Disclaimer: This isn’t funding recommendation. PLEASE DO YOUR OWN RESEARCH !!!

Collector’s Nook Introduction

I at all times needed to introduce this class of shares that usually I’d not purchase as a bigger place, however for some motive or the opposite I need to personal nonetheless. Lots of such shares I had handed on up to now and so they usually carried out higher than I’d have thought. So as a substitute of a typical Funding portfolio, that half would slightly be a “assortment of positive shares” and this sequence will due to this fact be the collector’s nook. The purpose right here could be a small pocket of “particular” shares which may look not so enticing from a purely monetary perspective, however nonetheless have are enticing to me. This might be luxurious shares but additionally some very unusual shares that I discover attention-grabbing for different causes. I’m now lengthy sufficient within the inventory market that I can not afford myself a couple of “responsible pleasures”.

I don’t have a goal allocation right here however this could keep under 10% general at portfolio stage. Additionally, don’t anticipate an excellent detailed analyis as with greater positions.

And, by coincidence, I have already got the primary inventory for the “collector’s nook:

The primary candidate: Laurent-Perrier SA

For the previous 10 years or so, i’ve incessantly regarded on the Laurent Perrier share worth by mistake, as I truly needed to look upGerard Perrier, my long run French inventory holding. I at all times advised myself to have a look at the opposite Perrier inventory sooner or later however by no means did, regardless of the a lot nicer Brand in comparison with G. Perrier.

Extra lately nonetheless, I learn an attention-grabbing snippet from the legendary John Prepare on Laurent Perrier which then made me look into Laurent Perrier once more:

Personally, I’m not a giant Connaisseur of Champagne however I get the idea of a prestigious model. LVMH, the massive luxurious Juggernaut has its roots in Champagne as properly (the M is for Moet Chandon which was a part of the preliminary merger).

To qualify as Champagne, the next wants to use:

Champagne, the wine, is named after the area the place it’s grown, fermented, and bottled: Champagne, France. Nestled within the nation’s northeastern nook, close to Paris, the one labels which might be legally allowed to reveal the title “Champagne” are bottled inside 100 miles of this area (in response to European Regulation).

That naturally restricts the quantity of Champagne that may be planted and harvested. The most important manufacturers can command costs as much as a number of lots of of Euros and even hundreds for older vintages.

I feel what the Champagne Indusry did properly is to position Champagne as THE (very costly) drink to have fun at particular events. In line with some sources, this custom began accidentally in 1961 in Le Mans. Undecided whether it is true, however I assume it’s a frequent customized all around the world to celbrate success with a glass of Champagne. Curiously, Laurent-Perrier by no means sponsored the components One. However Moet & Chandon did for over 30 years. Curiously, since 2021 an Italian model is the F1 sponsor (Ferrari Trento).

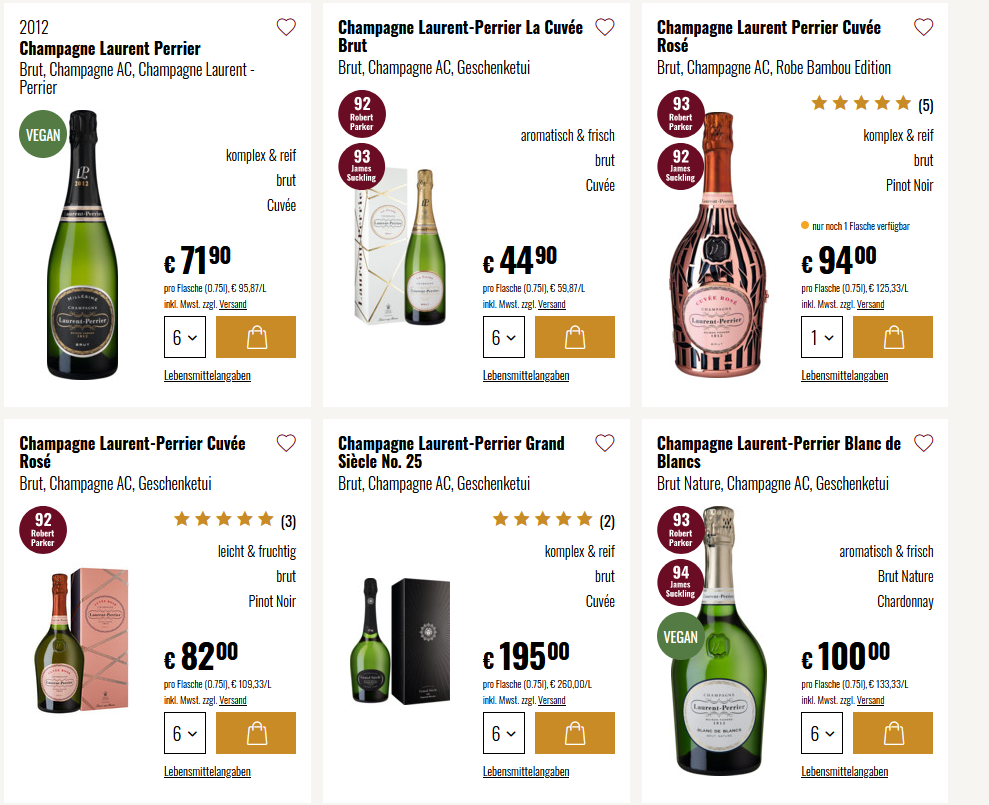

And Laurent-Perrier is clearly one of the crucial well-known and greatest promoting Champagne manufacturers (relying on the place you look, they’re prime 5 or so with a worldwide market share in Champagne of ~5%). Trying on the Hawesko web site one can see that the most cost effective bottle begins at 45 EUR and goes as much as 200 EUR:

Elsewhere I’ve seen bottles for 300-400 EUR as properly.

One of many attention-grabbing facets of Champagne is that regardless of being mosty white wine, it ages properly. Within the regular bottle (750 ml), 40 years is not any downside, massive bottles may need a shelf lifetime of over 100 years when saved properly.

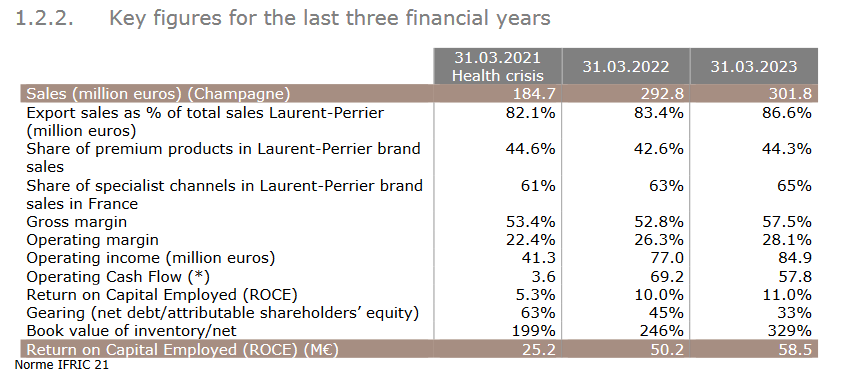

Prime Champane is a excessive margin luxurious product, nonetheless, the way in which Champagne is made, means additionally that it’s fairly a capital intensive enterprise. This exhibits within the numebrs.

Whereas EBIT margins (till these days) at all times have been 17-18%, return on capital and ROE have been solely 5-7%. Laurent-Perrier holds on common 2 years of gross sales stock which is sort of logical as Champagne must ripen and ferment for some years with the intention to be (costly) Champagne. I assume that the stock at Laurent-Perrier (and different Champagne producers) include fairly some hidden reserves, as the nice vinatages usually improve in worth which isn’t proven within the steadiness sheet or P&L.

Now comes the attention-grabbing half : Over the past 10 years, EPS at all times hovered arond 3-4 EUR per share earlier than instantly leaping to eight,49 in 2021/2022 and virtually 10 EUR per share in 2022/2023.

On the present share worth, this values Laurent-Perrier at a really affordable 12x traillng earnings and round 11xEV/EBIT which isn’t costly for a real luxurious model. In line with TIKR, LP solely traded at that valuation proper after the GFC.

The query clearly is: What result in this drastic improve in profitability ? The principle motive has been a robust restoration after Covid and worth will increase. The 12 months led to March 2023 clearly exhibits this: Though quantity gross sales declined barely, they managed to extend costs by +10%. As they have been promoting merchandise that haven been bottled 2 years agao, this worth improve roughly drops on to the underside line.

This desk from the registration doc summarizes properly the final 3 years:

The excellent registration doc offers additionally lots of info on Champagne all the way down to very attention-grabbing particulars.

The share worth has reacted positively over tha previous 2 years however not a lot as reflecting the numerous improve in income during the last 2 years:

As well as, LP has diminished debt from near 300 mn a couple of years in the past to presently lower than 180 mn. So regardless of much less threat, the inventory has truly change into cheaper. Plainly presently buyers don’t consider in these excessive margins to persist.

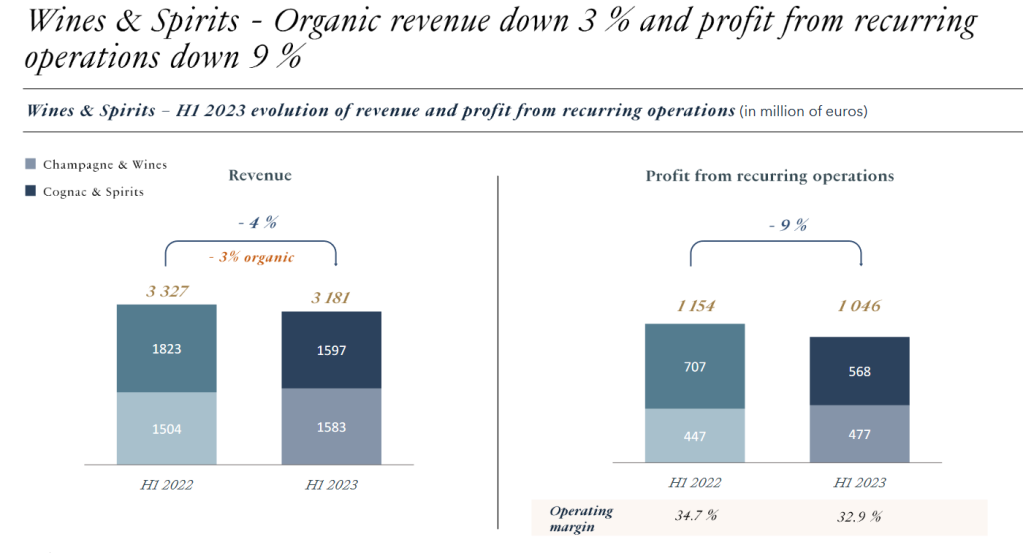

Curiously, in LVMH’s 6M 2023 report, we will see that inside the Spirits & Champagne section, Champagne continues to be doing fairly properly, in distinction to the exhausting spirits:

Nearly all of Laurent-Perrier shares are owned by the Nonancourt household (65%) which purchased the property in 1939. US worth store First Eagle owns round 10%.

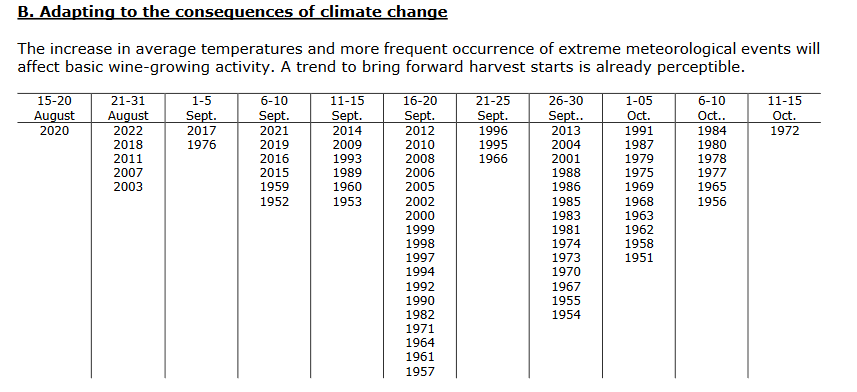

On the danger facet, Local weather threat is clearly one of many dangers that LP is going through. As the world the place Champagne will be made is small, a rise in temrperature would possibly hurt the product. LP exhibits this attention-grabbing desk on the beginning dates of the harvest during the last 50 years or so. A pattern is clearly seen right here:

On the adverse facet, they don’t pay a lot dividend, and solely ocassionally purchase again some inventory. Within the final years, cashflow was used to pay again largely debt which, contemplating the rise in rates of interest was possibly a good suggestion.

The massive query in fact is that if and the way Laurent Perrier can maintain this stage of profitability going ahead and the way they allocate capital. I actually don’t know and that’s why I solely purchase this share for my “assortment”.

Abstract:

Trying all of the years mistakenly on the improper Perrier share worth, I’m now very glad to welcome Laurent-Perrier to my “Collector’s Nook”. A pure, high-end Champagne producer is an effective begin for this sequence. I allotted 1% of the portfolio at a share worth of round 124 EUR into my new “bucket” and hope for the perfect.