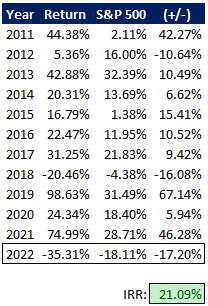

This 12 months within the markets wasn’t enjoyable. Whereas I did not take part within the headline driving speculative manias (development shares, SPACs, crypto, and so forth), I did get caught with a leveraged PA heavy in actual property and pre-arb/takeover conditions which had been hit by rising rates of interest and M&A financing markets tightening up. I used to be down -35.31% for the 12 months, versus the S&P 500 ending down -18.11%, my worst absolute efficiency and relative end result to the markets since starting investing in particular person shares. My lifetime to-date IRR fell to 21.09%.

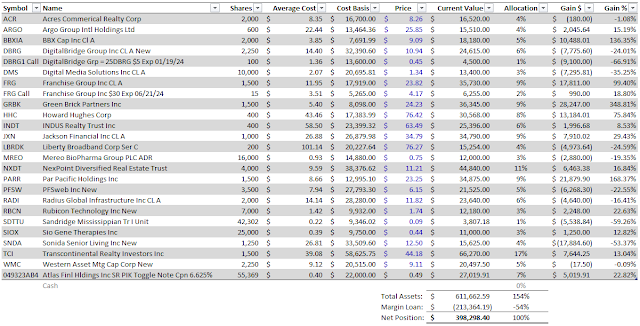

Present Positions Updates

As common, I wrote these intermittently during the last week, a few of the share costs/valuations could be barely stale. Introduced in largely random order:

- My largest holding by a good quantity — partially as a result of it has held up in value this 12 months versus the whole lot else falling — is Transcontinental Realty Buyers (TCI), TCI’s three way partnership with Macquarie lately accomplished the sale of their portfolio, together with the holdback of seven properties by TCI. The e book worth of TCI jumped to roughly $90/share, however this probably understates the worth created within the JV sale transaction, the holdback properties had been valued at market within the break up between TCI and Macquarie, however stay at historic value in TCI’s e book worth. Cheap individuals can argue the place sunbelt multi-family would commerce as we speak (decrease) versus earlier within the 12 months when the JV sale was introduced, however the possible truthful worth of TCI is greater than $100/share whereas it trades for ~$43/share. After all, TCI shareholders won’t ever see that quantity, however the bigger the hole between truthful worth and the share value, the extra possible it’s that the Phillips household’s incentives would align with a go-private proposal. The present said plan for the JV money is “for added funding in income-producing actual property, to pay down our debt and for normal company functions.” Optimistically, I view that as boilerplate language and does not rule out a go-private provide with the proceeds, nonetheless, if a portion of the proceeds get swept again to the Phillips household through their position as “Money Supervisor”, that would be the sign to exit as they’d be getting liquidity for themselves however not minority shareholders.

- In hindsight, fortunate for Franchise Group (FRG) they received chilly toes of their try to purchase Kohl’s (KSS) (I bought my place in KSS at a loss after the potential deal was known as off), regardless of the upside potential because of excessive monetary engineering. Following that pursuit, the present financial atmosphere’s grim reaper got here for FRG’s American Freight section (liquidation channel furnishings retailer idea the place not like their company identify, they personal and function these areas). Administration made the covid period provide chain mistake of shopping for something they might get their arms on, when shopper preferences shifted, they had been left with stock that was now not in demand. FRG stays bullish on American Freight, on the final convention name Brian Kahn said within the context of his M&A urge for food, “.. if we even choose what you may take into account to be a low a number of of 5x, which not many companies go for we will go investor our capital in opening extra American Freight shops at lower than 1x EBITDA.” I am guessing subsequent 12 months, Kahn will keep out of the headlines and refocus on the enterprise. Most of FRG’s issues are centered within the American Freight section, their different two massive segments, Vitamin Shoppe and Pet Provides Plus, proceed to carry out effectively. Excluding their working leases, utilizing TIKR’s avenue estimate of $375MM in NTM EBITDA, I’ve it buying and selling for about ~5.5x EBITDA. June 2024 LEAPs can be found, I purchased some versus averaging down within the widespread inventory.

- My valuation was sloppy on Western Asset Mortgage Capital (WMC), the hybrid mREIT lately introduced that their present estimated e book worth is $16.82/share (not together with the $0.40 dividend) versus $24.58/share on the time of my put up. I known as out that the $24.58 quantity was overstated and was going to come back down, however did not anticipate the magnitude. The corporate is at present up on the market, there might be an extra ~$3/share in a termination payment to the exterior supervisor, so if the present e book is comparatively secure, taking a look at ~$11-12/share worth in a takeout after bills and want to separate a part of the low cost with the client. Surprisingly, the shares have traded up for the reason that present e book worth disclosure, buying and selling as we speak for ~$10.00/share. I ought to most likely promote given I am stunned by that response, however my present inclination is to attend for a deal announcement. There ought to be loads of consumers, there are at all times credit score asset managers in search of everlasting capital, and a deal should not depend on the M&A financing window being open like an LBO (it’s going to be a reverse-merger like transaction). On the unfavorable aspect, they’ve remaining industrial mortgage publicity to the albatrosses which are American Dream and Mall of America, their residential belongings (the core of the portfolio) are prime quality non-QM adjustable charge mortgages, however most are of their mounted charge interval and thus vulnerable to charge volatility.

- In distinction, Acres Business Realty Corp (ACR) is a clear mREIT with minimal legacy credit score issues, all floating charge belongings and floating charge debt (through CRE CLOs) that ought to reduce rate of interest danger. A majority of their loans are to the multi-family sector, affordable individuals can argue that multi-family is being overbuilt in lots of areas of the nation as we speak, however these are usually not development loans to future class A properties which are at larger danger for oversupply, however quite to transitional properties which are present process some form of repositioning, value-add cycle. ACR is buying and selling for an absurd 32% of e book worth, largely due to its small measurement ($70MM market cap) and lack of a dividend. As a substitute of paying a divided, ACR is utilizing their NOL tax asset generated by prior administration to defend their REIT taxable earnings (thus not being required to pay a dividend) to repurchase inventory at a reduction. First Eagle and Oaktree are massive shareholders, two effectively regarded credit score retailers, that may hold administration trustworthy. If the shares do not totally rerate by the point the NOLs are burned off, I might see an analogous situation to WMC the place it is sensible to promote, regardless of needing to pay the exterior administration termination payment.

- One mistake I made in 2021 that carried over into 2022 was oversizing my preliminary place in Sonida Senior Dwelling (SNDA). SNDA was an out of court docket restructuring sponsored by Conversant Capital, which controls SNDA now, that resulted in an injection of money, however nonetheless a really levered entity (SNDA does not have leases, they personal their properties). After the shares have been greater than minimize in half this 12 months (possible because of inflation/shortages hitting their labor value construction and slower than anticipated occupancy restoration), the market cap is roughly 10% (pre-convertible most popular inventory conversion) of the general enterprise worth. SNDA options each excessive monetary leverage and excessive working leverage, occupancy sits at round 83%, if occupancy strikes one other 5-6% larger to normalized ranges, SNDA is probably going a multi-bagger. However the reverse may very well be true additionally. I am sitting on an enormous loss, however sticking it out with the unique thesis that occupancy ranges will normalize as Covid-fears subside and growing older demographics shift of their favor.

- PFSweb Inc (PFSW) lately distributed the money ($4.50/share) from their 2021 sale of LiveArea, what stays is a third-party logistics (“3PL”) enterprise that’s subscale however has navigated the present atmosphere higher than you’d anticipate from a Covid-beneficiary, signing up new purchasers and estimating 5-10% income development in 2023. Whereas traders had been possible upset that PFSW hasn’t bought the 3PL enterprise to-date, they did re-iterate on their Q3 earnings name that finishing a transaction is their high precedence and prolonged their government group’s incentive comp construction based mostly on a sale via 2023. I’ve received PFSW buying and selling for about ~4.6x 2023 EBITDA (utilizing the TIKR estimate), extraordinarily low-cost for a enterprise that ought to have a number of 3PL (there are dozens of them) strategic consumers, simply want the M&A window to open again up. I am snug seeing that course of via to completion.

- The rose is off the bloom with DigitalBridge Group (DBRG), shares have retraced most of their beneficial properties for the reason that summer time of 2020 when the transition to an infrastructure asset supervisor was in its infancy. That transition is basically fully, they nonetheless personal a slug of BrightSpire Capital (BRSP) — possible low-cost by itself, trades at 61% of e book — and fairness positions in two information middle corporations that they are within the strategy of shifting to managed automobiles. Multiples possible want to come back down for beforehand high-multiple digital infrastructure investments in a non-zero rate of interest world, it is arduous to understand how correct their marks are inside their funds and the way the present atmosphere is impacting future fund elevating. I tried to catch a backside too early, buying Jan 2024 LEAPs which have a post-split adjusted strike value of $20/share. Shares at present commerce for $10.45/share, effectively in need of my LEAPs and effectively in need of CEO Marc Ganzi’s $100MM pay day at $40/share. Activist investor Legion Companions Asset Administration has lately pushed DBRG to place itself up on the market if shares do not get well.

- INDUS Realty Belief (INDT) and Radius International Infrastructure (RADI) have comparable traits, every have excessive overhead bills in comparison with their asset bases as they appear to develop/originate new belongings. Each have been damage by rising charges this 12 months as they’re targeted on low cap charge asset lessons with long run leases (RADI so far hasn’t been capable of flex its CPI-linked resets, probably an unfair criticism as they’re on a lag), however each have comparatively recession proof money flows. The weak spot of their share costs is nearly totally charge pushed. Each corporations nonetheless have moderately lengthy development runways with no need to lift capital, however looking, each may profit from being in non-public arms the place the price of capital could be decrease or a minimum of much less unstable. INDT has a public $65/share bid from Centerbridge excellent and RADI has been the fixed goal of deal hypothesis all year long, the newest agency mentioned to have an interest is infrastructure supervisor EQT. I underestimated how excessive rates of interest would rise this 12 months and hope one or each of those holdings is profitable in procuring themselves early within the new 12 months.

- NexPoint Diversified Actual Property Belief (NXDT) lastly did totally convert to a REIT from a closed finish fund. Nonetheless, the shares have not reacted a lot to that change, the corporate did put out common means SEC financials for his or her 9/30 10-Q, however disappointedly have not hosted an earnings name or put out a supplemental that will make the tangled net of holdings extra digestible. I get a variety of questions on my present ideas on NXDT, and the “no change” reply might be unsatisfying, however I am content material holding this for one more a number of years and letting the story slowly (somewhat too slowly proper now) unfold. There’s a variety of wooden to cut, that is a type of steadiness sheet to earnings assertion tales that’ll take time, I might see it being a triple from right here (~$11.50/share) over the subsequent 3 years.

- Howard Hughes Corp (HHC) continues to be a price entice, anybody who spends time doing the bottoms up evaluation comes away saying it’s undervalued but it surely’s simply by no means going to be totally appreciated by public markets (because of complexity, Ackman, growth/capital allocation danger, and so forth., take your choose). In October, Pershing Sq. (Ackman’s funding automobile) tried to make the most of this worth disconnect by launching a young provide at $60/share, later elevating it to $70/share, and nonetheless received only a few takers. James Elbaor on Andrew Walker’s unbelievable podcast supplied some hypothesis that Ackman might do a reverse merger of Pershing Sq. into HHC in an effort to redomicile. Pershing Sq. at present owns ~30% of it and it is a double low cost contained in the publicly traded PSH because the fund trades at a large low cost as effectively. Possibly Ackman does one thing one in all these years, however within the meantime, I am emotionally vested to proceed to carry.

- BBX Capital (BBXIA) is basically the publicly traded household workplace of the disliked Levan household. Shares commerce for ~$9.40/share and the 9/30 e book worth was $20.72/share, included within the $20.72/share is roughly $11.63/share of money, securities and their observe from associated get together Bluegreen Trip Holdings (BVH). Moreover, they personal a spattering of multi-family actual property in Florida, an actual property developer, door maker Renin (barely financially distressed) and sweet retailer IT’SUGAR (you’ve got most likely seen these is airport terminals). Administration is not to be trusted right here, however just like my hopeful thesis in TCI, the low cost between the share value and truthful worth is so large that administration’s greed is form of on the shareholders aspect in the mean time. BBXIA lately accomplished a $12MM tender provide for 1.2 million shares, that makes the proforma e book worth ~$21.70/share. Shares commerce for simply 43% of that worth, and nonetheless have $11.75/share in money/securities to buyback extra inventory. As a result of the shares commerce beneath that quantity, every repurchase beneath that line are literally accretive to the money/securities per share metric. Whereas it’s arduous to see a agency catalyst to get the shares a lot larger within the close to time period, the low cost appears too extreme to promote into their periodic tender provides.

- A inventory that possible will not point out once more for 3 years, I purchased again into Rubicon Know-how Inc (RBCN) this month because the inventory has bought off significantly, presumably sellers getting out earlier than the corporate stops reporting right here quickly (may commerce with expert-market standing), following the transaction with Janel Company (JANL). To recap, Janel successfully paid $9/share for RBCN’s NOLs within the tender provide, they’re restricted from buying extra RBCN for 3 years, however now the shares commerce for ~$1.40. There’s loads of room in there for JANL to pay a premium in three years and get a unbelievable deal for themselves. The principle remaining danger is JANL going bust within the meantime.

- My vitality vacationer hedge is Par Pacific Holdings (PARR). PARR is a rollup of area of interest downstream vitality companies in distant areas (Hawaii, Washington, Wyoming, quickly to be Montana). Their thesis is these refineries are neglected by the big gamers but in addition have a defendable market place due to value benefits of their native markets because of their distant areas (excessive transportation prices for rivals). 2022 was lastly the 12 months when stars aligned, crack spreads widened out considerably and PARR’s refineries had been working at close to totally capability with no important downtime for upkeep capex initiatives. In Q3 for instance, PARR reported $214MM in adjusted EBITDA, roughly their mid-cycle steering for a complete 12 months. Much like different vitality companies, this 12 months’s money flows allowed PARR to scrub up their steadiness sheet and now are positioned to as soon as once more purchase one other refinery, this time Exxon’s Billings refinery. The deal ought to shut within the first half of 2023, simply perhaps PARR is popping a nook and has gained sufficient scale to lastly begin considerably chipping away at their massive NOL (that was my unique thesis 8 years in the past).

- Much like PARR, I’ve owned Inexperienced Brick Companions (GRBK) for 8+ years and simply form of let it sit there. Regardless of new housing growth hitting a wall within the again half of 2022 as mortgage charges briefly peaked above 7%, GRBK shares are literally up 20% since 6/30. It is pretty sure that robust occasions in housing will proceed within the close to time period. However I am guessing it will not final overly lengthy, single household houses have been underdeveloped following the excesses of the GFC, politically overly tight mortgage situations for a very long time appears untenable, and millennials want houses. With enticing land in brief provide, I do not see the big scale write-downs of the GFC reoccurring, perhaps asset heavy homebuilders like GRBK might be seen to be enticing once more versus asset-lite builders. Shares commerce for a comparatively undemanding 7x TIKR’s NTM (trough?) earnings estimates.

- One other sloppy purchase from me was Argo Group Worldwide Holdings (ARGO), shortly after my put up the specialty insurer got here out with disappointing outcomes and dropped considerably regardless of being in the midst of a sale course of (the preliminary curiosity from potential consumers was reported to be muted). I tax harvested my place and re-entered at decrease costs. Administration lately survived a proxy contest from activist Capital Returns, now seems to have discovered faith and reiterated time and time once more they’re dedicated to their restarted sale course of. My conviction is fairly low right here, hoping for a sale in 2023. It trades effectively beneath friends on P/B, optically for a P&C insurer vacationer like myself, a sale ought to make sense for each a purchaser and ARGO.

- Mereo BioPharma Group (MREO) equally confronted a proxy contest within the fall, as an alternative of combating like ARGO, MREO noticed the writing on the wall and let activist Rubric Capital on the board. Rubric’s said technique for MREO is to monetize/liquidate a lot of the corporate’s belongings, we have but to see motion on that (I would argue it’s nonetheless early, however others may disagree). Regardless of the potential for a method change, shares have dropped roughly in half as cash burning biotechnology corporations proceed to be out of favor in a rising charge in atmosphere. MREO is an possibility like fairness at this level, may very well be a multi-bagger or shareholders might get considerably diluted.

- One other choose of mine that’s down considerably regardless of little information is Digital Media Options (DMS). DMS has an a $2.50/share bid from a consortium of administration and PE sponsors that personal 75% of the DMS shares. No information has come out since 9/8/22 non-binding provide, shares have fallen all the way in which to ~$1.30/share as we speak. There’s an amazing dialogue within the remark part of my put up speculating on varied eventualities, anybody ought to sift via them.

- I haven’t got any unique ideas on both Jackson Monetary (JXN) — looks as if many of the index shopping for has occurred — or Liberty Broadband Corp (LBRDK), others are going to talk extra intelligently than me. Every are shopping for again a big quantity of inventory, optically low-cost, may very well be coiled springs if recession fears break, however each even have difficult/complicated enterprise fashions in their very own respects. I’d promote one, each, or none to fund new concepts early in 2023.

- Nothing has actually modified within the final two weeks for Sio Gene Therapies (SIOX), it’s a failed biotech liquidation, which possible might be a continued theme for me in 2023. Different liquidations I proceed to carry embrace Sandridge Mississippian Belief I (SDTTU), Luby’s (non-traded) and HMG Courtland Properties (non-traded). One previous 2019 liquidation, Industrial Providers of America (non-traded), lately made its last distribution and ended up being a disappointing low-single digit IRR. To spherical out the miscellaneous stuff, I personal the Atlas Monetary Holdings bonds (CUSIP 049323AB40) which do not seem to have traded for the reason that change provide, and remaining CVRs in Prevail Therapeutics, Utilized Genetic Tech, OncoMed and the BMYRT potential ligation settlement.

Closed Positions

- One of the crucial puzzling M&A transactions of 2022 has to go to Superior Emissions Options (ADES). Administration dragged shareholders on an extended strategic options course of by which it was extensively assumed that ADES could be a vendor and return their money to shareholders. As a substitute, ADES flipped round and grew to become a purchaser of an early stage enterprise firm, destroying worth within the course of. Shares traded for $6.28 the day earlier than the deal announcement and now commerce for $2.23, I do not understand how this deal even closes. If it weren’t for the poison tablet to guard the NOL (which I imagine is being disqualified on this transaction anyway), I would assume an activist would are available right here and block the deal.

- My unique thesis for ALJ Regional Holding (ALJJ) centered across the NOLs being monetized following a pair asset gross sales, thus the explanation for the automobile current was gone and Jess Ravich would take out minority shareholders with the brand new liquidity on the steadiness sheet. That did not occur, as an alternative Ravich delisted ALJJ and went on a mini-buying spree, turning ALJJ right into a household workplace. I moved on after that.

- Ballys Corp (BALY) was a tax harvesting casualty for me (regardless of the horrible efficiency, I nonetheless realized beneficial properties in 2022, largely holdovers from very early within the 12 months), I nonetheless like the corporate and observe it. The Chicago on line casino challenge might be a house run, possible the identical for no matter they do with the previous Tropicana on Las Vegas Blvd strip. It’s low-cost and value a glance.

- WideOpenWest (WOW) was one other sloppy mistake, the M&A financing atmosphere modified and I did not change my framework as rapidly, thought that an LBO might get executed, however with the restricted free money circulate, it simply did not make sense. Regardless of the few rumors round it, nothing received executed, if the M&A market reopens, WOW may very well be one of many early targets.

- I bought Regional Well being Properties (RHE-A) lately to reap the loss, the corporate’s most popular change provide did not get sufficient of the widespread inventory to vote in favor of the distinctive proposal. Shares have drifted considerably decrease since, the corporate’s fundamentals are nonetheless strained, their operators are struggling below the identical labor points as SNDA, RHE has been compelled to takeover administration of those underperforming nursing services. The asset worth seems to nonetheless be there in a liquidation like situation, however unsure how that will get initiated, the popular inventory is in a tricky spot. I’d re-enter a place, there is a commenter on my RHE posts in search of others to change notes on the place the popular stockholders ought to go from right here.

- LMP Automotive Holdings Inc (LMPX) and Imara (IMRA) had been my two large winners this 12 months, each conditions performed out in a short time. IMRA did not pursue a liquidation, however quite a reverse merger, I exited shortly after that, nonetheless making a big fast acquire, however missed the run as much as the highest by a very good margin. Nonetheless engaged on when to promote these when day merchants get ahold of them.

Efficiency Attribution

Present Analysis/Watchlist

These are corporations that I am actively researching, many I am going to by no means purchase however are at present attention-grabbing to me in a technique or one other, in case you have sturdy ideas about any of them, please attain out to swap notes, or use them as additions to your watchlist:

- STAR/SAFE, BHM, SRG, AAIC, ACEL, SCPL, ABIO, ANGN, SFE, ADMP, MBI, NWSA, TV, MACK, FPH, AIV, ILPT, CMRX, ADMP, SCU

As common, thanks to everybody who reads, feedback, shoots me an electronic mail. I apologize if I do not get again to you rapidly, however I do recognize all of the suggestions, it helps me as an investor.

Blissful New Yr, excited to show the web page to 2023.

Disclosure: Desk above is my taxable account/weblog portfolio, I do not handle exterior cash and that is solely a portion of my total belongings (I even have a secure/rising profession, do not want this cash anytime quickly). Because of this, using margin debt, choices or focus doesn’t totally characterize my danger tolerance.