If you happen to handle your individual portfolio, understanding the true threat and return traits of your holdings is crucial to attaining your monetary targets. By leveraging portfolio evaluation software program to watch these metrics, buyers can save time and enhance long-term outcomes. Similar to buyers are occupied with completely different sorts of metrics, although, platforms differ within the forms of evaluation supplied. On this article, we’ll check out six of one of the best portfolio evaluation instruments in the marketplace right this moment and consider which areas every software excels in.

Fast Evaluate

BEST PERSONAL BALANCE SHEET

Kubera

Kubera is without doubt one of the greatest portfolio evaluation instruments for buyers who view their portfolios as encompassing all their belongings and liabilities, not simply their monetary investments. Study extra

- Strengths: Asset-liability administration, consumer interface, direct dealer integration.

- Weaknesses: Restricted statistical evaluation, value.

- Monetary Planning: Asset-liability administration, share portfolio with advisor, household wealth monitoring

- Statistical Evaluation: Asset returns

- Basic Evaluation: None

- Screening: None

- Dealer Integration: Sure

- Further Options: Automotive valuation, area valuation, lifeless man’s change

| Pricing | |

|---|---|

| Kubera Private | $150/yr |

| Kubera Household | $225/yr |

BEST FREE TOOL

Empower

Empower is a free platform that focuses on monetary planning, together with web value, budgeting, and retirement evaluation. Study extra

- Strengths: Value, monetary planning analytics, direct dealer integration

- Weaknesses: Restricted statistical and basic evaluation, advisory upselling techniques

- Monetary Planning: Budgeting, retirement planning, web value tracker

- Statistical Evaluation: Fundamental Monte Carlo and environment friendly frontier evaluation

- Basic Evaluation: None

- Screening: None

- Dealer Integration: Sure

- Further Options: Goal allocations to watch drift

Pricing: Free

BEST STATISTICAL ANALYSIS

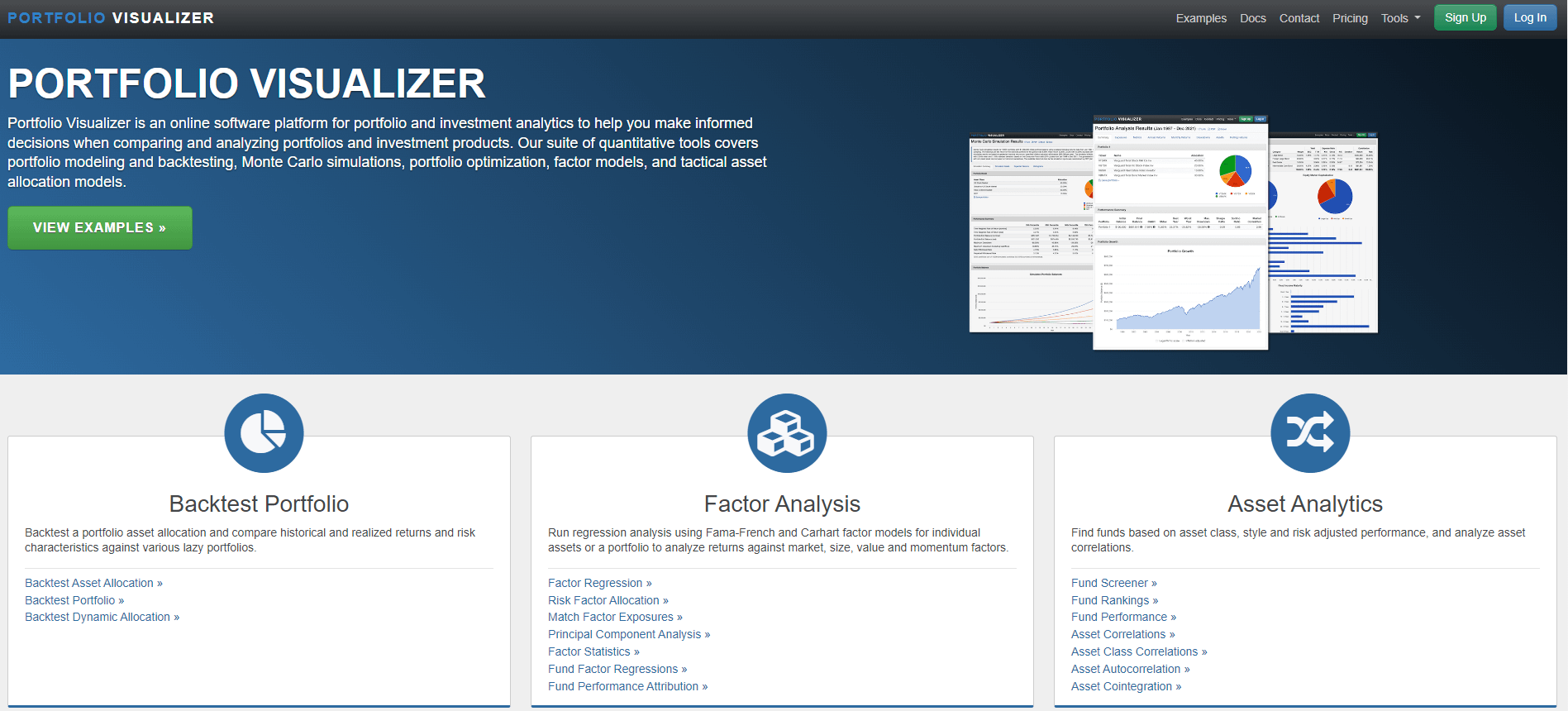

Portfolio Visualizer

Portfolio Visualizer is without doubt one of the greatest portfolio evaluation instruments for buyers occupied with statistical optimization. The platform contains superior backtesting, Monte Carlo simulations, and extra. Study extra

- Strengths: Statistical performance, visualizations

- Weaknesses: No direct dealer integration, value

- Monetary Planning: None

- Statistical Evaluation: Portfolio backtesting, Monte Carlo simulation, optimization, timing fashions

- Basic Evaluation: Fundamental asset analytics

- Screening: None

- Dealer Integration: No

- Further Options: Custom-made PDF experiences

| Pricing | |

|---|---|

| Free Plan | – |

| Fundamental | $19/month |

| Professional | $39/month |

BEST FUNDAMENTAL ANALYSIS

Morningstar Investor

Morningstar Investor is among the many greatest portfolio evaluation instruments for basic evaluation and analysis and is designed for buyers who take a value-based method. Study extra

- Strengths: Basic analytics, direct dealer integration, analysis entry

- Weaknesses: Restricted statistics, value

- Monetary Planning: None

- Statistical Evaluation: Asset efficiency

- Basic Evaluation: Portfolio valuation ratios, inventory valuation ratios

- Screening: Inventory screener, together with profitability, valuation, measurement standards, and extra

- Dealer Integration: Sure

- Further Options: Inventory intersection evaluation, X-ray evaluation

Pricing: $34.95/month

BEST ESG FOCUSED

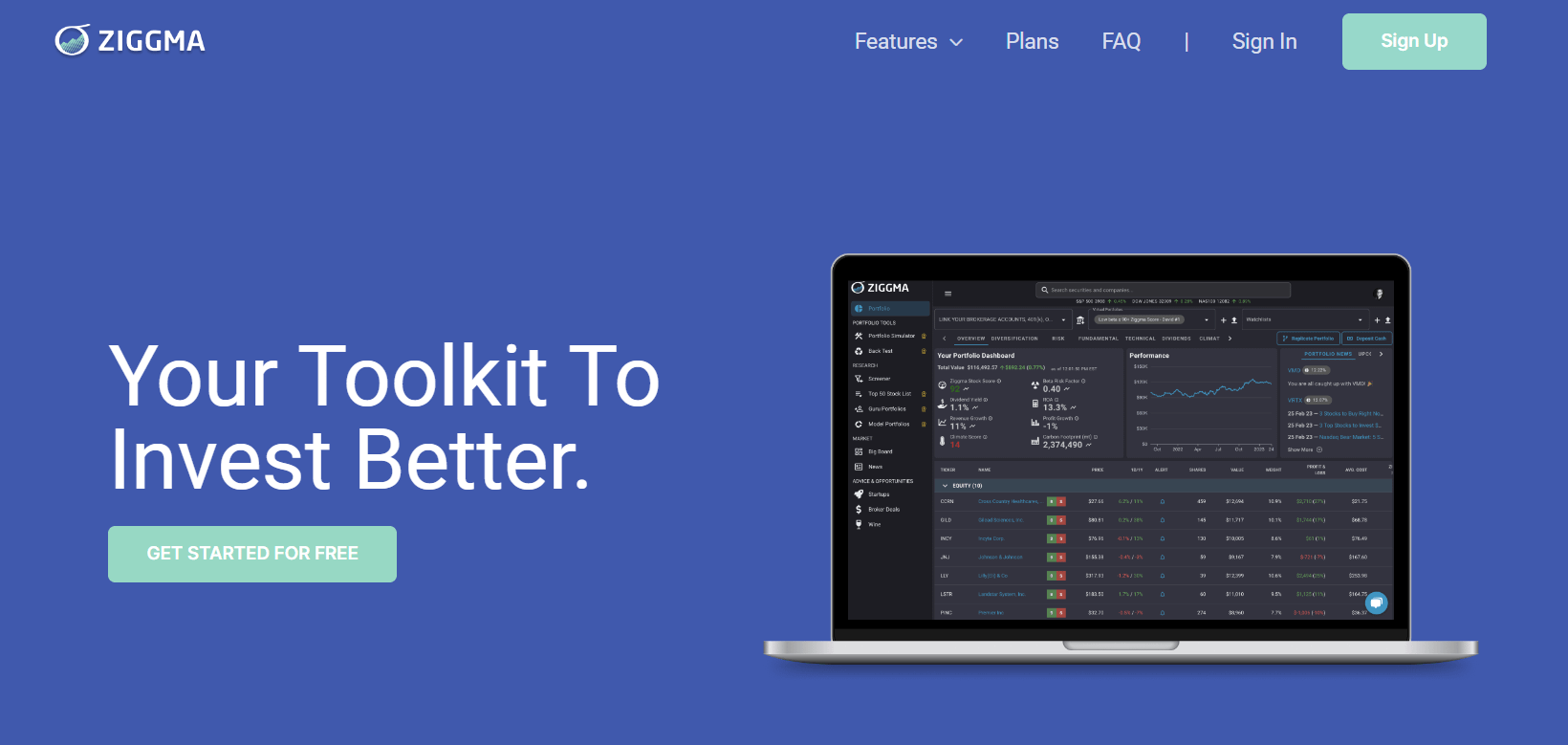

Ziggma

Ziggma is an effective basic analytics platform however stands out as among the finest portfolio evaluation instruments for ESG-conscious buyers, together with metrics for carbon depth and environmental rating in screeners. Study extra

- Fundamental Plan: $9.90/month

- Strengths: Value, good technical and basic evaluation, ESG focus

- Weaknesses: Crowded UI

- Monetary Planning: None

- Statistical Evaluation: Portfolio simulator backtest

- Basic Evaluation: Valuation metrics for ETFs and shares, saved analysis, curated newsfeed

- Screening: ETF screener and inventory screener, together with quant scoring

- Dealer Integration: Sure

- Further Options: Local weather rating, carbon depth metrics, guru portfolios

| Pricing | |

|---|---|

| Free Plan | – |

| Premium Plan | $9.90/month |

BEST FOR DIVIDENDS AND TAXES

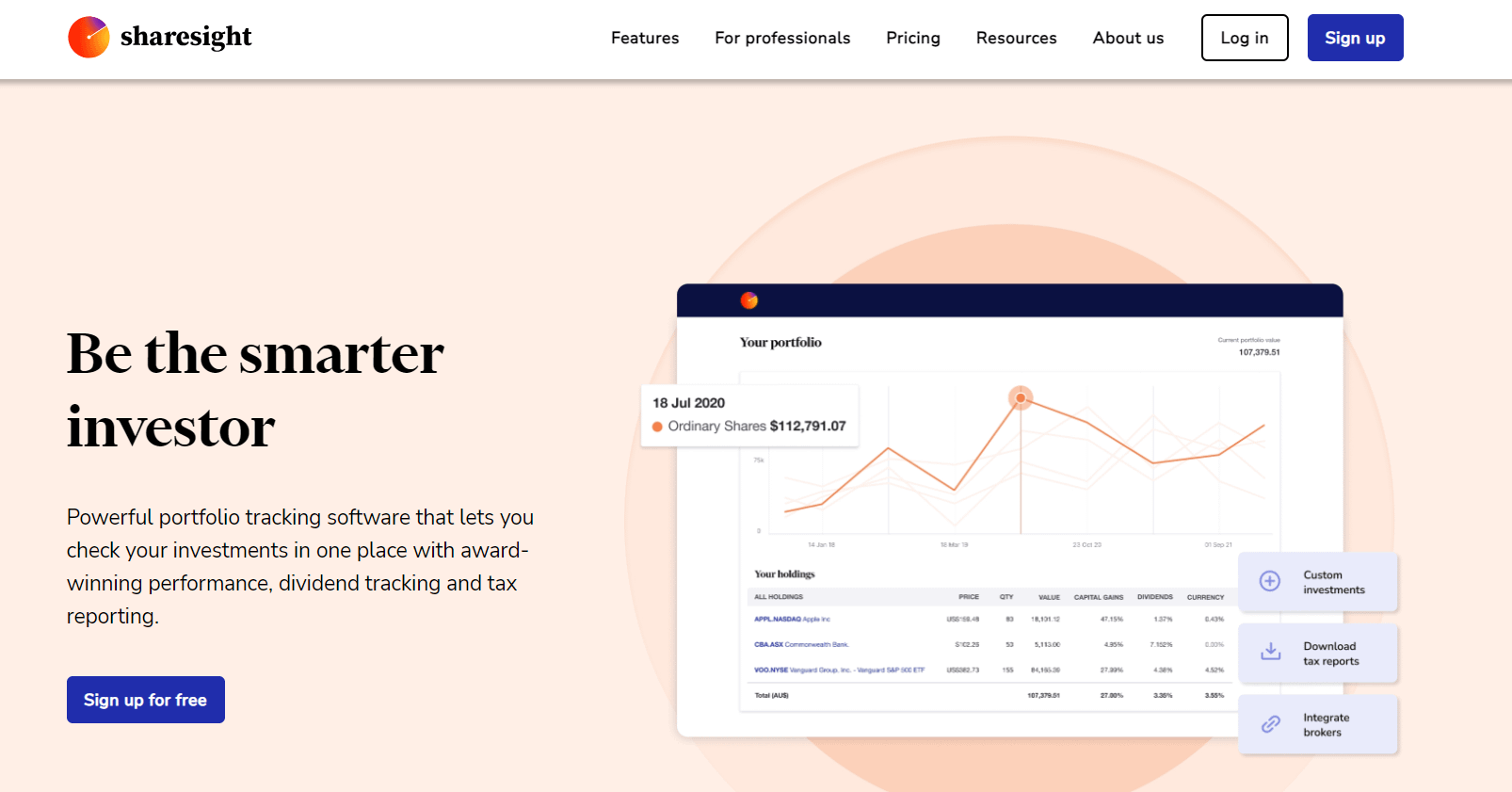

Sharesight

Sharesight is among the many greatest portfolio evaluation instruments for worldwide buyers, making dividend monitoring and tax administration seamless. The platform additionally affords a lovely UI and good visualizations. Study extra

- Strengths: Taxes and dividends, backtesting, and optimization

- Weaknesses: Restricted threat metrics

- Monetary Planning: Tax administration, future dividend revenue monitoring

- Statistical Evaluation: Benchmarking, variety evaluation, distribution evaluation

- Basic Evaluation: Computerized dividend administration, multi-currency valuation, multi-period valuation

- Screening: None

- Dealer Integration: Sure

- Further Options: Restricted holdings for decrease tiers, limitless holdings for increased tiers

| Pricing | |

|---|---|

| Free Plan | – |

| Starter | $15/month |

| Investor | $24/month |

| Skilled | $31/month |

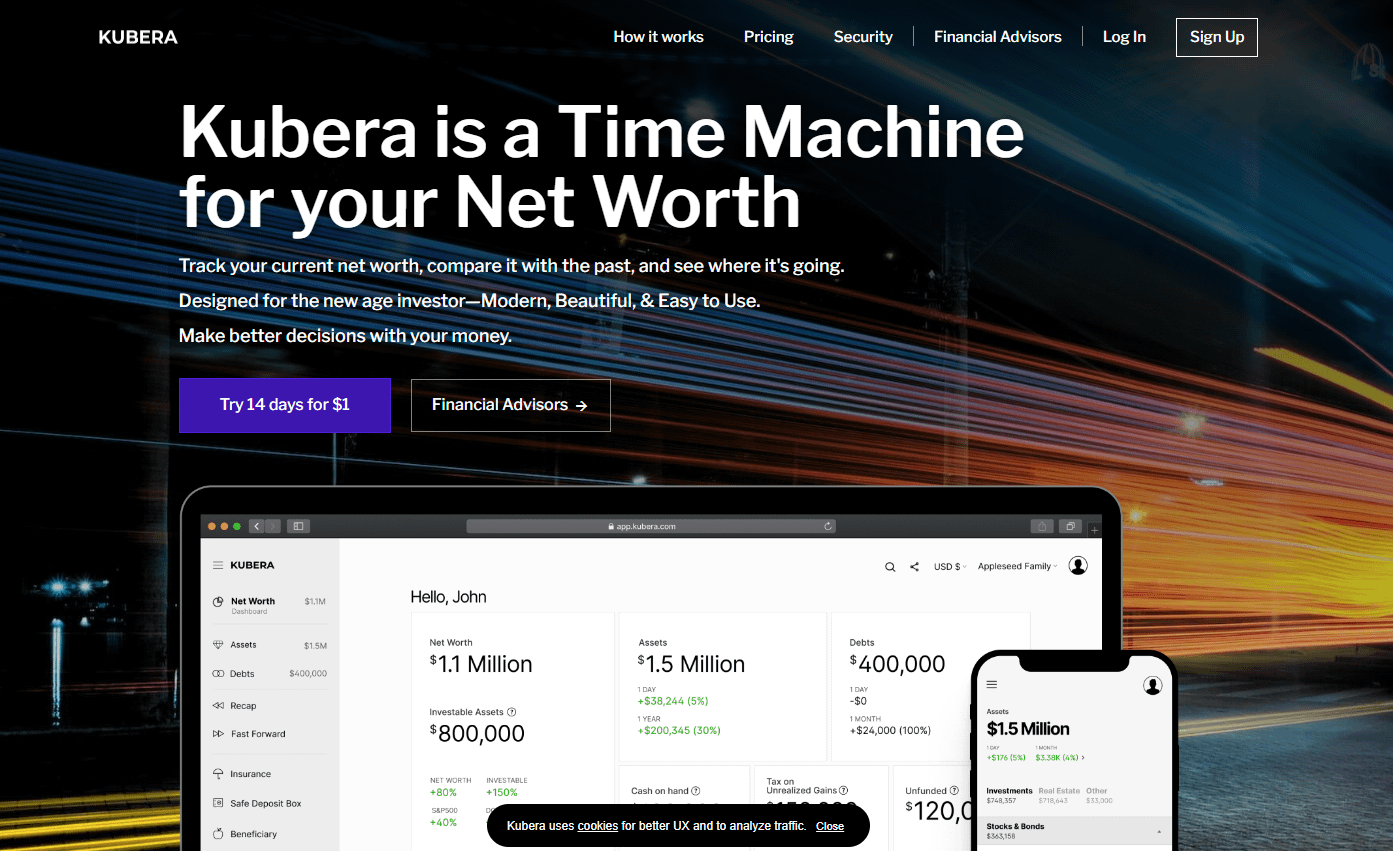

1. Kubera

🏆 Finest Private Stability Sheet

Kubera goals to trace the worth of all of your belongings and liabilities, but it surely doesn’t provide the statistical firepower some buyers want.

➕ Execs:

- A variety of belongings supported

- Brokerage and checking account integration

- Minimal and intuitive consumer interface

➖ Cons:

- Restricted statistical instruments

- Costly for the performance supplied

Kubera is a robust portfolio evaluation software that payments itself as “the world’s most fashionable wealth tracker.” Along with Kubera’s smooth interface, which is a refreshing break from legacy monetary software program, Kubera helps all kinds of digital belongings, together with cryptocurrencies and NFTs.

What makes it among the finest portfolio evaluation instruments, although, is assist for monitoring non-financial belongings. For instance, Kubera permits customers to trace the worth of their autos, with estimated market costs up to date over time. Customers also can manually enter actual property holdings or personal investments. Whereas incorporating your automotive into the worth of your whole portfolio won’t impression your funding selections, the flexibility to get an summary of your complete monetary image at a look is significant for customers who care primarily about understanding their private stability sheet.

Kubera is proscribed in its capacity to offer the superior statistical instruments that some buyers rely on. For example, you gained’t be capable of do backtests or evaluate your portfolio with an environment friendly frontier. Nevertheless, Kubera makes it clear which sort of buyers it’s designed for – those that want a platform that encompasses all of their belongings and liabilities, not simply their shares and bonds.

Pricing

| Private | Household | |

|---|---|---|

| Monetary Planning | Asset-liability administration, share portfolio with an advisor | Household wealth monitoring |

| Statistical Evaluation | Asset returns | Asset returns |

| Basic Evaluation | None | None |

| Screening | None | None |

| Dealer Integration | Sure | Sure |

| Further Options | Automotive valuation, area valuation | Useless man’s change |

| Pricing | $150/yr | $225/yr |

🎁 Intro Provide: 14 days for $1

📊 Finest Portfolio Evaluation Instruments. Study Extra: New to the inventory market? Uncover actionable steps to create your first portfolio in our newest put up.

2. Empower

🏆 Finest Free Device

Empower affords a collection of free portfolio instruments, though they’re geared towards budgeting and retirement planning on the expense of complete analytics.

➕ Execs:

- Free budgeting and retirement platform

- Brokerage and checking account integration

- Glorious visualizations

Empower, previously Private Capital, affords a free private dashboard that options budgeting instruments, a web value calculator, and a retirement planner. Whereas the dashboard is primarily used as a advertising and marketing gadget to introduce buyers to Empower’s advisory companies, it affords customers a complete overview of their portfolio and a few helpful state of affairs planning instruments.

Empower helps you to hyperlink all kinds of accounts to the dashboard, together with financial institution accounts, bank cards, and funding accounts. This offers you the flexibility to trace each your web value and your price range targets in actual time. Furthermore, Empower lets customers set goal allocations for his or her funding portfolios, that means you possibly can monitor drift and see if it’s essential rebalance.

The dashboard additionally options environment friendly frontier calculations and Monte Carlo simulations, though each are extra restricted in comparison with different greatest portfolio evaluation instruments we’ll study. Some Empower customers have reported frustration with the corporate’s gross sales techniques, with advisors repeatedly contacting high-net-worth customers to try to convert them to advisor purchasers. Moreover, there are experiences of issue with account integration because the Empower rebranding. For most individuals, although, these are small costs to pay for an in any other case free software.

Pricing

| Free | |

|---|---|

| Monetary Planning | Budgeting, retirement planning, web value tracker |

| Statistical Evaluation | Fundamental Monte Carlo and environment friendly frontier |

| Basic Evaluation | None |

| Screening | None |

| Dealer Integration | Sure |

| Further Options | Goal allocations to watch drift |

| Pricing | Free |

👴 Study extra: Get a transparent image of your retirement funds with our easy, step-by-step information to calculating your retirement quantity.

3. Portfolio Visualizer

🏆 Finest for Statistical Evaluation

Portfolio Visualizer’s value is justified by its glorious statistical instruments, however buyers who aren’t used to superior analytics ought to look elsewhere.

➕ Execs:

- Sturdy statistical performance

- Good visualizations and charts

- Intensive documentation

➖ Cons:

- Costly in comparison with different instruments

- Considerably restricted asset assist

Portfolio Visualizer is taken into account among the finest portfolio evaluation instruments in the marketplace, particularly designed for buyers occupied with statistical optimization. Along with sturdy backtesting and Monte Carlo instruments, the platform lets customers analyze asset correlations, discover issue allocation fashions, and rather more. This superior performance, although, additionally comes with a big studying curve, particularly for buyers not well-versed in portfolio concept.

Portfolio Visualizer affords a free tier with sturdy performance, however customers gained’t have the flexibility to save lots of their fashions or customise sure information assumptions. One main limitation of Portfolio Visualizer is the shortage of direct integration with brokerage companies, that means customers should import their current portfolios to the platform manually. Moreover, buyers on the lookout for a software with sturdy retirement or money stream planning ought to look elsewhere.

Whereas Portfolio Visualizer is dearer than different choices, the worth is justified by the variety of distinct analytics instruments on provide. Whereas different platforms might present clearer basic valuation metrics, no different platform matches the Portfolio Visualizer’s statistical instruments. For buyers trying to perceive the statistical traits of their portfolio without having to code the analytics themselves, Portfolio Visualizer is probably going nicely well worth the value.

Pricing

| Free | Fundamental | Professional | |

|---|---|---|---|

| Monetary Planning | None | None | None |

| Statistical Evaluation | Portfolio backtesting, Monte Carlo simulation, optimization, timing fashions | Save simulations, save fashions | Add capital market assumptions, tax assumptions, administration charges |

| Basic Evaluation | Fundamental asset analytics | Fundamental asset analytics | Fundamental asset analytics |

| Screening | None | None | None |

| Dealer Integration | No | No | No |

| Further Options | – | Excel/PDF export | +Custom-made PDF experiences |

| Pricing | Free | $19/month | $39/month |

🎁 Intro Provide: 14-day free trial

📊 Study extra: Acquire insights into the highest inventory backtesting platforms and streamline your funding method with our newest information.

4. Morningstar Investor

🏆 Finest for Basic Evaluation

Morningstar Investor excels in basic portfolio evaluation and funding analysis, however a excessive value and restricted forecasting instruments make this software inappropriate for some buyers.

➕ Execs:

- Entry to thorough funding analysis

- Basic metrics for a complete portfolio

- Distinctive inventory intersection and X-ray instruments

➖ Cons:

- Excessive value in contrast with different choices

- Restricted statistical forecasting or optimization

Morningstar Investor, previously Morningstar Portfolio Supervisor, is a sturdy portfolio evaluation platform for buyers that excels in offering basic portfolio evaluation. Whereas Morningstar does a superb job reporting efficiency, with some restricted statistical choices, it stands out as among the finest portfolio evaluation instruments for buyers who’re primarily occupied with up-to-date valuation metrics and basic analysis for his or her portfolios.

Whereas the platform affords some fundamental charting instruments, that are useful to see the change within the worth of a portfolio or safety over time, Morningstar’s historical past as an unbiased analysis agency is chargeable for the clear concentrate on basic evaluation of ETFs, shares, and funds. Moreover, Morningstar’s screeners, which cowl a wide range of completely different devices, will assist buyers discover new funding alternatives.

The principle downside of the platform is its excessive value. Whereas that is unsurprising given Morningstar’s historical past of catering to institutional purchasers and asset administration companies, the platform is unlikely to be well worth the value until an investor has a selected affinity for basic evaluation. Further Morningstar-specific instruments that will partially justify the worth embody the inventory intersection evaluation (which evaluates particular fund holdings to find out actual inventory publicity) and the X-ray evaluation operate (which evaluates portfolio publicity by asset class, sector, geography, and extra).

Pricing

| Investor | |

|---|---|

| Monetary Planning | None |

| Statistical Evaluation | Asset efficiency |

| Basic Evaluation | Portfolio valuation ratios, inventory valuation ratios |

| Screening | Inventory screener, together with profitability, valuation, measurement standards, and extra |

| Dealer Integration | Sure |

| Further Options | Inventory intersection evaluation, X-ray evaluation |

| Pricing | $34.95/month |

🎁 Intro Provide: Seven-day free trial

📊 Study extra: Investing in shares requires sturdy analysis. Discover a complete roundup of one of the best inventory analysis instruments in our newest put up.

5. Ziggma

🏆 Finest for ESG-Acutely aware Traders

Along with being a specialised software for ESG-focused buyers, Ziggma is a basic analytics platform that performs nicely in a wide range of areas.

➕ Execs:

- Sturdy ESG issues

- Engaging value for the options

- Each technical and basic metrics

➖ Cons:

- Crowded UI

- Restricted backtesting performance

Whereas Ziggma is flexible sufficient to serve a broad viewers, it stands out as among the finest portfolio evaluation instruments for buyers who’re significantly targeted on ESG investments and local weather change. Along with a complete assortment of conventional metrics, Ziggma screeners embody issues for a agency’s local weather rating and carbon depth, serving to buyers kind by the greenest companies. Asset protection will not be restricted merely to ESG investments, although; Ziggma affords charts and information for equities, fixed-income investments, crypto, and commodities.

Along with its ESG focus, Ziggma affords an assortment of nice analytics instruments for an inexpensive value. Whereas the platform lacks monetary planning instruments, there are mannequin portfolio allocations to information your individual investments. Moreover, Ziggma encompasses a simulator software to judge the impression of potential trades in your portfolio’s beta, yield, and diversification.

Ziggma additionally options direct dealer integration, which is able to prevent from having so as to add your current portfolio positions manually. In totality, the platform serves as a powerful hybrid analytics platform. Whereas it doesn’t do basic evaluation, technical evaluation, or statistical optimization, in addition to platforms that concentrate on these particular areas, Ziggma serves as an efficient software for buyers who want appropriate performance in all areas.

Pricing

| Free | Premium | |

|---|---|---|

| Monetary Planning | None | None |

| Statistical Evaluation | None | Portfolio simulator backtest |

| Basic Evaluation | Valuation metrics for ETFs and shares | Saved analysis, curated newsfeed |

| Screening | ETF screener and inventory screener | Quant inventory scoring |

| Dealer Integration | Sure | Sure |

| Further Options | Local weather rating, carbon depth metrics | Guru portfolios |

| Pricing | Free | $9.90/month |

🎁 Intro Provide: Seven-day free trial

📚 Study extra: Excited about accountable investing? Our current put up outlines one of the best ESG ETFs you may wish to think about.

6. Sharesight

🏆 Finest for Dividends and Taxes

Sharesight is without doubt one of the greatest portfolio evaluation instruments in terms of dividend and tax options, however threat and return metrics could possibly be improved to grant clearer portfolio insights.

➕ Execs:

- Glorious dividend monitoring

- Nice tax options

- Sturdy assist for non-U.S. customers

➖ Cons:

- Optimization is proscribed to built-in experiences

- Restricted basic metrics supplied

Sharesight is a portfolio analytics platform designed to make dividend and tax monitoring so simple as potential. Whereas Sharesight affords a lot of different options, together with restricted backtesting, direct dealer integration, and good visualizations, it’s the concentrate on dividends and taxes that can possible be the strongest worth add for buyers involved with these areas.

Sharesight lets you shortly see your complete dividend historical past, making certain that you just by no means miss a payout. In contrast to another platforms, Sharesight breaks down whole return metrics by capital good points and dividends, letting buyers see the exact components driving returns. Lastly, the benefit of monitoring reinvested dividends and upcoming dividends, together with built-in calculations of dividend yield on the safety degree and the portfolio degree, makes this platform a transparent winner for dividend-focused buyers.

Sharesight could possibly be a superb choice for buyers pissed off on the problem of organizing their funding taxes. The platform can generate an in depth taxable revenue report based mostly on a user-specified timeline, which can be utilized to file taxes your self or given to an accountant to file in your behalf. To make this course of even simpler, Sharesight helps you to share your portfolio immediately with an accountant.

Pricing

| Free | Starter | Investor | Skilled | |

|---|---|---|---|---|

| Monetary Planning | Tax administration | Tax administration | +Future revenue | Tax administration, future revenue |

| Statistical Evaluation | None | Benchmarking | +Range evaluation, distribution evaluation | Benchmarking, variety evaluation, distribution evaluation |

| Basic Evaluation | Computerized dividend administration | Computerized dividend administration | Computerized dividend administration | Computerized dividend administration, multi-currency valuation, multi-period valuation |

| Screening | None | None | None | None |

| Dealer Integration | Sure | Sure | Sure | Sure |

| Further Options | 1 portfolio, as much as 10 holdings | 1 portfolio, as much as 30 holdings | 4 portfolios, limitless holdings | 10 portfolios, limitless holdings, precedence buyer assist |

| Pricing | Free | $15/month | $24/month | $31/month |

🎁 Intro Provide: Seven-day free trial.

📈 Study extra: Eager on understanding an funding technique with a concentrate on steadily rising dividends? Our current put up delves deep.

Deciding on the fitting portfolio analytics instruments will be tough, significantly as a result of there isn’t any one definition for what constitutes a fully-fledged platform. Traders ought to be mindful how they personally outline the boundaries of their portfolio, whether or not that features their complete monetary lives or simply their funding holdings. Then, it is very important decide the evaluation you wish to carry out on this portfolio. Totally different platforms specialise in completely different areas, so it’s very important to think about the relative worth of basic evaluation, monetary planning, and statistical evaluation in your wants. Within the desk beneath, we evaluate one of the best portfolio evaluation instruments on provide based mostly on these metrics in addition to pricing.

| Device | Free Trial | Fundamental Plan | Premium Plan | Finest For | Monetary Planning | Statistical Evaluation | Basic Evaluation |

|---|---|---|---|---|---|---|---|

| Kubera | None | $12.50/m | $18.75/m | Stability sheet administration | Sturdy asset-liability planning | Very restricted | None |

| Empower | Free | – | – | Monetary planning | Sturdy budgeting, retirement planning | Fundamental Monte Carlo, environment friendly frontier | Very restricted |

| Portfolio Visualizer | 14-day | $19/m | $39/m | Statistical optimization | None | Sturdy Monte Carlo, backtesting, and extra | Restricted |

| Morningstar Investor | 7-day | – | $34.95/m | Basic evaluation | None | Very restricted | Sturdy portfolio ratios, screeners, holding evaluation |

| Ziggma | 7-day | Free | $9.90/m | ESG investing | None | Fundamental simulator, portfolio tracker | Good inventory screener, portfolio metrics |

| Sharesight | 7-day | $15/m | $31/m | Taxes and dividends | Good tax planning | Restricted backtesting, optimization | Dividend administration |