My foremost 2020 funding thesis is the belief this #pandemic does not herald new & everlasting societal change. However it should reinforce & speed up present traits, with #cryptocurrency/#blockchain innovation, growth & adoption poised to learn vastly. It’s simply three years since my first & final crypto put up (& Bitcoin‘s solely twelve years previous!), however its progress since has been astonishing…

We kicked off with a spectacular crypto-bubble in late-2017, with the launch of Bitcoin futures triggering the devastating early-2018 collapse…which happily performed out in lower than a 12 months. Constancy, Coinbase & Bakkt launched institutional-grade digital custody platforms & even the OCC confirmed US banks can now supply digital custody companies. Crypto exchanges like Binance, BitMex, Coinbase, Huobi & Kraken now boast a whole lot of thousands and thousands/billions of {dollars} in every day crypto quantity. Libra was introduced by Fb. Extra & extra hedge funds are getting concerned – Mike Novogratz launched Galaxy Digital, with Paul Tudor Jones & even Stan Druckenmiller shopping for into Bitcoin as a digital asset/inflation hedge – to not point out, household workplace/school endowments (are pension funds & sovereign wealth funds subsequent?). Sq. & PayPal now settle for crypto & extra fee firms will observe. Proof of stake has emerged as a inexperienced different to crypto-mining. Grayscale‘s listed crypto funds now boast a $14 billion+ mixture market cap (alas, many of the US fund trade nonetheless awaits SEC crypto approval), whereas Complete Worth Locked Up in #DecentralizedFinance can be at a $14B+ all-time excessive (& doubling each month/two since June!). Stablecoins are additionally rising as stable-value/high-volume bridges to the fiat world. We’ve even seen listed firms like MicroStrategy & Sq. purchase Bitcoin as a company treasury asset. And Bitcoin’s now solely 6% off its all-time excessive…

The volte-face in attitudes has additionally been spectacular, with the crypto sector recognizing that embracing (& selling change in) present monetary/regulatory regimes gives a slice of an infinitely bigger pie. Whereas regulators are additionally extra open too – although US regulators might stay as schizophrenic & over-reaching as ever – with central banks (just like the PBoC, Fed & BoE) now floating (& trialing) digital forex proposals, to co-operate/compete with crypto. As for buyers, the Bitcoin survival debate’s lifeless…it’s been anointed digital gold & no person may disagree it’s not a contender. Whereas the mantle of blockchain innovation handed to Ethereum (& the upcoming Ethereum 2.0), plus the smart-contract tasks & infrastructure being constructed atop it (3,750 DApps & counting, totally on Ethereum). And #DeFi is shaping up as a killer app for blockchain…to affix forces with #fintech & ultimately #BigTech to problem the legacy monetary companies/funds trade. [Maybe even value investors get this…look at bank valuations!?] Its IPO could also be on ice, however Ant Group‘s nonetheless a prescient reminder (for the West) of how simply bank-customer relationships & economics could be cannibalized by disruptive know-how & enterprise fashions.

However hey, I’m not right here to promote crypto…there’s numerous evangelists, articles & Twitter feeds to persuade you of its deserves. Assuming you’re (even remotely) open to investing in a brand new foundational know-how, a nascent asset class, and/or a possible retailer of worth, we’ve now reached a degree the place a modest 3-5% crypto allocation arguably is sensible in any portfolio. [And yes, it’s an allocation – don’t be red-herringed by its technical intricacies/ideological arguments – most investors can & should buy crypto just like they buy a sector/country/thematic ETF, i.e. for its big picture exposure & potential]. And so, I am right here to revisit afresh considered one of my highest return investments…a inventory you would possibly think about proudly owning too, regardless of whether or not your present crypto information/expertise is professional-grade, or near zero! I current:

Lengthy-time readers will keep in mind I first wrote it up in Sep-2017, simply days earlier than Bitcoin/crypto went exponential:

‘Kryptonite Even Superman May Love…’

And if you wish to learn that piece, I first suggest this crypto/blockchain inventory primer. It highlights how few viable pure-plays had been obtainable to fairness buyers – and albeit, it’s a lot the identical as we speak – and gives worthwhile context on why I homed in on KR1 as a distinctive crypto funding firm.

KR1’s origins are in Guild Acquisitions plc…a former automobile of (the late) mining investor Bruce Rowan. [A nano-cap* listed shell: Just £0.1 million equity, minimal admin. expense/cash/debt & no outstanding options/contingent liabilities]. In Jul-2016, in a deal sponsored by Rupert Williams & Jeremy Woodgate of Smaller Firm Capital – each appointed administrators, together with new CEO George McDonaugh – the corporate introduced a £0.1 million putting & a brand new blockchain funding technique. By year-end, it was renamed Kryptonite 1 plc, and accomplished one other £0.3 million in placings & participated in its first preliminary coin providing (simply £6K in SingularDTV!).

[*UK Adjustment: e.g. Median AIM market cap is barely £25 million, so I re-classify nano as sub-£5M, micro as £5-20M & small-cap as £20-100M here!]

McDonaugh’s background is in advertising…’til he found Bitcoin & fell down the crypto rabbit-hole. Whereas Keld van Schreven is a serial startup man – he grew to become a director in 2017, however was a marketing consultant from the beginning & is now a fellow MD/Co-Founder. Janos Berghorn is the third & last staff member…in true crypto spirit, KR1’s a lean decentralized operation that’s in any other case outsourced to exterior crypto consultants (as wanted) & advisers/service suppliers.

Right here’s George & Keld recalling the courageous beginnings of KR1, and an interview with McDonaugh which is an effective total introduction to KR1, its portfolio & funding strategy:

Ending 2016 with simply £0.4 million of fairness, the corporate clearly wanted to bootstrap itself through additional placings…however what’s wonderful is that KR1’s solely accomplished three placings since. All instructed, it’s raised simply £2.7 million in its lifetime, with no additional placings since Dec-2018!

[NB: It also completed a 19-for-1 share consolidation in Apr-2017 – note when consulting prior RNS/results. And in 2018, we learned Superman didn’t actually love Kryptonite 1, so they ‘…changed its name to KR1 Plc at the request of a global entertainment company which has trademarked the word ‘Kryptonite’ in relation to a fictional alien mineral associated with the weakness of a particular superhero’!]

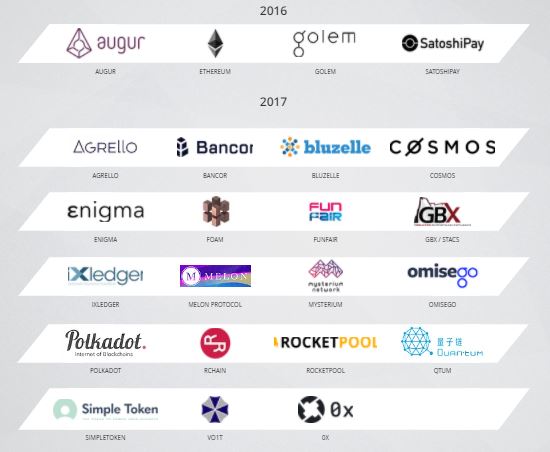

And the operational progress of the KR1 staff since has been nothing wanting extraordinary! Right here’s a visible abstract of their investments so far:

And for reference, right here’s KR1’s present investments (43 in whole), by classic – sure, you may ignore the excruciating element – focus as a substitute on whole portfolio worth (per market/newest funding spherical valuations, or value/adjusted value) as of end-June & as we speak (20-Nov-2020):

[i) Coinmarket pricing used (if possible) for all tokens, 2019/20 funding round valuations used for certain equity investments, a 0.7x multiple (vs. cost) for all other 2017/18 investments (per average vintage multiple, exc. outlier multi-baggers), and cost for all other non-traded 2019/20 investments.

ii) Token holdings (as of 20-Nov-20) may exc. tokens earned staking, and are generally unchanged vs. end-June except for subsequent investments/sales/staking (see recent RNS).

iii) NB: Polkadot, Nexus Mutual & Dfinity held at cost as of end-June – all started trading Jul/Aug (Dfinity still a grey market IOU pre-launch).]

And it’s truly 56 investments in whole, summarized as:

[NB: KR1’s RNS always focused purely on reporting actual investment purchases & sales – and compared to the blue sky crap many nano-cap companies issue, this was actually my first/big positive signal re management! It meant some immaterial investments & non-purchases/sales (like bonus allocations/staking/etc.) weren’t reported along the way – but KR1’s made a much better effort this year to identify staking/lockdrop rewards & exact token holdings in its RNS.]

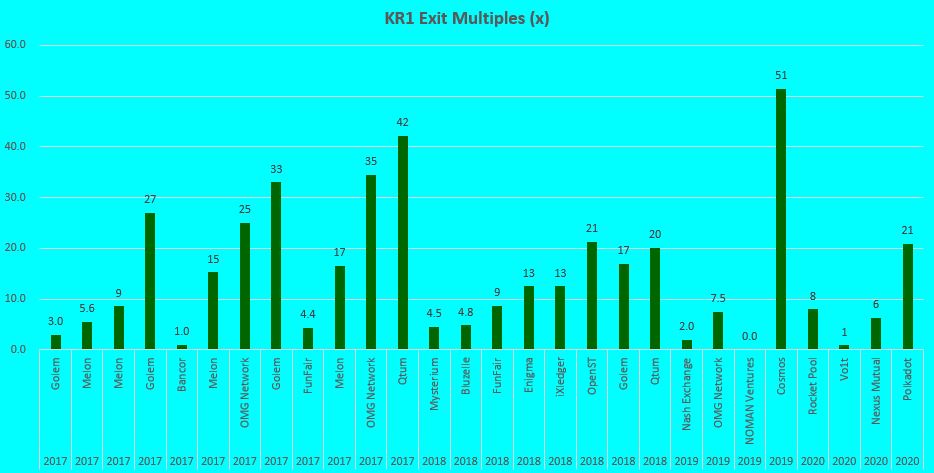

And people partial/full exits (29 particular person gross sales) boast some unimaginable multiples alongside the best way…and sure, I imply multiples of value!

The dangerous information: A (small) zero, a ten% loss & a break-even sale…any VC value their salt would sigh in aid at such exits! In any other case, exit multiples vary from 2x for Nash Alternate, 21x for Polkadot (final month), 35x for OMG Community, all the best way as much as an astonishing 51x for Cosmos…and notably, most of the staff’s (finest) exits occurred lengthy after the late-2017 crypto bubble!

In mixture, KR1 boasts a median 15x exit a number of so far.

However what have its realized & unrealized portfolio positive factors delivered for shareholders since inception? Nicely, right here’s KR1’s reported fairness/NAV per share so far:

[NB: Initial 20-Jul-2016 NAV per share reflects end-Jun £0.1 million equity & KR1’s first £0.1M placing vs. 30M shares outstanding (adj. for subsequent 19-for-1 consolidation.]

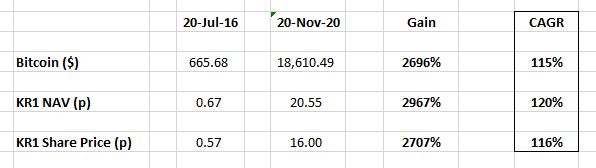

2017 was like taking pictures tuna in a barrel, crypto buyers loved unprecedented bubble income…whereas 2018 was the unavoidable collapse. However total, KR1 buyers have nonetheless loved a large crypto tailwind/adoption curve since Jul-2016. For perspective, let’s evaluate KR1’s NAV & share value efficiency vs. Bitcoin itself:

Simply marvel at Bitcoin’s return…94% pa! And with KR1 racking up such wonderful 76% pa & 89% pa NAV/share value absolute returns – and keep in mind, that’s internet of all bills/efficiency charges/taxes/and so forth. & not forgetting preliminary unavoidable fairness dilution – is it churlish to ask, the place’s the alpha?

Besides there’s a hell of a kicker right here…

Keep in mind, three of KR1’s high holdings (Polkadot, Nexus Mutual & Dfinity) had been nonetheless held at value as of end-June. And so, inevitably, we’d like a present NAV estimate – utilizing interim & as we speak’s portfolio valuations, we will (re)assemble KR1’s stability sheet as of end-Jun & as we speak (20-Nov-20):

[i) ETH were time-locked to earn Edgeware & Plasm tokens.

ii) KR1’s registered as a 0% tax Isle of Man company (see 2016 annual report), but management was maybe naive about ensuring it did not have a UK permanent establishment & was ultimately subject to UK tax. Noting the resignation of two UK-resident directors last year, the drastic fall in office rental & decentralized nature of KR1’s business, and the absence of any current tax liability, I’ve actually confirmed a majority of the board are now non-resident. [And KR1 does have losses it can realize too]. I’m nonetheless making use of 50% of an estimated 19% UK tax legal responsibility right here – however would hope to see a decrease tax cost at year-end.

iii) NB: All Headline NAVs. For a completely diluted NAV, deduct deferred C shares £0.3 million nominal worth (deferred D shares are particularly designed to have zero financial worth) & modify for excellent 9.9M choice grant.]

At present’s estimated NAV/share of 20.55p (that’s a 232% achieve vs. a Jun-2020 NAV/share of 6.18p) might look like an astonishing windfall in simply months…besides it’s an accounting mirage, with worthwhile holdings nonetheless held at value as of end-June. And attentive KR1 buyers anticipated these positive factors (through gray market pricing) again in June/earlier this 12 months. In actual fact, monitoring crypto sector commentary, firm updates & undertaking milestones, it’s clear KR1 loved regular underlying worth creation/accretion ever since invested in Polkadot et al. again in 2017/18, but it surely’s solely absolutely acknowledged as we speak. So, let’s assess efficiency once more, from inception to as we speak:

Wow, even Druckenmiller can be impressed…now he’s a crypto-head! It’s a unprecedented achievement to bootstrap a £0.2 million nano-cap – regardless of an initially gradual funding section & disproportionate expense ratio, a UK company tax (& efficiency payment) legal responsibility & unavoidable fairness dilution alongside the best way – and find yourself with £27 million of internet fairness & boasting absolute 120% pa & 116% pa NAV/share value returns! Bitcoin’s the apparent beta…however KR1 was the actual alpha wager to make!

Alas, I missed the primary 12 months of KR1’s journey, however from Sep-2017 (& regardless of the crypto collapse), I’ve nonetheless loved a +288% achieve…that’s a 4-BAGGER in precisely 3 years! And sure, I consider there’s one hell of a crypto adoption curve nonetheless forward – so if KR1 delivers even a fraction of its 120% pa NAV returns so far, shareholders as we speak would additionally get pleasure from distinctive returns (& an virtually inevitable re-rating).

So…can the KR1 staff preserve delivering?!

Nicely, the numbers are compelling…however that query requires a qualitative evaluation. However first, we gotta look a present horse within the mouth: If our NAV estimate is 20.55p/share, why’s KR1 buying and selling at 16p/share…a 22% NAV low cost?! Nicely, let’s break it down:

Pores and skin In The Recreation:

Shouldn’t the KR1 staff have extra #skininthegame?

Blame the annual report, which lacks related shareholdings/choices disclosure. Once more, it’s all within the RNS: i) George McDonaugh‘s 2.6 million shares & Keld van Schreven‘s 0.7M shares, ii) Smaller Firm Capital‘s 5.0M shares & Jeremy Woodgate‘s 1.4M shares, iii) in lieu of compensation, a 2017 grant of choices to amass 9.87M shares (at their 0.19p nominal worth, ’til Jun-2027), with 20% being awarded to every of McDonaugh, Woodgate & Rupert Williams, and the remaining 40% being awarded (I’d presume) to van Schreven & Janos Berghorn. [Woodgate & Williams both resigned as directors last year, but they/SCC remain as consultants – and this could present an opportunity to consider adding a new independent non-resident/non-crypto director]. In mixture, that’s a 15%+ stake in KR1’s absolutely diluted odd share capital.

[NB: In terms of free float, also note these significant long-term holdings: a) Roshan Ashok Vaswani (rep. a UAE/African family office), 15.1 million shares, 11.5%, b) Adam Powell (of Neopets fame), 8.8M shares, 6.7%, and c) (estate of) Bruce Rowan, 4.8%.]

KR1 additionally has a bonus scheme (clearly disclosed within the annual report): A 15% efficiency payment, primarily based on internet asset positive factors (adj. for brand spanking new capital), with a excessive water mark. [A 20-30% fee’s normal for similar private crypto VC/hedge funds, that require a significant min. investment & offer far less liquidity]. The solely bonus paid so far (£1.3 million) was in 2017, when KR1’s fairness elevated from £0.4M to £13.6M. [Puts the high water mark at £14.5M, to inc. KR1’s final £0.8M placing in 2018 & misc. share issuance re options/services rendered]. Per the scheme, the staff opted to obtain a part of the bonus as an across-the-board allocation of unlisted tokens. Uncommon for a UK-listed firm, however solely regular for a VC agency, and it was designed for a nano-cap to draw/retain precise crypto-heads & ideally pay them through unlisted holdings, slightly than money/traded crypto it wanted to fund new investments.

Frankly, I used to be delighted with this bonus allocation – crypto’s an rising sector that may nonetheless count on radical change & volatility, so I sleep higher understanding the staff lies awake at night time worrying in regards to the worth, safety & staking potential of each KR1’s and their very own private holdings. And experiencing the identical economics – lots of KR1’s unlisted tokens soared & collapsed since, however similar to shareholders, the staff’s Polkadot allocation turned out to be the first multi-bagger winner for them too.

I imply, what higher pores and skin within the sport is there than that?!

And don’t under-estimate the retention side: With such a small & extremely profitable staff, the actual fear is that somebody/all of them depart (or get aqui-hired). Besides…they’d be hard-pressed to search out remotely the identical private economics elsewhere (or be their very own bosses)!

These are lovely digital gold handcuffs…

Between the bonus, choices & their shareholdings, the KR1 staff are true owner-operators. My solely proviso is the bonus set off – it makes no provision for KR1’s market cap. And since incentives drive behaviour, the board ought to think about amending the scheme to appropriately incorporate each KR1’s market cap and internet property development, for even nearer alignment with shareholders. They need to additionally acknowledge the biases of buyers…lots of whom worth choices exercised (& held) excess of a bonus & worth precise shareholdings much more once more. Noting their 2017 bonus & ensuing Polkadot holding, plus a probably bigger bonus once more this 12 months, it might be a good time & sign from administration to train their choices and make an open market share buy/two!

Proprietor-Operator Paradox:

Extra not too long ago, I’ve centered on founder/household/owner-operator run firms – no person would dispute they ship among the finest long-term returns! Besides buyers purchase their strengths…then instantly cherry-pick their weaknesses. I imply, why can’t they ship glorious efficiency and exit & pump the inventory to Kingdom come?! Besides the share value solely actually issues after they increase recent capital, or lastly make an exit. And founders are entrepreneurs…they consider that in the event that they deal with the enterprise, the inventory will deal with itself!

And it’s the identical with KR1: You may’t select an owner-operator & abruptly count on a promoter. [Who invariably fail to deliver…so careful what you wish for!] Some persistence is required..’cos ultimately, share costs actually do meet up with distinctive efficiency. However in the meantime, when George & Keld are in entrance of buyers, they might & ought to focus much less on promoting crypto…and focus extra on promoting KR1 as a compelling crypto play regardless!

That being stated – to be honest – we see much more IR effort & common engagement with the crypto/monetary media within the final 12-18 months, which ought to repay. After all, a jazzy new web site would clearly assist too..!?

Portfolio/NAV Updates:

KR1 nonetheless does not present an in depth portfolio breakdown (by models & worth). Or a daily NAV replace – besides through its outcomes, months later! Nonetheless, KR1’s RNS do present an in depth historical past of latest investments, partial/full exits & its newer time-lock/staking actions – work by ’em & you’ll nail/observe the portfolio fairly precisely (as per above).

Alas, that’s a ardour undertaking for hard-core shareholders…

Sadly, most nano/micro-cap (funding) firms begin out this manner. And in an rising sector like crypto, with a enterprise capital portfolio, there have been & arguably nonetheless are good causes for not offering a daily portfolio/NAV replace. [But KR1 does offer a monthly Medium update & an active Twitter account]. However 4 years & 4 dozen+ investments later, KR1 now has a £21 million market cap & some main winners driving its portfolio worth – it’s time to open the kimono!

And in the end, it’s about attracting a a lot bigger pool of potential buyers now able to lastly think about/add some crypto publicity. With its compelling observe file & uniquely diversified portfolio, KR1’s the apparent candidate…however that’s irrelevant if new buyers don’t realize it trades on a NAV low cost (vs. a 2.6 P/B a number of, primarily based on KR1’s final reported NAV), or just reject it as a #blackbox they only can’t get comfy with!

Aquis Inventory Alternate Itemizing:

Which brings us to the opposite apparent motive extra buyers haven’t found & purchased KR1…it’s listed on the Aquis Inventory Alternate (previously, NEX). Um, you what now?! Really, it’s considered one of solely two energetic/UK-focused Acknowledged Funding Exchanges – sure, the London Inventory Alternate (inc. AIM) and Aquis each function beneath primarily the identical regulatory regime! However NEX did a poor job of its buying and selling know-how & direct relationships with the foremost (on-line) UK brokers, so even as we speak shopping for KR1 might require a full-service deal – i.e. phoning a dealer to commerce – which, let’s face it, is a tall order for as we speak’s buyers!

Aquis Alternate plc (AQX:LN) solely acquired NEX in March, and per CEO Alasdair Haynes‘ file (as CEO of Chi-X Europe), we will consider his transformation plan – which explains KR1 not too long ago noting: ‘…the intention of improving the change infrastructure with regard to digital buying and selling, greater volumes, deeper liquidity and permitting for a extra world investor base. We’re trying ahead to seeing how the brand new Aquis Alternate staff implements their plans for bettering the legacy NEX Alternate over the months to return’. Such loyalty’s comprehensible…however once more, let’s not under-estimate investor biases. How lengthy earlier than the common investor realizes Aquis is not some gray/OTC market, or that the sins of NEX (& earlier failed incarnations) are irrelevant as we speak? Yeah, I feel you already know the reply…

An up-listing is the answer…i.e. an AIM/LSE itemizing. [And/or even a US OTC listing, which could deliver a drastic valuation re-rating – albeit, it might still require significant time/money to attract US investors]. That doesn’t essentially assure higher spreads & buying and selling volumes, however would bestow a seal of approval on KR1…within the eyes of a a lot bigger pool of buyers. And if that is one other crypto inflection level – as KR1 certainly believes – you need to speculate in regards to the revaluation potential of an up-listing, not to mention the possibility to possibly/lastly increase recent capital at an NAV premium. Due to this fact, an up-listing’s one thing KR1 now urgently owes its shareholders. A brand new choice grant contingent on an up-listing (however with an up-to-date NAV strike) can be an acceptable administration incentive on this situation – asserting this with a deliberate up-listing can be a terrific sign to the market of KR1’s under-valuation & ambitions.

OK, let’s recap:

– Board to think about amending bonus scheme to additionally mirror market cap development, exercising their choices & making open market buy(s).

– Focus much less on promoting crypto & focus extra on promoting KR1 to new buyers!

– Present a quarterly portfolio breakdown & NAV estimate to shareholders.

– Announce & proceed with an AIM/LSE itemizing (and/or perhaps a US OTC itemizing) as quickly as attainable, tied to a brand new/contingent (NAV strike) choice grant.

The primary two are nice-to-haves, whereas the final two are must-haves if KR1 desires to draw (vs. look ahead to) a a lot bigger pool of buyers. In case you’re a shareholder, I encourage you to endorse these suggestions to the staff. However keep in mind, they’re nonetheless icing on the cake…’cos owner-operators are proper: ‘As soon as the enterprise does properly, everyone does properly!’. Which brings us full circle:

So…can the KR1 staff preserve delivering?!

Sure, completely, is the brief reply! And that’s not just a few crypto wager…the lengthy reply lies in the identical unique causes I homed in on KR1 as a really distinctive crypto/blockchain funding firm.

[Again, I recommend this post – still a good primer on choosing between various crypto investment alternatives & separating the wheat from the chaff (& outright duds/frauds)!]

Staking Income/Income:

Very first thing I observed was KR1’s expense ratio. An odd metric, however rising sectors appeal to numerous promotional nano/micro-cap funding firms – they haven’t any actual working enterprise, administration’s centered on getting paid & returns (if any) invariably fail to beat an absurd expense/money burn hurdle. Whereas KR1’s whole workers prices in 2019 had been simply £269K & its whole £0.7 million value base places its expense ratio at simply 2.6% as we speak! This frugality & give attention to performance-based pay was an enormous constructive sign…since then, I’ve at all times been impressed with the staff’s integrity & no-nonsense under-promise/over-deliver strategy.

However as we speak…what expense ratio?! ‘Cos from day one, KR1 had no intention of being a Bitcoin/crypto miner (or tracker). As an alternative, it centered on investing in smart-contract/token economies, esp. these counting on a ‘Proof-of-Stake community that, not like Proof-of-Work networks, comparable to Bitcoin, doesn’t require monumental computing energy & vitality consumption to ensure the safety & censorship-resistance of the community’ (per current Kusama RNS). Proof of stake now appears set to be a dominant blockchain know-how – esp. with Ethereum 2.0 able to go stay – and when you’ve examine/had a pal lecture you about Bitcoin vitality consumption consuming the world, then KR1’s a real inexperienced/ESG crypto funding for you (& your pal) to think about!

Final 12 months, KR1 earned £242K from Cosmos, its first staking alternative. It’s now incomes Polkadot staking rewards at a present $1.7 million annual run-rate, and simply confirmed $124K in annual Kusama staking rewards, with Dfinity & Ethereum 2.0 to additionally supply staking quickly. In actual fact, its $1.5 million Kusama holding was itself a zero-cost Polkadot airdrop…and equally, KR1 earned ChainX & Phala tokens, is incomes Edgeware & Plasm from lock-drops, and expects comparable rewards through Acala & different tasks. To not point out, it earned £181K in advisory revenues from Vega Protocol, one other 2019 funding – notably, many tasks hail the KR1 staff for working with them pro-bono from day one, and it will undoubtedly produce extra advisory revenues (and/or preferential token entry & pricing) to return.

So KR1 now boasts a recurring income of one thing like $2.3 million, vs. an present expense base of $0.9M. And because the Kusama RNS famous, these ‘staking actions don’t impose any overhead or further working prices to the corporate’! That’s a considerable intangible asset/enterprise lacking from the stability sheet. Accordingly, if we capitalize* recurring internet earnings at an affordable 12 P/E, it may indicate an adjusted NAV of 29.5p/share, that’s 44% ($15.5M) greater than my present NAV estimate! To not point out, the dear inverse correlation in staking rewards vs. portfolio values – i.e. if staking yields drop, it typically implies greater utilization/demand & token values!

[*You may ask if this is double-counting…but it’s wayyyy too early in the crypto game to treat staking as merely equivalent to a passive yield embedded in asset values/prices. Crypto can offer utility, currency & investment in a single token, and staking’s not some default earnings stream at this point, it obviously requires intangible investment (time/flexibility/experience) & it can transform an expense ratio into recurring revenue/profits – all of which makes KR1 an even more uniquely diversified crypto portfolio & earnings opportunity today vs. the rest of the listed crypto universe (many of which boast none of the above).]

Funding Guidelines:

Perhaps the largest false impression about crypto buyers is the binary assumption {that a} fortunate few had been blessed with unimaginable multi-baggers, whereas the unfortunate had been eviscerated by frauds. In actuality, the phrase ‘luck is a matter of preparation meets alternative’ (& its inverse) are clearly true! Most fairness frauds are merely un-investible firms to start with & the remainder invariably belong within the ‘too onerous’ tray. The identical’s true in crypto…it simply takes somewhat widespread sense & a trusty funding guidelines. Certain, the KR1 staff’s had funding losses alongside the best way, however their funding course of has been exemplary – they’ve constantly averted the apparent frauds & absurd promotions.

KR1’s multi-baggers will also be credited to its funding guidelines course of. Assessing a staff’s expertise & fame is crucial step…as with all startup, their skill to pivot, execute & scale is essential. Subsequent is the undertaking itself: How modern is the know-how, how troublesome is the precise growth & implementation, what’s the potential timeline, scale & business alternative, and who else could also be focusing on comparable purposes & area? Ideally, you desire a credible staff, an thrilling undertaking & loads of white area to take advantage of! And eventually, there’s an analysis of the particular crypto economics – each the brief time period provide/demand dynamics, plus the long term utility, demand, inflation & retailer of worth potential of the token.

Diversified #BleedingEdge Portfolio:

The variety & variety of investments in KR1’s portfolio is kind of distinctive – globally, possibly a handful of crypto VC/hedge funds come shut, whereas listed crypto & blockchain portfolios aren’t remotely as diversified! And common VCs can’t match that blistering investing tempo. The naysayers assume a shotgun strategy is okay for crypto – however once more, guidelines it – you want a rifle, persistence & numerous onerous work for the portfolio and constant/spectacular returns KR1’s truly delivered.

And from day one, KR1 eschewed Bitcoin & centered on seed/early stage funding in token economies/blockchain tasks. As a result of Bitcoin’s in the end a wager on value…whereas investing in blockchain is a wager on innovation! [And I’ll always choose innovation – that’s why I bet on KR1, vs. Bitcoin]. It’s a basic picks & shovels technique…or ought to I say, roads & rails: With the increase/land seize so younger, they give attention to the structure & infrastructure of this new crypto world, and tasks that complement & leverage off present investments. Therefore, smart-contract instruments/DApps/platform tasks constructed on Ethereum, interoperability as an extremely profitable theme (through Cosmos & Polkadot), investments within the rising ecosystem round Polkadot itself…and naturally #DeFi, now exploding as the last word killer app for crypto. Right here’s van Schreven with a terrific overview:

After all, now everybody desires to put money into these themes & tasks…

Besides you actually needed to anticipate this crypto-evolution again in 2017/18, and uncover/put money into what had been bleeding edge tasks on the time! As Gretzky stated: ‘I skate to the place the puck goes to be, not the place it has been’. Or as Steve Jobs joked…Henry Ford was dreaming up the Mannequin T, when most individuals thought they wished a quicker horse! And that’s the #bleedingedge KR1 centered on beginning out…and and are nonetheless laser-focused on as we speak.

[And accordingly, shareholders should scan KR1’s portfolio/new buys now & again for emerging hidden gems…even a $0.2 million holding is meaningful if it ultimately turns into a potential multi-bagger!]

Enterprise Capital Economics:

Let’s re-iterate: KR1 is not some Bitcoin tracker, it focuses on seed/early stage investments in crypto/blockchain tasks…and enjoys the identical economics as the most effective VC funds! As Fred Wilson of Union Sq. Ventures describes it:

‘I’ve stated many occasions on this weblog that our goal batting common is “1/3, 1/3, 1/3” which implies that we count on to lose our complete funding on 1/3 of our investments, we count on to get our a refund (or possibly make a small return) on 1/3 of our investments, and we count on to generate the majority of our returns on 1/3 of our investments.’

And it’s possibly much more skewed, with a Pareto-like 80% of VC returns coming from simply 20% of their holdings. KR1 buyers have to embrace this: You may’t have a good time its multi-baggers…after which curse its losers! ‘Cos they’re inevitable. And big winners are in the end the important thing – as returns mirror a lognormal/power-law distribution, that appears one thing like this:

The key’s in the best tail…a large winner/two pays for all of the losers, length, bills & carry, and nonetheless pays out distinctive returns. Or as Peter Thiel put it (time to learn ‘Zero To One’ once more!):

‘The most important secret in enterprise capital is that the most effective funding in a profitable fund equals or outperforms all the remainder of the fund mixed.’

And as we speak that’s an ever extra dominant phenomenon because the world’s embraced on-line enterprise fashions/platforms & their community results. And blockchain takes it to a logical excessive, as crypto tasks: i) are largely open-source, recognizing worth doesn’t reside of their IP, it’s in the end created/embedded of their platform & community results, and ii) exploit blockchain’s trust-less & decentralized know-how to eradicate intermediaries & join/reward customers instantly. That’s why fairness (which historically owns/exploits IP) is uncommon & tokens are the dominant funding mechanism – ‘cos they’re each forex and funding – i.e. they’re speculative buying and selling chips, a possible retailer of worth, a utility token for transactions/companies, and/or a direct funding within the growing worth (creation) of a community.

It’s a wedding of twenty first century know-how (blockchain) & a centuries-old know-how (mutuality)! Not solely are you able to eradicate middlemen, you may eradicate (conventional) possession solely, and this can be a multi-trillion greenback alternative for blockchain to re-allocate income to customers/customers. [Picture Facebook with no shareholders, where its net revenue/profits belong to its most important stakeholders…i.e. users, who actually generate all its content. Likes could have evolved into the world’s most valuable utility token!] However as a substitute, #DeFi often is the killer app – the (legacy) monetary companies/funds trade is an extremely compelling goal by way of world income (to not point out dissatisfied prospects!).

However irrespective of how prescient your funding technique, or efficient your funding guidelines course of, it’s nigh inconceivable to know a priori which of your fledgling investments in the end turn out to be large winners. And that’s why, in such an rising/early adoption section, KR1’s extremely diversified portfolio offers it such a novel aggressive benefit, by way of previous & future returns!

VC Economics on Velocity:

In 2017, I described KR1’s particular crypto sauce as…flipping ICOs! This time ’spherical, I’ll describe it as VC on pace!

As a result of KR1 enjoys VC economics – which normally play out over a 10-14 12 months life-cycle – on a hyper-accelerated schedule. In 2017, this occurred in weeks/months through an ICO, usually primarily based solely on a white-paper. Now, the tempo is extra measured – a minimum of with respected/best-in-class tasks – they depend on small non-public seed/early stage funding rounds, set up & execute technical/undertaking milestones, evolve by varied beta levels, earlier than lastly launching (& possibly elevating extra funds) publicly. This performs to KR1’s strengths & eliminates direct ICO competitors – i.e. crypto’s evolving in the direction of a extra conventional VC mannequin & (initially) shutting out common non-public buyers.

Which enhances the economics: On the front-end, it’s low cost to capitalize/finance a staff & undertaking in growth/beta for a few years. Whereas on the back-end, crypto VCs can nonetheless count on a liquidity/exit alternative in 1-3 years – with the ensuing provide/demand imbalance much more turbo-charged as a world pool of buyers struggle to entry/low cost potential multi-baggers & the community results of profitable tasks. Simply have a look at equities…they’ve been round for hundreds of years & but the identical provide/demand equation nonetheless ensures IPO income/flipping are the best & most profitable supply of alpha on the planet!

However let’s not neglect the extreme remorse of missed gross sales. Some buyers are nonetheless bitter KR1 didn’t dump its portfolio wholesale in Dec-2017…certainly the worst sort of hindsight/back-seat driving. [Who would care if they’d sold their own KR1 shares at the top?!] I’ll supply a extra constructive perspective & meals for thought. Right here’s that KR1 exit multiples chart once more:

And right here’s the precise multiples on KR1’s High 5 holdings as we speak:

As KR1’s said: ‘We carry metropolis self-discipline to exiting our positions, and we put the proceeds again into additional investments’. For a lot of tasks, that’s a sale of 25% of their holding – usually to get better their unique value. However let’s get actual, there’s no self-discipline within the Metropolis that might truly preserve you in a 10-bagger, not to mention a 50-bagger! I imply, WWYBD: What Would Your Dealer Do?! You realize he’d have you ever in & out a dozen occasions & you’d miss a minimum of half the trip! You by no means go broke taking a revenue…who higher than Buffett to remind you the way silly that recommendation could be. Or Thiel:

‘This means two very unusual guidelines for VCs. First, solely put money into firms which have the potential to return the worth of all the fund. This results in rule quantity two: as a result of rule primary is so restrictive, there can’t be another guidelines.’

And when you rent KR1 as crypto fund managers, ought to they even/ever be contemplating cashing out some/all of their holdings? Is it a part of the job description…a query fund buyers & lecturers have debated for many years. There’s no simple reply, or onerous & quick guidelines. However sure, I clearly count on the KR1 staff’s realized from the bubble & discovered an actionable game-plan accordingly – recognizing that’s an bold problem when crypto presents such uneven risk-reward. And ultimately, as shareholders, don’t neglect the ultimate promote determination’s at all times as much as us…

Community & Repute:

And we have to recognize KR1’s community & fame. That’s the grasp key to all the things & one other extremely worthwhile intangible asset for buyers to understand. Thankfully, whereas crypto’s world, it’s nonetheless a comparatively small world – crypto-heads stay in/close to the identical few cities, attend all the identical conferences & are completely glad working/connecting in a completely decentralized method (pre & post-COVID)!

In actual fact, the KR1 staff’s core exercise is actually networking…that’s the place the deal stream comes from. And the way they consider a staff – essentially the most essential side of the funding course of – they already know the folks, or know individuals who know them. That’s how/why they usually work pro-bono with startups from day one – it’s sweat fairness they know pays off by way of seed/early-stage entry, pricing & valuation reductions, mates & household allocations, air-drops, early staking entry, potential advisory revenues, and serving to them discover & leverage off associated tasks. Once more, it’s all about accessing VC economics & determining what’s comes subsequent – everybody talks, shares concepts & offers again within the crypto group, recognizing {that a} bigger pie advantages all – and discovering the bleeding edge tasks already heading in that course.

And the way you community, give again & observe by as a VC investor is how you determine & develop your fame. KR1’s at all times punched properly above its weight – it’s been extraordinary to see a nano/micro-cap firm entry & put money into among the greatest & finest tasks, alongside Andreessen Horowitz, Pantera Capital, Polychain Capital, Union Sq. Ventures, Winklevoss Capital, et al! And its success will now open new doorways…as testomony to the staff, they’re now invited to think about seed investments in among the hottest new tasks, esp. within the burgeoning Polkadot ecosystem.

So sure, I completely consider the KR1 staff can preserve delivering! And you may wager they do too. It’s a novel story, a novel firm & a novel alternative…

…and possibly one other distinctive second for crypto?

I imply, simply have a look at the Bitcoin chart! Perhaps that is what the trajectory/adoption of a brand new asset class appears like…who is aware of actually, ‘cos how usually in human historical past have we seen a brand new asset class emerge?! [And a $0.5 trillion crypto market is literally still a rounding error in terms of global financial assets, while the listed crypto/blockchain sector’s a rounding error again in terms of crypto itself. Those are really tiny exit doors if more & more investors rush to leave fiat…] And after I say emerge, it’s occurring at warp pace – like all the things else we’ve carried out within the final two centuries, not to mention the final 20 years (& we’re nonetheless accelerating, learn your Kurzweil), vs. the in any other case glacial tempo of human progress:

And this current Pantera slide is a spectacular reminder of the particular scale of Bitcoin’s value/adoption cycles (& reversals) so far:

And the goalposts preserve shifting…now Bitcoin’s surpassed $18.5K once more, with simply the $20K #alltimehigh left as a serious technical hurdle. If/when Bitcoin blows by that stage, this time ’spherical institutional shopping for will probably be driving it, and I reckon the media & common public will scarcely even discover…i.e. the following nice crypto bubble solely inflates at a lot greater Bitcoin ranges (possibly even reaching $318K by end-2021, per Citibank?!). I imply, have a look at the Bitcoin Google Developments chart…the place’s the bubble, not to mention the curiosity?

Noting among the loopy sector multiples/bubbles we’re seeing, the absurd Robinhood buying and selling (in bankrupt shares!), the #YOLO #revengespending & buying and selling increase nonetheless to return post-COVID, the trillions in cash printing/spending on this new no matter it takes MMT world…properly, it’s not all that onerous to image crypto as a brand new retailer of worth and attainable mom of all bubbles to return!

Soooo…how can we go about pricing KR1?!

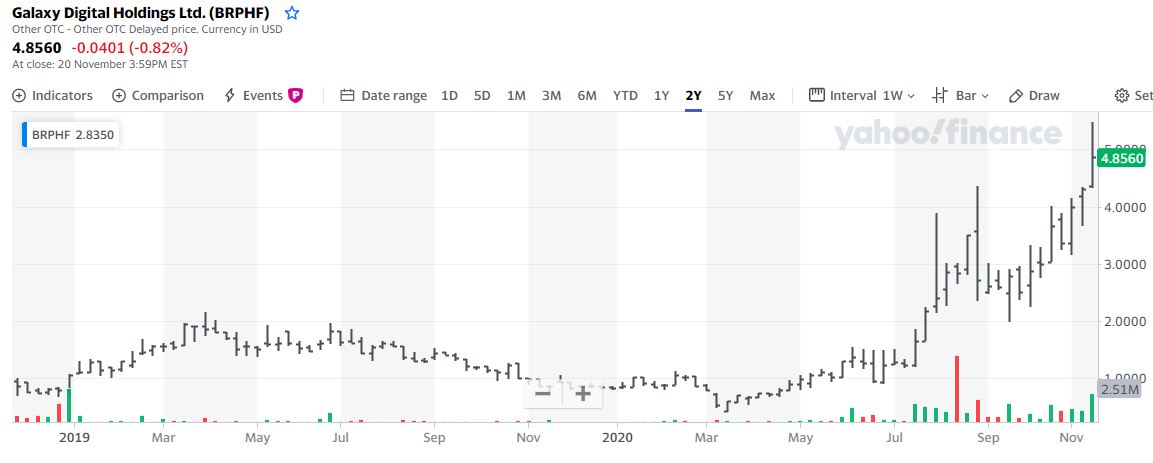

Nicely, with a unimaginable 4 12 months file beneath its belt…what’s KR1’s peer group precisely?! Take into consideration the biggest & most evident (real) crypto shares on the market, the one one remotely comparable is Galaxy Digital Holdings (BRPHF:US)…sure, an bold comparability, however the distinction is generally scale. Certain, Galaxy’s an apparent large-cap* listed crypto pure-play for buyers. [*Actually, the listed Galaxy Digital Holdings Ltd. (with a 27%+ stake in the LP) market cap is only $0.4 billion – if you see a $1.5 billion market cap, it reflects the underlying Galaxy Digital Holdings LP]. However its probably risky buying and selling (& nascent asset administration) companies require substantial personnel & stability sheet funding, so Galaxy now has a 14% pa expense ratio hurdle to clear…and right here’s its precise NAV file so far (as of end-June):

Finish-Sep NAV appears higher at $1.54/share…however said NAVs inc. non-controlling pursuits, so its precise NAV is $1.39/share. Thankfully, they’ll now increase recent capital at an NAV premium – a possible future alternative for KR1 – so final week’s $50 million PIPE enhances NAV by 5%, to $1.455/share. However check out the worth chart:

Galaxy truly traded on a 33% NAV low cost at end-2019…however the share value is up +496% YTD, vs. a mere +20% YTD NAV achieve, leaving Galaxy now buying and selling on a 3.3 P/B a number of! [And yes, other/large (non-passive) crypto stocks trade on even higher average multiples, with even the (passive) Grayscale Ethereum Trust (ETHE:US) trading on insane premiums this year!] The size of the revaluation’s simply extraordinary. Now, you may argue it displays potential revaluations of unlisted holdings, the worth of intangible property, the stand-alone worth of its working companies & the potential for multi-bagger crypto positive factors. However the identical is true of KR1! And do not under-estimate how a lot a £21 million market cap can rally if & when a bigger pool of latest buyers lastly uncover it. Esp. if it’s KR1, which boasts a uniquely diversified bleeding-edge crypto/blockchain VC portfolio, a worthwhile staking operation that’s lacking from its stability sheet/NAV, a crypto community & fame that’s additionally a worthwhile intangible asset…and most astonishing, its shares nonetheless commerce on a 22% NAV low cost, regardless of a 4 12 months+ file of 120% pa NAV returns!? Sure, let’s all get pleasure from that chart once more…

Based mostly on KR1’s file & assuming it may possibly ship even a fraction of these returns going ahead – and noting Galaxy now instructions a 234% NAV premium – it is sensible to allocate (say) two thirds of that premium to KR1 (rounding down, that’s a 150% NAV premium), i.e. a 2.5 P/B honest worth a number of. Due to this fact:

20.55p NAV/Share * 2.5 Value/Guide = 51.4p Honest Worth per Share

Which means a 221% Upside Potential, vs. the present 16p share value.

And positive, proper now that clearly looks like a value goal that’s far too bold & aspirational…and will require an up-listing as a mandatory step? However once more, that’s icing on the cake. Overlook the worth hole – a standard worth investor failing – as a substitute, give attention to KR1’s compounding potential! If the KR1 staff/portfolio retains delivering a mere fraction of its 120% pa NAV CAGR so far, the share value will in the end blow proper by that value goal, no matter its a number of. And ultimately, does it actually matter the way you get there:

In case you recall, when KR1 was buying and selling at solely 4.125p/share again in Sep-2017, I set an much more bold 23.6p a share/473% upside potential as an final honest worth value goal…which it surpassed lower than three & a half months later!

And don’t fear an excessive amount of about conserving tabs on an up-to-date NAV estimate – this KR1 High 5 Holdings NAV Proxy (which I tweet periodically) is a pleasant fast & soiled estimate. It clearly assumes all different holdings/crypto liquidity/money/staking/and so forth. property are offset by potential tax/efficiency payment/and so forth. liabilities – at 18.7p/share, it’s fairly correct/conservative vs. my precise 20.55p NAV estimate:

However once more, I ought to stress: KR1’s a £21 million micro/small-cap inventory listed on Aquis, with a comparatively broad unfold & restricted every day quantity – although sentiment, spreads & quantity will inevitably enhance (as they’ve earlier than) because the share value rallies – and crypto/crypto shares will stay risky, no matter their final trajectory. Solely purchase a place you may truly stay it…and you’ll have to stability value vs. persistence when shopping for. Alternatively, word the #spillovereffect: Bitcoin tends to suck in all the cash & curiosity when it’s rallying, however then home cash spills over into Ethereum & then KR1’s portfolio/remainder of the crypto universe. This summer time Bitcoin hit $12K, but it surely took one other month for ETH to peak at $480 & KR1 to achieve 18.5p/share. Now Bitcoin’s $18.5K+ & ETH appears prefer it lastly bust $480 as we speak, so with KR1 closing at 16p/share…properly, possibly there’s a #freelunch on the desk for brand spanking new buyers?

You could have the opportunity purchase on-line/instantly through your AQSE dealer…in any other case, you’ll have to choose up the cellphone & truly name a dealer, who might in flip have to name a (London) counter-party to finish the deal. [And yes, this should work for non-UK clients & brokers – KR1 settles via CREST, just like any LSE share]. [And if you’re a UK investor, you can buy via a tax-free ISA]. And if they are saying they can’t commerce KR1, it most likely simply means they don’t need to commerce KR1…so be persistent!

For many buyers, I’d suggest contemplating KR1 as some/all of an affordable 3-5% crypto allocation in your portfolio. However personally – reflecting my robust stage of conviction, plus my positive factors so far – I now have a 10.5% portfolio holding in KR1 plc (KR1:PZ). And regardless of some inevitable volatility, after I have a look at the KR1 staff, portfolio & valuation – plus the present crypto market – I’m comfy with that threat allocation as we speak. Keep in mind:

No matter your stage (or lack) of crypto information & experience, you might have a near-zero probability as we speak of in any other case accessing/assembling a portfolio like KR1. Bitcoin is a wager on value…however KR1 is the #crypto #alpha wager on blockchain innovation. Perhaps it’s time to purchase & #HODL..?!

- Market Value: 16p per Share

- Market Cap: GBP 20.9 Million

- P/B Ratio: 0.78

- Goal P/B Ratio: 2.50

- Goal Honest Worth: 51.4p per Share

- Goal Market Cap: GBP 67 Million

- Upside Potential: 221%