Because the 2023 vacation season approaches, retailers and customers brace for a market formed by inflation considerations, altering procuring behaviors, and rising applied sciences.

The impression of worldwide financial situations, the persistence of inflation, the rise of purchase now, pay later choices, and buyers’ ready for reductions will impression the 2023 vacation procuring.

What follows are 5 holiday-shopping predictions, and a report card, if you’ll, grading my predictions final yr.

Right here’s an AI -generated Santa Claus as a fortune teller predicting how the 2023 vacation procuring season will end up.

1. Vacation Spending Grows Much less Than 5%

World financial situations should not nice in 2023. The primary half of the yr was just like 2022, and, in response to Numerator, a analysis agency, greater than half of Individuals are involved about inflation and the specter of additional financial slowdowns, with 22% of “vacation celebrators” saying inflation considerations would have a “vital” impression on their procuring, and 31% anticipating it to have a “reasonable impression.”

Individually, Salsify, a product engagement platform, estimated that 90% of worldwide customers in 2023 are “adopting cost-saving behaviors.”

With this in thoughts, I predict little vacation gross sales progress — under 5%.

Suppose total inflation grows round 6% annualized within the final quarter of 2023. In that case, this prediction implies that whereas complete gross sales would develop, that progress won’t replicate an actual improve since inflation would have pushed up the greenback quantity spent.

This prediction would buck a development. In 2022, most retail prognosticators anticipated complete U.S. retail gross sales to develop lower than 6% when, in reality, retail gross sales rose greater than 8%.

2. Purchase Now, Pay Later Is 9% of Orders

Some buyers will flip to purchase now and pay later financing to make last-minute purchases, peaking at a report 9% the week earlier than Christmas.

This prediction represents a big however probably improve from 2022 when purchase now, pay later gross sales represented 7% of all on-line orders.

Sadly, rising shopper debt is usually a symptom of underlying financial issues. Within the first quarter of 2023, complete family debt in the USA, for instance, reached $17 trillion, a report excessive. This rising debt represented a 0.9% improve from the fourth quarter of 2022 and is $2.9 trillion greater than on the finish of 2019, earlier than the pandemic recession.

In case your ecommerce store shouldn’t be at the moment providing a purchase now, pay later possibility, you may wish to add one.

3. Discounting Drives Gross sales

In 2022, reductions and offers had been the heroes of the vacation procuring season.

Rising inflation was anticipated to maintain many patrons out of the market, however retailers slashed costs, attractive present consumers.

On Black Friday, when U.S. vacation gross sales hit $11.3 billion, in response to Adobe, electronics had been usually provided at a mean 29.8% low cost. Toys could possibly be had that day for about 33.8% off, once more in response to Adobe.

Discounting on Black Friday shouldn’t be new. However the reductions in 2022 had been longer and comparatively deeper in lots of circumstances. Most retailers provided double-digit reductions — as much as 34%.

Whereas inflation charges are falling within the U.S. and worldwide, don’t be shocked if discounting continues in 2023. Retailers shall be tempted to repeat what labored final yr, anticipating price-sensitive buyers.

4. Consumers Await These Reductions

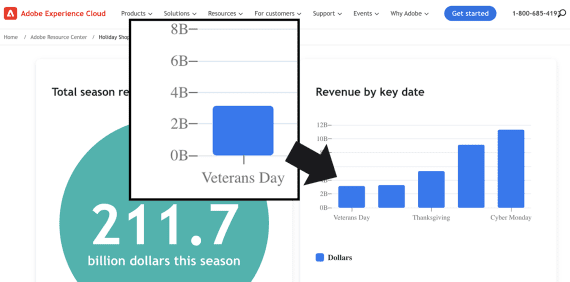

For years, Christmas procuring has begun earlier within the season. As proof, be aware that Adobe included Veterans Day, November 11, on its vacation procuring report in 2022.

However what if 2022’s comparatively heavy discounting has taught buyers to play a ready recreation? For instance, within the U.S., toy costs had been the bottom — averaging a 33.5% low cost— on November 29 and 30, 2022, in response to Adobe.

Therefore some gift-givers will probably wait. They may begin shopping for early however may unfold that procuring out longer, ready for last-minute offers.

5. Generative AI Impacts Product Discovery

This prediction is hard to measure however is nonetheless a development that may impression vacation procuring. Shoppers will use generative AI on Google and through ChatGPT to search out Christmas items through the 2023 vacation procuring season.

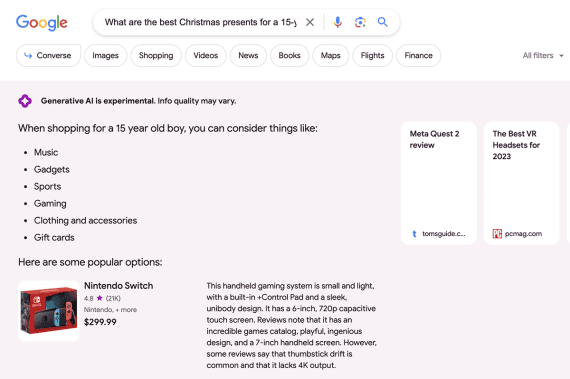

Most buyers begin their hunt for present concepts with a search engine, however now for a lot of Google customers, a present concept question will produce an AI response. Take my latest Google search, for instance, looking for present concepts for a 15-year-old boy.

When buyers question Google, “What are one of the best Christmas presents for a 15-year-old boy?” they could obtain each AI-generated and extra acquainted outcomes. Click on picture to enlarge.

Moveover, count on some buyers to ask ChatGPT. I entered this immediate:

I wish to shock my spouse with an important Christmas present this yr, however I solely have a price range of $150. My spouse loves cooking. She likes wine. And he or she reads loads of historic fiction. She hates popular culture and has not watched a film in years. Please suggest some items.

ChatGPT responded with a listing of concepts, together with a cooking class, high-quality kitchen devices, a cookbook, and extra.

AI’s impression on procuring is unclear however actual.

Final Yr’s Predictions

Each autumn since 2013, I’ve predicted ecommerce gross sales for the approaching vacation season. Right here’s how my 2022 forecast fared.

U.S. retail gross sales will develop lower than inflation — unsuitable. In 2022, complete U.S. retail gross sales for the yr reached $7 trillion, up some $500 billion from 2021. That works out to be an 8.1% improve. In the meantime, U.S. inflation rose 6.5%.

Inflation tops 6% worldwide by Christmas — appropriate. Worldwide annualized inflation fell to six.5% in December however was nonetheless above the mark predicted in June 2022. In complete, world inflation for 2022 was 8.75%, the best in 26 years.

Market gross sales will rise — appropriate. U.S. ecommerce gross sales rose simply 3.5% through the vacation season, in response to Adobe. It was nonetheless the largest-ever vacation season when it comes to gross sales quantity however had comparatively sluggish progress. In 2021, for instance, U.S. ecommerce gross sales rose 17%. By comparability, Amazon market vacation gross sales jumped 9% year-over-year.

Vacation purchases will come early — appropriate. In keeping with Deloitte, greater than half of American buyers began shopping for earlier than Black Friday and Cyber Monday.

Cellular commerce will develop 20% — unsuitable. Relying on the supply, gross sales on cell gadgets elevated by roughly 8% through the 2022 vacation season.