Managing pairs commerce the POWR Choices manner will seemingly handle to extend the chance of revenue.

We’ve got mentioned in a number of earlier articles the advantages of a pairs commerce strategy. A pairs commerce is solely taking a bullish place on the inventory you’re feeling will do higher than an analogous inventory that you simply take a bearish stance on. Purchase Ford/Promote Basic Motors the traditional instance when you assume Ford will outperform GM.

As an alternative of utilizing easy inventory to specific the viewpoints, it’s in some ways higher to make use of choices. Why? Restricted threat, decrease upfront value together with three considerably much less recognized, however crucial, advantages.

A fast walk-through our current commerce within the POWR Choices portfolio will assist shed some mild on understanding these “below the radar” commerce administration advantages we make use of.

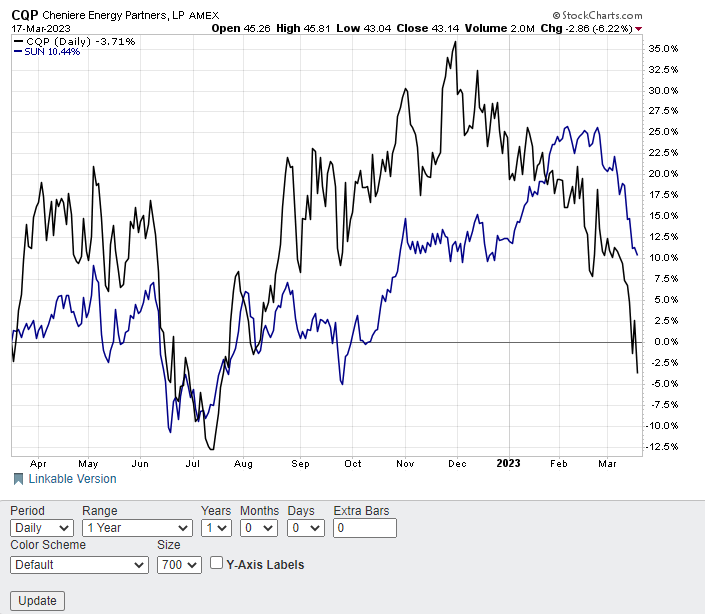

The pairs commerce we chosen was a lately accomplished bullish name on Cheniere Power Companions (CQP) and a bearish placed on Sunoco (SUN) . Each oil associated names so extremely correlated stocks-meaning they transfer up and down collectively frequently.

Preliminary commerce February 27 proven under:

Motion To Take

Purchase to open SUN 6/16/2023 $50 put for $4.10 w/.20 discretion

Every choice will value round $410 per contract.

Motion To Take

Purchase to open CQP 6/16/2023 $50 name for $4.00 w/.20 discretion

Every choice will value round $400 per contract.

Reasoning on the commerce was this: Cheniere Power Companions (CQP) was an A-rated (Sturdy Purchase) inventory whereas Sunoco (SUN) was a C-rated (Impartial) inventory. Each in the identical industry-MLP Oil& Fuel.

You’d count on these two shares to maneuver similarly given they’re each oil associated names. Certainly, they did for just about all of 2022.

Nonetheless, much-lower rated SUN had dramatically out-performed the upper rated CQP in 2023 by over 17%. The graph under reveals how these two usually associated shares diverged. The pairs commerce was placed on with the expectation of CQP subsequently outperforming SUN over the next few weeks and for the unfold to slim. This outperformance would trigger the unfold to converge, resulting in a revenue.

This did happen, however to not a big diploma. The unfold did converge by about 3.5%, narrowing from 17.7% to 14.15% as each shares fell sharply.

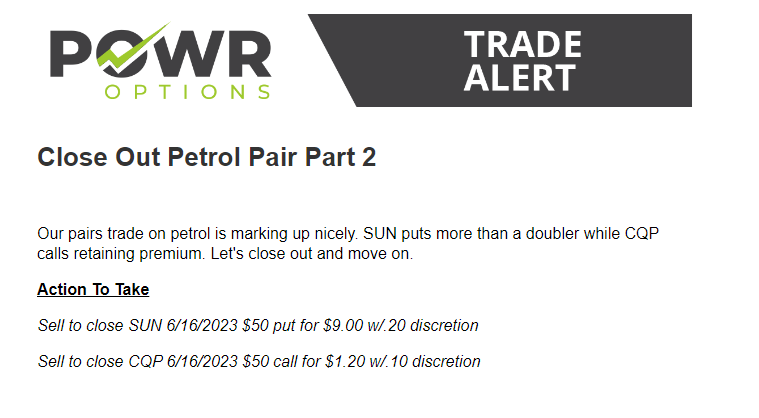

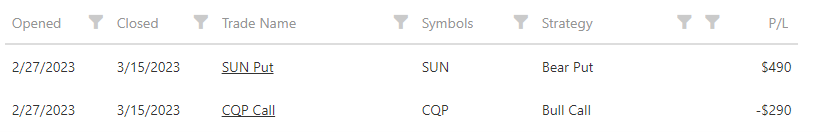

Our pairs commerce, nonetheless, did fairly properly. Closed out on March 15 as seen under.

We gained $490 on the SUN places and misplaced solely $290 on the CQP requires a internet acquire of $200 as proven within the desk.

The preliminary value on the pairs commerce was $810. The web acquire of $200 equates to a 24.69% return. Holding interval was a little bit greater than two weeks. Plus, we had been hedged at commerce inception with a bullish name and bearish placed on two extremely correlated shares.

So, whereas the 2 shares that comprised the pairs commerce did begin to converge as anticipated, that convergence actually did not account for almost all of the revenue.

As an alternative, the three issues listed below-gamma, time decay administration, and implied volatility analysis-are the hidden advantages to the POWR Choices Pairs Commerce strategy.

Gamma

Choices transfer in a curved, not linear, trend. The larger the favorable transfer within the underlying inventory the extra favorably the choice strikes compared. Conversely, the larger the unfavorable transfer within the inventory the much less the choices will transfer in opposition to you.

The preliminary delta at commerce inception will change because the inventory worth adjustments. This price of change within the choice delta in comparison with the inventory worth is known as “gamma”.

Gamma is an choices metric that describes the speed of change in an choice’s delta per one-point transfer within the underlying asset’s worth. Delta is how a lot an choice’s premium (worth) will change given a one-point transfer within the underlying asset’s worth.

Shopping for choices places you lengthy gamma. This implies you might be extra proper if you’re proper in selecting course. It additionally means you might be much less incorrect when you’re incorrect on course. Sounds to good to be true? Properly, it sort of is-because time decay is the unhealthy half about shopping for choices.

Time Decay

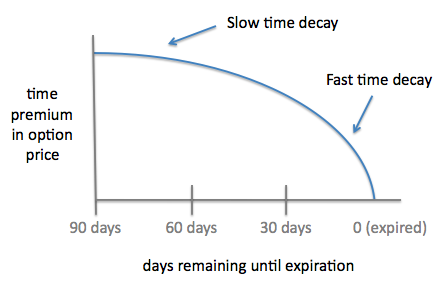

Choices are a losing asset. Every day that passes they lose a little bit extra of their total worth. This notion is known as time decay, or theta to make use of the Greek time period. Whereas gamma is the great aspect of shopping for choices, theta is certainly the unhealthy aspect. POWR Choices is conscious about time decay. That is why we virtually invariably elect to exit the choices properly earlier than expiration (normally 30 days or so).

The illustration under reveals how choice time decay actually hits up exhausting within the closing 30 days or so earlier than choice expiration. Exiting earlier than then and salvaging time premium, or the remaining worth of the choice, is essential to long-term success.

Definitely exiting the CQP/SUN pairs commerce in just some weeks made time decay much less related.

Having choices to procure expire nugatory, or for zero worth, is one thing that must be avoided-at all value. We’ve got achieved that thus far in POWR Choices.

Implied Volatility

At POWR Choices, we all the time look very carefully at implied volatility (IV) when contemplating commerce prospects. It’s, in our opinion, probably the most essential components to choice buying and selling.

Implied volatility is a measure of how a lot the choices market expects the underlying inventory to maneuver. Larger IV means greater strikes are anticipated and decrease IV equates to smaller anticipated strikes. IV can be in essence the value of the choice. Larger IV makes choices dearer. Decrease IV cheapens choices.

Since we’re all the time shopping for choices, we concentrate on buying these choices which have a relatively low implied volatility. Low comparative IV means choice costs are considerably cheap-always a great factor.

The present IV percentile ranks the place the implied volatility is true now as in comparison with IV vary over the previous 12 months. The decrease the percentile the decrease the IV is true now. 100% would imply IV is on the highest readings prior to now 12 months. 0% can be the bottom. 50% can be about common.

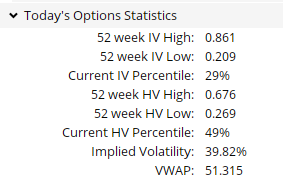

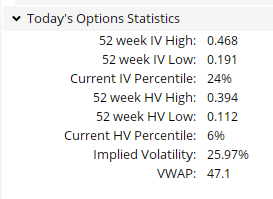

We glance to purchase choices which might be buying and selling properly under the 50% level-in different phrases comparatively low cost choices. A take a look at the choices on each SUN and CQP under reveals that each had been properly below the 50% IV percentiles once we purchased them on February 27.

CQP IV

SUN IV

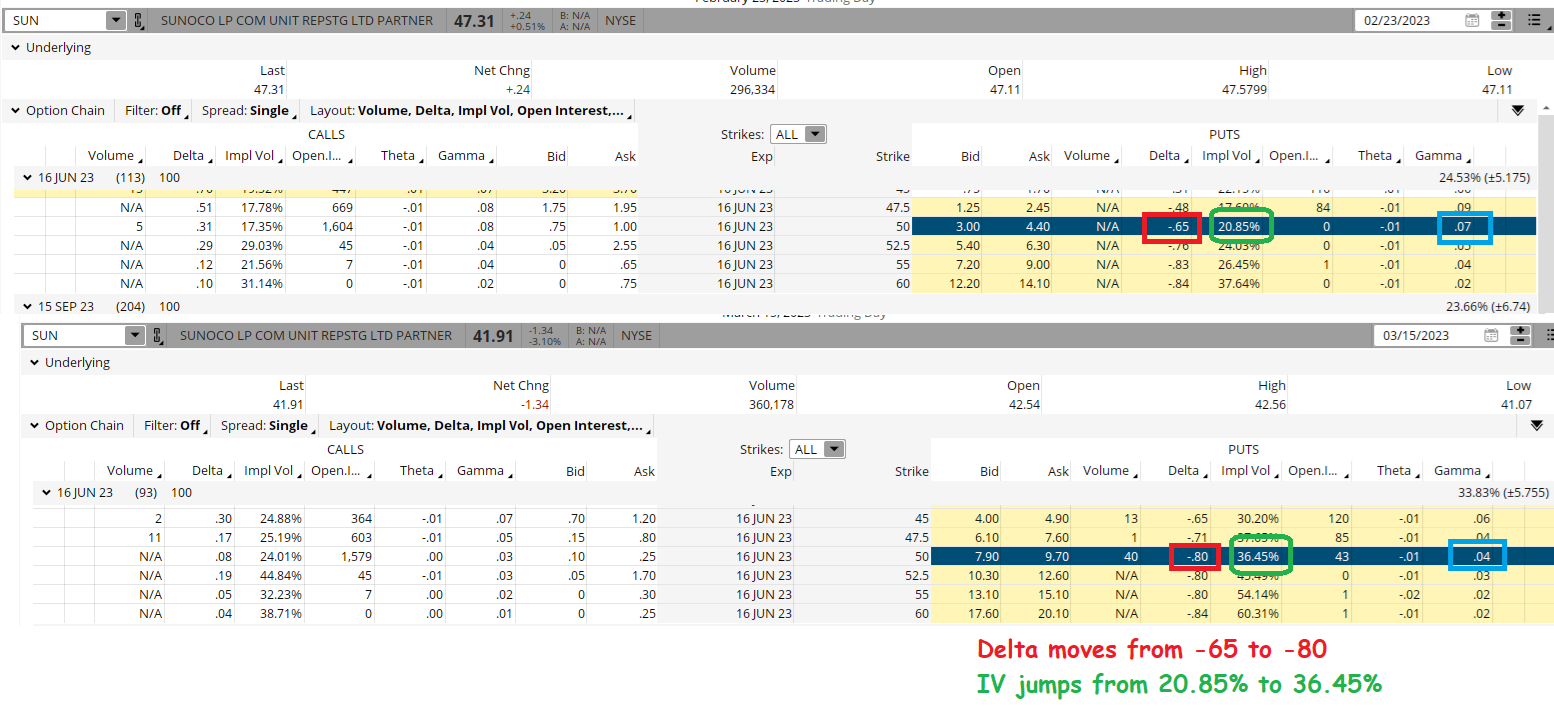

You may see under how the implied volatility (IV) jumped from 20.85% once we bought the SUN places to over 36% once we closed out the place. One other benefit to purchasing cheaply priced, or low IV, choices. Additionally proven is how the delta on these bearish places moved from -65 to -80, the constructive impact from gamma.

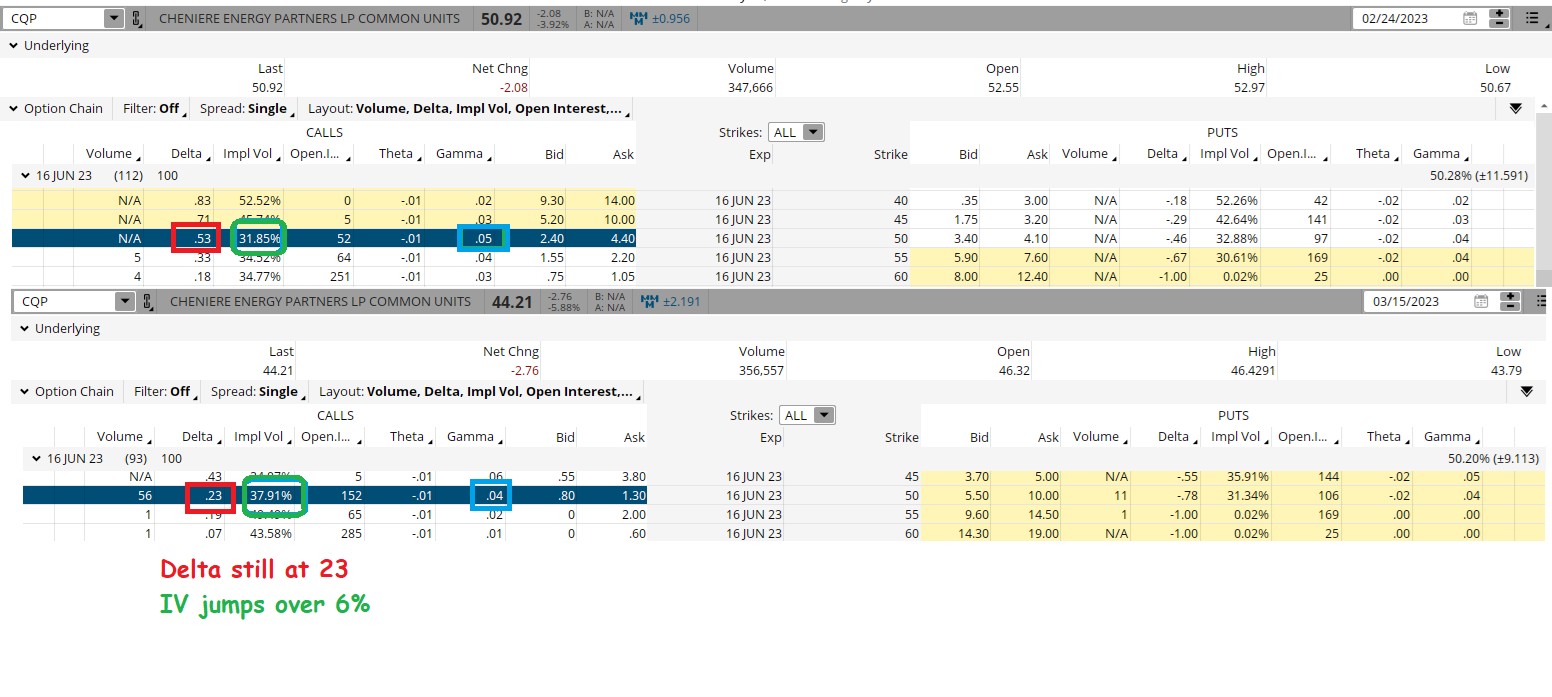

The identical situation performed out within the CQP calls as properly.

The facility of the POWR Scores plus the anticipated convergence of associated shares generally is a determined edge when developing pairs trades. Understanding the considerably hidden advantages of gamma, time decay administration, and implied volatility evaluation turns the pairs trades into POWR Pairs trades. Put the chances additional in your favor with this strategy.

POWR Choices

What To Do Subsequent?

In case you’re in search of the most effective choices trades for at present’s market, it’s best to try our newest presentation Learn how to Commerce Choices with the POWR Scores. Right here we present you methods to constantly discover the highest choices trades, whereas minimizing threat.

If that appeals to you, and also you wish to study extra about this highly effective new choices technique, then click on under to get entry to this well timed funding presentation now:

Learn how to Commerce Choices with the POWR Scores

All of the Finest!

Tim Biggam

Editor, POWR Choices E-newsletter

SUN shares closed at $41.60 on Friday, down $-0.32 (-0.76%). 12 months-to-date, SUN has declined -1.79%, versus a 1.98% rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Reside”. His overriding ardour is to make the complicated world of choices extra comprehensible and due to this fact extra helpful to the on a regular basis dealer. Tim is the editor of the POWR Choices e-newsletter. Be taught extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The put up Three Higher Methods To Put Revenue Possibilities In Your Favor With A POWR Pairs Method appeared first on StockNews.com