Like nearly each different deSPAC, DMS got here to the market with inflated expectations, they initially guided to $78MM EBITDA in 2021, however solely delivered $58MM. DMS began 2022 with flat steering of $55-60MM EBITDA, however now solely count on $30-35MM attributable to wage inflation hitting their value construction (500+ staff), advertising budgets getting slashed and LTV fashions being adjusted down of their core auto insurance coverage market (Allstate and State Farm are two of their largest prospects). Administration expects to return to progress in 2023.

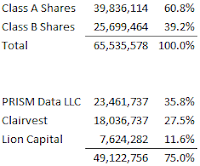

DMS is founder led, the corporate was began in 2012, the three co-founders are nonetheless within the c-suite right this moment and personal 35.8% of DMS by way of their “Prism Information LLC” funding automobile. In 2016, DMS took on a PE funding from Clairvest, who nonetheless owns 27.5% of DMS, and rounding out the highest 3 holders is Lion Capital at 11.6% possession, Lion was the sponsor of the SPAC. In complete, these three corporations personal 75% of DMS, the remaining 25% has little or no institutional possession and is probably going held by retail holders who have been caught up within the SPAC mania.

On Monday 9/8, through Prism Information, administration made a non-binding supply to amass all the publicly traded Class A shares for $2.50/share, a 121% premium from the place the inventory closed the earlier Friday. In their letter, they point out that Clairvest and Lion “are more likely to comply with take part” alongside Prism, leaving solely 25% of shares needing to be bought, or about $40MM. The supply will not be topic to a financing situation (necessary in right this moment’s market), however DMS does have $26MM money on its steadiness sheet and Prism has $50MM in pre-committed financing from B. Riley (RILY) to finish the transaction.

The supply values the minority curiosity at someplace round ~10x doubtlessly trough EBITDA, once more administration expects to return to progress in 2023 (they’re the most effective positioned to know if there may be certainly an inflection) so this could possibly be an opportune time for them to take it non-public once more. In August 2021, the corporate introduced they have been exploring strategic options, on the final two convention calls, CEO Joe Marinucci (the signatory on the Prism supply letter), has said they have been “hoping to have an replace right this moment” concerning strategic options, this supply is probably going the tip outcome. Marinucci would know the place third events gives have been for the enterprise earlier than providing $2.50 to the board, that is seemingly the most effective supply and the impartial board members will take it given there aren’t any vocal or vital minority shareholders.

Shares closed right this moment at $1.94/share, a 28% unfold to the Prism supply. Sure, there may be vital draw back given the place DMS traded earlier than the supply, however there aren’t any shareholders to place up a combat and certain that is the most effective supply after the corporate ran a course of. In any other case, I feel the unfold is large as a result of it’s a low float former SPAC. I purchased a smallish place. Given the variety of deSPACs, I anticipate this being the same fruitful searching floor because the “damaged/busted biotechs”, please ship me any others that sound or really feel like this one.

Disclosure: I personal shares of DMS