Your credit score is one of the most powerful numbers tied to your name. It determines the interest rates you get, your chances of loan approval, and even whether you can rent an apartment or get certain jobs. But here’s the thing—most people don’t realize it’s starting to slip until it’s already too late.

A crashing credit score doesn’t happen overnight. It starts with patterns, overlooked payments, and financial behaviors that slowly chip away at your score until one day, you’re denied for something you thought was a sure thing. The key is spotting the warning signs early. If you want to keep your credit score in healthy territory, here are eight red flags you should never ignore.

1. You’re Using More Than 30% of Your Available Credit

One of the biggest factors affecting your credit score is your credit utilization rate, aka how much of your available credit you’re actually using. If you’re consistently carrying high balances on your cards, especially above 30%, your score is already under pressure. Even if you’re making payments on time, maxing out your cards signals to lenders that you might be in over your head.

2. You’ve Missed a Payment (or Cut It Close)

Late payments are like poison to your credit score. Just one missed payment can ding your score by 50 to 100 points, especially if your credit history is otherwise clean. Even if you’re just a few days late, once it reaches the 30-day mark and is reported, it becomes a long-term blemish. A pattern of late or barely on-time payments? That’s a credit crash in the making.

3. You’re Opening New Credit Cards to Stay Afloat

If you’ve found yourself applying for new cards not because you want the perks but because you need the extra room to keep spending, it’s time to hit pause. While opening a new line can help with utilization in the short term, it also means a hard inquiry and more debt to manage. When it becomes a habit, it shows lenders you’re stretching yourself too thin.

4. Your Minimum Payments Are Getting Harder to Make

It might not seem like a big deal at first. You’re still making the minimum payments, after all. But if those minimums are becoming a burden, or if you’re juggling which card to pay late, your financial foundation is cracking. This is one of the clearest signs that you’re headed toward trouble, especially if an unexpected expense would send things spiraling.

5. You’ve Stopped Checking Your Credit Report

Out of sight, out of mind doesn’t work when it comes to credit. If you’ve stopped monitoring your credit report, either out of fear or forgetfulness, you’re flying blind. Errors, fraudulent activity, or unpaid accounts you’ve forgotten about could be pulling your score down without your knowledge. By the time you’re denied a loan, it’s already too late to undo the damage quickly.

6. You’re Co-Signing Loans Without Thinking It Through

Helping someone out by co-signing might seem like a kind gesture, but it can become a financial trap. If that person misses payments, your credit takes the hit. Worse, many people forget they even co-signed until their own credit starts to tank. Unless you’re 100% sure the borrower is responsible, this “favor” can cost you dearly.

7. Your Debt-to-Income Ratio Is Way Off Balance

Lenders don’t just look at how much debt you have. They look at how much debt you have compared to your income. If your debts are creeping higher but your income isn’t moving, it’s a red flag that you’re on unstable ground. A high debt-to-income ratio makes you look risky to lenders and can tank your score even if you’ve never missed a payment.

8. You’re Ignoring Collection Notices or Small Debts

That $90 medical bill you thought your insurance paid? Or the subscription service you forgot to cancel? Left unpaid, even small debts can end up in collections, and once they do, your credit score pays the price. Collections can drop your score significantly and stay on your report for up to seven years. Ignoring them only makes things worse.

Stay Ahead of the Crash. Don’t Wait for the Fall

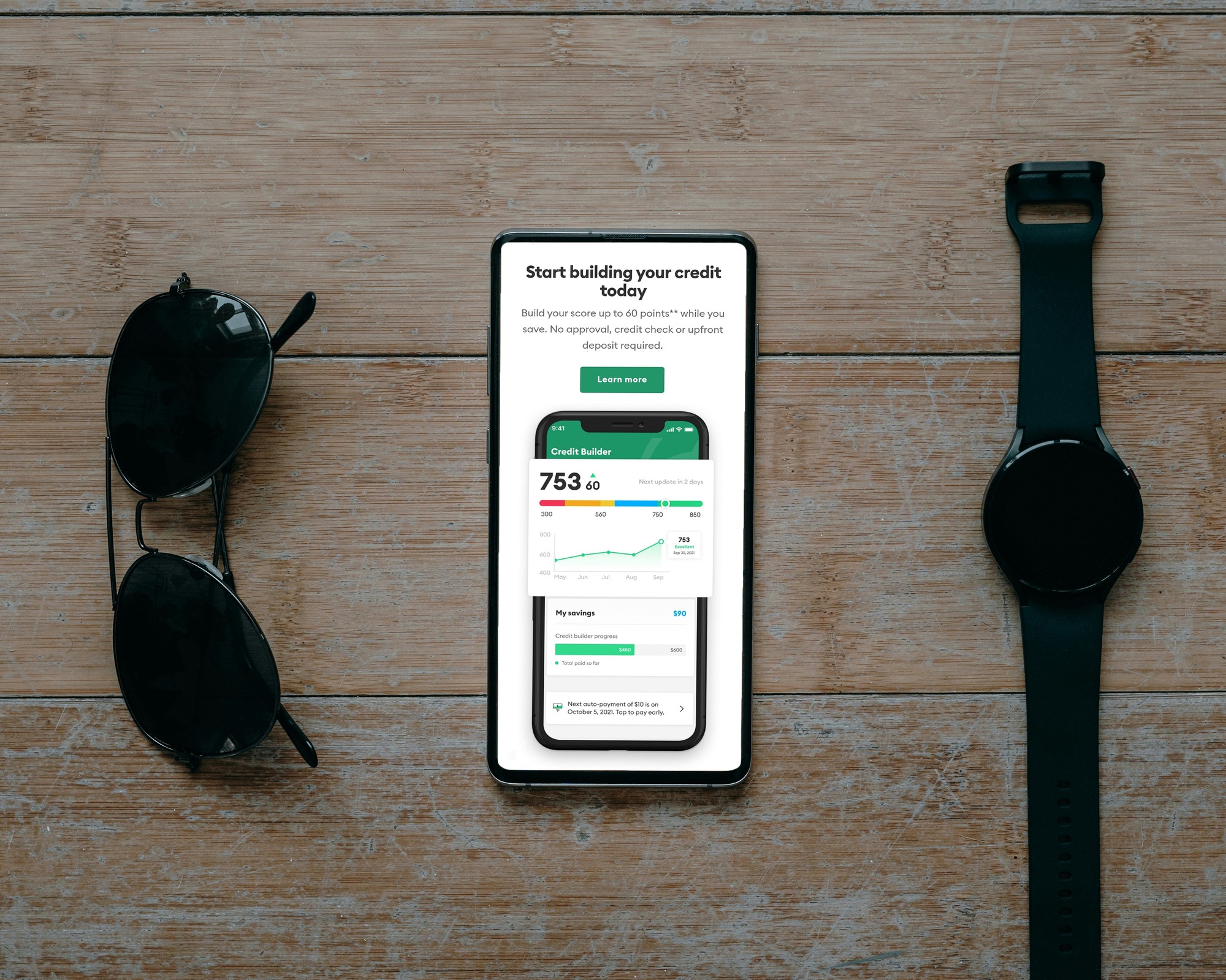

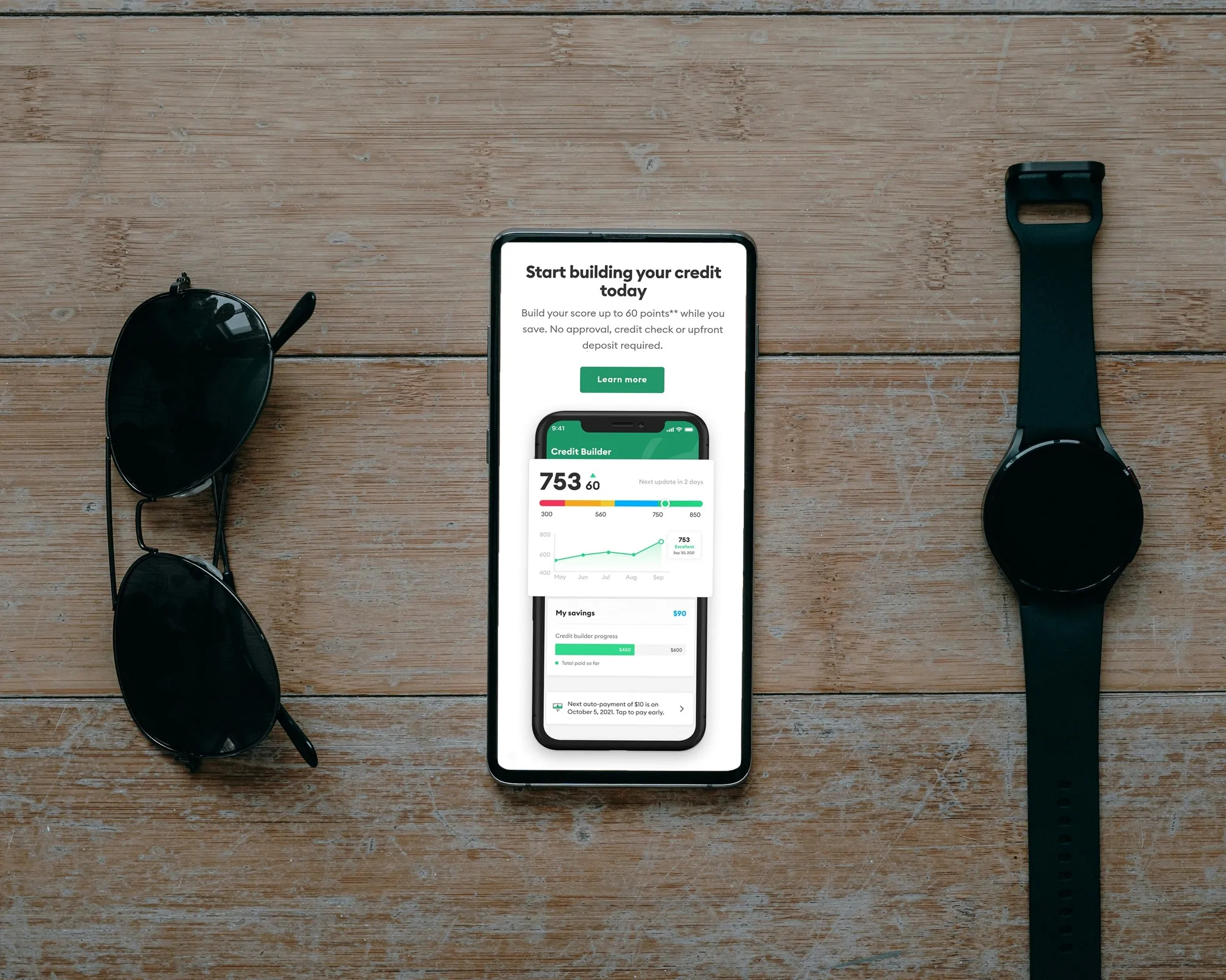

Most credit score damage is preventable if you catch the signs early enough. A few missed payments or rising balances might not seem like a big deal today, but compounded over time, they create a situation that’s hard to dig out of.

The good news? Every one of these red flags is fixable. You can lower your utilization, negotiate payment plans, or set up auto-pay before your score suffers a hit. But it starts with awareness.

Have you ever caught a red flag in your own financial habits before it led to serious credit damage? What helped you turn things around before it was too late?

Read More

Credit Score Myths That Are Preventing You from Qualifying for an FHA Loan

10 Ways to Use Credit Card Rewards to Fund Your Lifestyle Completely

Riley is an Arizona native with over nine years of writing experience. From personal finance to travel to digital marketing to pop culture, she’s written about everything under the sun. When she’s not writing, she’s spending her time outside, reading, or cuddling with her two corgis.