Elevating funds is an inevitable a part of a startup’s journey. Entrepreneurs should undergo a number of funding rounds to lift the mandatory funds for increasing their operations.

A startup wants to lift funds on the proper time; earlier than it’s too late to hitch due to competitors or too early to hamper the product-market match.

The primary concern arises when a startup can not run on a bootstrap mannequin, which means that the founder can not use their present assets within the enterprise. They need to search for traders, enterprise capitalists or incubators to put money into their companies.

However earlier than all that, the founder wants to find out how a lot funds they want. That is the place the method of startup valuation is available in.

Nevertheless, it’s important to be sure that your startup doesn’t find yourself getting overvalued or undervalued, as it would negatively impression the traders.

To keep away from this, listed here are some startup valuation strategies that will help you on this course of.

Startup Valuation Terminologies

Earlier than shifting on, listed here are some key phrases you want to perceive:

- Startup valuation: The worth of a startup merely means what the startup can be value if it’s offered right this moment for IPO or to every other agency. It considers elements just like the group’s experience, product, property, competitors, market alternatives, and development potential.

- Pre-money valuation: The pre-money valuation merely refers back to the firm’s worth earlier than any funding.

- Submit-money valuation: The post-money valuation refers back to the firm’s worth after elevating funds. Merely put, pre-money valuation plus the quantity of funding is the post-money valuation.

- Enterprise capitalists: Enterprise capitalists are personal traders that purchase a portion of an organization in alternate for capital (cash). These corporations might be startups or small corporations with excessive development potential sooner or later. They’re usually part of a VC agency that has an funding fund devoted to financing companies.

- Pre-revenue startups: An organization that’s at a prototype stage or has launched its first product available in the market however has not truly made any cash from promoting its services or products.

- EBITDA: Earnings earlier than Curiosity, Tax, Depreciation, and Amortisation

- Angel traders: Angels are rich personal traders who put money into small companies or startups in alternate for a stake of their enterprise. In contrast to VC companies, angel traders use their very own web value for investing.

For Pre-Income Startups

Most startups don’t have concrete earnings on the starting of their life cycle. Because of this, it turns into tough to worth startups with none monetary knowledge. However, founders of pre-revenue startups nonetheless want to establish the worth of their firm when elevating funds.

So listed here are a number of totally different startup valuation strategies utilized by entrepreneurs when they’re pre-revenue.

The Berkus Methodology

The Berkus methodology calculates the worth of a startup earlier than it generates its first income. As a substitute of monetary estimates, it focuses on the dangers linked with the corporate.

Founders of startups regularly count on speedy gross sales development and unrealistic revenue margins, which they’re unable to satisfy.

Because of this, Dave Berkus created this mannequin to worth a startup primarily based on its potential as an alternative of precise efficiency.

Beneath this startup valuation methodology, your startup is assessed primarily based on 5 key success elements related to main dangers that may make or break a startup. These are

- Sound thought – It represents a enterprise’s fundamental worth, indicating that it has a good startup thought.

- Prototype – Expertise threat is decreased if an organization has a product that draws prospects.

- Strategic relationships – Sturdy strategic alliances and companions cut back the market threat of a startup.

- High quality administration – A wonderful administration group reduces the danger of poor implementation.

- Product roll-out or gross sales – Manufacturing threat is decreased when an organization has sturdy indicators of income development sooner or later.

Every issue is assessed and assigned a financial worth starting from zero to $500,000. The sum of all 5 values is a startup’s pre-money valuation, which might go as much as $2 million – $2.5 million beneath this methodology.

Let’s perceive this with an instance:

|

Worth driver |

Assigned worth (Most $500,000) |

|---|---|

|

Sound Thought |

$300,000 |

|

Prototype |

$275,000 |

|

Strategic relationships |

$175,000 |

|

High quality administration |

$350,000 |

|

Product roll-out or gross sales |

$200,000 |

|

PRE-MONEY VALUATION (SUM) |

$1,300,000 |

Even when you’ve got a very good enterprise thought ($300,000), your startup requires a superb implementation group to succeed. Now when you’ve got a group of area consultants and professionals on board, so the very best financial worth is assigned to high quality administration ($350,000).

The sound expertise used makes the prototype marketable ($275,000) and exhibits promise of producing income sooner or later ($200,000). Because of this, your organization can be valued at $1.3 million.

Value To Duplicate

Because the title implies, the price to duplicate method determines the price of constructing the identical startup from scratch.

Each expense from the price of constructing a product to buying bodily property is taken into account. The sum of all these bills is the “honest market worth” of the enterprise.

The rationale is {that a} potential investor wouldn’t enable a better valuation of the enterprise than its honest market worth.

In case you have a SaaS startup, for instance, it is going to be valued on the general value of creating the software program. For a high-tech startup, the prices may very well be incurred in analysis and growth, submitting patents, and product engineering.

By concentrating solely on an organization’s bodily property, this method largely ignores intangible property like human capital, mental property, or model worth. It is a main downside as intangible property are an necessary supply of aggressive benefit and are sometimes described as an organization’s lifeblood.

One other flaw with this startup valuation methodology is that the startup worth stays unaffected by the corporate’s future potential to generate income, income, and better development charges.

The associated fee-to-duplicate method is usually seen as a place to begin in valuing startups as it’s merely a file of historic bills. You possibly can mix this with different approaches just like the Berkus methodology or Scorecard valuation to realize higher outcomes.

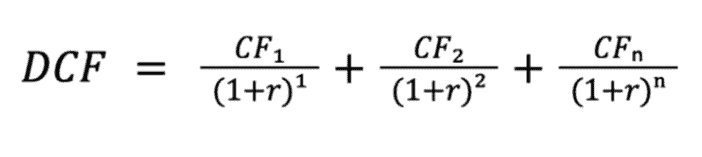

Discounted Money Circulate Mannequin

The discounted money circulation mannequin refers to a valuation methodology that determines the worth of a startup primarily based on its future money flows.

It is among the most generally used strategies that think about the time worth of cash. This merely signifies that a greenback is value extra right this moment than a yr from now as a result of it may be invested.

For instance, with a ten% annual rate of interest, $1 in a financial savings account can be value $1.10 after one yr, $1.21 in 2 years, and so forth.

The projected future money flows are then discounted with a set price to find out their current worth.

The sum of all discounted money flows for the interval is termed the startup’s worth.

The components for the DCF valuation methodology is:

The place CF1 = Money circulation of yr 1

CF2 = Money circulation of yr 2

CFn = Money circulation of yr ‘n’

n = variety of durations

r = low cost price

Money circulation refers back to the web amount of money and money equivalents shifting out and in of enterprise. For valuing a startup, we take free money flows, which discuss with earnings (together with curiosity) web of taxes

The variety of durations is the variety of years money flows are anticipated to happen.

The low cost price is normally taken because the weighted common value of capital (WACC) or value of capital. WACC refers back to the return anticipated by the suppliers of capital.

Let’s perceive this methodology with the assistance of an instance:

Suppose your organization A Ltd. is evaluating a brand new mission. Your organization’s WACC is 10% therefore the discounting price. The mission has the next money inflows for the subsequent 5 years together with the preliminary funding of $1 million.

Take into account the long-term development price to be 15%.

So terminal money circulation is calculated for the interval after 5 years as follows

Free money circulation after 12 months 5 = Free money for the final interval (12 months 5) * (1 + development price)

|

12 months |

Money circulation (in $) |

Discounting issue (10%) |

Discounted Money circulation (in $) |

|---|---|---|---|

|

1 |

100,000 |

0.909 |

90,909 |

|

2 |

200,000 |

0.826 |

165,289 |

|

3 |

300,000 |

0.751 |

225,394 |

|

4 |

400,000 |

0.683 |

273,205 |

|

5 |

500,000 |

0.621 |

310,460 |

|

5 |

575,000 (terminal money circulation) |

0.621 |

357,075 |

|

|

The sum of discounted money flows |

|

1,422,332 |

Therefore the worth of the startup, on this case, is $1,422,332

Scorecard Valuation

Formulated by Invoice Payne, the scorecard valuation is among the hottest strategies utilized by angels.

Just like the Berkus methodology, the scorecard methodology doesn’t depend on monetary projections however compares different funded startups in the identical area with added standards.

First, you establish the pre-money valuation of the corporate. Then, you’ll examine the place your organization stands on the next parameters.

- Power of the Administration Group (0-30%)

- Dimension of the Alternative (0-25%)

- Product/ Expertise (0-15%)

- Aggressive Setting (0-10%)

- Advertising and marketing/ Gross sales Channels/ Partnerships (0-10%)

- Want for extra funding (0-5%)

- Different (0-5%)

Now let’s take an instance to grasp this startup valuation methodology higher.

Suppose your organization X Ltd is seeking to elevate funds.

The very first thing you do is locate the common pre-money valuation of comparable corporations. Say, you discovered pre-money valuations of three corporations:

|

A Ltd |

$3,500,000 |

|

B Ltd |

$5,000,000 |

|

C Ltd |

$3,500,000 |

|

Common pre-money valuation |

$4,000,000 |

Now, it’s important to modify this valuation primarily based on some attributes. That is how we discover the adjustment issue.

|

Attribute |

Vary |

Precise weight (X) |

Goal firm (X Ltd) (Y) |

Issue (X*Y) |

|---|---|---|---|---|

|

Power of the administration |

0-30% |

20% |

100% |

0.2 |

|

Alternative measurement |

0-25% |

15% |

60% |

0.09 |

|

Product/ expertise |

0-15% |

15% |

130% |

0.195 |

|

Aggressive Setting |

0-10% |

10% |

150% |

0.15 |

|

Advertising and marketing/ Gross sales Channel/ Partnerships |

0-10% |

5% |

75% |

0.0375 |

|

Want for extra funding |

0-5% |

5% |

100% |

0.05 |

|

Different |

0-5% |

0% |

80% |

0 |

|

|

|

|

Adjustment issue |

0.7225 |

The precise weight you assign to every parameter is subjective to your judgments. For instance, when you imagine the administration group shouldn’t be sturdy sufficient, its weight might be lowered to twenty%. In case you suppose there may be a variety of competitors available in the market then the burden might be 10%.

The goal firm’s impression is assessed primarily based on a worksheet which is a listing of varied points and their impression.

The adjustment issue (0.7225) is multiplied by the common pre-money valuation ($4,000,000).

This provides the goal firm’s pre-money valuation to be $2,890,000.

Enterprise Capital Methodology

Enterprise capital companies put money into startups by shopping for a portion of the corporate in alternate for cash. They use startup valuation to find out how a lot of an organization they need to purchase.

Within the absence of constructive money flows or good comparable corporations available in the market, it turns into tough to determine the worth of an organization.

Because of this, Invoice Sahlman launched the enterprise capital methodology of startup valuation that focuses on the Exit Worth (EV) or Terminal Worth (TV), which is the worth at which the corporate is anticipated to be offered at a future time.

Let’s perceive the method with an instance.

You need to elevate $5 million as an funding on your startup.

First, decide the corporate’s monetary forecasts together with projected gross sales, EBITDA, and Web Revenue.

|

12 months 1 |

12 months 2 |

12 months 3 |

12 months 4 |

12 months 5 |

|

|---|---|---|---|---|---|

|

Income |

$1M |

$10M |

$30M |

$55M |

$100M |

|

EBITDA |

$0.5M |

$2M |

$5M |

$15M |

$20M |

|

Web earnings |

$0M |

$1M |

$3M |

$6M |

$10M |

Now, let’s say that the Enterprise Capital agency needs to exit by 12 months 5. This means that the Exit Worth can be calculated at 12 months 5.

The comparable corporations available in the market are buying and selling for 10 occasions their earnings (web earnings)

Exit Worth (EV) = Web Revenue x A number of

EV = $10M x 10 occasions = $100M

Now, you low cost the exit worth with a price equal to the specified price of return of VC traders to achieve a Current Worth (PV).

Price of return anticipated = 33%

Utilizing the DCF components

PV = $100M / (1 + 33%)^5 = $24M

This current worth of $24M is the corporate’s post-money valuation.

Now subtract the preliminary funding of $5M to get the pre-money valuation.

So the pre-money valuation can be $19M.

To calculate the possession stake of VC

Quantity of preliminary funding / post-money valuation

$5M / $24M = 20.83%

Danger Issue Summation

The chance issue summation or the RFS methodology is a pre-money valuation methodology for early-stage or pre-revenue startups.

Just like the scorecard valuation, the RFS methodology begins with a base worth which is the pre-money valuation of an organization computed on the premise of comparable startups.

This base worth is then adjusted for 12 customary threat elements.

Merely put, you examine your startup to related startups available in the market and decide whether or not you’ve got a better or decrease threat.

Every of those dangers is assigned a rating throughout the vary [-2,2] relying on its severity.

|

Ranking |

Danger |

Adjustment to Pre-money valuation |

|---|---|---|

|

+2 |

Extraordinarily Optimistic |

Add $500,000 |

|

+1 |

Optimistic |

Add $250,000 |

|

0 |

Impartial |

Add/ Minus Nothing |

|

-1 |

Unfavourable |

Minus $250,000 |

|

-2 |

Extraordinarily Unfavourable |

Minus $500,000 |

You’ll perceive this higher with the assistance of an instance.

Suppose you need to elevate funds on your startup FabFood Ltd from the market.

You begin by figuring out a benchmark worth which is computed by taking the common of the valuations of comparable startups in your space.

|

Identify |

Valuation |

|---|---|

|

ABC Meals Ltd. |

$4M |

|

XYZ Edibles |

$3.5M |

|

PQR Ltd |

$6M |

|

Spoodle Ltd |

$2.5M |

|

Common pre-money valuation |

$4M |

This worth would be the benchmark worth which can be adjusted for the next threat elements.

|

Danger Issue |

Ranking |

|---|---|

|

Danger of the Administration |

1 |

|

Stage of the Enterprise |

2 |

|

Exit Worth/ Potential profitable exit threat |

0 |

|

Danger of popularity |

-1 |

|

Provide chain threat |

-2 |

|

Political threat |

0 |

|

Funding/ Capital elevating threat |

1 |

|

Gross sales and advertising threat |

1 |

|

Competitors threat |

-1 |

|

Expertise threat |

1 |

|

Litigation threat |

0 |

|

Worldwide threat |

2 |

|

Sum |

4 |

You now multiply this quantity by $250,000 to reach on the adjustment worth.

Danger adjustment = 4 x $250,000 = $1 million

So, the whole pre-money valuation of your startup is $4 million + $1 million = $5 million.

For Submit-Income Startups

Startups which have made some cash by promoting their services or products available in the market are generally known as post-revenue startups. They’ve concrete monetary knowledge which might be in contrast with different corporations in the identical business to establish their valuation.

So let’s perceive a number of startup valuation strategies utilized by post-revenue startups:

Commonplace Earnings A number of Methodology

A a number of of earnings is a valuation method wherein the worth of a agency is established by multiplying its earnings by a a number of.

For instance, if a agency has $1 million in earnings and a a number of of 5, its valuation is $5 million.

This means that beneath this technique, two components impression the worth of your organization: the corporate’s earnings and a a number of.

An organization is valued on the premise of its working efficiency over time. Because of this, most corporations use EBIT (Earnings earlier than Curiosity and Taxes) – working revenue – as a measure of their earnings. Whereas generally, corporations additionally use EBITDA to measure earnings.

The subsequent step is to decide on an earnings a number of. Companies within the $1-10 million vary use a multiplier of 2-4x whereas companies bigger than $10 million can use a a number of as excessive as 8 – 12x.

Many elements affect the worth of the a number of.

- Trade: The most typical issue is the business wherein the enterprise operates. Small service corporations are likely to have a smaller a number of like 2-3x. Then again, software program as a Service (SaaS) corporations can have a a number of as excessive as 15x.

- Income pattern: If the enterprise exhibits a year-on-year or month-on-month development price in income, it would obtain a better a number of than an organization whose revenues are lowering.

- Firm age: A well-established firm with a robust model worth and a robust buyer base can have a bigger a number of than an organization that’s simply beginning out. These components take time to construct and are a sign of stability thus rising the a number of.

The simplicity of this methodology makes it extraordinarily widespread for startup valuation. One other main issue is that almost all startup valuation strategies are for pre-revenue startups, however this methodology offers a approach to calculate it for startups who’ve some stage of earnings.

Market Multiples Methodology

The market multiples method is a startup valuation methodology primarily based on the precept that related corporations in the identical business ought to have an identical worth.

To make use of this methodology, an investor or analyst of the corporate identifies a bunch of comparable corporations and gathers knowledge on their monetary efficiency and metrics like income, earnings, and money circulation.

Based mostly on the metrics gathered, numerous monetary ratios are calculated. A mean or median of those ratios are then used to find out the a number of for valuing your startup.

Let’s perceive this higher with the assistance of an instance.

Suppose you’ve got an e-commerce startup – A Ltd.

Step one is to gather monetary knowledge of all comparable corporations within the business:

|

Firm |

Income |

Web Revenue |

EBITDA |

|---|---|---|---|

|

P Ltd |

$100M |

$20M |

$30M |

|

Q Ltd |

$50M |

$5M |

$7M |

|

R Ltd |

$10M |

$2M |

$1M |

|

S Ltd |

$75M |

$6M |

$8M |

Subsequent, you calculate monetary ratios as follows

|

Firm |

Value-Gross sales Ratio (P/S Ratio) |

Value-Earnings Ratio (P/E ratio) |

Value EBITDA ratio |

|---|---|---|---|

|

P Ltd |

8x |

40x |

26.67x |

|

Q Ltd |

2.5x |

25x |

17.85x |

|

R Ltd |

2x |

10x |

20x |

|

S Ltd |

1.2x |

15x |

11.25x |

Now, to find out the market a number of, it’s important to take the median or common of monetary metrics.

Let’s take the common of the P/S ratios of all comparable corporations.

Common P/E ratio = (8x+2.5x+2x+1.2x) / 4 = 3.425x (market a number of)

The estimated worth of your startup is calculated as follows:

Startup worth = Income x market a number of

If the income of your startup is $15M then your startup valuation can be

$15M x 3.425 = $51.375 Million.

Ebook Worth Methodology

The e-book worth methodology of startup valuation is a technique the place the worth of an organization is set by taking the web worth of its property and liabilities.

Corporations can use this startup valuation methodology at any stage of their life cycle.

Successfully, this methodology is predicated on the corporate’s stability sheet, the place its worth is calculated by subtracting the worth of liabilities from the property. That is also referred to as the web value of the enterprise.

Let’s illustrate this with the assistance of an instance:

Suppose you’ve got a startup that manufactures sustainable utensils for households. That is your monetary data:

|

Liabilities |

Quantity |

Belongings |

Quantity |

|---|---|---|---|

|

Capital |

$1,000,000 |

Plant & Equipment |

$500,000 |

|

Collectors |

$450,000 |

Debtors |

$550,000 |

|

|

|

Money |

$400,000 |

|

Whole |

$1,450,000 |

Whole |

$1,450,000 |

Now web value or e-book worth of your organization is calculated as

Ebook Worth = Whole property – Exterior liabilities

Ebook Worth = $1,450,000 – $450,000

Ebook Worth = $1,000,000

Capital in your enterprise shouldn’t be an outdoor legal responsibility as a result of it represents your (proprietor’s) possession within the firm.

Nevertheless, this methodology might not precisely replicate the true worth of a startup. Monetary statements regularly fail to symbolize components like mental property, model id, and administration group high quality. This technique doesn’t think about an organization’s income forecasts and future development potential.

So it’s best suggested to pair this with different startup valuation strategies to reach at a extra correct valuation.

Go On, Inform Us What You Suppose!

Did we miss one thing? Come on! Inform us what you consider our article on startup valuation strategies within the feedback part.

A startup fanatic, optimist and full time learner. With eager curiosity in finance and administration, Khushi believes communication to be the important thing to each administration. All the time able to discover extra and strolling that further mile in placing efforts.