Investing with little cash could be complicated. You would possibly suppose it’s unimaginable to begin investing with a small amount of money, otherwise you may not know what to put money into.

Fortunately, micro-investing apps have democratized investing, permitting extra folks to begin investing with minimal quantities of cash.

This Robinhood assessment will show you how to resolve if the inventory buying and selling app is an appropriate instrument to construct your wealth.

What’s Robinhood?

Robinhood is an investing app that focuses totally on youthful traders. It has minimal charges and provides commission-free trades.

The app additionally has no minimal steadiness necessities to open an account.

Whereas it follows the namesake story of taking from the wealthy and giving to the poor, it doesn’t essentially reside as much as the identify. Nonetheless, it does make investing within the inventory market accessible to extra people.

The app doesn’t simply supply inventory buying and selling. You may as well commerce choices. Latest additions to the platform embrace a money administration characteristic and the power to commerce cryptocurrencies.

How Does the Inventory Buying and selling App Work?

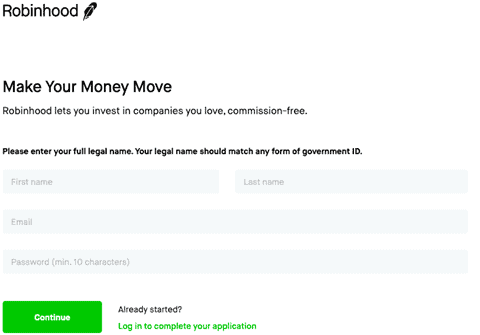

Opening an account with the Robinhood app is pretty easy. You don’t need to deposit cash to open an account, and it solely takes a couple of minutes to get began.

Signing up is simple. Enter your identify, e-mail deal with, and password to maneuver ahead.

This data is critical to satisfy federal necessities when opening up a brand new monetary account.

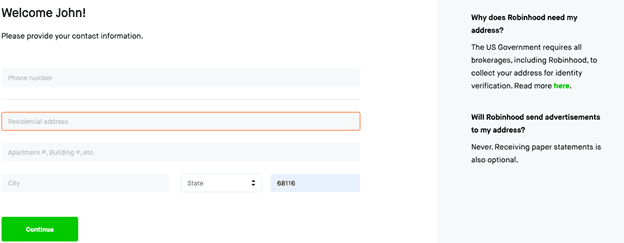

Upon offering this data, you’ll be prompted to supply your mailing deal with and telephone quantity.

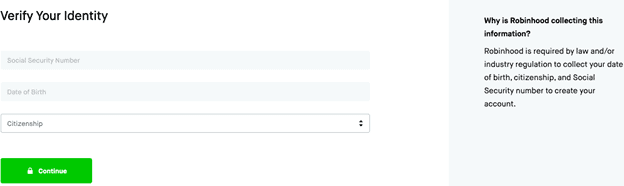

Then you’ll need to supply your Social Safety quantity, date of beginning, and citizenship standing. The federal authorities requires this to open all new monetary accounts.

After offering your private data, Robinhood will ask on your funding expertise.

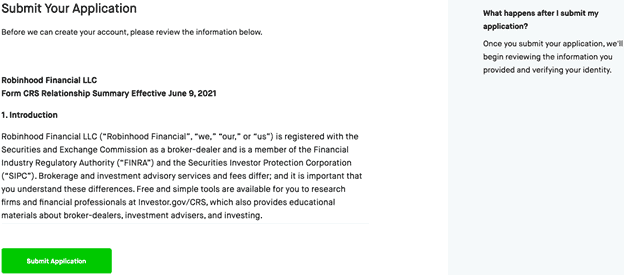

The following few steps ask on your employment standing. When you present that data, you may submit your software for approval.

It sometimes takes a few minutes to obtain approval, after which you may fund your account.

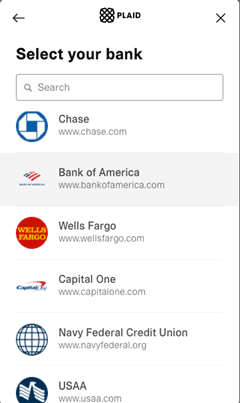

Within the preliminary setup, Robinhood has 17 totally different nationwide and regional banks you may hyperlink to for funding.

For those who’re unable to find your financial institution or use a smaller financial institution, Robinhood gives steps to manually set up a hyperlink.

After your account is authorised and also you hyperlink a checking account, you may deposit and immediately commerce as much as $1,000 in deposits.

Robinhood customer support is on the market by way of e-mail in case you encounter any points.

The app additionally provides a referral program that permits you to and a buddy obtain a free inventory value as much as $500.

How A lot Does the Robinhood App Price?

Robinhood is a commission-free buying and selling platform. This implies you don’t pay something to put a commerce on the cell app.

Nonetheless, there are some charges you may’t keep away from with any low cost inventory dealer. These are charges established by the SEC and FINRA.

They aren’t particular to the Robinhood buying and selling app.

These charges embrace:

- SEC charges of $22.10 per $1,000,000 of principal on gross sales transactions

- FINRA buying and selling price of $0.0001119 per share of inventory fairness gross sales and $0.002 per contract of every sale of an choice

You’ll face a most cost of $5.95 per fairness commerce. For those who’re an lively dealer and select to make the most of Robinhood Gold, the associated fee is $5 per 30 days.

This opens up margin buying and selling functionality, they usually cost two and a half p.c in annual curiosity on borrowed quantities over $1,000.

Options

Price-free inventory trades are a major perk for traders, however that’s not all Robinhood provides. Listed here are a couple of of the highest options provided by the app-based investing platform.

Fee-Free Buying and selling

Not all brokerages supply fee-free trades, so this can be a large good thing about utilizing Robinhood.

Apart from the SEC and FINRA charges, which you’ll encounter at any brokerage, you can begin investing with no charges when you fund your account.

Easy-to-Use Interface

The app is a mobile-first brokerage. You’ll be able to entry a desktop model, however you may also do every part out of your telephone.

The app is simple to make use of, permitting you to put trades inside a couple of clicks. You are able to do the identical to seek out your funding efficiency.

This is a superb perk regardless in case you’re new to investing or a day dealer.

Robinhood Gold

One of many methods Robinhood makes cash is thru their subscription-based service, Robinhood Gold.

The Gold choice is right for day buying and selling and gives quite a few options, together with:

- Entry to Morningstar analysis and evaluation of over 1,700 particular person shares

- Pre-market and after-hours buying and selling

- Bigger prompt deposits availability of as much as $50,000

- Stage II Market Information from Nasdaq

- Margin buying and selling (requires a $2,000 minimal steadiness)

For those who join Gold, you additionally obtain three p.c curiosity in your money sweep steadiness. That is 23 occasions the present nationwide common.

Robinhood Gold prices $5 per 30 days. You’ll be able to attempt it without spending a dime for the primary 30 days.

Buying and selling Instruments

Entry to numerous buying and selling instruments is important to be a profitable investor. Listed here are a couple of of the instruments accessible with the Robinhood inventory app:

- Buying and selling alerts and notifications

- Watchlist creation

- Information

- Academic library for younger merchants

No matter in case you’re new to investing or a seasoned dealer, benefit from these instruments to reinforce your portfolio efficiency.

Margin Buying and selling

Robinhood does assist you to commerce on margin.

Chances are you’ll wish to benefit from Gold in case you plan on actively buying and selling. They cost a aggressive two and a half p.c in annual curiosity on balances over $1,000.

Money Administration

Not solely does Robinhood supply the power to take a position, however they now additionally supply money administration, referred to as the brokerage money sweep program.

The platform just isn’t a financial institution. As an alternative, it cooperates with banks to deal with your uninvested money.

You earn as much as 1.50 p.c on this money, which is 11x greater than the nationwide common, and it’s accessible to be used for purchases via an hooked up debit card.

Curiosity compounds every day and paid out month-to-month. You may as well observe how a lot you earn inside the app.

You’ll be able to automate transfers into the money account and entry over 75,000 ATMs to handle your money wants.

Robinhood Retirement

In December of 2022 Robinhood opened its waitlist for a brand new product referred to as Robinhood Retirement. The concept behind the characteristic is easy – providing a match on IRA contributions.

The match isn’t strong, it’s a one p.c match. Nonetheless, it’s not one thing at present discovered at different micro-investing platforms.

Moreover, you don’t want an employer to take part. The brand new characteristic is in the end finest for individuals who don’t have entry to retirement accounts or matching via an employer.

To qualify, the contributions should come from a linked exterior checking account. Funds transferred internally from a Robinhood account don’t qualify.

You’ll be able to make investments contributions into both a conventional or Roth IRA.

Moreover, you could hold funds that earn a match with Robinhood for 5 years. For those who withdraw the funds earlier than that they cost a clawback price.

What Investments are Accessible with Robinhood?

The app is an effective selection if you wish to begin investing in shares, however that’s not your solely choice. Here’s what you may put money into at Robinhood.

Shares and ETFs

Like all brokerage, you may put money into shares and exchange-traded funds (ETFs) with the app. One key characteristic is which you can benefit from fractional share investing on Robinhood.

For instance, Tesla is buying and selling at over $650 per share on the time of publication. For those who solely have $100 to take a position however wish to put money into Tesla, you should purchase a fractional share.

The app helps market, restrict, stop-limit, and cease orders. You may as well commerce $1,000 in prompt funds.

Choices

Like shares and ETFs, choices buying and selling is on the market at no price via Robinhood. Along with commission-free trades, in addition they don’t cost contract, train, or task charges.

That’s a gorgeous profit in case you wish to commerce choices.

Crypto

Cryptocurrency just isn’t for the faint-hearted, however is an funding selection at Robinhood. You’ll be able to put money into the next currencies:

- Bitcoin

- Bitcoin Money

- Dogecoin

- Ethereum

- Ethereum Traditional

- Litecoin

It’s additionally potential to trace varied different currencies inside your account. The characteristic isn’t at present accessible to all customers because it’s roughly accessible in half of the USA.

Who Ought to Use Robinhood?

Earlier than selecting an internet dealer, it’s vital to know if it could possibly be a superb match for you. Right here’s who would possibly profit from utilizing this commission-free investing platform.

New Traders

Investing within the inventory market could be overwhelming to new traders. Robinhood simplifies the method for younger traders.

The interface is simple to make use of, and there aren’t any minimums to open an account. You don’t even have to fund an account to begin utilizing lots of its options.

Day Merchants

Buying and selling on margin is a characteristic that lively merchants like to make use of to benefit from market actions. For those who qualify, Robinhood makes margin buying and selling easy to handle.

The app gives $5,000 to $50,000 accessible for margin. Your account steadiness determines the quantity you’ve gotten accessible.

The curiosity is 2 and a half p.c yearly on any quantity you employ over $1,000.

Cryptocurrency Merchants

Not all app-based buying and selling platforms supply crypto buying and selling. If that is one thing you’re in search of, Robinhood is an effective option to commerce cryptocurrencies.

Who Ought to Not Use Robinhood?

Low-cost investing is superior, however this inventory buying and selling app isn’t for everybody. Right here’s who would possibly wish to steer clear.

Lengthy-Time period Traders

Robinhood isn’t actually for folks saving for retirement or long-term traders. Outdoors of the brand new Robinhood Retirement, the app at present doesn’t supply retirement accounts.

It’s nice for brand new traders or folks eager to complement their important portfolio, however not retirement financial savings. There are higher choices if you wish to save for retirement.

Learn our information on the finest locations to open a Roth IRA if that you must establish appropriate options.

Moreover, the app doesn’t supply mutual funds or bonds for traders.

Folks Wanting a Full Brokerage Expertise

Robinhood is mild on options for somebody who needs a full-service brokerage. It does have some useful instruments to handle your investing, nevertheless it lacks the options you will see that at brokers like Constancy or Schwab.

It’s additionally lacking funding autos comparable to mutual funds, bonds, foreign exchange, and extra. Some traders could discover this leaves them missing a whole option to handle their portfolio.

Execs and Cons

No service is ideal. Right here’s what to bear in mind when contemplating Robinhood on your investing wants.

Execs:

- Fee-free trades

- No minimal deposit necessities

- Means to handle investments out of your telephone

- Straightforward to make use of interface

- Fractional-share investing

Cons:

- Restricted funding choices

- Just one account kind

- Restricted performance

Robinhood isn’t often a match for long-term traders. Nonetheless, in case you’re a brand new investor, wish to commerce cryptocurrencies, or desire a play account, the buying and selling app is an effective selection.

Is Robinhood Protected to Use?

Investing is filled with threat, no matter your funding car. Consequently, chances are you’ll marvel if Robinhood is protected by way of safety. The straightforward reply is sure.

The app is a legit buying and selling platform and reportedly has almost 20 million account holders. It protects prospects utilizing encryption, Transport Layer Safety protocols, and extra.

Robinhood additionally gives the identical SIPC safety you will see that at another main brokerage. This gives $500,000 in account safety per account.

The Competitors

Are you new to investing or just in search of an various to Robinhood? Listed here are some appropriate selections.

Acorns

Acorns, like Robinhood, is a micro-investing app that lets traders buy fractional shares of shares. You solely want $5 to open an account.

Acorns additionally provides each retirement and non-retirement accounts. The app targets individuals who wish to put money into small quantities, significantly via round-ups.

For instance, in case you spend $30.03 in filling up your automotive with gasoline, it invests the remaining $0.97.

Acorns has two account choices, costing $3 or $5 a month.

Learn our assessment of Acorns to study extra.

Stash

Stash is one other buying and selling app specializing in new traders. It has retirement and non-retirement accounts.

You’ll be able to put money into shares and ETFs on the app. A cool characteristic it provides is connecting your debit card to your account.

While you store, you earn rewards you need to use to buy shares of inventory. Stash costs $1, $3, or $9, per 30 days on accounts after a 30-day free trial.

Learn our assessment of Stash to study extra.

SoFi Make investments

SoFi Make investments is a brokerage to think about if you need a extra full-service method. The platform provides all kinds of funding selections, together with shares, ETFs, crypto, and choices.

SoFi Make investments has no charges required, and there’s a $1 minimal steadiness requirement. It additionally provides fractional-share investing and user-friendly choices buying and selling.

The brokerage has each retirement and non-retirement accounts.

Robinhood Assessment

-

Commissions and Charges

-

Instruments

-

Buyer Service

-

Ease of Use

-

Funding Selections

Robinhood Assessment

Robinhood is a inventory buying and selling app that lets customers put money into shares, choices, cryptocurrency, and extra without spending a dime.

Execs

✔️ No minimal to open an account

✔️ Fee-free trades

✔️ You should buy fractional shares

✔️ Every thing could be performed by way of the app

✔️ Margin buying and selling capability

Cons

❌ Has skilled down occasions throughout heavy buying and selling

❌ Lacking widespread account sorts

❌ Restricted selections past shares, choices, and crypto

Backside Line

Robinhood is a legit inventory buying and selling app you need to use to begin constructing wealth and study extra about investing.

Zero buying and selling charges and no minimal steadiness necessities make it powerful to say no to an investing platform. If you’d like extra of your cash to give you the results you want, begin as quickly as potential and mitigate your charges.

What do you search for in an investing platform?

SoFi Make investments refers back to the three funding and buying and selling platforms operated by Social Finance, Inc. and its associates (described beneath). Particular person buyer accounts could also be topic to the phrases relevant to a number of of the platforms beneath.

1) Automated Investing and advisory companies are offered by SoFi Wealth LLC, an SEC-registered funding adviser (“Sofi Wealth“). Brokerage companies are offered to SoFi Wealth LLC by SoFi Securities LLC.

2) Energetic Investing and brokerage companies are offered by SoFi Securities LLC, Member FINRA/SIPC, (“Sofi Securities”). Clearing and custody of all securities are offered by APEX Clearing Company.

3) SoFi Crypto is obtainable by SoFi Digital Belongings, LLC, a FinCEN registered Cash Service Enterprise.

For added disclosures associated to the SoFi Make investments platforms described above, together with state licensure of SoFi Digital Belongings, LLC, please go to SoFi.com/authorized.

Neither the Funding Advisor Representatives of SoFi Wealth, nor the Registered Representatives of SoFi Securities are compensated for the sale of any services or products offered via any SoFi Make investments platform. Info associated to lending merchandise contained herein shouldn’t be construed as a proposal or pre-qualification for any mortgage product provided by SoFi Financial institution, N.A.

Associated Posts