This publish might include affiliate hyperlinks. See our affiliate disclosure for extra.

It’s the vacation season and also you’re most likely already feeling super-strapped for money. Nevertheless, now’s top-of-the-line occasions of yr to make enterprise purchases.

Why?

As a result of vacation gross sales are likely to drive costs down AND you possibly can doubtlessly lower this yr’s tax invoice with deductions in addition.

However earlier than you go spending your total financial savings account, bear in mind this rule of thumb:

When you want it, purchase it now. When you don’t want it, don’t purchase it.

Undecided if it’s a “good” buy? Learn extra right here:

You additionally have to know these few technical particulars:

- The fee should be recorded on or earlier than December 31. (It’s not ok that you just’ve acquired the bill.)

- You don’t truly must have the merchandise(s) in hand.

Okay, so let’s get to buying!

**Be aware: I’m not an accountant, and whereas generally that is sound recommendation, it is best to at all times verify along with your accountant or monetary advisor on how finest to reduce your tax invoice.**

1: Electronics

When you want a brand new laptop, laptop computer, cellular phone, pill, printer, Wacom pill, and so on., now’s the time!

Electronics traditionally get discounted severely for the vacation and post-holiday gross sales to make method for subsequent yr’s fashions.

2: Software program & apps

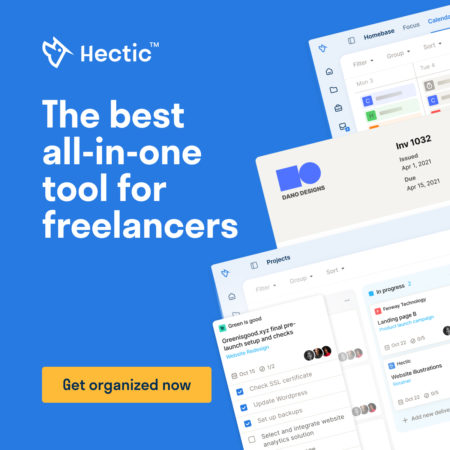

Get that newest model of artistic software program, improve your working system, renew your MailChimp (or related) subscription, or buy that productiveness app you’ve had your eye on.

3: Workplace furnishings and décor

This consists of desks, chairs (super-important to discover a comfy one!), artwork, storage, shelving, and the like.

4: Workplace provides

Normally these are fairly small purchases, however each little bit helps.

And don’t overlook about printer ink, which may add up if you are going to buy sufficient for all the yr (even when that’s solely 2 cartridges!).

5: Advertising and marketing

When you’re going to be purchases spots in publications or having a brand new web site created, pay for it now!

Not solely will you get the deduction on this yr’s tax invoice, you’ll additionally pressure your self to undergo with it as a substitute of placing it off since you’re too busy.

Why this is sensible financially

You is likely to be saying, “What about subsequent yr’s tax invoice? Aren’t I simply kicking that may down the street?”

YES. Sure you’re.

However that’s form of the entire sport in taxes: pay the least in taxes you possibly can this yr, and fear about subsequent yr subsequent yr.

The hope is finally one thing will come up (like needing a brand new automotive, for instance, or a change within the tax code) that can erase a couple of years of pushing the tax invoice off.

[Tweet “Pay the least in taxes you can this year, and worry about next year next year. #businesstaxadvice”]

How are you minimizing your tax invoice this yr?

Preserve the dialog going…

Over 10,000 of us are having day by day conversations over in our free Fb group and we might like to see you there. Be part of us!