Gold has been synonymous with wealth, status, and energy for the reason that earliest human civilizations. We nonetheless acknowledge the standing of long-forgotten anonymous kings of previous from their gold-adorned tombs and our bodies. And whole areas of the world, like California and South Africa, had been formed by gold rushes.

For many of human historical past, gold (and generally silver) meant cash. Till 1971, gold was nonetheless the basic backing behind the greenback, which itself was the backing behind each different foreign money.

The greenback’s convertibility into gold stopped in 1971, however gold by no means stopped fascinating the higher public. In a time of worldwide dysfunction and successive financial crises, some are trying again on the “barbarous relic” as a secure haven.

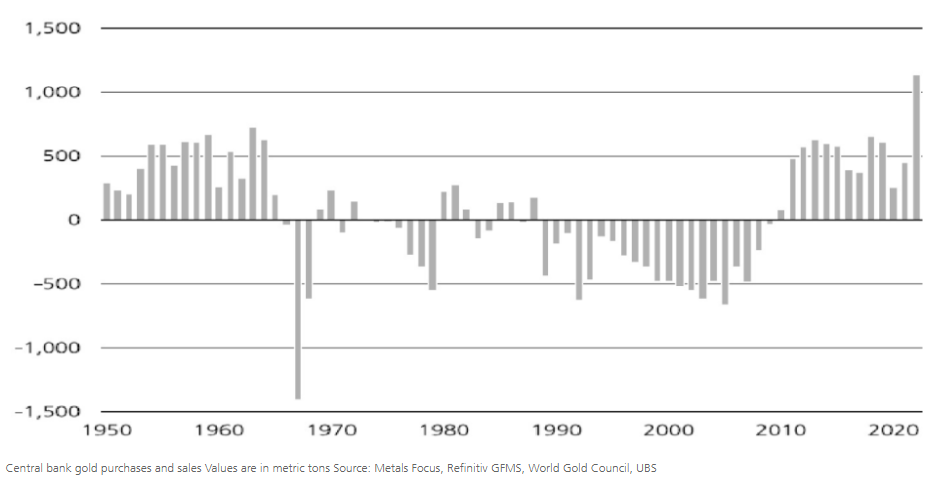

On the forefront are central banks, which have been main patrons since 2010. Most of this comes from Eurasian nations, who symbolize greater than 80% of the shopping for since 1999.

With gold near all-time-high costs, let’s take a look at a few of the greatest gold shares.

Finest Gold Shares

Let’s check out a panel of various gold miners and gold shares profiles. These are designed as introductions, and if one thing catches your eye, you’ll wish to do extra analysis!

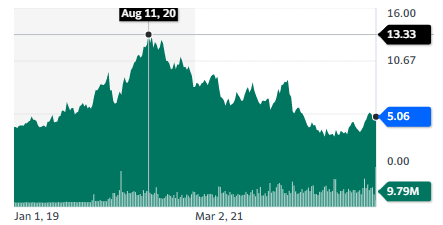

1. Barrick Gold Company (GOLD)

| P/E | 82.46 |

| Dividend Yield | 2.89% |

Barrick Gold is the second largest gold miner by market cap and has the biggest “Tier 1” asset portfolio (largest gold mines). It produced 4.1 million ounces (Moz) of gold in 2022, in addition to 440 million kilos (Mlb) of copper. It has reserves of 76 Moz of gold (18.5 years of manufacturing).

The corporate’s AISC (All-In-Sustainable-Price) was round $1,200/ounce.

The corporate is generally producing in North America and in Africa. It’s planning to maintain manufacturing rising slowly, with roughly 10% extra manufacturing by 2030.

Barrick is a fairly secure guess on the subject of miners, due to excessive reserves and low manufacturing prices, even when the African publicity carries some jurisdiction dangers.

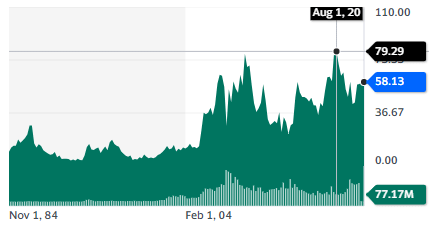

2. Newmont (NEM)

| P/E | – N/A |

| Dividend Yield | 3.41% |

The biggest gold miner by market capitalization and manufacturing, Newmont produced 6 Moz of gold and 16 Blb of copper in 2022. It additionally produced 35 Moz of silver and a few lead and zinc. It has reserves of 95 Moz of gold (15.8 years of manufacturing).

A lot of the firm’s manufacturing is within the Americas and Australia. Administration intends to maintain manufacturing regular as much as 2032 at the very least.

The corporate’s AISC (All-In-Sustainable-Price) was at $1,211/ounce in 2022.

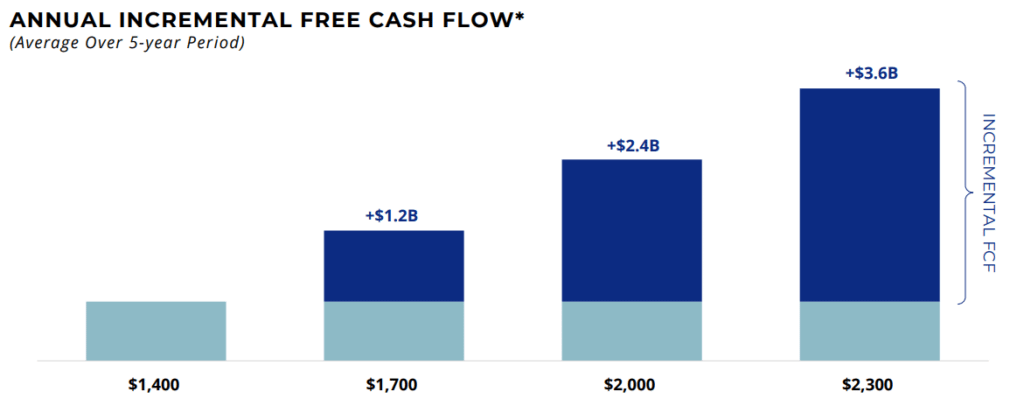

It turns money circulate optimistic when gold value reaches $1,400/ounce, and provides $400M in free money circulate for each $100 added to gold costs.

Newmont is safer from a jurisdiction viewpoint, even when South American mines are at all times a possible danger. Its subsequent debt maturity is in 2029, so it is usually pretty nicely protected against rising rates of interest.

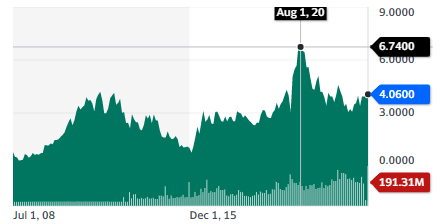

3. Equinox Gold (EQX)

| P/E | – N/A |

| Dividend Yield | – N/A |

Equinox produced 0.6 Moz of gold in 2022. It has reserves of 17 Moz of gold (28.3 years of manufacturing).

The corporate’s AISC (All-In-Sustainable-Price) was fairly excessive, from $1,500 to $1,950. The corporate operates largely within the Americas (Canada, USA, Mexico, and Brazil).

It’s a very new firm by mining trade requirements, targeted on progress by acquisitions and the opening of latest mines.

In 2018 it produced solely 25,601 oz of gold. It’s planning to double present manufacturing by the tip of the last decade, notably by the Greenstone challenge, deliberate to be certainly one of Canada’s largest gold mines.

Between costly AISC and aggressive progress, the corporate wants gold costs to remain above 2,000/oz to essentially make a revenue. So this can be a good firm for an aggressive guess on gold costs, just like utilizing excessive leverage on gold costs.

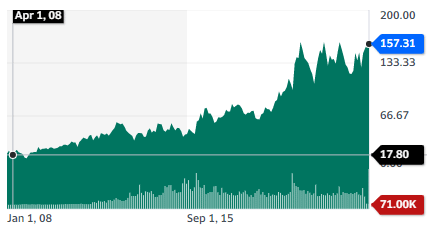

4. Agnico Eagle Mines Restricted (AEM)

| P/E | 11.44 |

| Dividend Yield | 2.86% |

AEM produced 3.1 million ounces (Moz) of gold in 2022, in addition to 2.3 Moz of silver. Its reserves are 49 Moz of gold (15.8 years of manufacturing).

The corporate’s AISC (All-In-Sustainable-Price) was round $1,090/ounce.

The corporate is producing solely in North America and Finland and lately merged with Canadian Kirkland Lake. It’s planning to maintain manufacturing rising slowly, with roughly 10% extra manufacturing by 2030.

This firm has very low jurisdiction danger, with little to no progress, a good selection for buyers on the lookout for security.

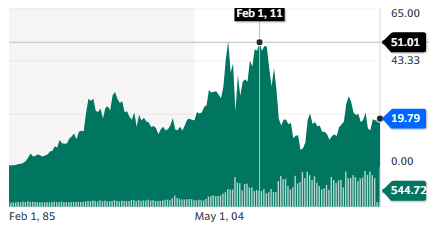

5. B2B Gold (BTG)

| P/E | 16.92 |

| Dividend Yield | 4.06% |

B2B produced 1 million ounces (Moz) of gold in 2022. It has reserves of 76 Moz of gold (18.5 years of manufacturing).

The corporate’s AISC (All-In-Sustainable-Price) was round $1,033/ounce.

The corporate is generally producing in Africa and the Philippines. It’s planning some progress (20% by 2026) by increasing its current mines (Fekola) and exploration within the area.

Attributable to its mines’ location, this can be a riskier guess, with a corresponding low cost on the corporate valuation. That danger is considerably compensated by low manufacturing prices and no debt.

So this can be a higher match for buyers keen to just accept the jurisdiction danger in change for greater dividends and progress.

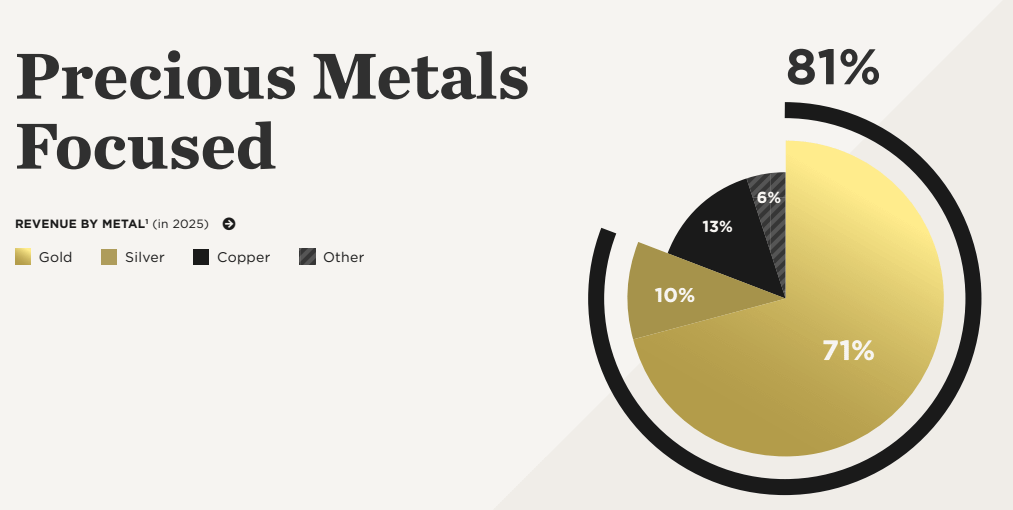

6. Franco-Nevada Company (FNV)

| P/E | 42.98 |

| Dividend Yield | 0.88% |

Not all gold shares are miners. Royalties corporations are one other breed of gold inventory.

Royalties corporations present financing to gold miners in change for both a future proportion of the overall revenues of the challenge or “free” supply of a proportion of the gold produced. As such, they’re comparatively shielded from macroeconomic adjustments that may damage miners.

Franco-Nevada was a pioneer in that enterprise mannequin. It has a CAGR of 17% since its inception and gives a big diversification of belongings and jurisdictions.

Reserves can assist round 17 years of operation. It has 419 belongings, of which 113 are producing, 45 are in growth, and 261 are within the exploration stage. Most of its largest core belongings are in Latin America.

Combining its popularity, monitor report, and concentrate on high-quality jurisdiction, Franco-Nevada is a robust strategy to obtain diversification of gold funding whereas specializing in comparatively low-risk belongings. The one criticism may very well be a comparatively excessive valuation.

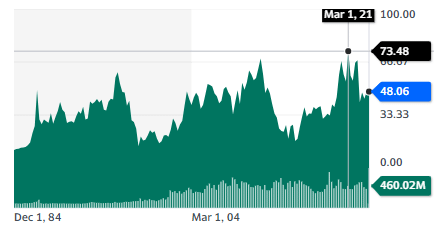

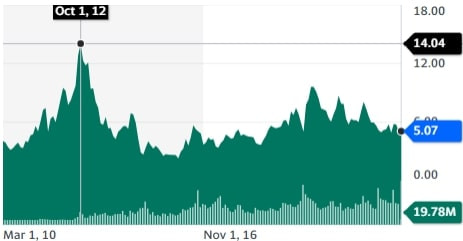

7. Sandstorm Gold Ltd. (SAND)

| P/E | 17.23 |

| Dividend Yield | 1.02% |

A more moderen entry within the royalty enterprise grew its asset portfolio from 3 in 2009 to 250 in 2022. Sandstorm’s technique is to concentrate on the lowest-cost mines, with 54% of its belongings within the most cost-effective quartile by AISC (for comparability, Franco-Nevada has simply 11% within the most cost-effective quartile).

Its belongings are at the moment producing 93,000 ounces of gold, with a goal of 100-140 Koz in 2024-2028. Revenues come largely from gold and silver.

Its largest asset is Hod Maden in Turkey. Different massive belongings are in Peru, South Africa, Brazil, Chile, and Mongolia. General, Sandstorm’s concentrate on low-cost manufacturing prices makes it extra worthwhile but in addition exposes it to extra dangerous jurisdictions.

This will make it an choice for buyers on the lookout for low-cost gold miners, hoping for the royalty enterprise mannequin to offer safety, and on the lookout for diversification in opposition to dangerous jurisdictions.

ETFs (Change Traded Funds)

Commodities, and particularly gold, may be uncovered to political and jurisdiction dangers. Proudly owning bodily gold may also be tough to do safely and cheaply. ETFs can tackle that drawback and may present diversification with even a modest funding.

- VanEck Gold Miners ETF (GDX): This main gold mining ETF is targeted on holding the highest gold miners and corporations on this planet. Newmont, Barrick, Franco-Nevada, and Agnico-Eagle are the highest 4 holdings (a 3rd of the fund).

- VanEck Junior Gold Miners UCITS ETF (GDXJ): As exploration for brand spanking new mines is a really dangerous enterprise, sturdy diversification is preferable. The ETF is unfold huge, with solely 7 shares composing greater than 3% of the portfolio and a pair of/3 of the holdings at lower than 2.5% weight.

- SPDR Gold Shares (GLD): The ETF represents the possession of gold, the commodity, as a substitute of miners. Every share of the ETF is value 0.093995 ounces of gold, held in vaults in London.

- Franklin Responsibly Sourced Gold ETF (FGLD): Much like GLD, however with a concentrate on holding solely responsibly sourced gold bullion.

- Abrdn Bodily Treasured Metals Basket Shares ETF (GLTR): This fund invests in bodily treasured metals, together with gold (60%), silver (27%), platinum (4%), and palladium (9%).

Gold shares aren’t for everybody. For those who’re on the lookout for exponential features, you’ll wish to look elsewhere. For those who’re on the lookout for insurance coverage in opposition to monetary disaster, foreign money or sovereign debt points, investing in gold is likely to be value a better look.