This shall be a comparatively fast one, thanks to Writser for pointing me on this route.

Magenta Therapeutics (MGTA) (~$47MM market cap) is one other addition to my rising basket of failed biotechnology firms which are pursuing strategic alternate options like a reverse merger or liquidation. Magenta is a scientific stage biotech centered on enhancing stem cell transplantation. Their main product, MGTA-117, initially had optimistic information readouts in December for his or her ongoing Part 1/2 trial, however shortly after, sufferers utilizing greater doses began experiencing hostile results, culminating with the loss of life of 1 trial participant and the following shutdown of the MGTA-117 scientific trial. Then yesterday afternoon, Magenta introduced they have been going to discover strategic alternate options, the press launch is fairly obscure and generic. However just like SESN and others, I anticipate Magenta first making an attempt to discover a buzzy reverse merger with a extra promising biotech, if that does not work, pursue a liquidation.

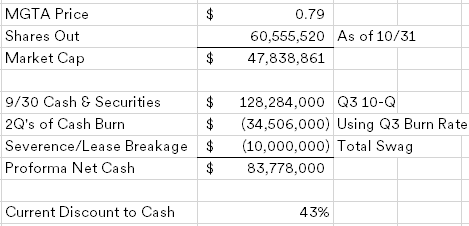

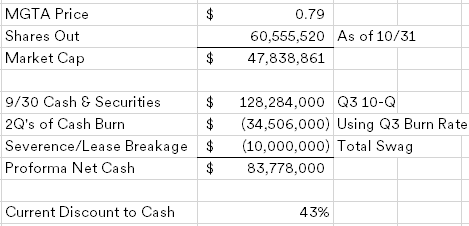

Magenta’s steadiness sheet is pretty easy, they’d $128.3MM in money and treasuries as of 9/30, no debt apart from subleased house in a Cambridge, MA workplace/lab complicated.

Since we’re getting near half method by means of Q1, I annualized the Q3 burn charge for 2 quarters. The corporate hasn’t given any preliminary indication of eliminating their workforce (as of the final 10-Ok, they’d 75 individuals), however I count on that to comply with shortly, together with breaking their lease. Cambridge is a biotech sizzling spot, Magenta or the first lessee should not have an excessive amount of hassle discovering a brand new tenant. Be happy to make your personal assumptions, however I give you MGTA buying and selling at a few 40% low cost to proforma web money even after spiking on the information immediately. By way of different belongings, Magenta does have $247.2MM in NOLs and two different early stage product candidates (one has a Part 2 trial ongoing), however as at all times, tough to place a price on these.

The first threat right here could possibly be the corporate deciding to double down on their two different early stage merchandise, however the low cost is broad sufficient right here to warrant an add to the basket.

Disclosure: I personal shares of MGTA