Arthur Brooks, in his interview with Peter Attia, which I extremely advocate, gives a components for happiness: enjoyment (pleasure + elevation in relationships), satisfaction (reward for a job effectively carried out), and function (that means in life).

I used to be reflecting on this and realized that it aligns completely with my private definition of happiness: relationships, stream, web optimistic. Folks write books on this topic; I’ll attempt to sum issues up in a couple of paragraphs.

Relationships: Have good, heat, significant relationships with household and buddies. This requires each addition and subtraction – allocating time to relationships that deliver that means and deallocating time from those that include empty or, even worse, adverse energy. Emphasize high quality vs. amount right here. And to be completely satisfied in relationships I’ve to be current (conscious) – not going by life daydreaming in regards to the previous or the longer term.

Move: In Soul within the Recreation I referred to as it stream. Have a inventive stream in actions that you just love and which are significant to you. These are extremely private selections; for me they’re: investing, writing, and operating IMA.

There may be a variety of subtraction on this class, too. A couple of years in the past I recognized all of the actions that fell into my lap. I wrote them down in two columns: “Love doing” and “Capable of delegate.” I saved those that I beloved doing and that have been necessary ones that I couldn’t delegate. However I delegated issues just like the scheduling of my appointments (this protects me no less than an hour per week).

One exercise that I found I don’t like doing is giving shows. I don’t have to do them, however I mindlessly agreed to do them after I was requested. They occupied an excessive amount of of my psychological actual property as I saved eager about them within the weeks earlier than I needed to give a speech. I noticed there was part of shows I truly take pleasure in: the Q&A that follows the speak. Now, when requested to talk, I reply that I don’t do conventional shows however love Q&A in a fireplace chat kind of format. To my shock, most individuals welcome it.

Internet optimistic: This can be a broad class. It applies to all my essential actions, relationships, and interactions with different folks (together with excellent strangers).

In my day job, investing, I’m making a distinction within the lives of IMA purchasers. I do know, I’m not saving folks from burning buildings, however IMA permits folks to undergo their lives and never fear about their retirement or capability to pay for his or her grandkids’ schooling. I discover that means in it. Writing permits me to assist folks on a bigger scale. I’ll be doing it even when IMA closes its doorways to new buyers (and sooner or later, it is going to). My articles are learn by a whole bunch of 1000’s of individuals. Being a web optimistic was considered one of my essential causes for writing Soul within the Recreation. There was a variety of altruism in that two-year endeavor.

What I’m about to share with you is an excerpt from a fall letter I wrote to IMA purchasers. It’s lengthy; due to this fact I’ve divided it into two sections. Immediately I’ll focus on the (sorry) state of the housing market; subsequent week I’ll focus on the financial system.

The Housing Market is Worse Than You Assume

On this letter I’d prefer to discover the impression rates of interest could have on the financial system and particularly the housing market.

At the moment, the 30-year mortgage price is pushing 7.6%, up from lower than 3% a 12 months in the past, whereas the median home worth within the US is up 37% from $320k in 2019 to $440k as we speak. You can’t have each rates of interest and housing costs making new highs. One thing’s acquired to provide.

Let’s begin with new residence patrons, as they’ll be impacted essentially the most.

If you’re a first-time residence purchaser, you don’t have residence fairness to roll into a brand new buy. When you purchased a home in 2019 for $320k (assuming you place down 20% of the acquisition worth as down cost), your annual mortgage cost at 4% would have been $15k.

Two years later, in 2021, you’ll have paid $420k for a similar 4 partitions and white picket fence (canines, partner and a pair of.5 children bought individually). Nonetheless, regardless of a 37% home worth improve, due to Uncle Fed, you’ll have been capable of finance this buy at 3%, and your annual mortgage cost would have gone as much as $17k – a manageable $2k annual improve.

As I’ve talked about, as we speak the median home worth is at $440,000, however the rate of interest has skyrocketed to 7.6%. Thus, if you’re a first-time residence purchaser, the identical American dream would price you $30k a 12 months – that may be a $13k improve from only a 12 months in the past.

Let me put this in correct context – median annual family earnings within the US is about $75k, or about $60k after taxes. In different phrases, half your after-tax earnings is now going to servicing your mortgage for those who purchased as we speak at peak residence costs and charges.

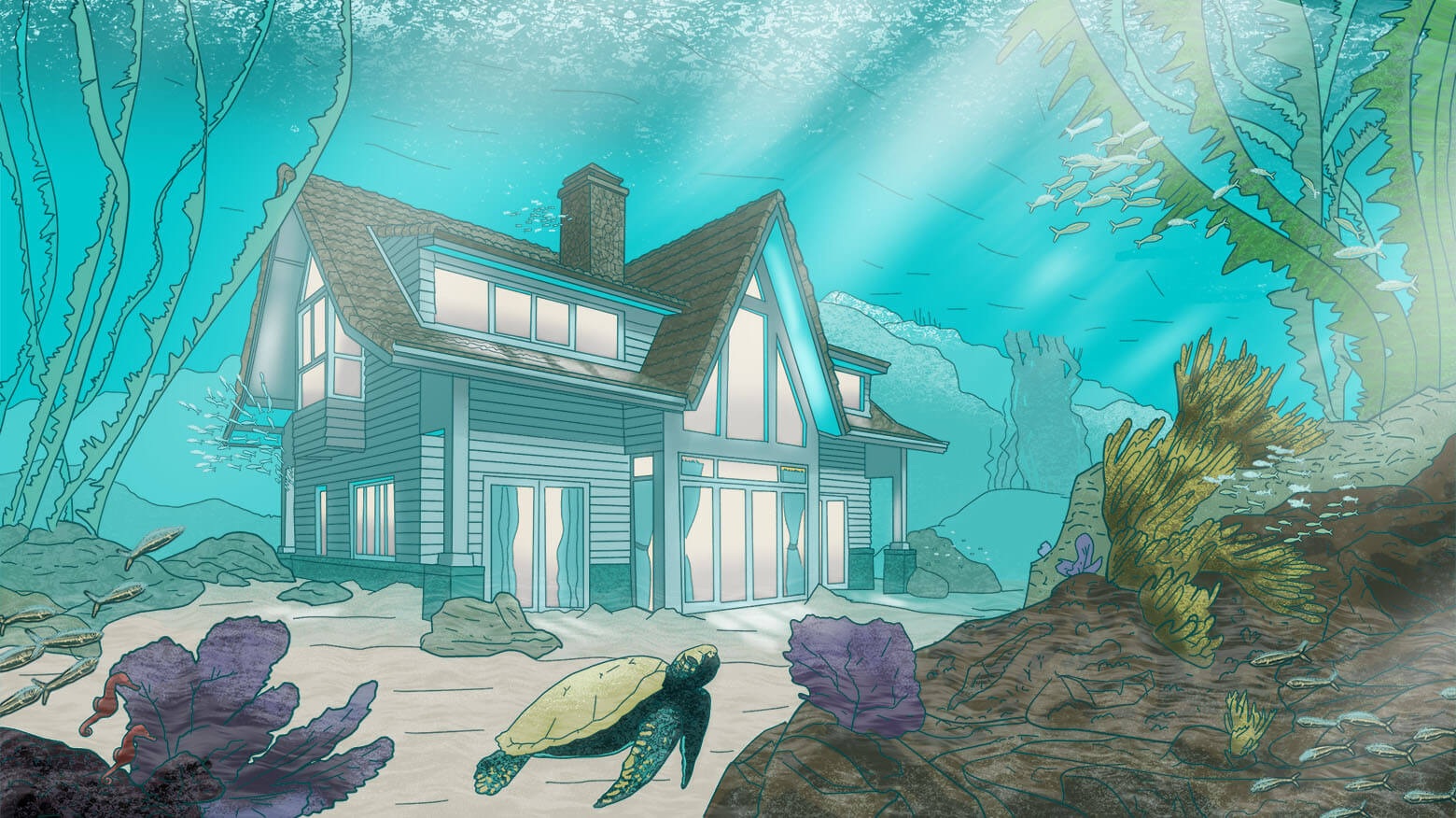

It’s straightforward to see how the mix of excessive costs and rising rates of interest have turned the American dream of proudly owning a house right into a nightmare. For affordability to return again to 2020 at present rates of interest, housing costs have to say no greater than 40% to $250k. If this have been to occur, anybody who purchased a home since 2012 could be underwater on their preliminary buy.

It’s onerous to examine this fast worth decline taking place in a single day. Identical to inventory costs, housing costs are set by provide and demand. However homes aren’t like shares. Folks dwell of their homes, increase their children there, create recollections, and thus get emotionally hooked up to them. Additionally, many a long time of declining rates of interest and rising housing costs have satisfied the general public that rising housing costs have to be assured by the US Structure in tandem with the best to the pursuit of happiness.

Once we determine to promote our home and we obtain presents which are beneath the best worth we noticed on Zillow only a few months earlier, we look ahead to the best, greater provide to return in. That is why the truth that we dwell in our homes is necessary – we’re emotionally hooked up to them and wish one of the best provide attainable. That is additionally why housing costs are fast to maneuver up and gradual to return down. It takes a number of painful conversations with a realtor to persuade us to begin reducing the asking worth.

That is the place issues get much more difficult. There are two kinds of sellers: individuals who should promote their homes (shifting to a brand new metropolis, misplaced a job, acquired divorced) and people who would like to promote their homes (uninterested in their previous 4 partitions, want an even bigger or smaller home, would love their children to go to raised colleges and so on.). I’m generalizing right here.

Our home is price what another person is keen and in a position to pay for it.

Let’s distinction two transactions:

You’re at a grocery retailer – you need to purchase tomatoes, however the worth of tomatoes has doubled. Your bank card firm isn’t going to say, “Jane, you can’t purchase tomatoes. They’re too costly. You can’t afford them.” Until you might be maxing out your credit score restrict, your bank card firm doesn’t care the way you spend your (borrowed) cash.

This isn’t what occurs while you take out a mortgage on your own home. After being blamed for the final housing disaster, bankers turned born-again bankers: they discovered underwriting faith. If a mean shopper walks right into a financial institution asking for a mortgage, this born-again banker will have a look at the price of the home in relation to the client’s earnings and can politely inform the client to search for a less expensive home or begin driving Uber on weekends.

Up to now, a lateral change from one home to a different didn’t actually price you a lot, apart from transaction prices. Nonetheless, for those who refinanced your own home at 3% when charges dropped, as many individuals did, as we speak this lateral transfer would price you dearly.

How a lot?

The median mortgage on a home as we speak is about $220k, and the median residence fairness mortgage is $40k. My purpose right here is to be vaguely proper fairly than complicatedly exact, so I assume that a mean home-owner owes a complete of $260k for his or her home. If the home was refinanced at 3–4% rates of interest in 2021 and 2022, then that common home-owner is paying about $13–15k a 12 months for his or her home.

Sadly, the mortgage is hooked up to a home. Promoting a home cancels an present mortgage, and a brand new home requires a brand new mortgage at market charges, which as we speak are 7.6%. Thus, this new mortgage would price $22k a 12 months, or a $7–9k improve. Simply promoting your own home and shifting to a equally priced home a couple of blocks away would price about 10% of your annual earnings! This explains why the variety of transactions within the housing market has hit a multi-decade low.

(When my brother Alex, a realtor, requested me if my housing market evaluation got here with any excellent news, I instructed him, sure, your loved ones loves you.)

When costs go up, individuals who need and should promote a home are promoting with ease. As costs decline, at first solely individuals who should promote are promoting. Nonetheless, as time goes by, promoting turns into much less and fewer discretionary as a want to promote turns into a necessity.

Individuals who should promote their homes must settle for decrease costs. How a lot decrease? That’s impacted not simply by a vendor’s willingness to just accept a lower cost (provide) but in addition by a potential purchaser’s capability to borrow (demand).

I hear this argument at occasions: “Within the Eighties rates of interest have been greater than they’re as we speak, and we had a functioning housing market.” There’s a substantial distinction between then and now. Immediately the median home worth in relation to median earnings is on the highest degree in fashionable US historical past, even greater than it was on the top of the housing bubble in 2007. It’s nearly double the extent of the early Eighties.

Aspect word: The scenario I described above isn’t distinctive to the US. Actually, different international locations, together with Australia, Canada, and the UK, are experiencing a lot larger housing bubbles.

Immediately, shoppers’ discretionary earnings is being attacked by inflation from totally different instructions: The price of every thing is up, from trash assortment to meals. Gasoline costs have declined, seemingly on account of our tapping into our strategic oil reserve and the slowdown within the financial system. Meals costs are much less prone to decline, although I could possibly be fallacious, since they’re pushed by at the moment elevated costs of fertilizers (I wrote about that right here.)

But it surely doesn’t cease there. Increased rates of interest make something that must be financed dearer – automobiles, fridges, iPhones, big-screen TVs, and so on. Over the past decade we acquired spoiled by zero-percent financing. Until rates of interest return down, these days are over.

You will need to point out that wage will increase so far have lagged inflation by a big margin. The federal authorities has thrown a bone to retirees by promising to lift Social Safety funds in 2023.

Spending is each a monetary and a psychological choice. When you really feel rich and assured in your future, you might be keen to spend your financial savings and borrow (in opposition to future earnings) to purchase stuff. The inventory market decline and declining housing costs, together with rising unemployment, will undermine shopper confidence and willingness to spend. Additionally, falling housing costs will begin to undermine the housing ATM (residence fairness), and rising rates of interest will make borrowing in opposition to the home dearer and scale back fairness folks have of their homes – thus fewer owners will undertake residence enchancment tasks or faucet out residence fairness to subsidize their day-to-day dwelling bills.

Keep tuned for Half 2: Recession is Coming