The Personal Faculty 529 Plan is a pay as you go tuition plan from CollegeWell, an unbiased collective of almost 300 personal schools and universities.

Most 529 pay as you go tuition plans are supplied by the state for in-state public schools, with the Personal Faculty 529 Plan being the one one supplied by a community of personal schools.

With the Personal Faculty 529 Plan, you purchase Tuition Certificates which are price a selected proportion of a yr’s tuition. The share will fluctuate by faculty, based mostly on the schooling charges within the yr the Tuition Certificates was bought. The redemption worth of a Tuition Certificates relies on the present tuition charge at every collaborating faculty.

Ensures

Collaborating schools assure that they may settle for the Tuition Certificates as cost of tuition and required charges, even when they subsequently go away the plan.

In different phrases, you should utilize the Tuition Certificates for pay for tuition and required charges at a school or college that was within the plan while you bought the Tuition Certificates, even whether it is not collaborating.

Limitations

Tuition Certificates can solely be used to pay for tuition and required charges. You can’t use them to cowl different prices, resembling housing, meal plans, transportation, books, provides and tools.

The next cut-off dates additionally apply:

- Tuition Certificates should be bought no less than 36 months earlier than they are often redeemed to pay for tuition and required charges. So, when you time the acquisition proper, you should buy Tuition Certificates simply earlier than the beginning of the freshman yr to pay for the senior yr, offering a hedge towards inflation. (The plan yr runs from July 1 to June 30.)

- Tuition Certificates should be held for no less than 12 months earlier than a refund could also be requested, with an exception for the dying of the beneficiary.

- Tuition Certificates expire 30 years after the difficulty date, at which level the account proprietor will obtain a refund.

Refund Quantity

The quantity of a refund is the overall contributions adjusted for web funding returns, capped at a most improve or lack of 2% per yr, compounded yearly. In keeping with the disclosure doc, “The Refund Quantity isn’t designed to supply a significant charge of return.”

If a scholar goes to a non-participating faculty, they may obtain the refund quantity towards tuition and required charges on the non-participating faculty.

Regardless of claims that there is no such thing as a direct publicity to inventory market volatility, a household that seeks a refund or sends the beneficiary to a non-participating faculty will probably be affected by a damped model of inventory market positive factors and losses.

Word that state 529 faculty financial savings plans can be utilized to pay for any faculty, public or personal. Traders in state 529 faculty financial savings plans obtain the complete return on funding, which is prone to be increased than the two% cap on the Personal Faculty 529 Plan.

Contribution Limits

The utmost contribution restrict is the price of 5 years of full-time tuition and required charges at the most costly collaborating faculty. That is $332,450 for 2022-2023.

The contribution restrict applies to all Tuition Certificates for a similar beneficiary, even when they’ve totally different homeowners. You should use five-year present tax averaging (superfunding) to make a contribution to the plan.

The minimal preliminary contribution is $25, however the account proprietor should contribute no less than $500 within the first two years after opening the account, or the contributions will probably be refunded to the account proprietor.

Thus, the minimal contribution is $500, which might be paid in installments as little as $25 over the primary two years.

Contributions could also be made manually, by means of computerized transfers from a checking account, by means of payroll deduction and thru a lump sum contribution.

Collaborating Schools

There are presently 295 member schools.

Among the extra well-known member schools embody:

- Amherst Faculty

- Berklee Faculty of Music

- Boston College

- Brandeis College

- California Institute of Expertise (Caltech)

- Carnegie Mellon College

- Case Western Reserve College

- Chatham College

- Claremont McKenna Faculty

- Duke College

- Emory College

- George Washington College

- Georgetown College

- Hampshire Faculty

- Harvey Mudd Faculty

- Hiram Faculty

- Johns Hopkins College

- Massachusetts Institute of Expertise (MIT)

- Oberlin Faculty

- Occidental Faculty

- Pitzer Faculty

- Pomona Faculty

- Rensselaer Polytechnic Institute (RPI)

- Rice College

- Sarah Lawrence Faculty

- Scripps Faculty

- Sewanee: The College of the South

- Skidmore Faculty

- Stanford College

- Stevens Institute of Expertise

- Syracuse College

- College of Chicago

- College of Notre Dame

- College of Southern California

- Vanderbilt College

- Vassar Faculty

- Wellesley Faculty.

Flexibility

The Personal Faculty 529 Plan gives flexibility. You don’t have to decide on a school on the time the Tuition Certificates are bought, and State residency isn’t required.

You’ll be able to change the proprietor of a Tuition Certificates to a member of the family, and a successor proprietor might be laid out in case the proprietor dies.

You’ll be able to change the beneficiary to a member of the household of the previous beneficiary. Upromise Rewards might be linked to this plan, and distributions might be made to the school or the account proprietor, however not the beneficiary.

Affect on Faculty Admissions

There isn’t a assure of admission or commencement for a beneficiary of a Tuition Certificates. Member schools might not discriminate in favor of or towards a potential scholar due to their standing as a beneficiary of a Tuition Certificates.

Affect on Monetary Assist

Tuition Certificates are reported as a guardian asset on the Free Software for Federal Pupil Assist (FAFSA) if the coed is a dependent scholar based mostly on the refund worth of the certificates.

This may increasingly have an effect on eligibility for need-based monetary assist.

Tuition Inflation Fee

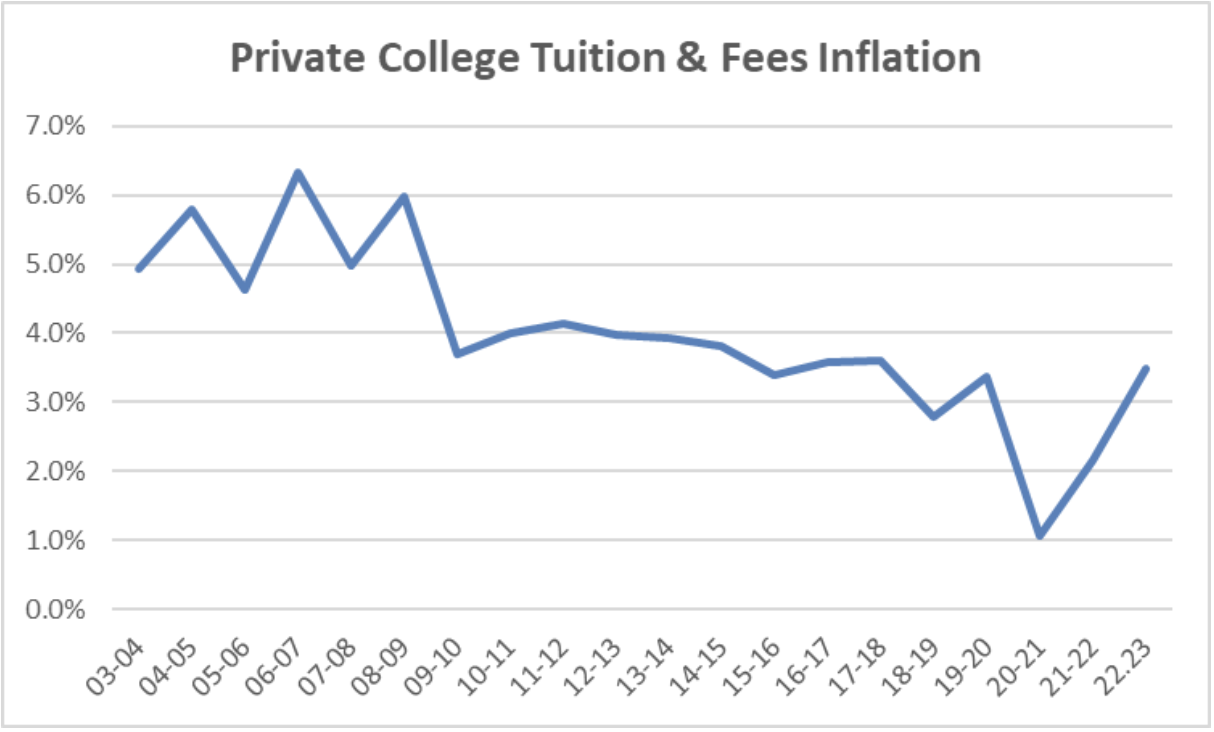

In keeping with the Tuition Plan Consortium, LLC (TPC), which runs the Personal Faculty 529 Plan, the median tuition and charges among the many collaborating colleges elevated by 4.29% per yr from 2003-2004 to 2022-2023.

Word that that is the median and never the common or the very best change in faculty tuition among the many member colleges. Your efficiency might fluctuate.

Amongst all personal 4-year schools, based mostly on information from the Faculty Board, the common annual improve in tuition and charges was 3.9% throughout the identical time interval. In 2018-2019, earlier than the pandemic, tuition and payment inflation was 2.8%. This elevated to three.4% in 2019-2020.

The time interval spans 20 years and should overstate the long run tuition inflation charges, since tuition inflation charges have been trending downward, as proven on this chart.

Taxes

There isn’t a state earnings tax deduction for contributions to the Personal Faculty 529 Plan.

Certified bills ought to be paid in the identical tax yr as a distribution from the plan to exclude such distributions from federal earnings tax or the ten% tax penalty.

You can’t specify which Tuition Certificates is redeemed. Fairly, the Tuition Certificates are redeemed on a prorated foundation. So, despite the fact that a newer Tuition Certificates might have a special proportion earnings than an older Tuition Certificates, the tax legal responsibility of a refund would be the similar.

Last Ideas On The Personal Faculty 529 PLan

When you’re able to buy a pay as you go Personal Faculty 529 Plan, the funding could also be effectively price it. It is a low-risk approach to save on future tuition prices by locking in at present charges. In spite of everything, we all know that the common price of faculty is not dropping anytime quickly. And with the plan assured by almost 300 collaborating colleges, the Personal Faculty 529 Plan gives loads of flexibility.