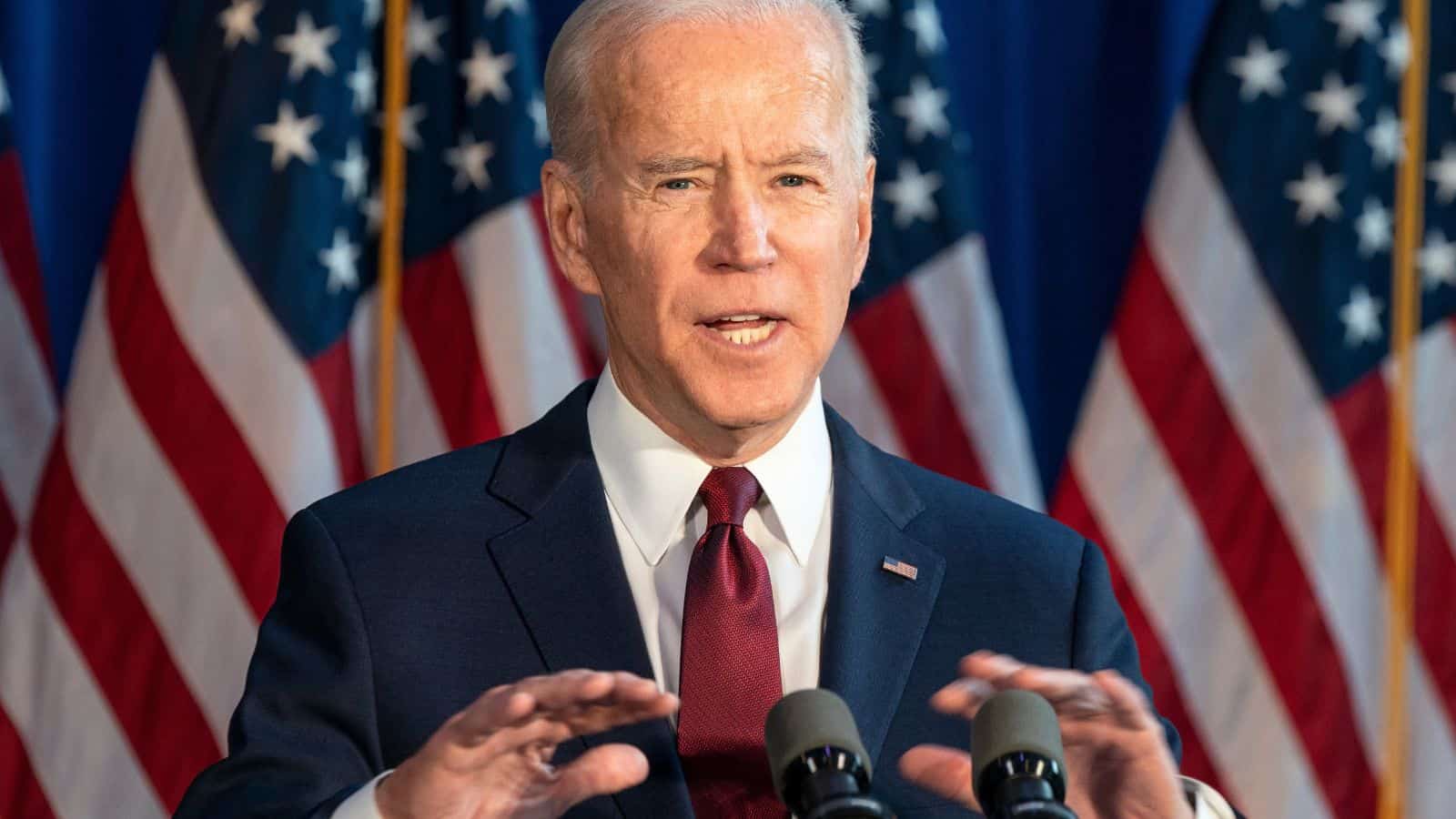

A latest ballot reveals what shouldn’t be surprising. A majority of People are struggling financially underneath Joe Biden. Whereas the White Home is touting its Bidenomics, a CNN ballot reveals 58 % of People really feel financial circumstances are worsening.

Whereas the President doesn’t management every part when it comes to economics, it’s straightforward to pin blame for a lot of People. Listed below are ten areas the place the financial system is worse underneath the Biden presidency.

The Value Of Gasoline

The fuel pump is the place many People really feel ache probably the most. The common price of fuel peaked at $2.81 a gallon underneath President Trump.

The bottom common worth underneath Biden was $3.10 a gallon. As of writing, AAA stories the typical worth is $3.79 a gallon.

Inflation Is Up

Do you’re feeling like costs are all the time going up? That’s an indicator of inflation. Whereas it’s bettering, it’s not the place it must be.

Beneath Trump, it was 1.4 %. Beneath Biden, it’s at present at 3.7 %. Many households really feel that distinction.

Poverty Is Up

Poverty is a rising challenge in America and one which impacts too many households.

Beneath Trump, we had a poverty fee of 11.9 %. On the finish of 2022, it was 12.5 %. That’s definitely not the course we prefer to see it go.

Gross Home Product Is Down

Gross Home Product (GDP) is a measure of ultimate items and merchandise. It wasn’t strong underneath Trump, however he fared higher than Biden.

Beneath Trump, progress was at 2.6 %. The second quarter of 2023 was 2.2 %. Though not designed as an indication of the well-being of residents, it’s not a very good signal to see it go down.

Housing Is Turning into Extra Unaffordable

Buying a home is an important a part of the American dream. Sadly, it’s changing into extra unattainable underneath Biden.

Rates of interest are a number one offender of this. Worse but, the median dwelling worth has gone from $258,000 to $416,000 in 4 brief years. Wages haven’t saved tempo with it.

The Inventory Market Is Down

Whereas the President doesn’t all the time have a major impression on the inventory market, it’s powerful for a lot of People to not suppose the other.

The S&P 500 went up practically 20 % in his first 12 months in workplace. These positive aspects largely went away in 2022, and 2023 hasn’t been a terrific 12 months both.

Shopper Confidence Is Down

Shopper confidence is a good measure of how optimistic individuals really feel in regards to the financial system. Beneath Biden, it hasn’t fared one of the best.

It peaked at practically 90 % early within the Biden presidency. At the moment, it hovers round 60 %.

Automobile Costs Are Up

Buying an auto is commonly the second largest buy an individual makes. It’s changing into much more pricey underneath Biden.

In response to the Institute for Power Analysis, auto costs are up 25 % greater than underneath Trump. Mixed with increased charges, it makes an auto mortgage much more excruciating for many People.

Excellent Nationwide Debt Is Up

Each Trump and Biden skilled vital will increase in debt. Trump gave tax cuts, and Biden had support packages.

Sitting at roughly $23 trillion when Trump left workplace, it sits at roughly $32 trillion at this time. You could not really feel like this impacts you a lot proper now, nevertheless it does instantly impression financial alternatives for People.

Meals Stamps Have Elevated Meals Costs

Meals insecurity is an actual factor. It impacts far too many People unnecessarily. Biden has rightly seemed for tactics to cut back it by rising meals stamp advantages.

Sadly, it seems as if the rise wasn’t studied sufficient to the purpose that it has had an antagonistic impact. A authorities watchdog reported in August 2023 that the rise has led to a 15 % improve in costs on the grocery retailer.

It’s definitely controversial that it has solely made the general state of affairs worse.

12 Troubling Issues Donald Trump Will Do If Re-Elected

Are you involved or intrigued over what Trump may do if re-elected in 2024? Listed below are 12 issues he’s on document of claiming he’ll do.

What Trump Will Do if Re-Elected

13 Thoughts-Bending Donald Trump Information That Will Shock You

Do you’re feeling the media doesn’t share every part about Donald Trump? Listed below are 13 issues you could not know in regards to the former President.

Information About Donald Trump That Could Shock You

12 Information About Joe Biden You Could Not Know

Do you’re feeling the media doesn’t share every part about our present President? Listed below are 12 issues you could not find out about Joe Biden.

Information About Joe Biden You Could Not Know

The Race For Trump’s Throne, 11 Challengers Attempting to Unseat Trump

Donald Trump has a iron grasp on the Republican Celebration, however he does have some challengers. Listed below are 11 individuals attempting to unseat him.

11 Challengers to Donald Trump

21 Superior Passive Earnings Concepts

Passive revenue is a wonderful solution to construct wealth. Fortunately, many concepts solely require a bit cash to start out. Pursue these choices to develop actual wealth.

Greatest Passive Earnings Concepts to Construct Actual Wealth

I’m John Schmoll, a former stockbroker, MBA-grad, revealed finance author, and founding father of Frugal Guidelines.

As a veteran of the monetary providers trade, I’ve labored as a mutual fund administrator, banker, and stockbroker and was Sequence 7 and 63-licensed, however I left all that behind in 2012 to assist individuals discover ways to handle their cash.

My purpose is that can assist you achieve the data you want to grow to be financially impartial with personally-tested monetary instruments and money-saving options.

Associated