Initially written for Livewire

I’ve to confess to a contact of schadenfreude watching the demise of Silicon Valley Financial institution (SVB) on Twitter this week. All of these Silicon Valley free-marketeers screaming on the authorities to rescue them? Caps lock completely on and all.

Silicon Valley Financial institution $SIVB experiences earnings tomorrow

Traders have rightfully been fixated on $SIVB‘s massive publicity to the confused enterprise world, with the inventory down loads.

Nevertheless, dig just a bit deeper, and you will discover a a lot larger set of issues at $SIVB… 1/10

— Raging Capital Ventures (@RagingVentures) January 18, 2023

They’re proper, although.

Ethical hazard is a significant issue within the trendy economic system. Bailouts and rescues have gotten ubiquitous. Not solely does that create a system of heads non-public traders win, tails the taxpayer loses, it derails artistic destruction. Dumb concepts have to fail. Poorly deployed capital must be redeployed to companies and managers which have the great concepts.

That’s the way you get productiveness progress within the economic system. The truth that we don’t let anybody go bust today has been a big contributor to productiveness progress declining relentlessly for the previous 20 years.

For all that, no financial institution depositor ought to ever lose their cash in a developed-world economic system. It’s absurd to assume each single small and medium sized enterprise needs to be working round analysing financial institution steadiness sheets to find out the credit score worthiness of their deposits. Should you deposit your cash in a regulated, licenced, developed-world financial institution, you’ve got each proper to count on that your cash shall be there as and whenever you want it.

Regulated and capitalised

Earlier than we get onto the options, it’s price noting that loads of traders ARE shedding cash right here. SVB was listed on the inventory trade. Its $11bn of fairness has been worn out (the market capitalisation was $43bn on the peak). Unsecured lenders to the financial institution are in for a haircut too. And the taxpayer is unlikely to lose a lot, if something. There are far worse examples of ethical hazard if you wish to discover them.

Nevertheless it was an abject regulatory failure. Take a second to learn this Tweet thread from Invoice Martin (@RagingVentures on Twitter), a hedge fund supervisor. In 10 tweets, utilizing nothing however the newest publicly accessible steadiness sheet, Martin highlighted essentially the most basic liquidity mismatch you possibly can conjure up. How can a regulated financial institution make investments nearly all its at-call deposits in belongings with a length higher than ten years? How can a regulator allow them to do this? The best, most simple liquidity guidelines ought to cease a regulated financial institution from taking such a silly danger.

Financial manipulation the foundation of many issues

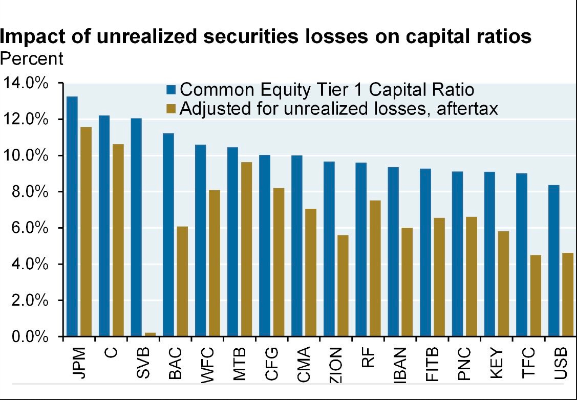

My greatest guess is that this gained’t be a widespread subject within the banking sector. Not many financial institution treasurers are that silly. For many banks, together with the bigger regionals within the US, valuing their belongings at present rates of interest won’t considerably affect their capital place. As you’ll be able to see within the chart beneath, for SVB, revaluing its steadiness sheet to market values worn out all its Tier 1 capital.

Influence of unrealized securities losses on capital ratios. Supply:JPMAM

It’s emblematic, although, of the stupidity that may occur when rates of interest are manipulated to zero. From industrial property to unlisted infrastructure belongings to Australia’s housing market, making an attempt to rescue an economic system by ultra-low charges has penalties that at the moment are changing into apparent to everybody.

Financial coverage is a really blunt, usually ineffective software with wide-ranging unintended repercussions. But it has develop into the first software relied upon in occasions of disaster, regardless of fiscal coverage (authorities spending) being a much more efficient methodology of focused stimulation.

Central Financial institution governors shouldn’t be on the homepage of the Every day Mail. The position that optimistic actual rates of interest play in environment friendly capital allocation needs to be given extra weight. And inspiring individuals to overextend themselves at artificially low charges could cause monetary crises.

The collapse of a US regional financial institution is perhaps a comparatively containable subject. It gained’t be the final catastrophe brought on by the financial insanity of the previous few years. If inflation dangers begin to recede and the economic system begins to weaken, I hope these classes aren’t forgotten.