The urge for food for {hardware} to coach AI fashions is voracious.

AI chips are forecast to account for as much as 20% of the $450 billion whole semiconductor market by 2025, in line with McKinsey. And Perception Companions, the VC agency, initiatives that gross sales of AI chips will climb to $83.3 billion in 2027 from $5.7 billion in 2018, a compound annual development fee 35%. (That’s near 10 occasions the forecast development fee for non-AI chips.)

Living proof, Tenstorrent, the AI {hardware} startup helmed by engineering luminary Jim Keller, this week introduced that it raised $100 million in a convertible notice funding spherical co-led by Hyundai Motor Group and Samsung Catalyst Fund.

$50 million of the entire got here from Hyundai’s two car-making items, Hyundai Motor ($30 million) and Kia ($20 million), which plan to accomplice with Tenstorrent to collectively develop chips, particularly CPUs and AI co-processors, for future mobility automobiles and robots. Samsung Catalyst and different VC funds, together with Constancy Ventures, Eclipse Ventures, Epiq Capital and Maverick Capital, contributed the remaining $50 million.

Hyundai Motor Co. and Kia Corp. – have bought a stake in Keller’s AI chip startup, Tenstorrent Inc., with a mixed $50 million funding. The funding – $30 million from Hyundai Motor and $20 million from Kia – is a part of Tenstorrent’s $100 million funding spherical.

Not like fairness, a convertible notice is short-term debt that converts to fairness upon some predetermined occasion. Why Tenstorrent opted for debt over fairness isn’t completely clear — neither is the corporate’s post-money valuation. (Tenstorrent described it as an “up-round” in a launch.) Tenstorrent final raised $200 million at a valuation eclipsing $2 billion.

The convertible notice tranche, which had participation from Constancy Ventures, Eclipse Ventures, Epiq Capital, Maverick Capital and extra, brings Tenstorrent’s whole raised to $334.5 million. Keller says it’ll be put towards product growth, the design and growth of AI chiplets and Tenstorrent’s machine studying software program roadmap.

Toronto-based Tenstorrent sells AI processors and licenses AI software program options and IP round RISC-V, the open supply instruction set structure used to develop {custom} processors for a variety of purposes.

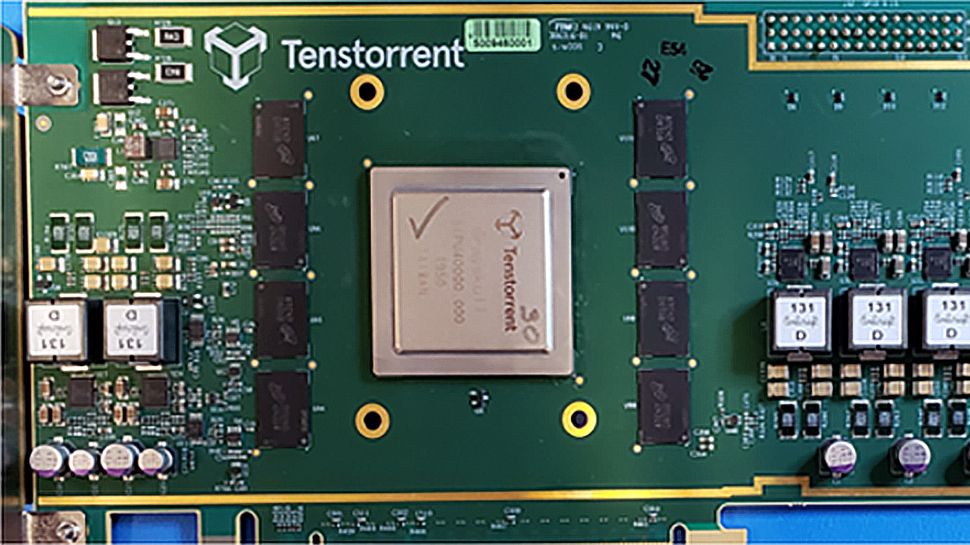

A top-down view of Tenstorrent’s custom-designed {hardware} for AI processing.

Based in 2016 by Ivan Hamer (a former embedded engineer at AMD), Ljubisa Bajic (the ex-director of built-in circuit design at AMD) and Milos Trajkovic (beforehand an AMD firmware design engineer), Tenstorrent early on poured the majority of its assets into growing its personal in-house infrastructure. In 2020, Tenstorrent introduced Grayskull, an all-in-one system designed to speed up AI mannequin coaching in knowledge facilities, private and non-private clouds, on-premises servers and edge servers, that includes Tenstorrent’s proprietary Tensix cores.

However within the intervening years, maybe feeling the stress from incumbents like Nvidia, Tenstorrent shifted its focus to licensing and providers and Bajic, as soon as on the helm, slowly transitioned to an advisory function.

In 2021, Tenstorrent launched DevCloud, a cloud-based service that lets builders run AI fashions with out first having to buy {hardware}. And, extra lately, the corporate established partnerships with India-based server system builder Bodhi Computing and LG to construct Tenstorrent’s merchandise into the previous’s servers and the latter’s automotive merchandise and TVs. (As part of the LG deal, Tenstorrent mentioned it could work with LG to ship improved video processing in Tenstorrent’s upcoming knowledge heart merchandise.)

Tenstorrent — nothing if not bold — opened a Tokyo workplace in March to develop past its workplaces in Toronto in addition to Austin and Silicon Valley.

The query is whether or not it compete in opposition to the opposite heavyweights within the AI chip race.

Google created a processor, the TPU (brief for “tensor processing unit”), to coach giant generative AI programs like PaLM-2 and Imagen. Amazon provides proprietary chips to AWS clients each for coaching (Trainium) and inferencing (Inferentia). And Microsoft, reportedly, is working with AMD to develop an in-house AI chip referred to as Athena.

Nvidia, in the meantime, briefly grew to become a $1 trillion firm this yr, driving excessive on the demand for its GPUs for AI coaching. (As of Q2 2022, Nvidia retained an 80% share of the discrete GPU market.) GPUs, whereas not essentially as succesful as custom-designed AI chips, have the power to carry out many computations in parallel, making them well-suited to coaching essentially the most subtle fashions immediately.

It’s been a tricky atmosphere for startups and even tech giants, unsurprisingly. Final yr, AI chipmaker Graphcore, which reportedly had its valuation slashed by $1 billion after a cope with Microsoft fell via, mentioned that it was planning job cuts as a result of “extraordinarily difficult” macroeconomic atmosphere. In the meantime, Habana Labs, the Intel-owned AI chip firm, laid off an estimated 10% of its workforce.

Complicating issues is a scarcity within the parts needed to construct AI chips. Time will inform, because it all the time does, which distributors come out on prime.