Retirement remains a far-off — and in some cases, unattainable — goal for many Americans.

About one in four adults over age 50 said they expect to never retire, according to an AARP survey. That’s perhaps not surprising given that Americans believe they’ll need $1.26 million to retire comfortably, per Northwestern Mutual.

In a new report from Bank of America, 68% of employees said that saving for retirement is their No. 1 financial goal, though working toward it often comes with significant challenges.

The research, which surveyed nearly 1,000 full-time employees who participate in 401(k) plans and 800 employers who offer a 401(k) plan, revealed that the average employee doesn’t start saving for retirement until age 30 and wishes they had more retirement education (33%).

Employees’ top expected sources of retirement income were as follows, per the survey: 401(k) or 403(b) (85%), Social Security (75%), checking or savings account 53%), IRA (38%), taxable brokerage or investment account (24%).

Related: How Much Money Do You Need to Retire Comfortably in Your State? Here’s the Breakdown.

Baby Boomers are retiring at a rapid rate, setting a record number of retirees in 2024 that allowed Gen X to outnumber them in the workforce for the first time, GOBankingRates reported.

On average, Boomers began saving for retirement at age 34; now in their 60s and 70s, one in four of them don’t feel on track to retire, according to the Bank of America survey. Additionally, only two in 10 Boomers said they completely understand their Social Security benefits.

Rising healthcare costs in retirement present another hurdle, as only 34% of employees said they’re saving and investing for future healthcare expenses, despite current research showing that a 65-year-old couple could need as much as $428,000 in savings to cover their retirement healthcare expenses.

Related: How to Start Thinking About Retirement Before You Plan to Retire

Respondents said the main reason they don’t save for health care is that they can’t afford it, but many who have access to an HSA through their employer also don’t understand the tax advantages and rollover process.

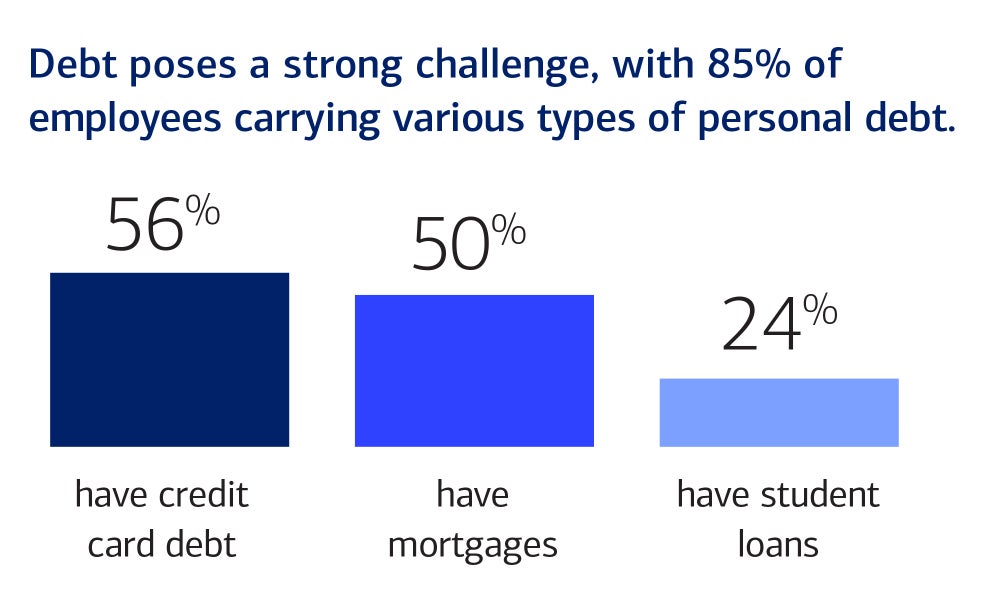

When employees across generations were asked to reflect on what they would have done differently to prepare for retirement, they cited three common mistakes: not starting to save at a younger age (49%), not taking full advantage of their employer’s 401(k) match (35%) and not paying off debt sooner (36%).

Image Credit: Courtesy of Bank of America

“The modern employee wants help with their broader financial goals,” Lorna Sabbia, head of workplace benefits at Bank of America, said. “Employers should consider additional resources to support their workforce in ways that bolster their long-term goals while also helping them tackle short-term challenges.”