The ecommerce business is rising yr after yr. With extra folks transferring their buying on-line and the development of easy-to-use on-line retailer constructing instruments like WooCommerce, every day new persons are realizing their dream of turning into small enterprise homeowners. Nonetheless, that additionally signifies that customers have extra choices than ever earlier than.

With ever-increasing competitors, shops need to get artistic to remain forward — every buyer and sale are extra helpful than ever.

A method that advantages each what you are promoting and your prospects is providing versatile cost choices, like month-to-month funds or purchase now, pay later. This offers a shopper credit score to forego an up entrance cost, however begin utilizing their purchases immediately. It’s principally a type of quick time period financing.

Providing this resolution to prospects is straightforward and risk-free for many WooCommerce shops who nonetheless obtain full cost for every buy of their checking account inside days and don’t need to concern themselves with pulling a buyer’s credit score rating, pursuing late charges for missed funds. Shops can concentrate on what they do greatest.

What’s purchase now, pay later?

Purchase now, pay later (BNPL) is a time period used to explain companies that allow prospects make purchases and repay the complete steadiness over a lot of installments. The shoppers obtain their buy immediately and retailers additionally gather full cost (minus a small price) up entrance.

In 2023, 50% of individuals underneath 44 used a BNPL providing.

These options make dearer purchases simpler for customers and might help on-line shops improve common order values.

Retailers promoting high-value objects are sometimes in a position to convert extra prospects by providing purchase now, pay later choices.

The purchase now, pay later supplier handles the duties of underwriting prospects, coping with any credit score bureaus, and managing and accumulating funds so retailer homeowners can concentrate on their enterprise. And, if a buyer information a fraud-related dispute, BNPL lenders tackle the danger and any related prices.

Purchase now, pay later is an enchanting, useful service that shops throughout the globe are including to their cost choices with nice success.

How WooCommerce shops can add purchase now, pay later

A quicker, extra seamless approach so as to add purchase now, pay later to your retailer is thru WooPayments — an answer that already helps retailers simplify retailer administration and increase conversions by providing a wide range of cost strategies and merging administration duties straight into the WooCommerce dashboard.

Virtually any retailer proprietor can add BNPL choices to their website with an extension, and that’s a good way to take action. Nonetheless, you’ll have to register for an account with the supplier you select, after which full activation steps when you’re permitted.

Now, main purchase now, pay later suppliers Affirm and Afterpay are built-in straight into WooPayments, so retailers can rapidly add these companies to their retailer.

Current WooPayments customers profit from a streamlined approval course of, and there’s no want to put in further extensions.

Be taught extra about purchase now, pay later options with WooPayments.

Why it is best to add purchase now, pay later choices to your on-line retailer

Simply as prospects are paying by a wide range of strategies — like digital wallets and cryptocurrency — they’re additionally in search of distinctive cost choices that assist them do extra with much less. In 2021, 2.9% of worldwide ecommerce was reportedly finished through purchase now, pay later, however that’s anticipated to nearly double to five% by 2025.

Listed here are 5 causes providing purchase now, pay later is a win-win for retailers:

1. Convert extra guests

In his e-book Virtually Alchemy, advertising legend Dan Kennedy tells the story of a consumer who was promoting an merchandise for $29.95. Kennedy suggested him to promote it in two funds of $19.95. He offered twice as many models, though the value was $10 greater.

This isn’t an remoted case; it’s been examined exhaustively in numerous industries. You’ll promote extra merchandise if prospects could make versatile funds as a substitute of paying .

You possibly can supply an installment cost choice to orders with a number of merchandise, too — it’s not restricted to higher-value objects. Say a buyer needs to purchase six merchandise for a complete of $138. Provide the choice of paying the full up entrance, or as three funds of $49. Fewer consumers can have second ideas in regards to the price ticket if there’s an possibility for month-to-month installments.

The onerous information backs up this principle, with Afterpay retailers reporting a median 22% improve in cart conversions. (Afterpay)

2. Improve your margins

Because the Kennedy instance demonstrates, folks will really spend extra money on the identical merchandise for the comfort of a cost plan. It’s a win-win. Consumers are in a position to get extra of what they want by avoiding lump-sum funds. Additionally they profit from a extra predictable month-to-month price range. In flip, you’ll be capable to shield your margins on merchandise.

Right here’s a web-based enterprise promoting a course with three cost choices: a lump sum, 4 funds of $225, or ten funds of $99.

Not solely have they gained 27% extra prospects since they started providing month-to-month funds, however 90% of their prospects who select to pay month-to-month select the ten-payment plan, though it prices $100 greater than the four-payment plan. 90% willingly pay extra in complete, simply to get a decrease month-to-month cost quantity for bigger purchases. Different estimates present that BNPL will increase conversion charges as a lot as 30% and will increase common order worth by as much as 50%.

And a latest research discovered that Afterpay retailers see a median 40% improve so as worth, plus extra repeat prospects.

3. Provide consumers extra decisions

Even when prospects select your lump-sum possibility (or select to not purchase in any respect), they’ll recognize having decisions. Providing cost choices communicates that you simply wish to make it as simple as attainable for them to make purchases. You’re making an attempt to satisfy them the place they’re.

Neil Patel studies that 56% of shoppers count on a wide range of cost choices on a checkout web page. A lot of your prospects need the power to pay in equal installments — and in instances of financial uncertainty, much more folks search for these choices.

The goodwill you’ll generate, even from non-buyers, can solely be factor for what you are promoting and may result in constructive word-of-mouth suggestions, higher critiques, and better buyer loyalty.

4. Decrease overhead and admin prices

There’s one major argument in opposition to providing financing strategies by yourself, and it’s an enormous one. Providing month-to-month plans for funds invitations a number of irritating administrative issues, and doubtlessly robs you of income if the shopper stops making funds earlier than finishing all of them.

Bank cards can expire earlier than all of the funds have been made, requiring followup. There will be a rise in product returns, which cuts into your income whereas growing your time spent on every buy. You can attempt to chase prospects for late charges which are practically inconceivable to get well.

However right here’s the nice information: it doesn’t need to be like this!

Devoted BNPL options — Afterpay and Affirm — are nice for these conditions, too. As soon as a consumer buys, you’re paid for the complete transaction inside days. The purchase now, pay later supplier companies the mortgage and takes on the danger, from chargebacks to fraud. The shopper expertise may be very easy and fast, which regularly results in repeat transactions.

6. Attain extra prospects

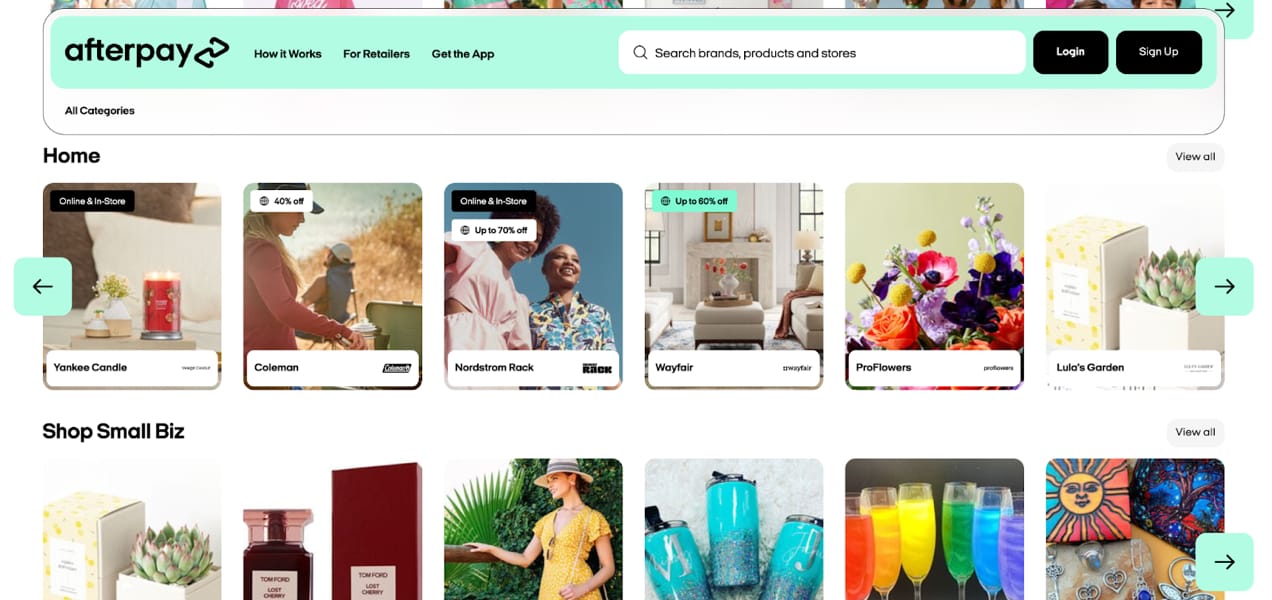

Each Affirm and Afterpay have directories the place prospects can discover trusted shops providing a BNPL plan. Every supplier has thousands and thousands of customers and practically limitless potential for sending highly-valuable site visitors to your retailer.

BNPL choices are particularly enticing to youthful prospects who could have decrease credit score scores, no bank card or the power to pay for big purchases in a single cost. Afterpay’s community contains 20 million world prospects, 72% of that are Gen Z or millennials. (Afterpay Inner Demographics, Q1, 2023)

In keeping with Afterpay, retailers discover that 30% of Afterpay consumers are new to their model. So are you in search of contemporary prospects? Add BNPL to your website.

Learn how to add BNPL to your WooCommerce retailer

If you happen to’re prepared to extend conversions and common order values whereas offering a useful useful resource to prospects, learn on to learn the way so as to add this performance to your WooCommerce retailer.

Enabling BNPL inside WooPayments

If you happen to’re already utilizing WooPayments, including purchase now, pay later to your retailer is easy: merely allow the function inside your WooPayments dashboard.

With the WooPayments BNPL integration, you’ll be able to view all orders and transactions in a single dashboard — no extra leaping between packages! And also you don’t have to pay further processing charges or set up an additional extension that would complicate website administration or cut back efficiency.

If you happen to don’t already use WooPayments, there’s by no means been a greater time to start out. Not solely will you profit from the BNPL companies mentioned right here, however you’ll be capable to:

- Maintain your whole transactions in a single place

- Provide contactless funds and sync order data and stock updates between your on-line and offline gross sales

- Settle for 135+ currencies

- Combine with instruments for subscriptions, memberships, and extra

Be taught extra about WooPayments.

Including BNPL to WooCommerce with an extension

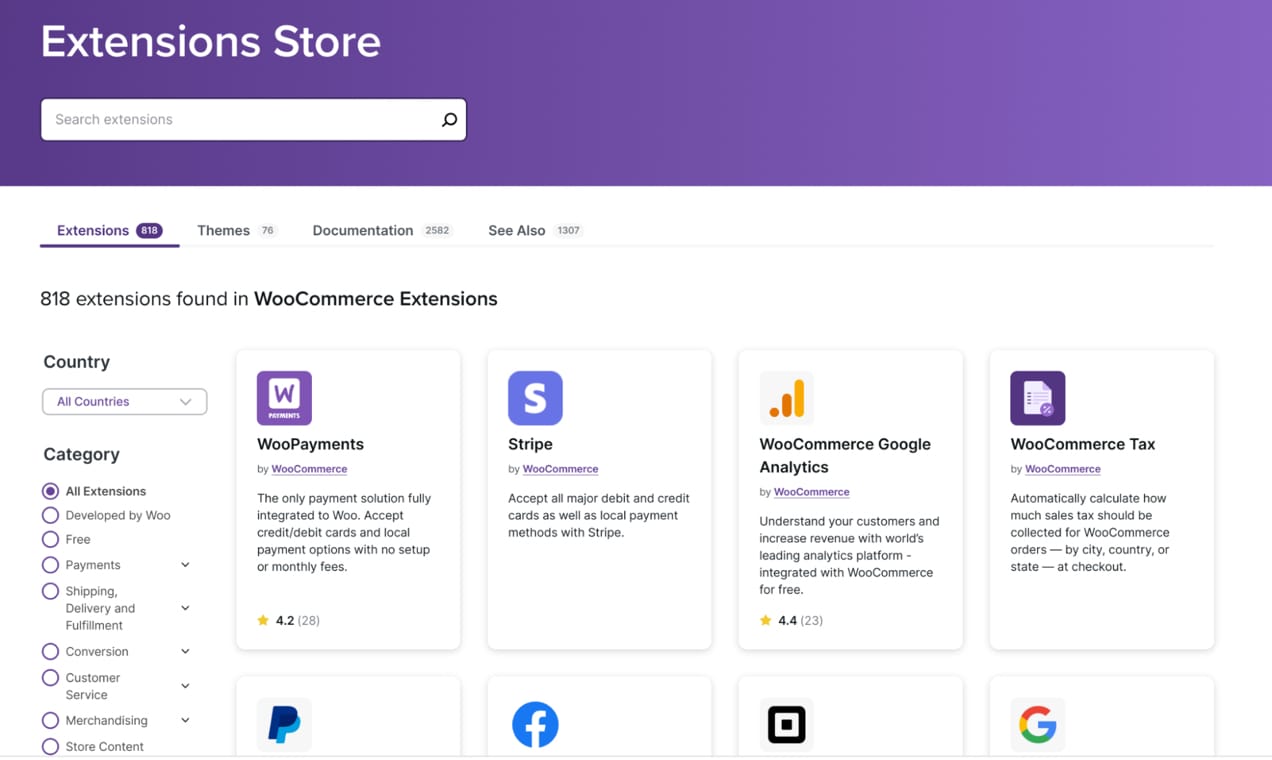

With out WooPayments, you’ll want so as to add an extension to your Woo retailer with the intention to allow purchase now, pay later performance. Go to the extension library and seek for “purchase now, pay later”. Fastidiously evaluation every possibility and select the one which’s best for you.

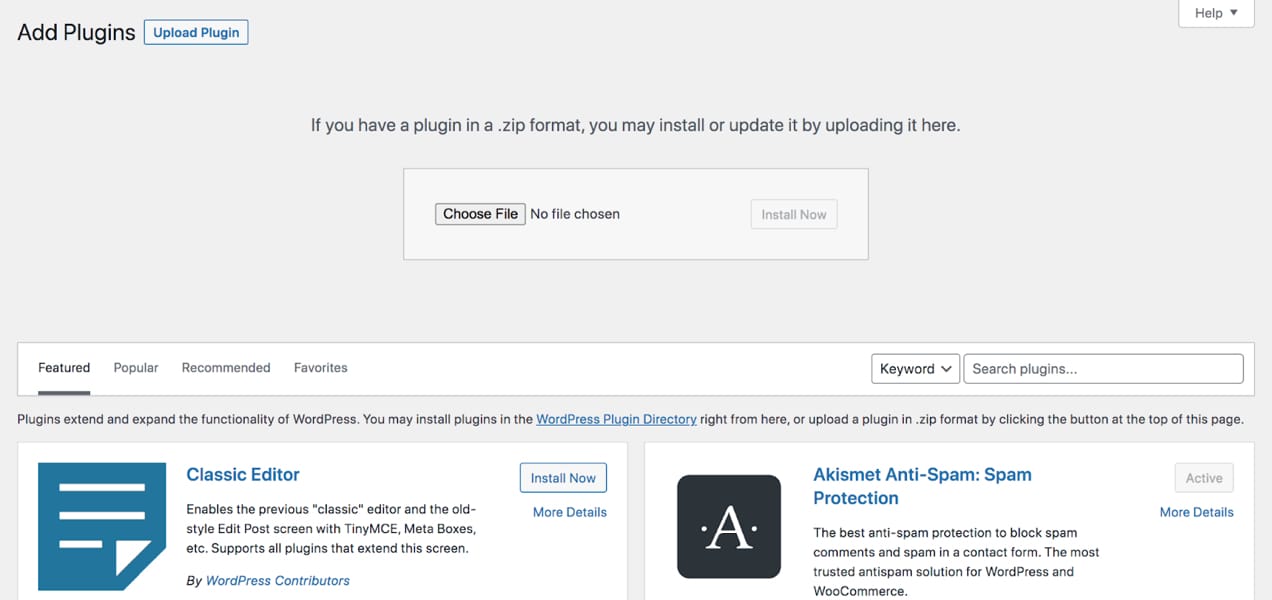

Then, go to Plugins → Add New in your WordPress dashboard, and click on the Add Plugin button on the high of the web page.

Select the file you downloaded from the extension library and click on Set up Now → Activate.

The precise setup course of will differ primarily based on the instrument you select, however every contains detailed documentation to make issues simpler. Typically, you’ll have to register for a service provider account with the supplier and await approval to obtain an API key and add the answer to your website.

Present the cost choices your prospects want

Purchase now, pay later choices bridge a niche between shops and prospects, benefiting each equally. Instruments like Affirm and Afterpay assist thousands and thousands of shoppers by offering quick entry to the issues they want whereas easing monetary pressure. Including a brand new cost technique merely provides prospects another choice to satisfy their wants. And hundreds of on-line shops have used these instruments to seek out extra prospects and improve common order values.

Are you an current WooPayments service provider? Discover ways to allow purchase now, pay later. Wish to get began with WooPayments? Obtain the extension now.

Searching for different choices? See all the accessible purchase now, pay later extensions.

Steadily requested questions (FAQs) about purchase now, pay later

Is BNPL dangerous for retailers?

Purchase now, pay later suppliers deal with buyer approval and pay retailers the complete quantity up entrance so it doesn’t affect cost stream. Additionally they assume accountability for fraud and compensation issues, issuing late charges, and so forth. So the method is risk-free for retailers and offers practically limitless upside potential.

A latest survey discovered that greater than 70% of companies utilizing BNPL report greater conversions, common order worth, and buyer acquisitions.

Do you want any particular instruments to supply purchase now pay in a while WooCommerce?

Retailers who use WooPayments have already got entry to BNPL options from Affirm and Afterpay. You possibly can activate these in your dashboard and get rolling immediately.

If you happen to don’t use WooPayments, you’ll want to put in an extension so as to add purchase now, pay later performance in your WooCommerce retailer and observe the registration and activation directions out of your chosen supplier.

Are there limits to BNPL?

Sure, the power to supply BNPL options in your website is topic to service provider approval and prospects’ means to make purchases utilizing BNPL is topic to their very own approval and limits. There are most order values for every platform, in addition to limitations primarily based on geography, foreign money, cost historical past, and extra.

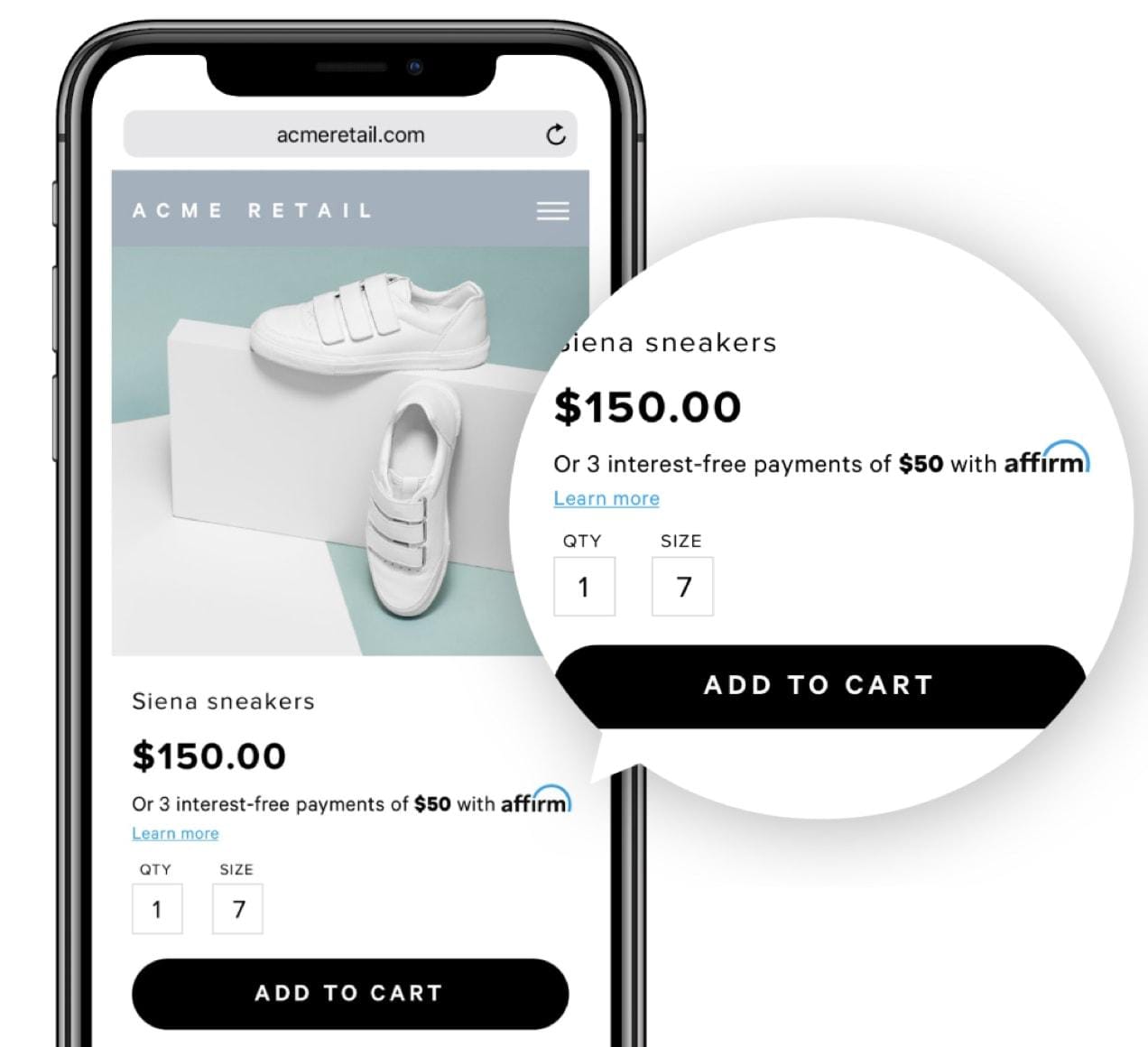

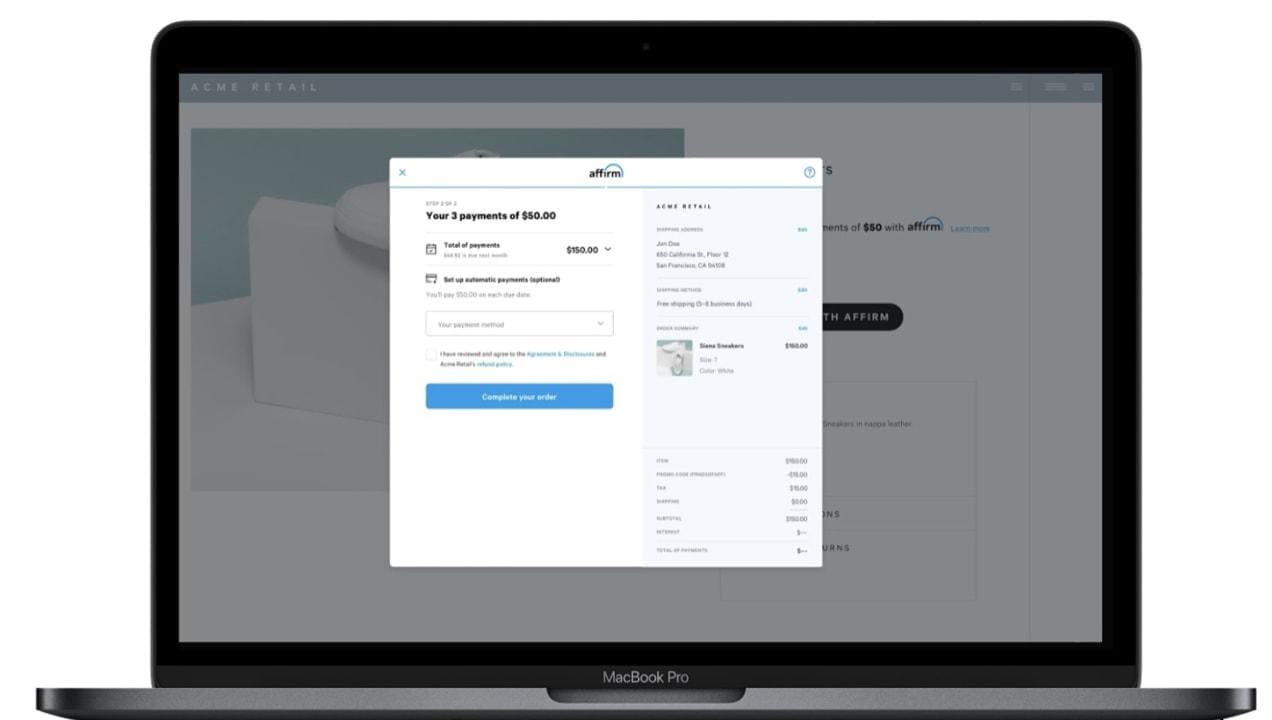

What are the main points and options of Affirm?

With Affirm, you’ll be able to permit your prospects to pay in 4 or fewer installments over an eight-week interval utilizing Pay in 4 for purchases as much as $250 (interest-free, no delicate credit score examine carried out). For orders between $150 and $30,000, funds will be remodeled a time frame, as much as 36 months with each zero curiosity and interest-bearing choices.

Affirm has a cost minimal of $50 and can be utilized on orders as much as $30K with a most mortgage quantity of $17.5K.

Affirm has 31 million addressable customers and 235,000 companies supply their instruments the world over. They’ve a 20% repeat buy fee and can be found in the USA and Canada.

What are the main points and options of Afterpay?

With Afterpay, you’ll be able to permit your prospects to pay in three or 4 installments relying on geography (no credit score examine carried out).

There’s a $2K most cost restrict in AU, NZ, the US, and CA. A £1K most cost restrict applies within the UK, and €1K most in ES, and FR.

Retailers can attain Afterpay’s 20M+ world prospects, roughly 73% of that are Gen Z or millennials. (Afterpay)

Retailers discover that 30% of Afterpay consumers are new to their model and Afterpay retailers see a median 40% improve in common order worth and extra repeat prospects. (Stripe, Afterpay)

Afterpay retailers see a median 22% improve in cart conversion. (Afterpay)