Again within the March 2019, I wrote up the merger between U.Ok. based mostly Mereo BioPharma (MREO) (~$100MM present market cap) and OncoMed Prescription drugs (previously traded as OMED) as a strategy to play the contingent worth rights that had been issued to OMED shareholders. The CVR a part of the thesis hasn’t labored out, at the very least but, there are nonetheless potential milestones on Navicixizumab in play earlier than the CVR expire on 4/23/24. Since closing out that commerce (I obtained MREO shares within the merger however offered instantly at $5.30, shares commerce for $0.95 right now), I’ve checked in on the corporate often because the CVRs naturally have Mereo counterparty threat. On the latest of these verify ins, I got here throughout two In search of Alpha write-ups (right here and right here) by Dalius Taurus of SSI that piqued my curiosity.

Mereo BioPharma has six product candidates, 4 bought from bigger biopharmaceutical firms (Novartis and AstraZenca) that beforehand obtained appreciable funding within the pre-clinical stage however had been now not strategic priorities and two product candidates inherited from the OncoMed acquisition. MREO’s market cap is roughly $100MM (MREO trades as an ADR, every MREO share equals 5 atypical shares) and final reported a money steadiness of $105MM (present conversion price, MREO reviews in GBP) as of 2021 yr finish, after some money burn, it doubtless has a small optimistic enterprise worth.

Just like most pre-revenue biotechs nowadays, Mereo’s traders have misplaced their persistence funding improvement pipelines, Rubric Capital (~14% proprietor) has stepped up as an activist to cease the money burn by trying to reconstitute the board of administrators. Rubric has its eyes on gaining management of the board, then monetizing belongings and returning money to shareholders in what quantities to a liquidation. Rubric is run by David Rosen, who was a portfolio supervisor at SAC Capital (now Point72) earlier than occurring his personal in 2016. It simply so occurs that the second largest MREO shareholder is Point72 with 8.6%, doubtless pleasant to Rubric, additional rising the chance that Rubric beneficial properties board seats within the proxy marketing campaign as the present board/administration owns an insignificant quantity.

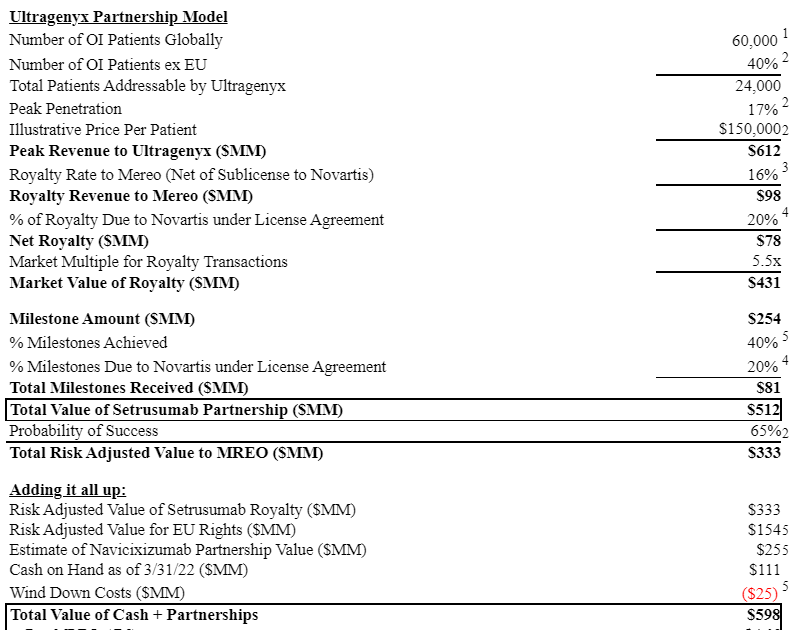

Under is the again of the envelope valuation math offered by Rubric of their 6/9/22 letter:

I’ve little approach of confirming or refuting their valuation, however even when they’re improper by half the inventory is roughly a double from right here. Mereo’s most dear asset based on Rubric is their partnership with Ultragenyx (RARE) on Setrusumab (initially bought from Novartis) which is a remedy for a uncommon bone illness, osteogenesis imperfecta (“OI”), that at the moment has no authorised therapies. Mereo retained the industrial rights for Setrusumab within the UK and Europe, in any other case Rubric is ascribing no worth to Mereo’s different product candidates, together with Alvelestat which is a remedy for a uncommon lung illness present process medical trials.

Alvelestat is the one product candidate that got here from AstraZenenca (AZN). In June, which to be truthful is a lifetime in the past on this market, The Occasions of London reported that AZN was contemplating a bid for MREO:

Phrase is that it’s contemplating a bid for Mereo Biopharma, a specialist in most cancers and uncommon ailments.

Mereo, which has developed a portfolio of six clinical-stage product candidates, is predicated in London however listed on the Nasdaq change in New York and lists AstraZeneca amongst its companions alongside Novartis, OncXerna and Ultragenyx. There are recommendations that at the very least one different suitor, probably one other companion, may additionally be on the prowl.

Shares in Mereo have been a stinker, shedding virtually 80 per cent of their worth prior to now yr, though they jumped by 8.5 per cent to 69 cents on Wednesday, valuing the corporate at $81 million. Analysts have a median goal value of $7 and the discuss is that Mereo would settle for $5, equating to $500 million together with American depositary receipts or ADRs. Evercore and Citigroup are mentioned to be concerned as advisers.

This text got here out across the identical time because the Rubric letter, they could be associated, or it could be coincidence. Even when the Setrusumab valuation is overstated, there could be different belongings value one thing right here. Rubric and Mereo’s administration have been going again forth on Rubric’s request for a particular assembly, Mereo seemingly was citing each technicality why Rubric’s request was ineligible however finally relented and the particular assembly is now set to occur someday in November. It seems that a brand new board will likely be put in place shortly, we’ll see what occurs from there. I purchased a small place.

Disclosure: I personal shares of MREO and a few non-tradable OMED CVRs