Is your retirement financial savings in want of a lift? If that’s the case, you’re in luck. Roth IRA contribution limits will lastly improve in 2023.

What precisely does that imply? Mainly, you’ll be able to improve your retirement nest egg even additional.

However, let’s pump the brakes a bit. You could be questioning, what are Roth IRAs? That is much like a daily IRA however with some superior tax advantages. With Roth IRAs, you’ll be able to contribute after-tax cash. Consequently, your retirement earnings shall be tax-free if you retire.

One other key distinction? The withdrawal of Roth IRA contributions is penalty-free, however the withdrawal of Conventional IRA contributions earlier than age 59 1/2 is topic to a ten% penalty. Moreover, every sort of IRA has completely different contribution limits and eligibility necessities.

However, wait, there’s extra. The brand new contribution limits allow you to save more cash yearly with out worry of Uncle Sam taking an excessive amount of. So, should you’re already contributing to a Roth IRA, you can improve your contributions even additional. In case you haven’t began, now could be the best time for you to take action. By elevating the retirement financial savings limits, you’ll be capable to maximize your retirement financial savings much more.

No surprise I contemplate a Roth IRA the most effective retirement software on the market.

It’s time to drag out the calculators and crunch some numbers as a result of Roth IRAs have a shiny future forward of them.

Roth IRA limits for 2023

That is the primary time in over 4 years that Roth IRA limits have been elevated. For 2023, Roth IRA contribution limits are as follows:

People can contribute $6,500 to Roth IRAs in 2023. “Catch-up contributions” are additionally out there to plan members who’re 50 and older.

The earnings cap on Roth IRA contributions, nonetheless, prevents everybody from contributing. With the intention to qualify, you could meet sure earnings pointers. In some circumstances, a Roth IRA isn’t even out there to individuals with excessive incomes.

Relying in your earnings bracket, Roth IRA contributions may be “phased out.” In different phrases, you can’t contribute the total quantity to a Roth account.

Primarily based in your tax submitting standing, listed here are the Roth IRA earnings limits and phase-outs.

{Couples} submitting collectively:

- A pair with a modified adjusted gross earnings (MAGI) below $218,000 could contribute the total quantity.

- Lowered contributions can be found to {couples} with MAGIs between $218,000 and $227,999.

- It’s not potential to contribute to a Roth IRA in case your MAGI is greater than $228,000.

Separate filings for married {couples}:

- A lowered contribution is obtainable to {couples} with a MAGI below $10,000.

- These with a MAGI of $10,000 or extra can not contribute to Roth IRAs.

People submitting a single tax return:

- Contributions could be made as much as the total quantity by single filers with a MAGI of below $138,000 per yr.

- Contributions are lowered for people with MAGIs of $138,000 to $152,999.

- Roth IRAs should not out there to people with an annual earnings of $153,000 or extra.

That can assist you benefit from your Roth IRA contributions, listed here are some further ideas:

- Even when your employer affords a retirement plan, you’ll be able to contribute to a Roth IRA.

- Roth IRA contributions could be withdrawn at any time with out penalty. Any earnings you withdraw will, nonetheless, be topic to tax.

- Earnings from Roth IRAs are tax-free. In the event you withdraw the cash in retirement, you’ll not be taxed.

I all the time advise that you just contemplate talking with a monetary advisor should you’re contemplating contributing to a Roth IRA.

Roth IRA Advantages

I already talked about this above. However, Roth IRAs are one in every of my favourite retirement instruments. One of many causes I’m such an advocate is that it gives a variety of advantages.

- Tax-free progress. Inside a Roth IRA, your funding earnings and contributions are tax-free. In the event you withdraw cash in retirement, you gained’t owe any taxes on it.

- Tax-free withdrawals. Roth IRA contributions and earnings could be withdrawn tax-free and penalty-free should you meet sure necessities. A minimal of 5 years holding within the account is required, in addition to being no less than the age of 59 ½.

- There is no such thing as a minimal distribution requirement. A Roth IRA doesn’t have a required minimal distribution (RMD), not like a conventional IRA. Consequently, you gained’t have to start out taking withdrawals out of your Roth IRA till you’re no less than age 55.

- Flexibility. A Roth IRA permits you to withdraw your contributions at any time, with out penalty or tax. Compared to a conventional IRA, this offers you extra flexibility.

- Portability. If you wish to change monetary establishments, you’ll be able to switch your Roth IRA to a different custodian. With conventional IRAs, this isn’t all the time potential.

Different advantages of a Roth IRA:

- There could also be further tax credit out there to you, together with the Saver’s Credit score.

- Regardless of exceeding the earnings restrict, chances are you’ll be eligible for a “backdoor Roth IRA” conversion.

- Within the occasion of your demise, your beneficiaries is not going to should pay taxes on Roth IRAs.

The draw back of Roth IRAs.

After all, Roth IRAs aren’t good. A Roth IRA does have some disadvantages, together with:

- Contribution limits. Roth IRA contribution limits are decrease than these for conventional IRAs. In 2023, people will be capable to contribute as much as $6,500 to a Roth IRA.

- After-tax contributions. Roth IRA contributions are after-tax, so that you gained’t get a tax deduction the yr you make them. In the event you’re at the moment in a excessive tax bracket, this could be a drawback.

On the whole, Roth IRAs are a superb possibility for saving for retirement. There is no such thing as a requirement to make minimal distributions, they usually can develop and withdraw tax-free. Earlier than you determine to spend money on a Roth IRA, you could contemplate the contribution limits and after-tax contributions.

You also needs to contemplate the next components earlier than deciding whether or not a Roth IRA is best for you:

- The tax bracket you might be at the moment in. Roth IRAs are possibility in case you are in a excessive tax bracket now. Since your tax charge is more likely to be increased in retirement, you’ll be able to pay taxes in your contributions now.

- Retirement targets. It might be a good suggestion so that you can contribute to a Roth IRA should you plan on retiring early. The explanation for that is that your cash could have an extended time to develop tax-free.

- What your funding horizon is. You could possibly profit from a Roth IRA should you plan to take a position for the long run. Due to this, your cash will be capable to develop tax-free for an extended time period.

ChatGPT Compound Curiosity Calculations

- So, you may surprise the place this $118,976.24 determine comes from. Let’s use ChatGPT to seek out out.

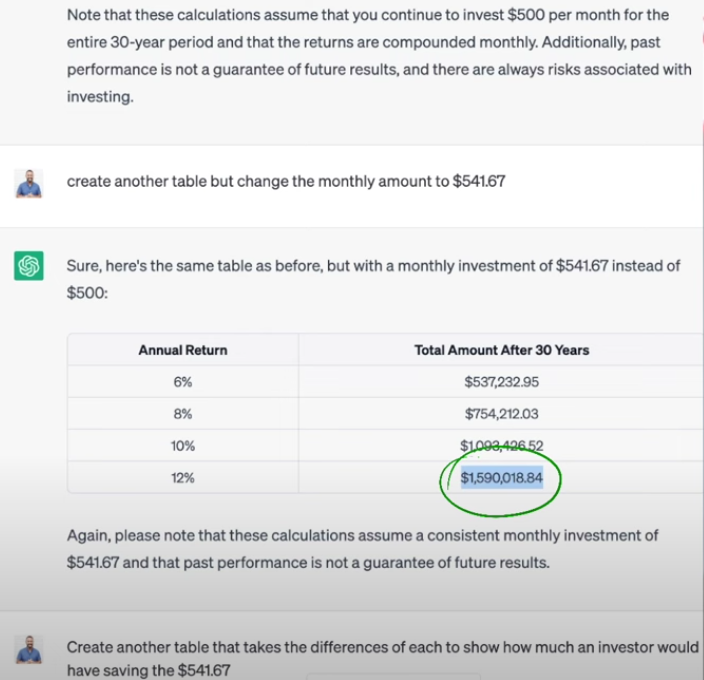

It’s simply a lot enjoyable to make use of this studying mannequin. For instance, I used ChatGPT to create a desk that reveals $500 a month invested for 30 years. I additionally wished it to point out the completely different returns for six, eight, ten, and twelve p.c. That will be $1,471,042.08.

How about if we elevated that quantity from $500 to $541.67? That’s $1,590,018.84.

As for the mathematics, I’m certain you recognize the place I’m going. With ChatGPT, that comes out to a distinction of $118,976.24.

As a result of IRS growing Roth IRA contribution limits, an additional $41 per thirty days may give you a big improve.

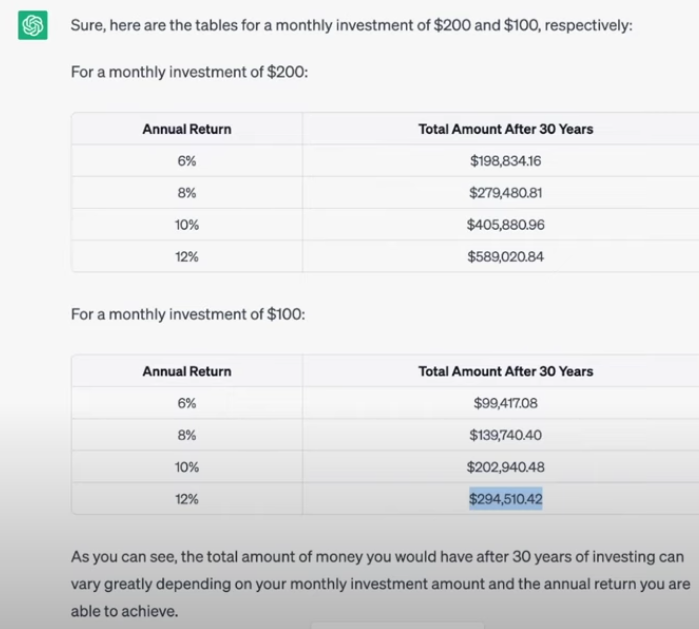

However, what should you can’t swing the $541 a month? Nicely, you’re nonetheless in luck.

If we used ChatGPT once more, what wouldn’t it appear like should you saved $100 or $200 a month tax-free? A 12% return on $100 per thirty days over 30 years would quantity to $294,510.42. For $200 per thirty days over 30 years, the return could be $589,020.84.

General, it will be silly to not reap the benefits of a tremendous retirement software just like the Roth IRA. And, better of all? You don’t want hundreds of {dollars} to make such a wise funding.

Last Phrases of Recommendation Concerning the Roth IRA

General, investing in a Roth IRA is a brilliant transfer should you comply with the following pointers:

- Select a diversified portfolio. By investing in a wide range of asset courses, similar to shares, bonds, and mutual funds, you might be diversifying your portfolio. Consequently, your danger shall be lowered, and your potential returns shall be maximized.

- Rebalance your portfolio often. Your portfolio will have to be rebalanced over time to fulfill your funding targets and danger tolerance.

- Contribute as a lot as you’ll be able to afford. You’ll have extra retirement financial savings the extra you contribute. Ensure you improve your contributions yearly should you can.

Roth IRAs are among the best methods to save lots of for retirement. You can begin by contributing no less than a small quantity per thirty days, even should you can’t afford a lot. It takes time for cash to develop, so the earlier you begin saving, the higher.

FAQs

What’s a Roth IRA?

The Roth IRA is a kind of particular person retirement account (IRA) that allows you to make a contribution after tax. The cash you contribute has already been taxed, however you gained’t should pay taxes on any earnings or withdrawals in retirement.

Why must you contemplate a Roth IRA?

The next are among the advantages of opening a Roth IRA:

- Tax-free progress. While you go away your Roth IRA investments within the account till retirement, they’ll develop tax-free.

- Withdrawals from a Roth IRA are tax-free. The earnings from a Roth IRA is not going to be taxed if you withdraw them in retirement.

- No required minimal distributions. In contrast to conventional IRAs, Roth IRAs haven’t any required minimal distributions (RMDs). The cash within the account could be saved indefinitely and withdrawn everytime you want.

- It’s versatile. It’s potential to withdraw contributions from a Roth IRA at any time, with out incurring any penalties.

Are there any drawbacks to Roth IRAs?

The next are some drawbacks of opening a Roth IRA:

- No upfront tax deduction. Roth IRA contributions can’t be deducted out of your taxes, not like conventional IRA contributions.

- Contribution limits. Roth IRA contribution limits are decrease than conventional IRA contribution limits.

- Revenue limits. Revenue limits could prohibit your Roth IRA contributions.

What investments can I maintain in a Roth IRA?

There are all kinds of monetary belongings that may be held in Roth IRAs, together with shares, bonds, mutual funds, and ETFs. Collectors’ gadgets, similar to artwork, antiques, and stamps, should not allowed.

What’s the 5-year rule for Roth IRAs?

Till you might have contributed to a Roth IRA account for no less than 5 years, you can’t withdraw earnings tax-free.

Withdrawals of Roth IRA contributions with out penalty should still be permitted should you don’t meet the 5-year rule. Nevertheless, earnings shall be topic to earnings tax and a ten% early withdrawal penalty if you don’t meet an exception.

5-year guidelines are topic to the next exceptions:

- You’re no less than 59 ½ years previous.

- You might have a incapacity.

- The cash is getting used for certified schooling bills.

- Your first house is being bought with the cash.

- After an individual has died, they’re entitled to a professional distribution.

The 5-year rule applies to each Roth IRA account. In different phrases, should you personal a number of Roth IRAs, you could preserve observe of the 5-year interval for every account.

The submit 97% of Individuals Qualify – IRS Simply Gave You $118,976.24 Tax-Free ( Gather) appeared first on Due.