Many readers let me know that they need options for FAST cash. And yes, you can use sites like InstaGC and Paid Viewpoint to do surveys and short tasks and get paid the same day you have enough to cash out. I highly recommend them!

However, sometimes it can take a bit to reach cash out on sites like that and you maybe need a little bit extra today.

If that’s you, MoneyLion might be of interest. I recently downloaded the app and requested some fast cash. It worked! Below, I have some information on how you can use it yourself.

MoneyLion App Review

What is MoneyLion?

MoneyLion, first off, is more than just an app to borrow small amounts of cash. You can use the app for automated investing, credit building tools, financial advice, and a lot more.

That said, the ability to get interest-free cash when you need it makes it desirable for those of us who live paycheck to paycheck and sometimes run short before the end of the week.

This review is going to focus on how you use the app to get cash quickly.

First – Create Your MoneyLion Account

You will have to download the MoneyLion app and create an account. This is not hard to do.

Linking your bank account to MoneyLion IS necessary. This is completely secure, and it’s needed so they can determine if you qualify for their InstaCash.

Note MoneyLion does not check your credit score. They have an automated system that looks at your bank balance to determine its age and ensure the account is receiving direct deposits on a regular basis.

Your account needs to be at least two months old with a history of recurring deposits to qualify for Instacash.

Second – Select the Amount You Want to Borrow

Once your bank account has been connected and verified, MoneyLion will show you an available amount of Instacash you can withdraw. This amount may range anywhere from $10 to $500.

As a new user, your available amount may be on the lower end to start with. After you’ve done this a few times and successfully repaid what you borrowed, you can see that amount increase.

You don’t have to borrow the max limit. You can choose a lesser amount.

Before you confirm the amount, MoneyLion will ask if you want to tip them a few dollars. This helps to pay them back for their service. You don’t have to do this, but they will prompt you each time.

Third – Get Your Money

You can get your money sent to your bank account instantly! But, there is fast-funding fee for that privilege. If you don’t want to pay the fee and you can wait a few days on your money, you can do a normal transfer.

Fourth – Pay the Loan Back

Your repayment will be due within about 2 weeks after you get the funds.

MoneyLion’s automated system will check your bank balance to ensure the funds are there before they attempt to withdraw the repayment from your account.

If the money isn’t there, they won’t try to take the amount because they don’t want to cause you overdraft fees. But they WILL keep trying each day until the money is there.

Going too long without getting your borrowed amount paid back means that you may lose your Instacash privileges for good.

My Experience

I tried this following the steps I outlined for you above, and it worked for me. I’ve had no negative consequences as a result of borrowing some money from MoneyLion.

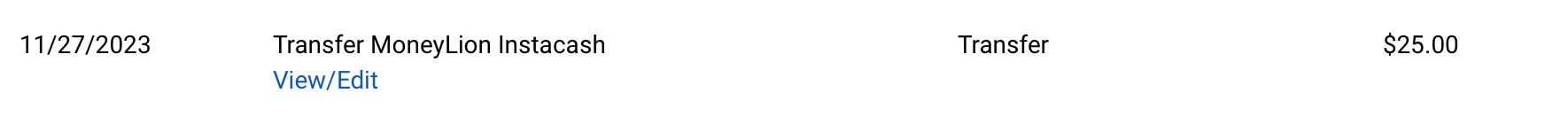

See below for proof of my payment:

Get Started

If you would like to go ahead and see if you qualify for some Instacash, you can use this link to register (my referral ink). Again, there is no credit check to do this.

Good luck!

Anna Thurman is a work at home blogger and mom of two. She has been researching and reviewing remote jobs for over 13 years. Her findings are published weekly here at Real Ways to Earn.