Kronos Bio (KRON) ($45MM market cap) was historically focused on cancer and autoimmune disease treatments, late last year, the company discontinued development of their lead asset, istisociclib, due to safety issues and announced a plan to explore strategic alternatives. At the time, I was nervous about their large operating lease obligation and ended up passing on adding it to my busted biotech basket as there was no shortage of cleaner opportunities at the time.

On May 1st, Kevin Tang’s liquidation vehicle, Concentra Biosciences, entered into an agreement to buy KRON for $0.57/share in cash plus a CVR, the CVR is structured differently than many of Tang’s recent deals where the CVR is mostly just IP dispositions, here the CVR is composed of a series of potential payouts:

(i) 50% of the net proceeds in the case of a disposition of the Company’s product candidates known as KB-9558 and KB-7898 that occurs within 2 years following closing; (ii) 100% of the net proceeds in the case of a disposition of the Company’s product candidates known as KB-0742, lanraplenib and entospletinib that occurs prior to closing; (iii) 100% of cost savings realized prior to closing; (iv) 80% of cost savings realized between the merger closing date and the second (2nd) anniversary of the merger closing date; and (v) 50% of cost savings realized between the second (2nd) anniversary of the merger closing date and the third (3rd) anniversary of the merger closing date, each pursuant to the contingent value rights agreement (the “CVR Agreement”).

Payouts (i) and (ii) are hard to predict and likely of minimal value, the legacy IP assets in (ii) need to be sold (but not closed) prior to the merger closing and (i) is their pre-clinical assets, who knows how much these are worth but the two year clock is pretty gameable, any value there likely accrues to Tang.

Payouts (iv) and (v) relate primarily to cost savings, subleasing or an early exit to their operating lease for a 40+k sq ft facility located in Cambridge, MA. The lease ends in February 2031 and it has approximately $30MM remaining, given the long time frame, Tang could potential game this one by back weighting any lease amendment/termination to give him the best payout and avoid paying CVR holders.

Payout (iii) is where the potential cash is for CVR holders, it will be paid no later than 60 days following the merger closing, the savings calculation is as follows:

“Additional Closing Net Cash Proceeds” means 100% of the amount by which the Closing Net Cash as finally determined pursuant to Section 2.01(d) of the Merger Agreement exceeds $40,000,000, adjusted for any claims that arise prior to 30 days following the Merger Closing Date that are not accounted for in such Closing Net Cash.

“Closing Net Cash” means, without duplication, (i) the Company’s cash and cash equivalents, restricted cash, and investments as of the Cash Determination Time, determined in accordance with GAAP, applied on a basis consistent with the Company’s application thereof in the Company’s consolidated financial statements, minus (ii) Indebtedness of the Company as of the Cash Determination Time, minus (iii) the Transaction Expenses, minus (iv) the Estimated Costs Post-Merger Closing, minus (v) $400,000 for the CVR Expense Cap under the CVR Agreement.

The curious part of this transaction is the $40MM threshold, why is it so low when the NCAV as of 3/31/25 is $73.5MM? CVRs are intended to bridge the gap between buyers and sellers on how much an asset is worth, here the asset is primarily cash which should have minimal uncertainty given the quick merger close (a tender offer is required to be launched by 5/15/25). What would Tang be protecting himself against with such a low closing cash number? Istisociclib did have safety issues, but no legal proceedings have been disclosed that meet a reporting threshold.

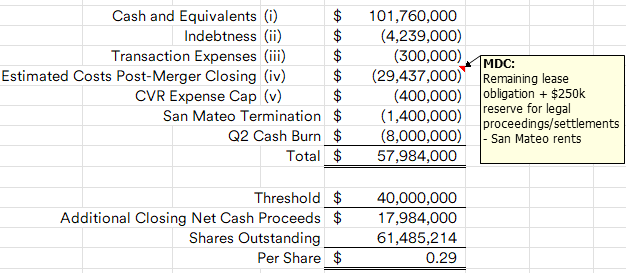

Below is my attempt at a back of the envelope calculation of the Additional Closing Net Cash Proceeds value, shares trade for $0.72/share today, implying a $0.15/CVR value:

The “Estimated Costs Post-Merger Closing” is where some potential games could be played:

“Estimated Costs Post-Merger Closing” means all costs that the Surviving Corporation would incur post-Merger Closing, including costs associated with: (i) CMC Activities; (ii) clinical activities; (iii) remaining lease-related obligations (including rent, common area maintenance, property taxes and insurance); and (iv) an aggregate of $250,000 for any legal Proceedings and settlements.

While the development pipeline is paused, potentially an argument could be made that spending some money to advance KB-9558 and KB-7898 could be worthwhile to CVR holders as they’d get paid 50% of any disposition proceeds? I don’t see it, but doesn’t mean management might not have an agreement with Tang to include some spend in that bucket. In the latest 10-Q, all their R&D costs sounded like legacy expenses, not ongoing expenses:

Research and development expenses were $2.1 million for the three months ended March 31, 2025, compared to $14.2 million for the three months ended March 31, 2024. The decrease of $12.1 million was primarily attributable to a $6.0 million reduction in consulting and other outside research expenses, a $4.2 million decrease in personnel-related costs and a $1.9 million decrease in facilities, depreciation and other costs. These decreases were primarily related to the discontinuation of the istisociclib clinical trial in November 2024, reduced headcount in our research and development organization following the restructuring activities and reclassification of lease costs to general and administrative expenses. Research and development expenses for the three months ended March 31, 2025 were related to performance obligations under the Transition Agreement and continued wind down of research and development activities.

I sort of expect to be screwed here, just not quite sure how, but the opportunity for a quick buck is too tempting, I added a small position.

Disclosure: I own shares of KRON