I just lately learn Annie Duke’s e book on choice making known as Pondering In Bets. Certainly one of her details is that life is like poker and never chess. In chess, the superior participant will at all times beat the inferior participant until the higher participant makes a mistake. There’s at all times the proper transfer to make, and the proper transfer in each state of affairs within the sport is probably knowable, and so chess is about sample recognition — memorizing as many sequences as attainable after which having the ability to draw on this library of potential strikes through the sport.

The perfect gamers have the deepest database of chess strikes memorized and one of the best capability to entry them shortly. Absent the very uncommon unforced mistake, an newbie has basically no probability to beat a grandmaster who in some instances has as many as 100,000 totally different board configurations memorized (together with the proper transfer for every one).

Nevertheless, life isn’t like chess, it’s like poker. In poker there are many uncertainties, a component of probability, and a altering set of variables that affect the end result. The perfect poker participant on this planet can lose to an newbie (and infrequently sufficient does) even with out making any poor choices, which is an end result that might by no means occur in chess.

In different phrases, a poker participant could make all the proper choices through the sport and nonetheless lose by means of dangerous luck.

Certainly one of my favourite examples that Duke makes use of within the e book for example the thought of good choice however unfortunate end result was Pete Carrol. The Seahawks coach, needing a landing to win the Tremendous Bowl with below a minute to go, determined to go on 2nd & aim from the 1-yard line as a substitute of operating with Marshawn Lynch. The go received intercepted, the Seahawks misplaced and the play was instantly and universally derided as “the worst play name in Tremendous Bowl historical past“.

However Carrol’s play name had sound logic: an incomplete go would have stopped the clock and given the Seahawks two probabilities to run with Lynch for a sport successful rating. Additionally, the percentages had been very a lot in Carrol’s favor. Of the 66 passes from the 1 yard line that season, none resulted in interceptions, and over the earlier full 15 seasons with a a lot bigger pattern measurement, simply 2% of throws from the 1 yard line received picked.

So it arguably was the proper choice however an unfortunate end result.

Duke refers to our human nature of utilizing outcomes to find out the standard of the selections as “ensuing”. She factors out how we frequently hyperlink nice choices to nice outcomes and poor choices to dangerous outcomes.

Choice-Making Evaluation

The e book prompted me to return and assessment a variety of funding choices I’ve made in recent times, and to try to reassess what went proper and what went incorrect utilizing a recent look to find out if I’ve been “ensuing” in any respect.

I reviewed loads of choices just lately, however I’ll spotlight a easy one and use Google for example right here.

I used to be a shareholder of Google for a variety of years however determined to promote the inventory final yr. After reviewing my funding journal, I can level to three most important causes for promoting:

- Alternative prices — I had a number of different concepts I discovered extra engaging on the time

- Misplaced confidence that administration would cease the surplus spending on moonshot bets

- I used to be seeing so many advertisements in Youtube that I felt like they might be overstuffing the platform and due to this fact alienating customers (I nonetheless assume this might be a threat)

I believe the first purpose was my strongest logic, and whereas a yr is simply too wanting a interval to evaluate, I believe what I changed Google with has an opportunity of being web additive over the long term.

Nevertheless, as I assessment the journal, my major motivation for promoting Google wasn’t alternative prices and there have been different shares that would have been used as a funding supply for the brand new thought(s). The principle causes for promoting Google was I misplaced confidence that administration would in the end stem unproductive spending and I used to be getting more and more involved in regards to the pervasive advert load on YouTube.

Bills

Google Search is a massively worthwhile asset with in all probability 60% incremental margins that has at all times been used to fund development initiatives. A few of these investments earn very excessive returns with tighter suggestions loops and clear targets. Constructing new datacenters to assist the large alternative in entrance of Google Cloud or the quickly rising engagement on YouTube has clear rationale. Hiring sensible engineers to work on AI know-how has an extended suggestions loop however is simply as necessary. However among the moonshot bets appeared to me like cash happening the drain with no clear path towards ever incomes any actual return. I felt this was diluting the worth of the large pile of money circulation. My thesis was that this may finally change, however I started shedding confidence that it could.

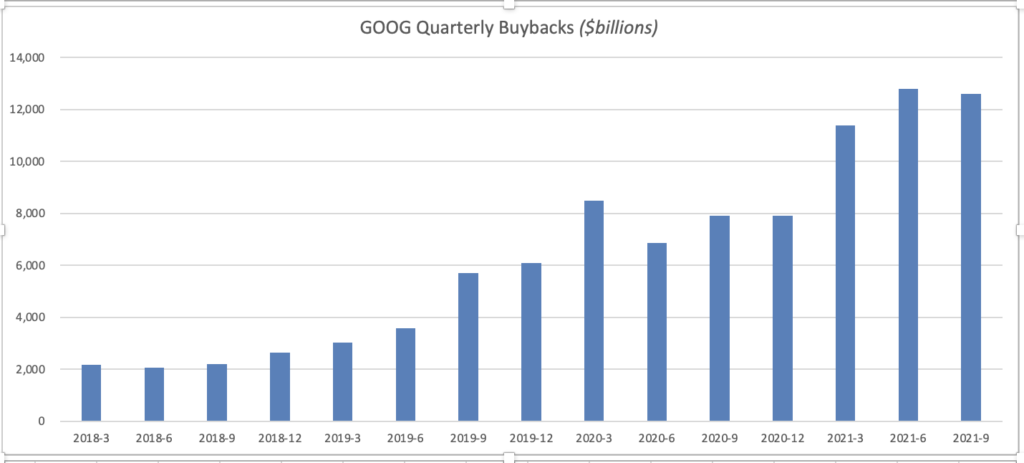

However solely a yr later, working bills have flatlined and have begun falling as a proportion of income, and buybacks are rising shortly and I believe will show to be an ideal return on funding on the present share worth.

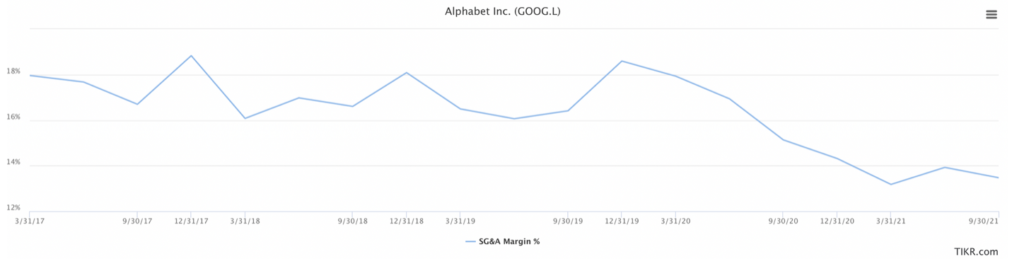

I’ve been watching working bills flatline, and SG&A is falling as a proportion of income:

Covid has been a tailwind to Google usually, however one profit that I don’t see talked about is how shocks like Covid are likely to drive extra give attention to core strengths. Crises are typically tailwinds to future price efficiencies. I learn press releases on a weekly foundation final yr about firms promoting “non-core property” (why they’d buy non-core property within the first place is a query I’ve by no means discovered). Soul looking tends to occur throughout dangerous instances and one of the best firms come out of a disaster in higher form, like an athlete that’s more healthy. Google was removed from unfit previous to Covid, however it’s attainable that their management emerged extra centered. The moonshot investments haven’t stopped, however buybacks have elevated dramatically through the pandemic:

This alone will likely be a big tailwind to worth per share going ahead.

After reviewing my spending considerations, I chalk it as much as a nasty end result (for me as a vendor of the inventory) however not essentially a poor choice. The information modified (administration for my part has improved give attention to capital allocation) and so I’ll change my thoughts.

Nevertheless, I spent essentially the most time occupied with the ultimate purpose (YouTube advert load) and right here is the place I believe I made a nasty choice. Fortuitously this little autopsy train led to a framework that I believe will assist my course of.

Flaws You Can Dwell With vs. Disaster Threat

My buddy Rishi Gosalia (who occurs to work at Google) and I had been exchanging messages Saturday morning and he made a remark that I spent the entire weekend occupied with:

“Investing is not only realizing the failings; it’s realizing whether or not the failings are important sufficient that I can’t reside with them.”

I assumed this was a wonderful heuristic to take note of when weighing an organization’s execs and cons. Alice Shroeder as soon as talked about how Buffett would so shortly get rid of funding concepts that had what he known as “disaster threat”. I wrote about this framework method again in 2013, and it has at all times been part of my funding course of. I nonetheless assume it’s a essential approach to consider companies as a result of many funding errors come from overestimating the power of a moat. Conversely, practically each nice long run compounder is a consequence not essentially from the quickest development fee however from essentially the most sturdy development — one of the best shares come from firms that may final a very long time.

Pondering critically about what might kill a enterprise has on steadiness been an enormous assist to my inventory choosing. However, my chat with Rishi made me notice this emphasis on cat threat additionally has a disadvantage, and I started occupied with quite a few conditions the place I conflated recognized and apparent (however not existential) flaws with cat threat, and this has been expensive.

I believe that is one facet of my funding course of that may and will likely be improved going ahead. A lot because of Rishi for being the catalyst right here.

Google Firing on All Cylinders

Google has for my part one of many prime 3 moats on this planet. The corporate aggregates the world’s data in essentially the most environment friendly method that will get higher as its scale grows, and it has the community impact to monetize that data at very excessive margins and with very low marginal prices. Google may be the best mixture of know-how + enterprise success the world has ever seen. My buddy Saurabh Madaan (a fellow investor and former Google knowledge scientist) put it greatest: Google takes a toll on the world’s data like MasterCard takes a toll on the world’s commerce. This data over time is for certain to develop and the necessity to arrange it ought to stay in excessive demand.

Google’s revenues have exploded greater as model promoting spending has recovered from its pandemic pause, engagement on Youtube continues to be very robust and advert budgets in a few of Google’s key verticals like journey have additionally rebounded.

Probably the most development might come from the monster tailwind of cloud computing. Google will profit from the continued shift of IT spending towards infrastructure-as-a-service (renting computing energy and storage from Google as a substitute of proudly owning your individual {hardware}). Google excels in knowledge science and so they have the experience and know-how that I believe will grow to be more and more extra beneficial as firms use AI to enhance effectivity and drive extra gross sales.

Google might additionally see extra tailwinds from one of many extra thrilling new tendencies known as “edge computing”, which is a extra distributed type of compute that locations servers a lot nearer to finish customers. “The sting” has grow to be a buzzword at each main cloud supplier, however the structure is important for the subsequent wave of linked units (Web of Issues). The a number of cameras in your Tesla, the sensors on safety cameras, the chips inside medical gear, health units, machines on manufacturing unit flooring, kitchen home equipment, sensible audio system and plenty of extra will all connect with the web and as these units and the info they produce grows (and this development will explode within the coming years), firms that present the computing energy and storage ought to profit. Google has 146 distributed factors of presence (POPs) along with their extra conventional centralized knowledge facilities. There are a pair rising firms which might be rather well counter-positioned for the subsequent wave of the cloud, however Google ought to be capable to take a pleasant minimize of this rising pie.

(Be aware: for an ideal deep dive into the three main cloud suppliers, their merchandise, and their comparative benefits together with their most important competitors, please learn this tour de power; I extremely suggest subscribing to my buddy Muji’s service for a masterclass on all the main gamers in enterprise software program, their merchandise, and their enterprise fashions).

Google is the poster baby for defying base charges. It’s a $240 billion enterprise that simply grew revenues 41% final quarter and has averaged 23% gross sales development over the previous 5 years. Its inventory worth has compounded at 30% yearly throughout that interval, which is yet one more testomony to the concept you don’t want an data edge nor distinctive under-followed concepts to seek out nice investments within the inventory market. I’ll have extra to say about this subject and a few implications for right now’s market within the subsequent publish.

Conclusion

After this autopsy, I nonetheless assume my choice to promote the inventory was a mistake. I believe the change in capital allocation was laborious to foretell however I might have higher assessed the probability there. I nonetheless assume that the advert load on YouTube is probably an issue, and I don’t like when firms start extracting worth on the expense of person expertise. I fear about extra of a “Day 2” mentality at Google. However Rishi’s heuristic has made me rethink this subject. Maybe that is one thing that may be lived with, simply as I reside with points at each different firm I personal.

This was a common publish about bettering decision-making. Annie Duke factors out how we crave certainty, however investing is about managing feelings, making choices, coping with uncertainty and threat, and being okay realizing that there will likely be each errors (dangerous choices) and dangerous outcomes (being unfortunate).

It’s what makes this sport (and life itself) so attention-grabbing and enjoyable.

John Huber is the founding father of Saber Capital Administration, LLC. Saber is the final companion and supervisor of an funding fund modeled after the unique Buffett partnerships. Saber’s technique is to make very rigorously chosen investments in undervalued shares of nice companies.

John may be reached at john@sabercapitalmgt.com.