This submit might include affiliate hyperlinks. See our affiliate disclosure for extra.

Should you’re having bother deciding on FreshBooks vs QuickBooks, this in-depth information is for you. We’ll discover the pricing, options, and different elements you’ll need to contemplate when debating between FreshBooks and QuickBooks.

In an effort to seek out one of the best accounting software program for freelancers (as a result of who desires to change later!?), you’ll have discovered your self asking what Freshbooks vs Quickbooks has to supply.

Each are incredible accounting instruments—with inbuilt freelancer invoicing options, time monitoring instruments, and different useful sources and taking the time to match Freshbooks vs Quickbooks side-by-side will probably be time well-spent.

FreshBooks vs QuickBooks Abstract

Should you’re in a rush and want a fast reply, right here’s what we advocate on the query of FreshBooks vs QuickBooks.

- Should you freelance or present a service and have aspirations to develop, go together with FreshBooks.

- Should you by no means need to rent or develop, use QuickBooks Self-Employed.

- Should you’re an enormous firm and want numerous superior options, go together with QuickBooks.

For a deeper dive we’ve damaged our evaluate down into a number of crucial classes with which we’ll evaluate FreshBooks vs QuickBooks side-by aspect on this article. Right here’s what you may count on:

How we’ll evaluate FreshBooks vs QuickBooks

There are a number of crucial items of data you’ll want when evaluating FreshBooks vs QuickBooks. Under are the classes we’ve recognized as crucial to understanding earlier than you select.

Pricing — Cash isn’t the whole lot when deciding between FreshBooks vs QuickBooks. But it surely’s actually a crucial issue.

Fundamental Options — We’ll reply the query: which software can do extra of the duties you want performed regularly?

Premium Options — We’ll additionally establish which premium or unique options stand out in both accounting software

Flexibility — We’ll consider which software program permits for extra flexibility—an essential ingredient if what you are promoting remains to be rising and altering.

Connectivity — We’ll discover which software higher connects to different apps you utilize every day to run what you are promoting.

Monetary Help — We’ll examine which software offers extra monetary assist by way of accounting strategies and finest practices.

Technical Help – We’ll establish which assist plan will probably be finest geared up that can assist you resolve issues after they come up.

The Human Aspect — We’ve additionally requested our neighborhood of freelancers and small enterprise homeowners to share their experiences utilizing FreshBooks vs QuickBooks, and we’ll remember to embrace that data too.

What it is best to personally contemplate when evaluating FreshBooks vs QuickBooks

Whereas the weather of our comparability analysis offers you an goal take a look at selecting FreshBooks vs QuickBooks, it’s essential to make sure you’re choosing your accounting software program primarily based by yourself particular person circumstances.

For instance, in case you’re a freelancer searching for a easy accounting software with room to develop, then it is best to most likely go together with FreshBooks.

Nevertheless, when you’ve got little interest in rising past your self OR you’re a much bigger well-established firm, then QuickBooks might be the higher alternative for you.

With all of that mentioned, right here is our in-depth comparability of FreshBooks vs QuickBooks for freelancers, small-business homeowners and solopreneurs.

For the effort and time we’ve put in to match these two instruments each FreshBooks and QuickBooks have agreed to share a portion of any income generated from this text with us at completely no additional price to you. We’ve performed our greatest to remain neutral. Should you click on by way of and join FreshBooks or QuickBooks, we thanks for supporting our efforts to deliver you one of the best info potential.

FreshBooks vs QuickBooks Pricing & Plans

The primary ingredient we’ll discover in depth is pricing. Whereas cash isn’t all the time absolutely the high issue when selecting an account software or different software program, it ought to be on the high of your listing.

Each FreshBooks and QuickBooks provide month-to-month plans that appear fairly reasonably priced for any small enterprise.

Overview

Right here’s a fast overview of FreshBooks pricing vs QuickBooks pricing at a look. For extra element, learn under this chart:

| FreshBooks | QuickBooks | |

| Variety of complete plans | 4 | 5 |

| Common value of plans | $30 | $58 |

| Worth of hottest plan | $25 | $70 |

| Free Trial | 30 Days | 30 Days |

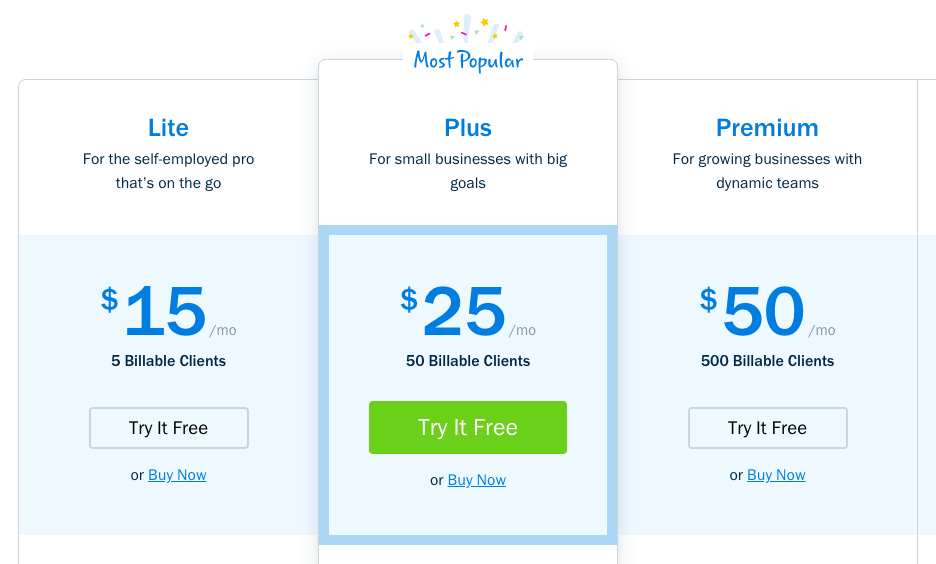

FreshBooks Pricing

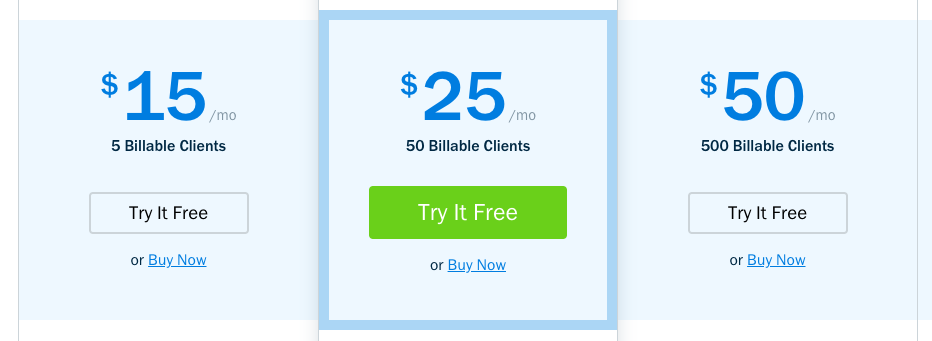

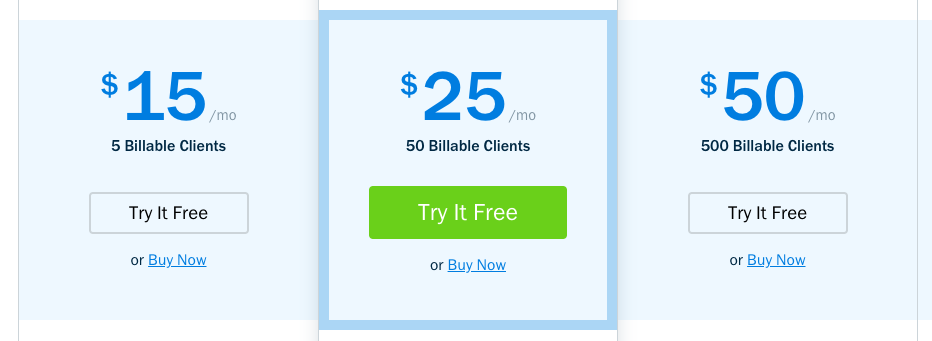

FreshBooks’ pricing choices are quite simple. They begin at simply $15/mo for freelancers and self-employed professionals and go to $50+ a month for bigger firms with rising groups.

Should you common out the price of every of their plans and divide by the variety of plans out there, you’ll see that on common you may count on to pay round $30/mo.

In all circumstances, you pay FreshBooks on a month-to-month foundation to make use of their service.

The “Plus” plan marked “hottest” is $25/month and is labeled as the appropriate alternative “For small companies with massive targets.”

You don’t want a bank card to attempt FreshBooks. Simply select the plan that’s finest for you and you may attempt it utterly free for 30 days.

As a bonus (QuickBooks doesn’t provide this) you may join a full yr and save a bunch extra. You too can make this improve at any time throughout your keep as a buyer. You possibly can find yourself paying as little as $13.50/mo for his or her “Lite” plan if it really works for you.

» Be taught extra about FreshBooks’ pricing right here

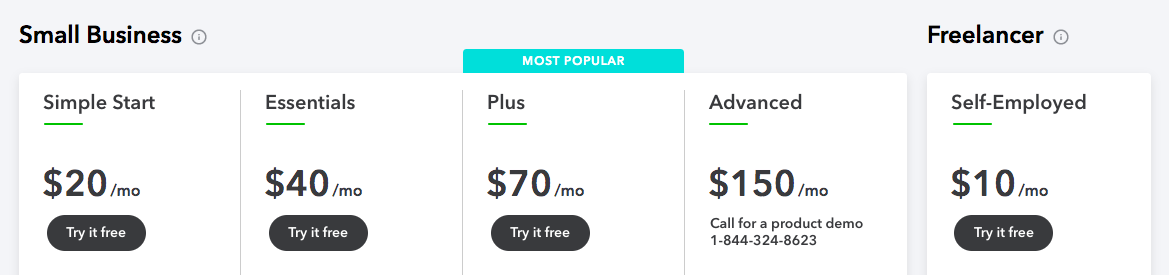

QuickBooks Pricing

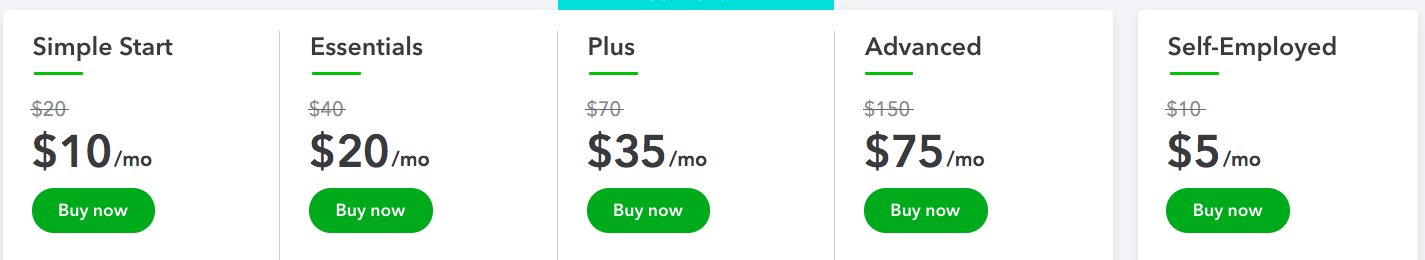

QuickBooks’ pricing choices are additionally very easy, albeit a bit dearer than FreshBooks.

At first look, they appeared to compete properly on value—that’s till you notice you’re signing up for 50% off which solely applies to the primary 3 months of your account.

After the three month promotional provide is over, you’ll find yourself paying way more for QuickBooks then you’ll for FreshBooks. However keep in mind: we’ll evaluate options later. It’s potential QuickBooks has some additional options you’ll need or want afterward.

Should you common out the QuickBooks costs, you’ll land at about $58/mo.

QuickBooks additionally marks their “Plus” plan as their hottest choice, and can price you $70/mo (after the promo) to remain on as a buyer.

And in case you select the 30-day trial, you don’t must enter your bank card till you’ve tried QuickBooks for your self.

» Be taught extra about QuickBooks’ pricing right here

FreshBooks Plans

Now that we’ve obtained pricing out of the way in which, let’s discuss what every FreshBooks plan really presents you as a buyer.

FreshBooks Lite Plan

Should you’re simply beginning out as a freelancer or a side-hustler, it’s possible you’ll need to check out their “Lite” plan.

The “Lite” plan has plenty of nice options inbuilt together with numerous limitless options like Limitless Invoices, Limitless Time Monitoring, or Limitless Estimates.

The place you’ll discover the “Lite” plan to stay as much as its identify is in the case of variety of billable shoppers. It’s solely 5.

So except you’re billing all 5 of your shoppers an infinite charge each month, this is probably not fairly sufficient for you.

Should you’re unsure or solely have a pair shoppers, begin with “Lite” since you may all the time improve to the subsequent stage if you could.

>FreshBooks Plus Plan

Shifting up the ladder to the “Plus” plan—which FreshBooks says is their hottest plan—you get some options that I personally actually love (lined extra within the function set part under) reminiscent of computerized bill reminders, scheduled late charges, and the choice to set shoppers on freelance retainer.

Should you’re beginning to really feel established as a freelancer or small enterprise, chances are high it is best to attempt the “Plus” plan. It’ll more than likely be one of the best match.

Nevertheless, if your organization is rising rapidly and you could spend money on a extra strong answer, it’s possible you’ll need to check out FreshBooks’ “Premium” plan which is for rising companies with bigger groups.

This top-tier choice will mean you can add group members and invoice as much as 500 shoppers each month. In fact, in case you’re utterly killing it and billing greater than 500 shoppers a month, you may get a concierge answer with their “Choose” plan.

In fact, no matter what plan you begin with, you may all the time improve or downgrade as you want to match the wants of your organization.

» Be taught extra about every of FreshBooks’ plans right here

QuickBooks Plans

Like FreshBooks, QuickBooks has plenty of plans tailor-made to suit the wants of your organization now—with the flexibility to regulate later as wanted.

QuickBooks Self-Employed Plan

For starters, their least expensive plan—labeled for Freelancers—is known as QuickBooks Self-Employed and begins at simply $10/mo (with 30-day free trial).

As a result of it’s QuickBooks’ most simple plan, it has a really restricted function set (nowhere close to FreshBooks’ entry-level choice) and the kicker? It doesn’t improve to some other QuickBooks plan sooner or later.

We’ll attempt to not be offended that the plan labeled particularly for freelancers doesn’t present any room for development. Thanks, QuickBooks. Hm.

Should you plan to ever develop past simply your self, you’ll need to try QuickBooks’ “Small Enterprise” plans.

QuickBooks Easy Begin Plan

Their “Easy Begin” plan (the most affordable actual choice) is $20/mo (after any promotions) and it’s the naked bones of what you would possibly want in what you are promoting: expense monitoring, invoicing, accepting funds, and stuff like that. Important, however primary.

One notable perk that QuickBooks has over FreshBooks on this occasion is the flexibility so as to add 1099 contractors at this level.

Since your first rent will doubtless be a fellow contractor, this can be a actually nice function they’ve included of their newbie plan.

QuickBooks Necessities Plan

From there you may transfer up the ladder to the “Necessities” plan, including options like time-tracking and multi-user functionality.

However the fact is, you don’t actually get much more to your cash with the “Necessities” plan and you need to transfer one or two extra tiers as much as actually see an enormous change in options.

QuickBooks Plus Plan

Marked as QuickBooks’ hottest plan, the “Plus” plan provides fairly a number of extra issues that you would be able to’t do in any of the earlier QuickBooks plans.

For starters, you may run extra superior stories and you may extra intently monitor the profitability of every challenge in your pipeline (as an alternative of the enterprise as an entire)—a much-needed choice for service-based companies. With “Plus” it’s also possible to add as much as 5 teammates which can turn out to be useful.

QuickBooks Superior Plan

If all of that also isn’t sufficient, you may improve to essentially the most premium choice QuickBooks presents: their Superior Plan.

With “Superior” you’ll get all of the options of the opposite plans plus plenty of extremely customizable stories and talents for managing a large enterprise. You too can set person permissions (which might turn out to be useful when your group is rising) and also you’ll get additional particular customer support assist with their “Precedence Circle” buyer care.

With QuickBooks, you may improve or downgrade anytime so long as you don’t begin with the Quickbooks Self-Employed.

» Be taught extra about every of QuickBooks’ plans right here

The Winner of FreshBooks vs QuickBooks Pricing & Plans?

After cautious evaluate, we have now to say the winner of the FreshBooks vs QuickBooks pricing & plans battle is:

FreshBooks — Click on right here to attempt it free for 30 days

Why FreshBooks wins this battle

Whereas each rivals had some nice plans to supply at cheap costs, FreshBooks not solely presents a lower cost common however appears to pack in simply as many crucial options into their starter plan…after which some.

QuickBooks’ short-sightedness in not letting freelancers improve from QuickBooks Self-employed to some other of their plans was additionally the nail within the coffin on this battle. Nonetheless a very good choice, however FreshBooks pulled a transparent win out on this one in our opinion.

FreshBooks vs QuickBooks Fundamental Options

The following massive query when deciding between FreshBooks and QuickBooks is: what primary options will I get as a brand new buyer?

To reply that, we’ll take a look at each FreshBooks’ and QuickBooks’ entry-level plans and evaluate their function units to see precisely what you may count on as a naked minimal from every service.

Overview

Under is a fast look at FreshBooks vs QuickBooks in the case of primary options.

| FreshBooks Lite | QuickBooks SE | |

| Ship Invoices | Sure | Sure |

| Observe Bills | Sure | Sure |

| Settle for Playing cards | Sure | Sure |

| Settle for ACH | Sure | Sure |

| Observe Time | Sure | No |

| Ship Estimates | Sure | No |

| Get Assist w/ Taxes | Sure | Sure |

| Combine w/ Apps | Sure | Sure |

| Add Workforce | Sure | No |

| Observe Receipts | Sure | Sure |

| Observe Mileage | No | Sure |

It’s essential to notice that the 2 plans in contrast above are each the entry-level plans supplied by each FreshBooks and QuickBooks however they’re not the identical value.

FreshBooks’ begin plan (Lite) is $15/mo whereas QuickBooks’ plan (Self-Employed) is simply $10. So it’s solely pure it is perhaps lacking a number of options. That being mentioned, you’d need to improve by two tiers to get a few of the similar options in QuickBooks that you just do in FreshBooks (extra on that later).

Invoicing with FreshBooks vs QuickBooks

Invoicing is probably probably the most frequent and primary wants of your service-based enterprise. With out invoices, it’s going to be so much tougher to receives a commission.

This implies, in our opinion, even essentially the most primary plans ought to embrace a good invoicing functionality. And it seems they each do.

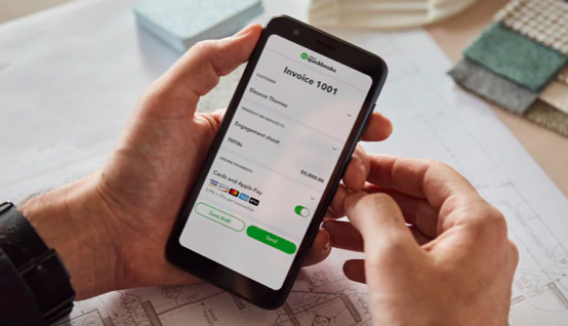

Invoicing with FreshBooks

With FreshBooks you may ship limitless invoices (to your group of 5 shoppers on essentially the most primary plan) and customise them to suit your firm’s model.

FreshBooks may even retailer and arrange your invoices so that you by no means surprise which of them have been despatched, paid, or are overdue.

Be taught extra about FreshBooks Invoicing

Invoicing with QuickBooks

Utilizing QuickBooks, you may ship invoices after which monitor the standing of your invoices and ship reminders to shoppers who “overlook” to pay.

With QuickBooks, it’s also possible to create partial invoices for milestones or partial funds, which is a pleasant function.

Be taught extra about QuickBooks Invoicing

Monitoring Bills with FreshBooks vs QuickBooks

In fact, probably the most primary capabilities an account software program ought to do is show you how to hold monitor of the cash coming out and in of what you are promoting.

Each FreshBooks and QuickBooks mean you can monitor primary bills of their entry-level plans.

Monitoring Bills with FreshBooks

FreshBooks’ expense monitoring options are extraordinarily slick. Maybe the best function is the flexibility to attach your financial institution on to FreshBooks so that every time an expense is comprised of your account, you see it (and might categorize it) in FreshBooks.

Be taught extra about Monitoring Bills with FreshBooks

Monitoring Bills with QuickBooks

With QuickBooks it’s also possible to import information out of your financial institution (or PayPal) and the QuickBooks software program will robotically use the names and quantities to make an informed guess on what the expense ought to be categorized beneath for tax functions. Fairly cool.

Be taught extra about Monitoring Bills with QuickBooks

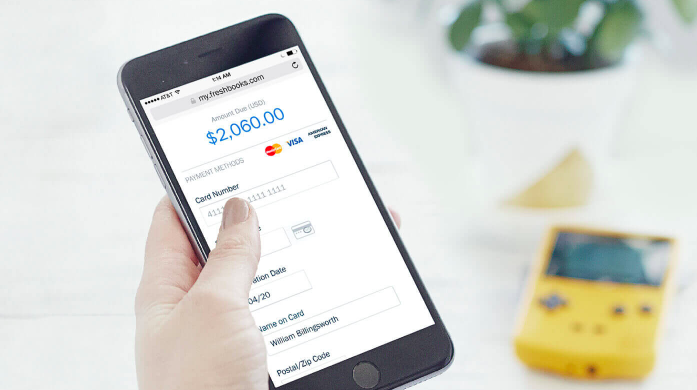

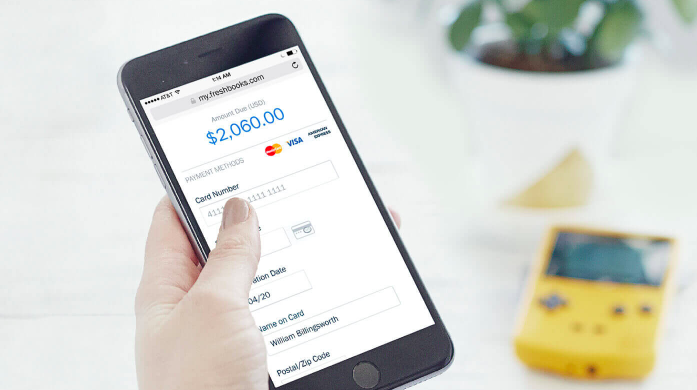

Accepting Funds with Freshbooks vs QuickBooks

Sending invoices and monitoring bills is ok and good, however in case you don’t really deliver cash into what you are promoting, then what’s the purpose of all of this?

That’s why any accounting software program price its salt ought to supply a top quality means of accepting funds from shoppers when you’ve despatched them an bill.

Accepting Funds with FreshBooks

With FreshBooks, your shoppers pays their invoices immediately by way of the bill itself. No extra sending the bill with a PayPal hyperlink the place they’ll make a deposit or ready for a test within the mail.

Be taught extra about accepting funds with FreshBooks »

Accepting Funds with QuickBooks

QuickBooks additionally enables you to settle for Credit score Card and ACH funds immediately out of your bill. Their free (with sure plans) bank card reader additionally means you may settle for funds out of your shoppers in individual.

Be taught extra about accepting funds with QuickBooks »

Time-Monitoring with FreshBooks vs QuickBooks

For a lot of small companies who cost by the hour for the work they supply their shoppers, a simple-yet-effective time-tracking app is a should.

And when you may select a time-tracking app that lives exterior your accounting software program, each FreshBooks and QuickBooks provide time-tracking capabilities of their primary plans.

Time-tracking with FreshBooks

Even in case you don’t cost by the hour, there are many good causes to trace the period of time you or your group are spending on every challenge.

And with the FreshBooks time-tracking software, you are able to do simply that. It’ll kind time by challenge or by class, providing you with an incredible image of the place you’re spending your treasured time every day.

Be taught extra about time-tracking with FreshBooks

Time-tracking with QuickBooks

Sadly, that is the place we begin to see a small divide between on FreshBooks vs QuickBooks by way of what QuickBooks presents of their starter plan (Self Employed) and what FreshBooks presents in theirs (Lite).

QuickBooks doesn’t introduce time-tracking till their “Necessities” plan which is $40—a whopping $25/mo greater than FreshBooks’ most simple choice.

For that type of cash, you could possibly get a unique time-tracker (I like this one), however it wouldn’t combine along with your accounting software program. Bummer.

Sending Estimates with FreshBooks vs QuickBooks

There’ll more than likely be moments in what you are promoting whenever you aren’t fairly able to ship an bill (possibly the consumer hasn’t finalized their resolution) however you could hold the challenge shifting ahead.

That is the place estimates are available in. Sending an estimate makes it simple to your buyer or consumer to get a transparent image of what they’re stepping into and the way a lot it’s going to price them. It additionally helps you get an image of what to anticipate by way of income if this consumer finally ends up hiring you.

Sending estimates with FreshBooks

With FreshBooks’ most simple plan, you may ship limitless estimates to potential new shoppers.

FreshBooks may even hold notes and monitor essential occasions associated to your estimate—together with the consumer’s approval particulars—which implies you don’t need to dig by way of your e-mail to seek out all of this essential data.

As soon as an estimate is accepted, you may convert that estimate into an bill, which is a extremely cool function to streamline your course of and get you paid a bit sooner.

Be taught extra about sending estimates with FreshBooks

Sending estimates with QuickBooks

Sadly, QuickBooks’ most simple plan (Self Employed) doesn’t provide any kind of estimating software for sending proposals or estimates of any variety—which, truthfully, feels unusual for a plan really helpful for freelancers.

With a view to ship estimates, you’ll must improve to QuickBooks’ “Easy Begin” plan which is able to run you $20/mo—giving FreshBooks a leg up on this FreshBooks vs QuickBooks comparability.

To see what we imply, evaluate QuickBooks plans right here.

Getting Tax Assist from FreshBooks vs QuickBooks

Monitoring bills and sending invoices is nice, however when it comes time for taxes, all the paperwork (from receipts in a shoebox to digital invoices) can really feel overwhelming in case you don’t know what you’re doing.

That’s why we have been comfortable to see that FreshBooks’ vs QuickBooks’ most simple plans are fairly equal when providing not less than some kind of tax assist. Every firm takes a singular method to tax assistance on their entry-level plans, so let’s dig in to see what each presents.

Getting tax assist from FreshBooks

Along with having a big library of tax apps that may combine with Freshbooks with a view to offer you a extra full image of your tax obligation annually, it’s also possible to run tax-specific stories at tax time which you’ll then give to your accountant or enter in your accounting software program.

Getting tax assist from QuickBooks

As a result of QuickBooks is a product of Intuit—which makes a speciality of tax software program—it far surpasses FreshBooks on this regard.

Not solely will it additionally run stories like FreshBooks does, QuickBooks’ most simple plan will allow you to estimate your quarterly tax obligation (earlier than it’s due) and you may arrange earnings & bills for fast tax submitting when the time comes.

Should you plan to do taxes your self (as an alternative of hiring an accountant or utilizing a service like Bench), it’s possible you’ll need to go together with the QuickBooks plan.

Be taught extra about how Quickbooks can assist you with taxes

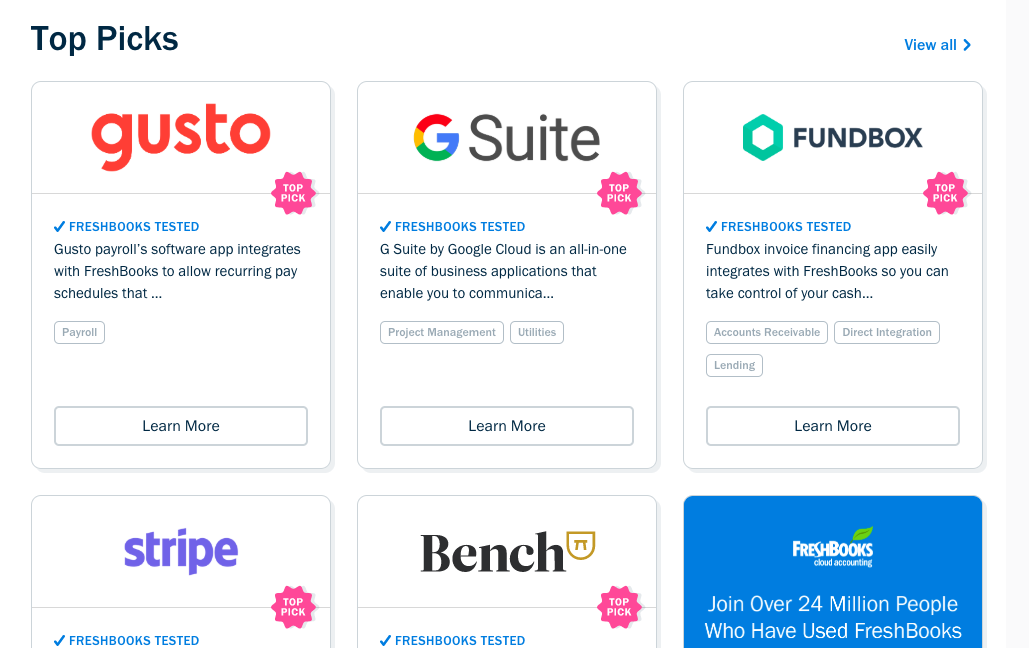

Integrating FreshBooks or QuickBooks with Third-Get together Apps

As a freelancer or small enterprise service supplier you most likely put on a zillion hats. And bookkeeping, accounting, funds, and so on. are simply one of many many issues that hold what you are promoting shifting ahead.

That’s why it’s essential that your accounting software program can talk the place wanted with different instruments you utilize every day to get your work performed.

Third Get together App Integration with FreshBooks

As a result of FreshBooks is extremely targeted on service-based firms, they’ve plenty of nice apps of their integration library to assist transfer what you are promoting ahead.

And the vary is fairly broad; from group instruments like G Suite to communication instruments like Slack to payroll software program like Gusto.

See FresBbooks’ App Integration Library

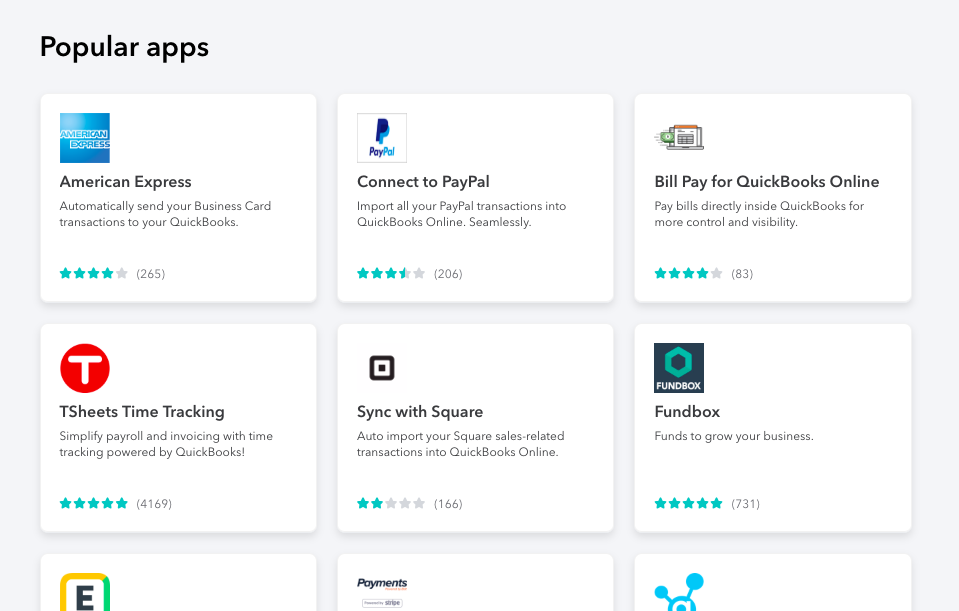

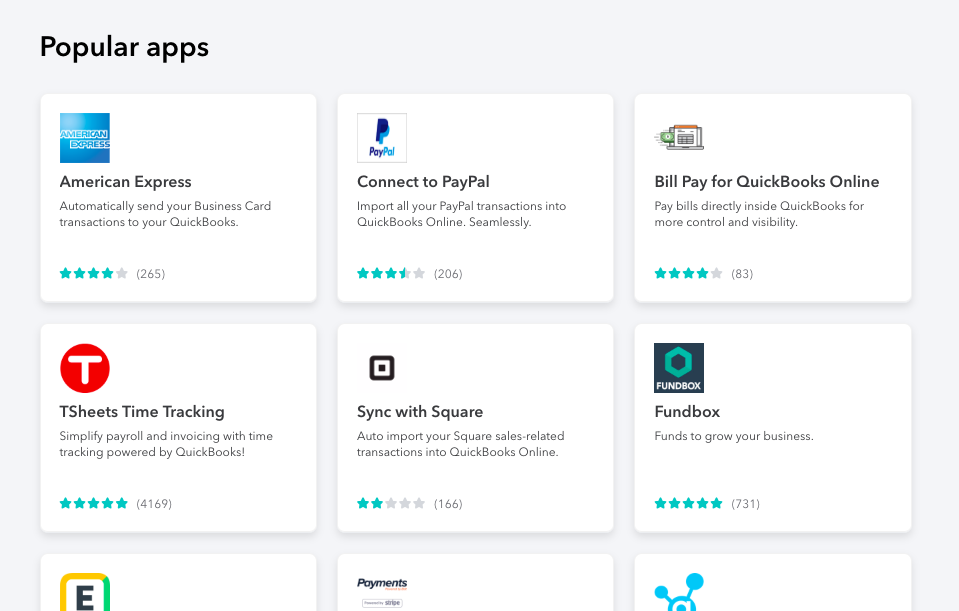

Third Get together App Integration with QuickBooks

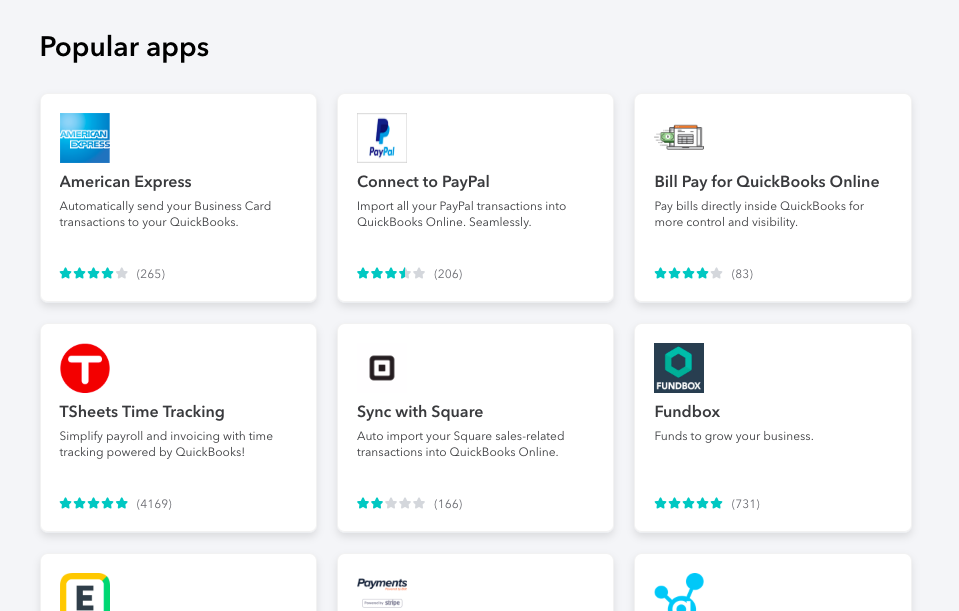

Equally, QuickBooks has a strong library of third-party apps that can assist you run what you are promoting extra easily.

QuickBooks focuses on bigger (or aspiring to be bigger) firms by integrating with fund-raising software program like Fundera, human useful resource apps like HRweb, or stock administration apps like Webgility.

Should you’re ramping as much as construct a much bigger enterprise, this app library could also be extra your match.

See QuickBooks’ App Integration Library

Including Teammates to FreshBooks or QuickBooks

When you could also be a single-person enterprise, freelancer, or sole proprietor now, there might come a day whenever you need to scale what you are promoting to one thing a bit larger.

In that second, it’s possible you’ll need to share monetary information and stories with members of your group so the monetary monitoring burden doesn’t fall utterly in your shoulders.

Teammates who might have entry to your accounting software program embrace an accountant, a companion, a bookkeeper, and even only a trusted worker or assistant.

That is one ingredient the place evaluating FreshBooks vs QuickBooks actually took us abruptly. To this point, FreshBooks has been tailor-made extra for groups of 1. And QuickBooks has been constructed extra for groups and rising firms.

However FreshBooks vs QuickBooks team-adding talents appear backward. Right here’s why:

Including teammates with FreshBooks

With FreshBooks Lite, you may add new group members to your account for $10/mo per teammate.

It’s a little bit of a steep value contemplating the whole plan is simply $15/mo however it’s possible you’ll discover it price it to dump a few of the burden of invoicing, monitoring funds, sending proposals, and so on.

Including teammates with QuickBooks

Neither QuickBooks’ most simple plan (Self-Employed) or the subsequent stage up (Easy Begin) mean you can add group members.

So as to add teammates utilizing QuickBooks, you need to improve two ranges to their $40/mo Necessities plan. Whereas QuickBooks limits teammates to a max of three at this stage, the mathematics really makes a bit extra sense if you recognize you need to add your group instantly.

Right here’s the way it breaks out whenever you evaluate FreshBooks vs QuickBooks.

| FreshBooks (Lite) | QuickBooks (Necessities) |

| Beginning value: $15/mo | Beginning value: $40/mo |

| 3 Teammates: $10 every (complete: $30/mo) | 3 Teammates: included in plan |

| Whole: $45/mo | Whole: $40/mo |

Take notice: this math solely is sensible if you have already got 3 teammates who you’ll need to give entry to right away.

Sadly, although, FreshBooks $10/mo/member price by no means goes away whereas QuickBooks means that you can add as much as 25 group members with their most costly ($75) plan.

The in need of it: when you’ve got a big group and also you care so much about sharing entry with them, go together with QuickBooks.

Monitoring Receipts with FreshBooks vs QuickBooks

Relying on the type of enterprise you’re in, you may need plenty of receipts you need to hold monitor of.

Should you’re primarily a digital-service-based enterprise, this is probably not the case because you don’t usually purchase bodily items that have to be tracked.

However in case you present a bodily service to your prospects, it’s doubtless you’re ceaselessly shopping for a brand new half, a brand new software, or one thing else from an area retailer.

If that’s the case, you’ll desire a good (simple) strategy to monitor your bills.

With each FreshBooks and QuickBooks, you may take pictures of your receipts along with your smartphone and assign them to particular bills pulled in out of your checking account. It retains the whole lot organized properly for later use.

Monitoring Mileage with FreshBooks vs QuickBooks

Commuting to a co-working tempo, driving to a consumer assembly, or becoming a member of your buyer on-site to supply your service—all of those, and extra, are mileage bills which could be deducted out of your tax obligation. Meaning, you’ll need to monitor your mileage intently.

Monitoring Mileage with FreshBooks

Sadly, none of Freshbooks’ plans provide mileage monitoring built-in to the app itself. Whereas it does have numerous third-party integration choices for connecting your mileage app to Freshbooks, having it proper within the app itself could be good.

Monitoring Mileage with QuickBooks

Right here, QuickBooks outshines FreshBooks. Constructed immediately within the app itself and out there even in QuickBooks’ most simple plans, you’ll discover a easy, largely automated mileage tracker.

With QuickBooks Self-Employed (or actually any plan), you’ll have the flexibility to robotically monitor miles along with your smartphone (no extra retaining a pocket book in your automotive). From there, you may separate enterprise journeys from private journeys and even add mileage manually in case you didn’t have your telephone with you.

Be taught extra about QuickBooks’ mileage monitoring options

The Winner of FreshBooks vs QuickBooks Fundamental Options

The winner of this FreshBooks vs QuickBooks battle was not simple to decide on. In truth, we nearly referred to as it a tie.

However then we remembered one crucial ingredient that we had neglected on this evaluate: Should you go together with QuickBooks’ most simple plan, you’re caught with it. You possibly can’t improve. It appears ridiculous, however it’s true.

So though QuickBooks has some good added options and makes extra sense in case you’re already a longtime group, we needed to understand that this battle was about primary options.

Should you’re simply beginning out—and simply evaluating essentially the most primary of plans—then the higher alternative is:

FreshBooks’ Lite Plan — Click on right here to attempt it free for 30 days

Why FreshBooks wins this battle

The first factor to bear in mind right here is that we’re evaluating primary options.

Which means, in case you’re evaluating FreshBooks vs QuickBooks as a reasonably new freelancer or solopreneur, that is the appropriate choice for you.

FreshBooks Lite has all the appropriate options so that you can get began on the appropriate foot and, maybe extra importantly, offers you the choice to improve afterward as what you are promoting grows.

If what you are promoting has already grown, you’ll discover the subsequent part on FreshBooks vs QuickBooks premium options useful.

In case your aim is to develop (it’s okay to remain small) and also you do issues proper, you’ll finally end up with a enterprise that’s larger than simply your self.

That’s nice information. And it will possibly additionally add a little bit of pressure to organizing your funds, monitoring paperwork like proposals or invoices, and sustaining correct team-wide communication at your organization.

So for this subsequent part on FreshBooks vs QuickBooks Premium Options, we’ll give attention to the options you would possibly want as your turn into extra superior in your small enterprise.

We’ll ask questions like: would FreshBooks vs QuickBooks be higher for a small company? Or for a distant group of 5+ individuals? Are there sufficient options on each platforms to permit for the correct of development on the proper value? And so forth.

We’ve taken a number of of our favourite premium options from every platform and in contrast how FreshBooks vs QuickBooks measures up on every depend.

Overview

Under is a fast look at FreshBooks vs QuickBooks in the case of extra superior premium options.

| FreshBooks | QuickBooks | |

| Shopper Retainers | Sure | Sure (personalized invoices) |

| Scheduled Late Charges | Sure | No (guide solely) |

| Recurring Invoices | Sure | Sure |

| Observe Venture Profitability | No (by class) | Sure |

| Observe Stock | No | Sure |

| Handle Sub-contractors | Sure | Sure |

| Handle & Pay Payments | No | Sure |

As with the “Fundamental Options” part above, we aren’t essentially evaluating apples to apples right here. Which means, we’re not evaluating solely FreshBooks vs QuickBooks hottest plans, for instance.

As an alternative, we’re taking a extra macro-level view and easily asking: of the premium options that exist (options not included in essentially the most primary plan) which ones are price noting and the way does the competitors measure up?

It could not be clever to make your ultimate resolution primarily based on this part alone (as is true with some other part in our FreshBooks vs QuickBooks deep-dive).

Shopper Retainers with FreshBooks vs QuickBooks

Should you’re in your strategy to turning into a bit extra superior than a one-person enterprise with a handful of recent shoppers every month, you’ve most likely thought-about consumer retainers as an choice.

Shopper retainers are basically an agreed-upon quantity of labor (and due to this fact income) your consumer is keen to pay you for every month. As you full work for that consumer, they might as much as the cap of the retainer (or extra in the event that they require extra work).

Shopper retainers could be a good strategy to plan extra long-term relationships and income along with your shoppers.

Setting consumer retainers with FreshBooks

When utilizing FreshBooks, you may set consumer retainers as simply as you create an bill (which is fairly easy). You simply need to put within the consumer identify, the retainer quantity, and some different particulars and also you’re set.

Plus, one function we actually like is the “extra hours charge” function. This implies in case your consumer wants you to work above the agreed-upon variety of ours, they’ll robotically be billed additional for the additional work. Good.

Be taught extra about FreshBooks’ retainer choices right here

Setting consumer retainers with QuickBooks

Whereas not fairly as easy with QuickBooks as with FreshBooks, it’s also possible to set retainer shoppers with this Intuit software. Nicely, kindof.

You really need to create a brand new bill after which go in to customise that bill. When you’re on the customization display screen, you may edit the bill to be a part of a retainer setup, however it’s positively much less user-friendly than FreshBooks.

Be taught extra about QuickBooks’ retainer technique right here

Making use of Late Charges utilizing FreshBooks vs QuickBooks

One slightly efficient strategy to inspire your shoppers to pay their invoices on time is so as to add a late charge to the bill if not paid by its due date.

Including a late charge is essential sure, however it’s all of the extra highly effective in case your accounting software program can run it robotically—sparing you the duty of remembering dozens of bill particulars and doubtlessly saving you from a clumsy dialog.

Setting Late Charges with FreshBooks

Freshbooks has all the time been an enormous advocate of freelancers—serving to them receives a commission on-time and pretty. And their late charge choice aligns completely with their stance.

With FreshBooks, you may robotically set a late charge to auto-generate and ship to a consumer who doesn’t pay their bill. In truth, it’ll simply tack the late charge proper on to the present bill so when your consumer lastly does get round to paying, they’ll need to pay that additional 5%, 10% or no matter you’ve set it at.

Be taught extra about FreshBooks’ late charge function right here

Setting Late Charges with QuickBooks

QuickBooks, whereas they do provide this feature, has a way more guide method (they declare its to your security—you wouldn’t need to ship a late charge to somebody who hasn’t even seen their bill, proper?).

Inside QuickBooks, you may apply late charges to invoices that haven’t been paid, however you need to go into your invoices display screen manually and choose the invoices which are late.

Evidently, we predict this may very well be a bit extra automated.

Be taught extra about utilizing late charges with QuickBooks

Recurring Invoices with FreshBooks vs QuickBooks

Maybe the all-time finest strategy to make your service-based enterprise extra dependable, predictable, and steady is to transform one-time shoppers into recurring shoppers.

It may be simpler mentioned than performed and requires plenty of belief between you and your consumer.

But when performed correctly, you may set your self up for good regular development. And sending recurring (auto-paying) invoices is a particular should if that’s the path what you are promoting goes.

Utilizing recurring invoices with FreshBooks

FreshBooks presents the choice to transform any present bill to a recurring bill fairly simply.

Simply set the bill sort to “recurring” after which choose how usually you’d prefer it to repeat (weekly, month-to-month, and so on.). FreshBooks will then generate and ship a brand new bill each time the cycle is accomplished.

Be taught extra about setting recurring invoices with FreshBooks

Recurring invoices in QuickBooks

QuickBooks additionally presents a recurring bill choice inside their primary bill settings. Typically they name these “Scheduled” invoices, however it’s the identical thought. Simply inform QuickBooks to ship an bill for $200 each Tuesday morning they usually’ll do it.

As an added bonus, QuickBooks may also CC you on any bill that will get despatched so there’s not just a few crazed accounting bot on the market sending recurring invoices lengthy after you imply to.

See extra particulars about QuickBooks’ recurring bill function

Monitoring Venture Profitability utilizing FreshBooks vs QuickBooks

Should you assume retaining monitor of the standing of a number of tasks without delay could be overwhelming, attempt additionally retaining monitor of the overall variety of hours labored on a challenge and the profitability of every challenge.

It may be so much to deal with—even for a mid-sized, rising firm (maybe particularly as you’re rising).

However if you wish to keep worthwhile and proceed to develop, you have to know the place every of your tasks stands.

Are you spending too many hours on it? Have your shoppers paid their invoices? Are you billing sufficient for the work you place in? Is the challenge financially underwater?

That’s the place a project-by-project monetary view turns out to be useful.

FreshBooks’ tackle challenge profitability

Sadly (possibly as a result of FreshBooks is constructed primarily for freelancers with few staff) there’s not a extremely nice strategy to see profitability by challenge when utilizing FreshBooks.

You possibly can, in fact (as you may with QuickBooks) see a breakdown of bills and revenues by class (for instance, internet design), however that’s hardly the identical.

Venture profitability stories with QuickBooks

QuickBooks, then again, has a much more dependable answer for monitoring the profitability of every particular person challenge you’re employed on.

In your QuickBooks dashboard, you may get a whole monetary view of all your tasks multi function place. You too can simply monitor labor prices, prices of products, and different bills all associated solely to that challenge.

Be taught extra about QuickBooks’ challenge profitability options

Monitoring Stock on FreshBooks vs QuickBooks

Whereas not each small enterprise has to trace stock with a view to get their each day work performed, for those who must, it’s a critically essential job. In any case, in case you run out of stock, you run out of money circulation.

Monitoring stock utilizing FreshBooks

In all probability as a result of it was constructed primarily to service artistic people (designers, writers, and so on.), FreshBooks doesn’t have a built-in stock monitoring mechanism. If you wish to monitor stock alongside your funds with FreshBooks, you’ll need to attempt utilizing certainly one of their stock add-ons.

Monitoring stock utilizing QuickBooks

QuickBooks, then again, contains primary stock monitoring functionality on their hottest plan and better.

Not solely are you able to monitor your stock ranges and get alerts when stock is operating low, however it’s also possible to see prices of products, handle distributors (when you’ve got them) and export all this essential information to Excel when wanted.

Be taught extra about monitoring stock with QuickBooks

Managing sub-contractors on FreshBooks vs QuickBooks

Should you plan to proceed rising your small enterprise, you’ll most likely work with contractors. Possibly you’ve already labored with them up to now. Otherwise you would possibly even have contractors on full-time or part-time workers indefinitely.

Both means, your group of contractors may need essential info that you just’ll want as you handle your funds like: hours labored on a challenge; price of property to finish a challenge; and so on.

For that, it’s useful in case your accounting and consumer administration software program can embrace your contractors seamlessly.

Working with contractors in FreshBooks

If you rent a contractor and add them to your FreshBooks account, they’re given their very own non-public FreshBooks person account. They’ll be capable of see the tasks you invite them to and add billable hours in direction of these tasks. They’ll additionally course of an bill to you for the work they full.

Working with contractors in QuickBooks

In QuickBooks, you may retailer crucial monetary information in regards to the contractors you’re employed with and, come tax time, you should use QuickBooks to ship them their 1099 varieties (if relevant) though an additional charge might apply to that state of affairs.

Managing and paying payments with FreshBooks vs QuickBooks

Wouldn’t operating a small enterprise be wonderful if all you ever needed to do was gather funds?

However because the saying goes, typically you need to spend cash to generate income and also you’re going to inevitably have payments you’ll must pay every month.

accounting software program will take that into consideration and show you how to pay your payments on time and from the appropriate accounts.

Paying payments with FreshBooks

Regrettably, FreshBooks doesn’t provide a strategy to robotically pay what you are promoting’ payments each month. After looking out excessive and low on my dashboard and throughout Google, I simply couldn’t discover something even near what I used to be searching for.

Admittedly, freelancers and solopreneurs might not have as many payments as, say, a brick-and-mortar retailer.

However actually they do have payments to pay and it will be good to do all of it from the identical place.

Paying payments with QuickBooks

QuickBooks, then again, integrates along with your financial institution to auto-pay essential payments that hold what you are promoting shifting ahead.

It’s essential to notice that they use an integration with Invoice to supply this service which lets you pay and monitor quite a lot of distributors, contractors, and payments.

You too can sync your funds and create checks from wherever—which might turn out to be useful when your landlord nonetheless is not going to take a bank card.

Be taught extra about QuickBooks’ invoice pay options

The Winner of FreshBooks vs QuickBooks Premium Options

That wraps up the premium options battle and we predict it’s fairly clear we are able to really feel assured in saying the winner is:

QuickBooks — Click on right here to attempt it free for 30 days

Why QuickBooks wins this battle

Whereas each rivals had some good premium options (and once more, it’s going to rely completely by yourself particular enterprise), QuickBooks snuck forward on this class as a result of it appears to be constructed extra for mid-sized companies.

Whereas FreshBooks is nice for freelancers, or groups of 1-3 individuals, in case you’re already a extra sizeable firm it’s possible you’ll need to go together with QuickBooks. Moreover, when you’ve got stock to trace or numerous distributors to pay, QuickBooks will probably be a greater choice for you proper now.

Flexibility with FreshBooks vs QuickBooks

Until you’ve been in enterprise for many years and also you’ve obtained all of your processes nailed down and also you’re assured what you are promoting won’t ever have to alter or adapt (Ha. Good luck!) you’re going to have to be versatile.

And that implies that your accounting software program and invoicing app must be extraordinarily versatile too.

On this part, we’ll examine which is extra versatile: FreshBooks or QuickBooks.

Progress flexibility utilizing FreshBooks vs QuickBooks

Maybe a very powerful query to ask is: will this accounting software program proceed to assist me and my enterprise as I develop (scale)?

To reply this query, let’s evaluate once more the out there plans from FreshBooks vs QuickBooks.

FreshBooks has mainly 3 plans: Lite, Plus, and Premium. In addition they have a Choose plan if what you are promoting outgrows the Premium plan (over 500 shoppers). Every new plan offers a better max-client quantity and new options.

QuickBooks has 5 plans: Self-Employed, Easy Begin, Necessities, Plus, and Superior. They don’t value by the variety of shoppers, however add extra superior options with every new plan.

To this point, they’re about even by way of flexibility to develop.

And that continues to be true except you contemplate QuickBooks Self-employed plan (their most entry-level plan). As unusual because it appears, it seems you may’t improve from Self-employed to some other plan.

So in case you’re coming into this as a freelancer, a side-hustler, a solopreneur, or a tinkerer you’d ideally be part of QuickBooks Self-Employed.

However then, if what you are promoting takes off (and even grows modestly) and also you need to add a number of new options, you may’t improve immediately.

Kindof a ache.

So for that, we’re going to say Freshbooks is essentially the most versatile accounting software program in the case of rising along with you and what you are promoting.

Workforce flexibility utilizing FreshBooks vs QuickBooks

Together with development comes the necessity to deliver different individuals into your circle of belief in the case of what you are promoting funds.

Even in case you don’t select to rent early on, you should still select to rent an accountant to assist evaluate your books and ensure you’re maximizing your tax deductions.

So the query is: which accounting software program appears extra versatile in the case of including group members?

FreshBooks means that you can add group members from the get-go on their Lite plan. The one caveat: every new group member will price you $10/mo.

QuickBooks doesn’t mean you can add group members till you stage as much as their necessities plan. And whereas there’s no additional cost on that plan for a number of customers, you’re maxed out at 3.

We should always notice: each instruments provide export choices to obtain spreadsheets of your information and ship to an accountant.

It’s additionally essential to do not forget that each FreshBooks and QuickBooks do have choices so as to add and/or handle contractors—which is perhaps your first set of group members anyway.

FreshBooks presents contractors in any respect ranges and QuickBooks presents related performance starting with their Easy Begin plan.

So, which is healthier in the case of flexibility?

Should you take value out of the combo (we already hit on value above), then FreshBooks wins this one too.

Whereas an additional $10/mo per person feels a bit steep in our opinion, it nonetheless stays extra versatile since technically we may add hundreds of customers (if cash weren’t a problem) even on essentially the most primary plan.

Even on QuickBooks’ most superior plan, you may solely add a max of 25 customers. And whereas it’s doubtless you received’t ever want greater than 25 individuals to have entry to your books, you would possibly want they’d entry/capacity to bill or monitor challenge funds.

Which is extra versatile, FreshBooks or QuickBooks?

Ultimately, we have now to say the extra versatile account software program for a younger, hoping-to-grow enterprise is:

FreshBooks — Click on right here to attempt it free for 30 days

Connectivity of FreshBooks vs QuickBooks

As we talked about earlier, each freelancer and small enterprise proprietor is aware of: you may have 1,000,000 issues to do.

Accounting, bookkeeping, or invoicing are simply a part of the combo.

Which implies you want a small enterprise accounting answer that may connect with different essential instruments in what you are promoting.

On this part, we’ll check out FreshBooks’ vs QuickBooks’ capacity to hook up with a very powerful instruments your organization might have because it grows.

Variety of third get together apps that can be utilized with FreshBooks vs QuickBooks

Since no two companies are precisely alike, we are able to’t fake to know what apps you’ll hope you may join your accounting software program with.

As an alternative, let’s take a extra high-level take a look at the third-party app marketplaces for FreshBooks vs QuickBooks.

Whereas we perceive that extra isn’t all the time higher, it’s a good place to begin for an goal take a look at the connectivity talents of FreshBooks vs QuickBooks.

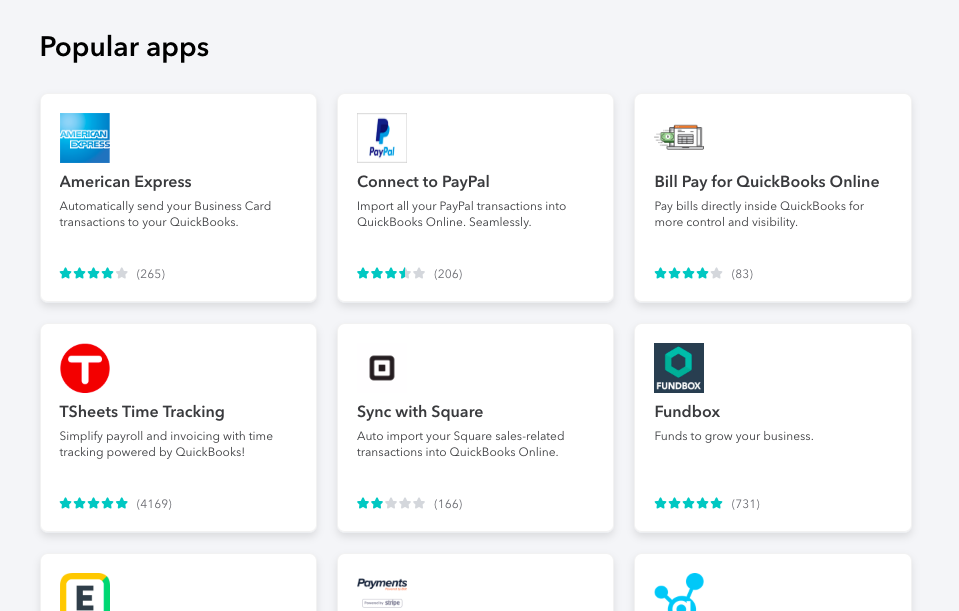

On the time of writing, FreshBooks has round 80 out there app integrations in over 25 classes. They’ve additionally added a “FreshBooks Examined” certification which we actually love because you don’t have time to be messing round with apps that simply don’t play properly collectively.

On the similar time QuickBooks boasts over 700 out there apps in 15 classes together with fee processing, buyer administration, payroll processing, and QuickBooks On-line backups. This is sensible because of QuickBooks’ market saturation and historical past within the market.

It’s attention-grabbing to level out that FreshBooks and QuickBooks even have integrations for each other. We’re not 100% positive why you would want each instruments, however the choice is there in any case.

High quality of third get together apps that can be utilized with FreshBooks vs QuickBooks

With out utilizing all 800+ of the apps out there in each of the add-on libraries, it’s onerous to actually decide who has greater high quality app integrations, FreshBooks or QuickBooks.

We are going to say (and possibly simply because there have been considerably fewer apps complete) I appeared to acknowledge way more manufacturers and instruments in FreshBooks’ market than in QuickBooks’.

Which presents extra connectivity, FreshBooks or QuickBooks?

Ultimately, there’s actually no contest. In order for you an accounting software program that may connect with tons of of different instruments you is perhaps utilizing in what you are promoting, then the apparent alternative is:

QuickBooks — Click on right here to attempt it free for 30 days

FreshBooks vs QuickBooks monetary assist comparability

Simply because you may have entry to a tremendous small enterprise accounting software program software like FreshBooks or QuickBooks doesn’t essentially imply you’ll know precisely learn how to handle what you are promoting funds like a professional.

Which implies, one essential consideration when selecting an accounting software is how a lot assist they can provide you by way of monetary data and assist.

Getting monetary assist with FreshBooks

Whereas FreshBooks does have an in depth library of documentation, most of it seems to be centered round utilizing their software program or operating your small enterprise (proposales, invoices, shoppers, and so on.)

We have been unable to seek out any choice for monetary assist from a stay human being reminiscent of an accountant or a marketing consultant.

Getting monetary assist from QuickBooks

QuickBooks, then again, does provide a “Reside Bookkeeper” choice (click on right here after which toggle the “Accomplice with a stay bookkeeper” tab).

Clients who need just a little extra skilled monetary assist can have an authorized bookkeeper units up their books by way of a video convention. That very same bookkeepers then offers month-to-month stories all year long.

It’s unclear how a lot assist they provide you apart from operating the stories. And this premium improve will price you a number of hundred {dollars} each month (beginning at $410/mo for QuickBooks’ most simple plan).

Who presents higher monetary assist, FreshBooks or QuickBooks?

If you take the hefty price ticket out of the query, the reply turns into apparent. Should you’re terrified to arrange your books alone and nervous you received’t know learn how to course of essential stories each month, then it is best to go together with:

QuickBooks — Click on right here to attempt it free for 30 days

FreshBooks vs QuickBooks technical assist comparability

Monetary assist isn’t the one type of show you how to would possibly want when utilizing a software like FreshBooks or QuickBooks.

Relying in your ability stage on the pc, it’s possible you’ll end up in want of technical assist when managing your books and different finance instruments (particularly to start with).

Which is why it’s price asking the query: how does FreshBooks vs QuickBooks evaluate by way of buyer assist?

Help availability with FreshBooks vs QuickBooks

There’s nothing extra irritating than being caught on a technical downside with nobody that can assist you for days.

So it’s crucial to have good technical assist on any bookkeeping or accounting software program you select.

Help availability with FreshBooks

Should you determine to enroll in FreshBooks, you may count on a group of technical assist workers prepared to help you.

And in case you’re a fan of speaking on the telephone, you’re in luck: they’ve their assist telephone quantity listed immediately within the “assist” part.

Other than the telephone, they’ve a assist e-mail deal with with pretty fast response instances, however hey: it’s nonetheless e-mail.

Help availability with QuickBooks

QuickBooks takes an identical method to buyer assist, however I’ve to confess: their contact info is so much tougher to seek out. I believe this comes with the sheer measurement of the corporate.

With a view to discover assist, you need to first inform them what software program you’re utilizing and the way, then the overall class of downside you’re having. Based mostly in your solutions you’ll be despatched to a chat module the place (hopefully) somebody can assist you.

Which assist will we advocate?

Admittedly, we’ve not used the assist groups a lot for both of those merchandise.

However what we do like is the openness and transparency FreshBooks presents with their assist.

Whereas they’re lacking a chat module (is available in actually helpful in case you’re in an workplace and might’t get away for a telephone name), the truth that their assist e-mail and telephone quantity are listed immediately on the high of their assist documentation web page means they appear to place the client very first.

We like that.

For that purpose, if technical assist is a crucial ingredient for you, we propose you utilize:

FreshBooks — Click on right here to attempt it free for 30 days

What do actual freelancers take into consideration FreshBooks vs QuickBooks?

To wrap up this in-depth side-by-side comparability of FreshBooks vs QuickBooks, we needed to deliver a extra human ingredient to this text.

So we requested our rising neighborhood of freelancers on fb what, if any, expertise they’d evaluating FreshBooks vs QuickBooks.

Will depend on your state of affairs…

Internet designer Cindy Rodriguez recommends QuickBooks Self-Employed in case you’re all the time planning to file a Schedule C, or FreshBooks in case you’re a freelancer.

“I’ve used each [FreshBooks and QuickBooks] and want QuickBooks Self-Employed in some methods (ACH funds are processed at no cost, mileage is robotically calculated and it’s solely $10 a month I consider.)

You should utilize it so long as you may file a Schedule C which might be plenty of freelancers. QuickBooks On-line is a bit completely different and I’d advocate FreshBooks over it for freelancers.”

When you have plenty of shoppers…

Freelancer Amber Richart has plenty of shoppers. Which is making her contemplate a change:

“I haven’t used QuickBooks however I’ve been contemplating going there and right here is why – the associated fee – I’m a freelancer who’s above the 50 consumer mark – however no the place close to an enormous enterprise with group members – and due to that i’ve to pay the premium value $50 US.

I do love FreshBooks although and I exploit it largely due to the time-tracking function.”

Contemplating a change…

Graphic designer Jeffrey Brown has thought-about shifting to FreshBooks—primarily as a result of QuickBooks has gotten so costly.

I did the trial of FreshBooks and have been utilizing QuickBooks for over 10 years now. I see advantages to every, truthfully. Haven’t made the change to FreshBooks due to the historical past with QuickBooks, I assume. QuickBooks is pricey, for what I exploit it for, I suppose. I’m contemplating the change, although.

Inform us what you consider FreshBooks vs QuickBooks

Now it’s your flip. Should you’d like to hitch within the FreshBooks vs QuickBooks debate, observe these steps:

- Be a part of our FREE freelancer mastermind group on Fb

- Click on this hyperlink so as to add your opinion to the dialog

Deciding which is healthier for you: FreshBooks or QuickBooks

Ultimately, solely you know what you are promoting state of affairs nicely sufficient to decide on between FreshBooks and QuickBooks.

The reality is, you most likely can’t actually go unsuitable with both of them. Each have their strengths and each have their weaknesses. If neither seem to be a match, there are many QuickBooks options on the market too.

However that may be a fairly disappointing reply in case you’re actually having some resolution paralysis right here. So… right here’s our general suggestion:

Our general suggestion

Should you simply can’t determine or they each seem to be a very good choice, we advocate you begin with FreshBooks.

Why? Their group appears to actually care about freelancers and small enterprise homeowners. They’ve wonderful rankings, all one of the best options, and just a few drawbacks. QuickBooks out-sizes them out there, however FreshBooks offers a superior expertise and can more than likely have essentially the most enhancements within the coming years.

And keep in mind, you may click on right here to attempt FreshBooks free for 30 days.

Extra questions individuals ask about FreshBooks vs QuickBooks

Even after an in-depth evaluate of FreshBooks vs QuickBooks, we all know a few of you’ll nonetheless have questions on these two accounting instruments.

Under, we’ve collected fairly a number of questions and tried to present our greatest reply that can assist you select FreshBooks vs QuickBooks.

Does FreshBooks combine with QuickBooks?

Sure. As talked about in our app integration part above, FreshBooks and QuickBooks each have integrations for the opposite. We’re uncertain why you’d want to attach them, however their have to be a purpose.

What’s the distinction between QuickBooks and QuickBooks Self-Employed?

As talked about in our plans and pricing part above, the most important limitation with QuickBooks Self-Employed is that you just aren’t in a position to improve to a different QuickBooks plan in case you outgrow it. So in case you plan to develop, go together with QuickBooks’ Easy Begin plan or FreshBooks’ Lite plan.

What’s the best accounting software program for small enterprise?

For ease of use, we advocate FreshBooks. The onboarding is gorgeous they usually stroll you thru the whole lot in order that what you are promoting could be up-and-running the identical day you enroll.

What’s the finest accounting software program for self-employed?

Should you’re self-employed and by no means plan to rent or develop, you may safely go together with FreshBooks or QuickBooks Self Employed and be fantastic. However in case you’d like software program that may develop with you, it is best to positively go together with FreshBooks.

Is QuickBooks onerous to be taught?

When put next with FreshBooks, QuickBooks is just a little tougher to be taught. That is most likely because of the truth that it’s been round longer and software program tends to get a bit clunkier with age. In equity, although, the trendy online-only variations of QuickBooks are fairly slick.

Is there a free model of QuickBooks?

No. We’ve by no means heard of a free model of QuickBooks. You possibly can positively attempt QuickBooks free for 30 days by clicking right here although. Should you can’t afford to pay for a service like FreshBooks or QuickBooks, there are numerous free accounting software program choices on the market.

Does FreshBooks do payroll?

No. FreshBooks doesn’t presently deal with payroll. However they do appear to have an excellent relationship with Gusto, a number one payroll software program which integrates fairly seamlessly with FreshBooks.

Does FreshBooks monitor mileage?

No. FreshBooks doesn’t presently have a local mileage monitoring function. However they do join nicely with Everlance, a number one mileage monitoring service for freelancers. In order for you an accounting software program with mileage monitoring constructed proper in, you’ll must attempt QuickBooks.

Is QuickBooks Self Employed Free?

No. There may be not a free model of QuickBooks out there wherever. QuickBooks Self-Employed is the most affordable choice out there from QuickBooks however, as we talked about on this article, it has vital limitations.

What did we omit when evaluating FreshBooks vs QuickBooks?

Thanks for studying (or hopefully skimming) our FreshBooks vs QuickBooks in-depth information.

After wanting by way of all of this info, what did we omit? Do you continue to have questions? In that case, simply contact us or chat with us within the Freelancer Mastermind on Fb.

We sincerely hope this analysis has helped and need you one of the best of luck in deciding between FreshBooks and QuickBooks.

Maintain the dialog going…

Over 10,000 of us are having each day conversations over in our free Fb group and we might like to see you there. Be a part of us!