On to my standard evaluate of the 12 months (final years right here). We’re barely shy of the total 12 months finish however I recon I’m up about 20.5%. That is in my standard 20-22% vary. It’s under that of the (not comparable) NASDAQ (at 27% (in USD) and behind the S&P500 – at 25.82% (in USD). The UK All share was 17.9% and the FTSE 100 was at 18.1%. There was a lower in market breadth which is historically an indication of a prime. Index efficiency within the US is pushed by tech and healthcare, sectors which I maintain subsequent to nothing in, so to *roughly* sustain given my idiosyncratic portfolio is definitely an indication of power. One can’t sensibly benchmark my portfolio in opposition to something because it’s simply so odd, however I must in order that I can decide whether or not I’m losing my time.

I’ve accomplished a variety of evaluation on why the efficiency quantity is *comparatively* poor. I feel heaps is all the way down to buying and selling. I’ve been including capital to present concepts on highs – which I anticipate to proceed and preserve going however really haven’t been. Equally I’ve been promoting on spikes which (in fact) continued. The extent of volatility is way greater than I’m used to in useful resource shares and I discover massive month-to-month swings in inventory costs / portfolio worth extremely unsettling. Yesterday the URNM ETF rose 7% on no information, little doubt will probably be down once more tomorrow. I’m involved we’re in the course of a speculative bubble and every thing is pumped and buying and selling on air. My efforts to dampen portfolio volatility have labored however at the price of a considerable quantity of efficiency. The excellent news is my underlying shares have accomplished effectively – I simply haven’t gotten the timing / allocations fairly proper. That is all being pushed by the pure sources a part of the portfolio. I want to take a look at shares like Warsaw Inventory Change which can be good however haven’t moved in years, downside is discovering issues to exchange them. Gold and silver metals / miners have detracted however I’ll proceed to carry. I’m not satisfied crypto displaces them now, far an excessive amount of rip-off and delusion in that market with too little actual world use occurring. Having stated that, crypto has crushed me handily over the 12 months with bitcoin up c45% and ETH up 3.5x.

One more reason efficiency isn’t what it ought to have been is that I took a significant hit by promoting AssetCo too early. I bought at 440 simply earlier than it went to 2000. It was an enormous weight for me and if I had held it and bought on the prime would have been price a 3rd of the portfolio. It’s now an funding automobile for Chris Mills – who I didn’t notably fee. One to keep in mind sooner or later – folks overpay for the property run by these investing ‘names’. I definitely wouldn’t be paying 4x NAV for his experience and value has fallen from over 2000 to simply above 1500 now. Presumably one I may by no means have received on.

For these which can be I had 3 down months of -1.5%, -1.3%,-3.6%.

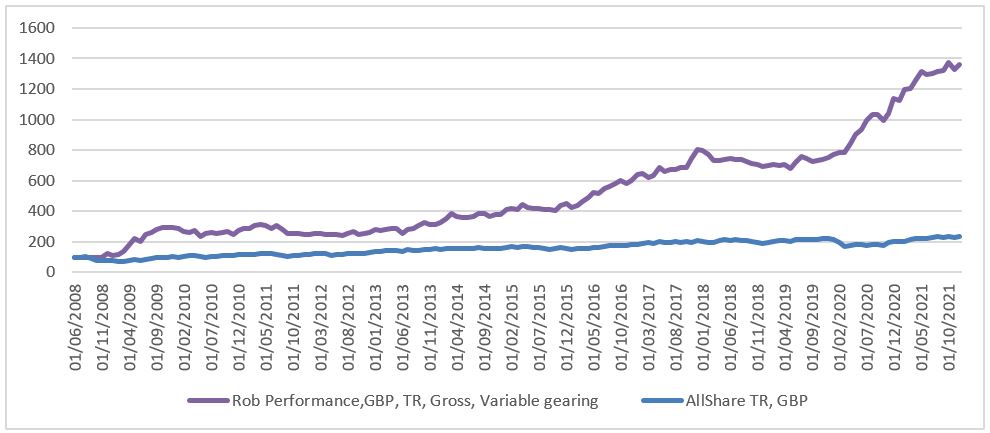

Having stated this, the compound return graph stays intact and searching wholesome at a CAGR of 20% over 13 years.

When it comes to life (which critically impacts my funding) I’m nonetheless working half time, job has made (once more) a couple of quarter of what I make from investing, based mostly on beginning portfolio worth or a sixth based mostly on finish 12 months values. My annual spending is roofed round 45X by the worth of the portfolio, assuming zero development. As ever, I plan to stop quickly – most likely early subsequent 12 months.

I’ve bought one (very small) purchase to let and put it within the portfolio in June (not a perfect entry level). This was 13% of the portfolio worth.

Standout performer was a little bit of a shock – Nuclearelectrica the Romanian nuke plant did 118%, it’s nonetheless at a PE of 8.7 and has a yield of 6.6%, examine this to the yields on hydro / wind farms and many others and it’s nonetheless an honest purchase with scope doubtlessly to double once more, notably given quickly rising vitality costs. The priority is they’re growing extra vegetation which generally tend in direction of large price over-runs however full funding resolution is not till 2024.

One other related thought which is appropriate for brand new cash is Fondul Proprietea. This has 59% of it’s NAV in Hidroelectrica – Romanian Hydro. P27 of this report provides (tough) 2021 Working Revenue of 3537 m RON (grossed up from the 9m). Hydro is tough to worth – as manufacturing is up c 25% on the 12 months and value up 48% (p27). I recon it’s on an EV/EBITDA of about 9-10, examine this to Verbund in Austria at 25. Hidroelectrica is web money while Verbund has debt, although clearly Austria is extra steady politically, there are additionally different property, Bucharest airport, electrical energy grids and many others. Catalyst on this can both be Hidroelectrica floatation or

Breakdown by sector is under:

Glad to be closely into Pure Assets, although I’m very a lot at my restrict – no extra weight shall be added by me and I’d effectively trim / reallocate on the grounds of extreme weight. I’d like to have extra in one thing agriculture associated however haven’t been capable of finding something good. I’m fairly comfy with the splits – presumably somewhat an excessive amount of in copper pure gasoline, and I’ve my doubts about holding copper / Uranium ETFS vs particular, good shares. Too simple for awful corporations to get into an ETF then be pumped up by flows. I’m not one of the best mining / metals analyst on this planet which is why I purchased the ETF, however my particular person picks have typically outperformed ETFs – at not far more value by way of volatility.

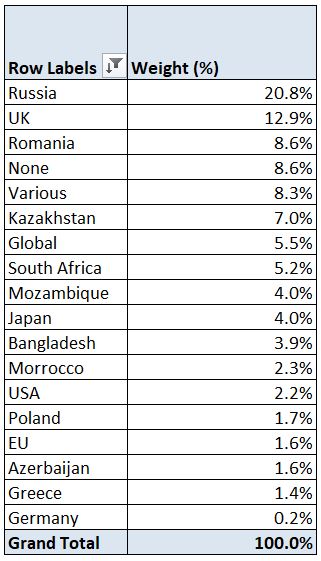

By nation I’m comfortable – Russia should be somewhat heavy, however then once more it is extremely, very low cost. I’ve about 10% in money/gold /silver.

Detailed stage is under:

Sadly these figures just about present my buying and selling has been considerably detracting from returns (it’s not an entire image as figures should not together with dividends). Weights have additionally modified considerably vs final 12 months, partly pushed by market strikes and partially my buying and selling.

On a extra optimistic word, one new holding I’ll briefly point out is IOG – Unbiased Oil and Gasoline, a small North Sea Gasoline firm. Two wells have been circulation examined at 57.8 and 45.5 mmscf/d (50% farmed out). I don’t need to get too into the numbers as costs are unstable and you’ll work out what you suppose yourselves (it additionally it isn’t my power on most of these inventory) however planning was accomplished on 45p/therm (p6 this presentation) and it’s now about £1.89, having hit £4.50 not so way back with Europe (and the world typically) being fairly in need of gasoline. There have been delays in getting every thing commissioned however they’re saying very early Q1. They’ve €100m borrowed at EURIBOR +9.5%. Additionally they have a number of different initiatives that sound as if they are going to generate good returns. Dealer forecasts point out that is at a PE of two in ’22. There have been a number of issues hooking all of it up however nothing that seems too severe. It’s additionally a little bit of a hedge for my Russian publicity as if conflict occurs Russia might fall attributable to adjustments within the RUB/USD alternate fee whereas gasoline costs ought to rise and this with it.

One other good thought I wish to spotlight is Emmerson. It’s a Moroccan Potash mine based mostly close to to present amenities run by OCP – the Moroccan state-owned potash firm. With quickly rising Potash costs and what seems to me as low capex to get into manufacturing I feel it’s more likely to rerate. A comparability put out by the corporate is on web page 17 right here. Apparently at spot costs it’s obtained an NPV of $3.9 bn vs MCAP of £62m now. I’m not extra closely invested as they might want to increase more cash and I don’t know the worth. Previous raises have been broadly honest. There are vital delays with allowing however nothing I’ve heard signifies any downside past the same old paperwork / Covid delays.

Plan so as to add extra to Royal Mail. To me, the pure finish state of the present market which consists of many competing supply corporations making no cash is one/two massive agency(s) that do all deliveries. Presumably competitors issues imply there shall be greater than that however so many various corporations coming at many various occasions, all driving from depots, to me, doesn’t make a variety of sense. Royal Mail as the large beast will undoubtedly do effectively. It’s at a value/ tangible e book of 1.8, and yields 6%. There may be loads of free money circulation and many alternative to make it run extra effectively. Loads of European operators may be excited about shopping for it on the present value. I had held off including in 2021 as I believed pandemic results may need raised gross sales / income in 2020 resulting in a dip in 2021, this was not appropriate, I added immediately (4/1/2022).

The variety of holdings could be very laborious to handle – at 37 however down from this time final 12 months (42). I feel it’s time for a little bit of a clean-up. Issues like GPW, first rate holding, has a catalyst however nothing has occurred, then once more you realize for positive one thing will occur the day after I promote it…

General I believed it might be a tough 12 months and it has been. I’m not anticipating far more from 2022 however I do really feel the portfolio is in a greater place and fewer buying and selling is more likely to be wanted. I would love extra low cost, good, non-resource shares in addition to some publicity to tin and extra to agriculture. I’m satisfied there are more likely to be points with meals provides, pure gasoline costs means fertiliser costs are greater, this implies prices shall be greater to farmers, they both fertilise the identical or minimize, and with it (presumably after a few years) manufacturing falls. Undecided how greatest to play this. Fertiliser producers don’t appear one of the best thought, the gasoline value (nitrogen) is only a feed by way of, and there could also be demand destruction. I’d moderately put money into farms/ meals producers. If meals provides fall, then they are going to be capable of seize extra of shopper’s wallets, doubtlessly far more as folks compete to purchase meals. Drawback is I can’t discover any good option to get publicity aside from a few Ukrainian / Russian producers that are oligarch dominated so not my cup of tea. Any concepts ? I’d additionally like to take a look at some extra esoteric markets – notably Pakistan – on a PE of 4 (screener), I simply have zero familiarity.

https://twitter.com/DeepValueInvIn 2022 purpose is to get the efficiency as much as the 30-40% vary. I preserve studying of individuals doing it, some 12 months after 12 months however they should have greater balls than me as I have a look at their portfolio and suppose ‘not bloody possible’. Want to recollect it solely takes one 60% down 12 months to (roughly) wipe out the compounded impact of three 40% up years. I’m more likely to want extra new concepts and should do some switching. YCA is probably going out and as soon as I get a number of new, higher concepts a number of extra names want shifting out as they aren’t more likely to do 30-40% PA. I’d run somewhat hotter on leverage to counter the impact of my gold holdings. I’d wish to try to keep away from what has felt like perpetual whipsawing which I’ve suffered this 12 months. Hope to promote tops and purchase dips moderately than the opposite means. Hazard to that is in fact you chop winners – one thing I’m often good at avoiding nevertheless it’s been a uneven 12 months. As ever, I plan to stop work in March/ April (few issues to kind earlier than then). I’d additionally wish to work out an inexpensive hedging technique (most likely with choices) for my first couple of years if in any respect potential.

As ever, feedback appreciated. New concepts and a few trades shall be posted on my twitter or right here.