It has been practically 2 months that the S&P 500 (SPY) has been mired in a buying and selling vary. That’s the reason funding veteran Steve Reitmeister shares his newest insights to elucidate why a bull market remains to be in place…and goal the most effective shares and ETFs for the times forward. Learn on for the complete story under.

Up, down and throughout. That’s the nature of a buying and selling vary.

Not as a lot enjoyable as a bull run…however a pure pause for buyers to catch their breath earlier than the subsequent run increased.

When will that be? And what would be the catalyst?

We are going to focus on these very important matters and extra in immediately’s Reitmeister Whole Return commentary.

Market Commentary

We’re in a bull market, however caught in a brief time period buying and selling vary between 4,374 and 4,600 on the S&P 500 (SPY).

Why a bull market?

As a result of most all indicators level to a comfortable touchdown for the economic system although the Fed launched into essentially the most aggressive price mountaineering regime in historical past.

Please do not credit score the Fed for this comfortable touchdown miracle. That is as a result of 12 of the final 15 occasions they raised charges resulting in a recession. Heck, they even a predicted a recession would come from their hawkish actions.

The one purpose a recession will not be taking place this time round is the power of the employment market. And that was borne of greater than 2 million People selecting early retirement throughout Covid, which led to an excellent job marketplace for anybody in search of employment.

So irrespective of how laborious the Fed stepped on the throat of the economic system with increased and better charges…they could not cease employers from filling vacancies with different staff. This stored earnings flowing…which stored spending flowing…which averted a recession.

We might go level for level on the financial indicators, however on the finish of the day the primary factor that issues is GDP. That rang in at +2.1% final quarter. And the present estimate from coveted GDP Now Mannequin factors to +4.9% in Q3.

Observe it is extremely early within the quarter and count on the mannequin to come back in a bit nearer to the Blue Chip Economist panel calling for one thing extra like 3% GDP progress. But even nonetheless that’s a formidable feat with charges this excessive for the aim of tamping down inflation.

The priority at this second is that, maybe, the economic system is a tad too robust. And with that can come extra inflationary pressures which results in a extra hawkish Fed (increased charges for longer) and that will increase the chances of recession down the highway.

That is the elemental purpose behind the pause within the bull rally resulting in our present buying and selling vary. However as shared in latest commentaries, most economists proceed to lower their odds of a recession forming within the coming yr. That features Goldman Sachs now seeing solely 15% likelihood of a recession within the yr forward.

At this second, buyers are holding their breath for what the Fed will say on Wednesday. It’s practically unanimously agreed upon that they are going to maintain charges at present ranges. So what actually issues is the speech given by Powell and what that tells us concerning the dot plot of charges within the months forward.

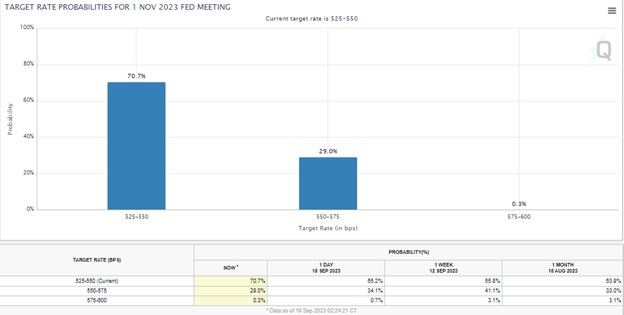

Only one week in the past buyers have been anticipating 44% likelihood of a price hike on the November assembly after this pause. That’s now all the way down to 29% given the constructive indications on this month’s CPI and PPI inflation reviews.

The Fed prides itself on the consistency and readability of its message. So, barring some miracle I count on on Wednesday that Powell will repeat comparable themes from previous:

- Extra work to do to get inflation all the way down to 2% goal

- Greater charges for longer

- Are open to elevating charges sooner or later…however are knowledge dependent

What can be attention-grabbing is that if there are adjustments within the statements about after they may decrease charges. Or the state of the economic system at the moment (which they lately modified from recession to comfortable touchdown). These adjustments might have market shifting impression.

Value Motion & Buying and selling Plan

Transferring Averages: 50 Day (yellow), 100 Day (orange), 200 Day (pink)

As famous above, we’re in a long run market, however mired in a brief time period buying and selling vary.

The 100 day shifting a is coming again into play because it was in mid August. Now that help stage is as much as 4,371 whereas the Tuesday low was 4,416.

I feel there may be not a lot logical purpose to press under that time. However you by no means know what the subsequent headline will learn…or if Powell throws a curve ball at his 9/20 press convention.

So, if that did occur resulting in a break beneath the 100 day…then the subsequent large stage of help could be the 200 day shifting common now at 4,186.

That will equate to an almost 10% pullback from the latest highs. And a correct expelling of extra available in the market. In order that stage of 4,200 is feasible, however not possible given the present elementary info in hand that ought to have shares bouncing earlier than that notion.

Including it altogether the buying and selling vary that began the start of August remains to be intact. That being framed by the 100 day shifting common (4,371) on the low aspect and 4,600 on the excessive aspect.

Most buying and selling ranges finish with shares shifting in the identical route as earlier than the buying and selling vary. In that case, it will be a resumption of the bull market.

That’s simply the technical image. The elemental image was shared above. Particularly that we appear to be on monitor for a comfortable touchdown for the economic system as inflation cools down. This factors to a possible decreasing of charges and resumption of earnings progress in 2024. Certainly, that may be a robust catalyst for future inventory advances.

We could presently be in a buying and selling vary…however what comes subsequent is probably going one other bull run increased. That’s the reason I stay totally invested in the most effective assortment of shares and ETF. Extra particulars on these within the subsequent part…

What To Do Subsequent?

Uncover my present portfolio of seven shares packed to the brim with the outperforming advantages present in our POWR Rankings mannequin.

Plus I’ve added 4 ETFs which are all in sectors effectively positioned to outpace the market within the weeks and months forward.

That is all primarily based on my 43 years of investing expertise seeing bull markets…bear markets…and all the things between.

In case you are curious to be taught extra, and need to see these 11 hand chosen trades, then please click on the hyperlink under to get began now.

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Whole Return

SPY shares have been buying and selling at $442.71 per share on Tuesday afternoon, down $0.92 (-0.21%). Yr-to-date, SPY has gained 16.64%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Creator: Steve Reitmeister

Steve is best recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Whole Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The publish Why the Bull Market is Nonetheless in Cost? appeared first on StockNews.com