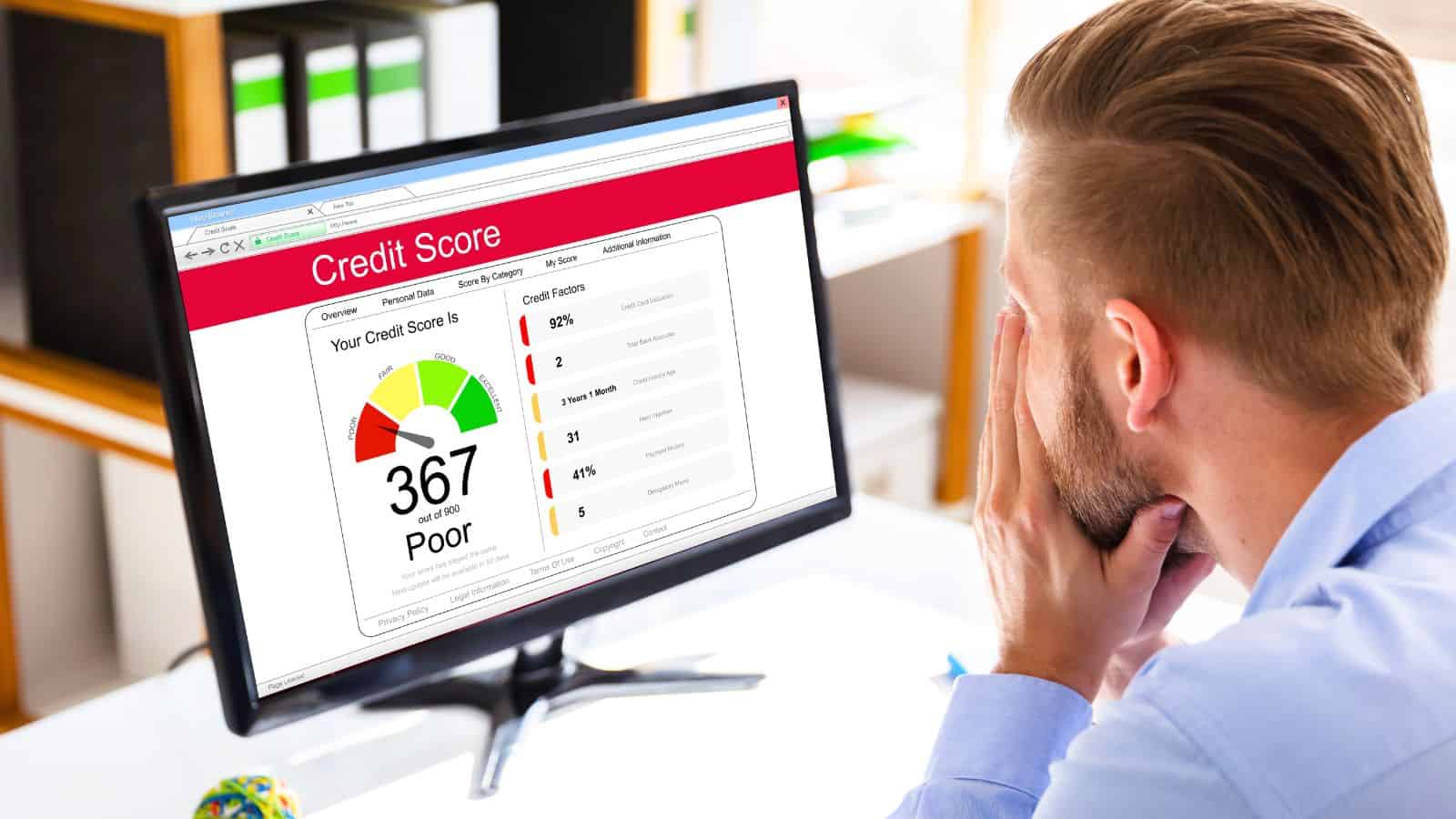

Ignoring Their Credit score Rating

A cheapskate is aware of that once they need to borrow cash, they need the perfect price potential. As such they watch their credit score rating to make sure they’re doing what’s wanted to maintain it excessive.

Should you plan on borrowing cash sooner or later, or carry out different monetary transactions, ignoring your credit score rating isn’t smart.

Carrying A Credit score Card Stability

Frugality and high-interest debt? That’s an oxymoron. Cheapskates pay their playing cards in full each month, in the event that they use a card. In addition they make the most of rewards bank cards to get one thing again for what they do need to spend.

Throwing Away Objects They Can Use

Cheapskates like to reuse objects to stretch their price range. Positive, it will probably go too far. Nevertheless, they at all times search for different methods they’ll reuse an merchandise earlier than tossing it.

If they’ll’t, they decide if they’ll promote the merchandise and reinvest the proceeds to switch it.

Staying Away From Investing

Frugal individuals know the significance of saving for the long run and so they don’t run from it. Moreover, they search for methods to do it as low cost as potential.

If you wish to develop a large portfolio, you’re smart to begin now and hold administration prices at a minimal.

Maintaining Cable

Cheapskates and cable? That’s an anathema. True cheapskates use an over-the-air antenna to get their native networks, get motion pictures from the library, and use free streaming providers to observe TV reveals and films.

You are able to do comparable and save upwards of $200 a month.

Shopping for Bottled Water

Bottled water is handy, however a frugal individual sees it as pointless. As a substitute, they buy a Brita Water Filter and a reusable water bottle.

The common American spends $100 a 12 months on bottled water. That’s $100 a cheapskate can put in the direction of different wants.

Spoiling Their Kids

Kids are a present. Cheapskates don’t bathe them with presents as that provides unnecessary expense. And, they search for methods to contain them in doing chores round the home. With an allowance, they assist their youngsters study to see the worth of a greenback.

We must always comply with go well with to assist put together youngsters for his or her future.

Upgrading Their Telephone Yearly

It’s not very frugal to improve to the newest iPhone yearly. A cheapskate makes use of their cellphone till it dies, then replaces it with a modest alternative.

Whereas the newest know-how might be enjoyable, we must always emulate this to maintain our price range in test.

Shopping for One thing Simply As a result of it’s on Sale

Buying an merchandise that’s on sale is a terrific approach to economize. Nevertheless, a cheapskate by no means buys an merchandise simply because it’s on sale. There’s a distinction as shopping for it as a result of it’s on sale can result in wasteful spending.

Don’t give into the advertising and marketing ploys and also you’ll be richer.

Skipping Free Occasions

True frugality takes benefit of free occasions. Going to the film is enjoyable, but it surely’s costly, and finest accomplished sparingly. A cheapskate seems to be totally free leisure like outside live shows, festivals, and extra.

You are able to do much like stretch your leisure price range and lower prices.

Methods to Reduce the Twine on Cable or Satellite tv for pc

File numbers of Individuals are chopping the wire on cable and satellite tv for pc. This information reveals one of the best ways to finish your contract and substitute it with a high streaming service.

Methods to Reduce the Twine on Cable or Satellite tv for pc

Methods to Change into Wealthy Shortly

Everybody desires to grow to be wealthy rapidly. Whereas not at all times potential, there are respectable methods to grow to be rich. Comply with these strategies and also you’ll be on the highway to riches.

Methods to Change into Wealthy in 9 Easy Steps

Methods to Watch ESPN With out Cable

Stay sports activities hold many individuals in a cable contract. There’s no want for that. Listed below are six methods to observe reside sports activities on ESPN and not using a nasty cable contract.

Methods to Watch ESPN With out Cable

Methods to Begin Investing With $500 or Much less

You don’t want some huge cash to begin investing. It’s potential to begin with a number of hundred {dollars}, or much less. Benefit from time and begin rising your cash as quickly as potential.

Methods to Begin Investing With $500 or Much less

Get Money Again on Your Fuel Purchases

It’s painful to refill on the pump. Fortunately, there’s an app for that! With Upside you will get rebates in your gasoline purchases that you could redeem for money.

Upside App Evaluate: Is the Fuel App Value it?

Associated