Rising dwelling prices, mounting inflation, and sudden bills can depart you quick on money on the finish of the month. Money advance apps can spot your cash earlier than your subsequent paycheck arrives.

Not like different forms of loans, money advances don’t have curiosity or charges, and so they don’t require a credit score test. That makes them an excellent various to costly predatory payday loans. Many additionally provide different useful options.

There are some limitations that the majority money advance apps share.

- You’ll have to join earlier than you want an advance. Money advances are solely accessible to members. Many apps cost a month-to-month price.

- It’s essential to hyperlink the app to a checking account the place you obtain your wage.

- Most money advance apps use a third-party service known as Plaid to connect with your checking account. In case your financial institution or credit score union will not be Plaid-compatible, discovering a money advance app you should use could also be tough.

- Money advance apps can get you into the behavior of spending cash earlier than you’ve earned it.

Inside these limitations, money advance apps can present a helpful service.

Listed below are the top-five finest money advance apps with annual proportion charges (APR) and truthful compensation phrases.

Finest Money Advance Apps

- EarnIn – 🏆 Besto for big advances

- Empower – 🏆 Finest for self employed debtors

- Dave – 🏆 Finest for overdraft safety

- Albert – 🏆 Finest for low-cost banking

- Cleo – 🏆 Finest for budgeting

1. BEST FOR LARGE ADVANCES

EarnIn

EarnIn gives $100 per day or $750 per pay interval (i.e., month) in money advances in opposition to the cash you’ve got already earned. There’s a price for immediate funds switch, and the app will ask for a voluntary tip for every advance.

- Stand up to $750 in payroll advance.

- No credit score test is required.

- Quick in-app onboarding.

- Similar-day switch to your checking account.

2. BEST FOR SELF EMPLOYED BORROWERS

Empower

Empower gives quick access to money from its modern app. To create an account, you could present solely two paperwork: a sound ID and present proof of deal with. When you’ve linked a checking account, you’ll be able to immediately confirm your availability for an advance with out offering different employment data.

- As much as $250 in immediate money advance.

- No employment verifications are required.

- Free debit card with cashback.

- Additional in-app budgeting instruments.

3. BEST FOR OVERDRAFT PROTECTION

Dave

Dave protects you in opposition to pricey account overdraft charges by monitoring your spending and alerting you everytime you’re about to hit a detrimental steadiness (due to upcoming payments). That will help you out, Dave spots you money till the following paycheck arrives.

- As much as $500 in immediate money advance.

- Automated budgeting options.

- Payback in installments is offered.

- No late or minimal steadiness charges.

4. BEST FOR LOW-COST BANKING

Albert

Albert meshes important banking providers with payday advances. You get a free debit card, an FDIC-insured financial savings account, and an inexpensive investing app with an AI monetary administration assistant (for a separate membership price).

- Stand up to $250 in immediate money.

- Get your full paycheck as much as 2 days early.

- As much as 0.10% annual bonuses on all financial savings.

- Micro-investments in shares from $1.

5. BEST FOR BUDGETING

Cleo

Cleo is a personality-packed monetary app combining money borrowing with different money-management options resembling a credit score constructing product and AI-driven budgeting instruments. With Cleo, you’ll be able to spot cash and discover ways to handle your money circulate higher.

- As much as $100 immediately, no-fee advance.

- Two-minute sign-up course of.

- No proof of employment is required.

- Free ACH transfers to a linked checking account.

EarnIn

EarnIn is a single-purpose money advance app. It lends you cash in opposition to your future paycheck for gratis. EarnIn doesn’t require a credit score test.

The app is primarily designed for full-time salaried workers. To qualify for an advance, you have to be of authorized age, legally reside within the US, and supply employment info. Additionally, you could hyperlink a checking account (financial savings or pay as you go accounts are usually not accepted).

To qualify, your wage have to be direct-deposited into your checking account. EarnIn will confirm this to make sure your eligibility.

As a part of onboarding, you’ll should show your wage by importing employer-issued timesheets, including a sound, employer-provided work electronic mail, or including a whole work deal with and maintaining your GPS on for the app to confirm your work hours (aka the time you spend on the designated deal with).

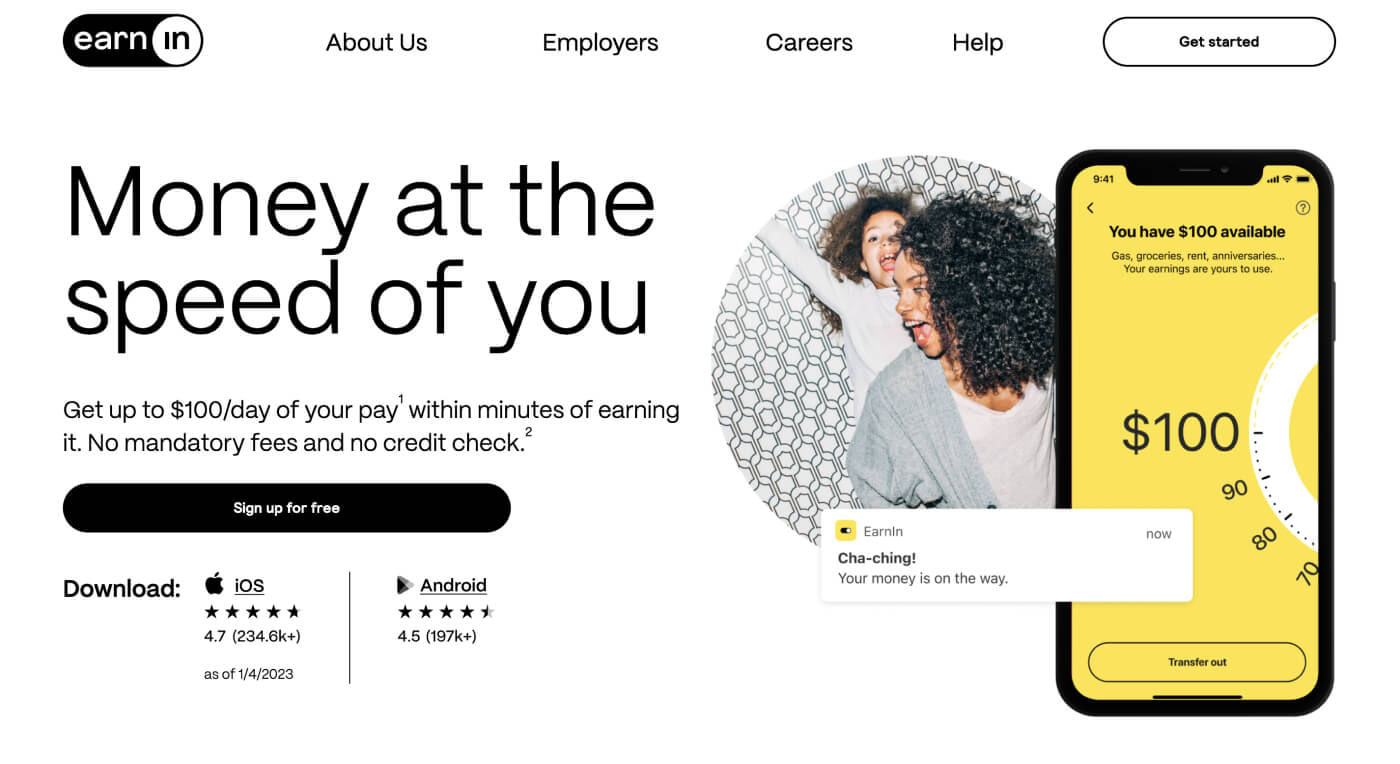

EarnIn then takes 2-3 enterprise days to confirm the supplied info. As soon as verified, you’ll get immediate entry to your free money advance. You’ll be able to add a customized tip quantity (non-compulsory) to help the corporate.

Supply: EarnIn.

You’ll be able to withdraw money to a linked debit card or a checking account. ACH withdrawals are free however take 1-3 days to course of. For immediate fund switch, you’ll be able to pay an additional $0.99-$3.99.

When your subsequent paycheck is deposited to your linked checking account, EarnIn will debit your money advance, immediate processing price, and tip quantity (if any).

➕ Professionals

- The best paycheck advance of any money advance app

- No month-to-month charges for utilizing the service

- Low categorical price for same-day payouts

- Limitless money withdrawals on EarnIn card

- No credit score test

- Prime-notch account safety and private knowledge safety

➖ Cons

- Your wage have to be direct deposited to your linked checking account

- Obligatory timesheet/worksheet submission

- Self-employed folks don’t qualify

- Ideas can add as much as a considerable quantity

Empower

Empower positions its money advance app as a substitute for conventional private loans (which require good credit score) and predatory payday loans. The corporate has issued over $500 million in advances.

With Empower Money Advance, you’ll be able to stand up to $250 with no curiosity, no late charges, and no credit score checks. Not like EarnIn, Empower expenses an $8/month subscription price to borrow cash and entry banking options.

For that value, you additionally get a no-fee debit card, providing as much as 10% cashback. If certified, you’ll be able to entry your paycheck two days earlier or obtain a free immediate advance payout. In any other case, same-day advance supply to a linked checking account prices $1-$8.

To open an Empower account, you could present a sound ID doc and proof of deal with no older than 60 days. It may be a pay stub, a utility invoice, an official financial institution assertion, or a lease settlement. When you’d wish to open an Empower checking account and get a debit card, you could present your Social Safety quantity. Then you definately’ll want to attach a checking account the place you obtain common direct deposits.

Empower doesn’t confirm your employment historical past like different standard money advance apps. When you’re self-employed or do gig work, you’re nonetheless certified to get a money advance.

As soon as your account is activated, go to the Money Advance part in your Accounts tab and click on “Examine eligibility” to test should you qualify for an advance. The app will robotically let you know how a lot cash you’ll be able to borrow. The outcomes are immediate. To extend your advance restrict, repay the sum in your subsequent payday and carry a optimistic steadiness within the related checking account.

The app will solely advance the quantity you’re authorized for. You’ll be able to’t borrow much less.

To extend your advance restrict, repay the sum in your subsequent payday and keep a optimistic steadiness within the related checking account.

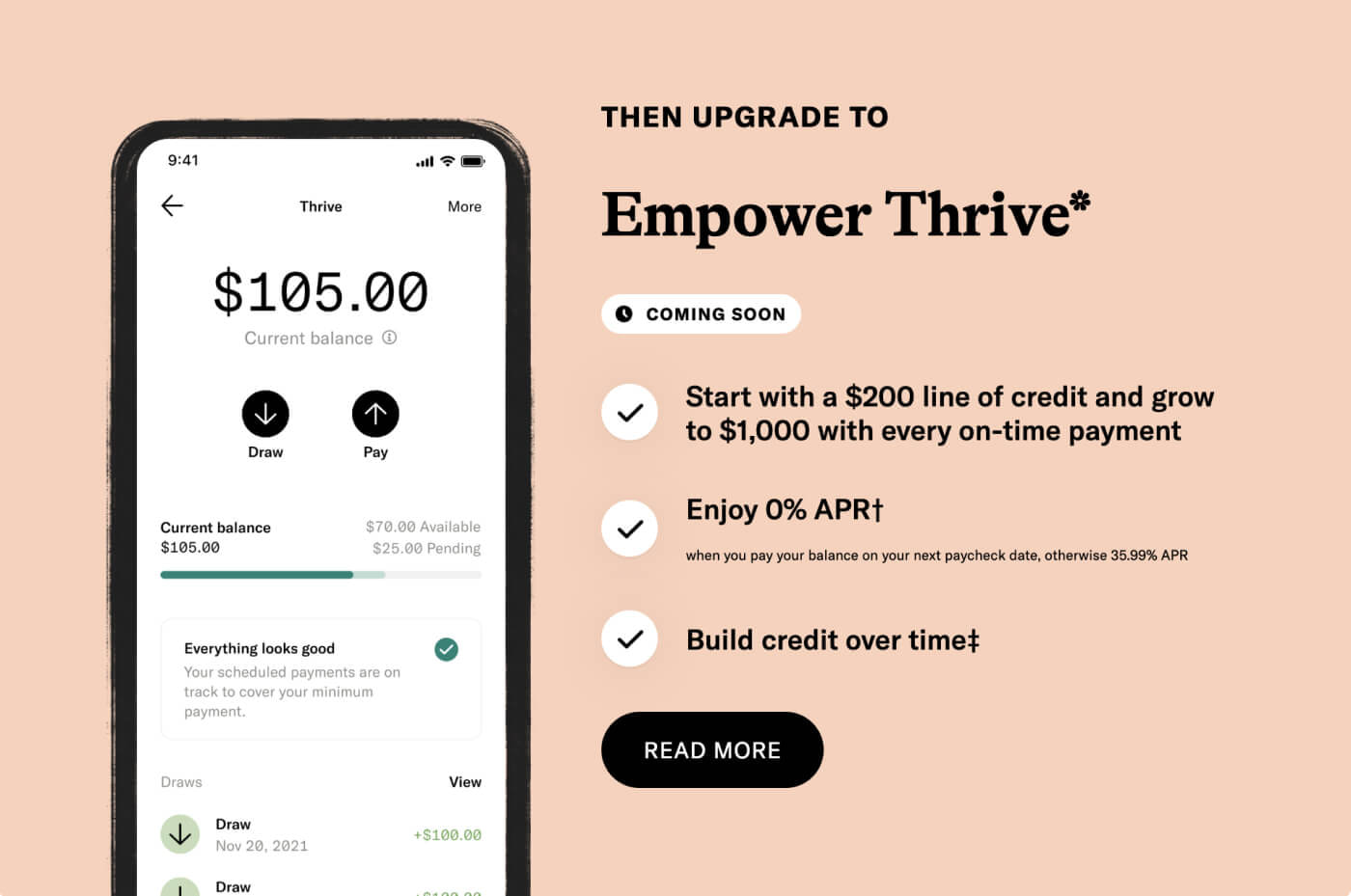

Empower additionally has a brand new lending product known as Empower Thrive, a line of credit score that’s reported to the credit score bureaus and can assist you construct credit score.

Promising a better credit score line (as much as $1,000), Empower Thrive could be a extra inexpensive various to high-interest private loans. However it comes with extra strings hooked up, together with a 35.99% APR should you miss a fee. Additionally, you’d be topic to a credit score test.

➕ Professionals

- Easy account registration course of

- No employment info required

- Instantaneous lending choices

- Free debit card with cashback gives

- Entry to AI-driven saving ideas

- Month-to-month earnings and bills report

➖ Cons

- Expenses a month-to-month membership price

- Doesn’t can help you select a decrease money advance quantity

- Excessive APR charge for a credit score constructing product

Dave

With Dave, you’ll be able to obtain as much as $500 directly, which is greater than most money advance apps provide. You may get entry to your paycheck as much as two days early should you’re a salaried worker. The common authorized advance new customers get is $120.

You’ll be able to switch the cash to an exterior account at no cost. Switch time takes 1-3 enterprise days. You may also switch your cash immediately to a Dave fee account at no cost or get an immediate payout to a related debit card or checking account for a price ($2.99-$13.99).

Whereas Dave doesn’t do any credit score checks, it analyzes your transaction historical past in related financial institution accounts to find out earnings and spending habits. To get a better payout, it’s best to display good monetary administration.

Your checking account also needs to have a minimum of three month-to-month recurring deposits totaling $1,000+. Dave will test for any current detrimental balances in your account within the final 60 days. You don’t have to offer proof of employment to entry a money advance.

Dave additionally gives extra flexibility in mortgage settlement than different money advance apps. By default, your compensation date is about to the following payday. In case your account steadiness continues to be low, Dave will acquire partial settlements till the complete sum is paid. No late charges or rates of interest apply.

To make use of Dave’s money advance function, you’ll should pay a $1 month-to-month membership price, one of many lowest charges of any fee-bearing money advance app. You’ll additionally get entry to budgeting instruments, at-risk of overdraft price notifications, and survey-taking aspect gigs.

➕ Professionals

- Versatile settlement date, no late charges

- Keep away from overdraft charges with well timed notifications

- Progressively growing money advance restrict

- FDIC-insured spending account by a accomplice financial institution

- Free debit playing cards with as much as 15% cashback

- No money withdrawal charges in 37,000 ATMs

➖ Cons

- Excessive immediate switch charges to an exterior checking account

- Brief compensation phrases (7 days) with out extension

- Sluggish buyer help, based on person evaluations

Albert

Albert will not be a financial institution, but it surely gives a lot of the options conventional monetary establishments do, and for a decrease value. Albert has a number of merchandise rolled into one. You’ll be able to obtain a direct deposit and spend the funds utilizing a free debit card. Individually, you’ll be able to (and may) hyperlink up different financial institution accounts to profit from Albert’s money-saving options. The app will allow you to monitor upcoming payments and counsel actionable methods to decrease them (both by negotiating or switching to a different supplier).

You may also open a free financial savings account powered by a wise saving algorithm. It screens your spending and earnings to foretell your month-to-month account steadiness fluctuations. Then it robotically transfers small financial savings quantities to your wet day fund. Customers get a 0.10% bonus (or 10 cents for each $100) of their financial savings account over a 12 months.

Albert Instantaneous is the money advance function accessible to all Albert customers (free or premium). A premium Genius tier prices $8/month minimal. It’s essential to activate a 30-day free trial to use for a money advance. You’ll be able to cancel your subscription with out dropping entry to advances (however another banking and funding options received’t be accessible).

Albert gives money advances of as much as $250 at a time to all eligible customers. To qualify, you could join a checking checking account the place your earnings is recurrently deposited. The related account(s) should not carry a detrimental steadiness over the previous two months (i.e., haven’t any historical past of overdraft charges), and it should have transactions indicating constant earnings from the identical employer. That makes Albert a much less enticing choice for self-employed professionals.

Additionally, it’s possible you’ll not qualify for an advance in case your paychecks arrive late or have been withdrawn out of your account in lower than 24 hours.

On the optimistic aspect, certified candidates can get a money advance of $250 thrice inside one pay interval, in the event that they’ve efficiently repaid the earlier one.

➕ Professionals

- As much as $250 in one-time advance or $750 max per pay cycle

- No credit score checks or employment verification paperwork

- Entry your full paycheck as much as 2 days prematurely

- Request free consultations from monetary consultants as a Genius member.

- Optimize your spending with automated budgeting and invoice administration instruments

- Begin constructing your wealth with micro-investments in shares and mutual funds

➖ Cons

- Premium subscription trial activation is required to use for Albert Instantaneous.

- An extended record of qualification standards to max your money advance dimension.

- Borrowing cash in opposition to future earnings could change into a behavior.

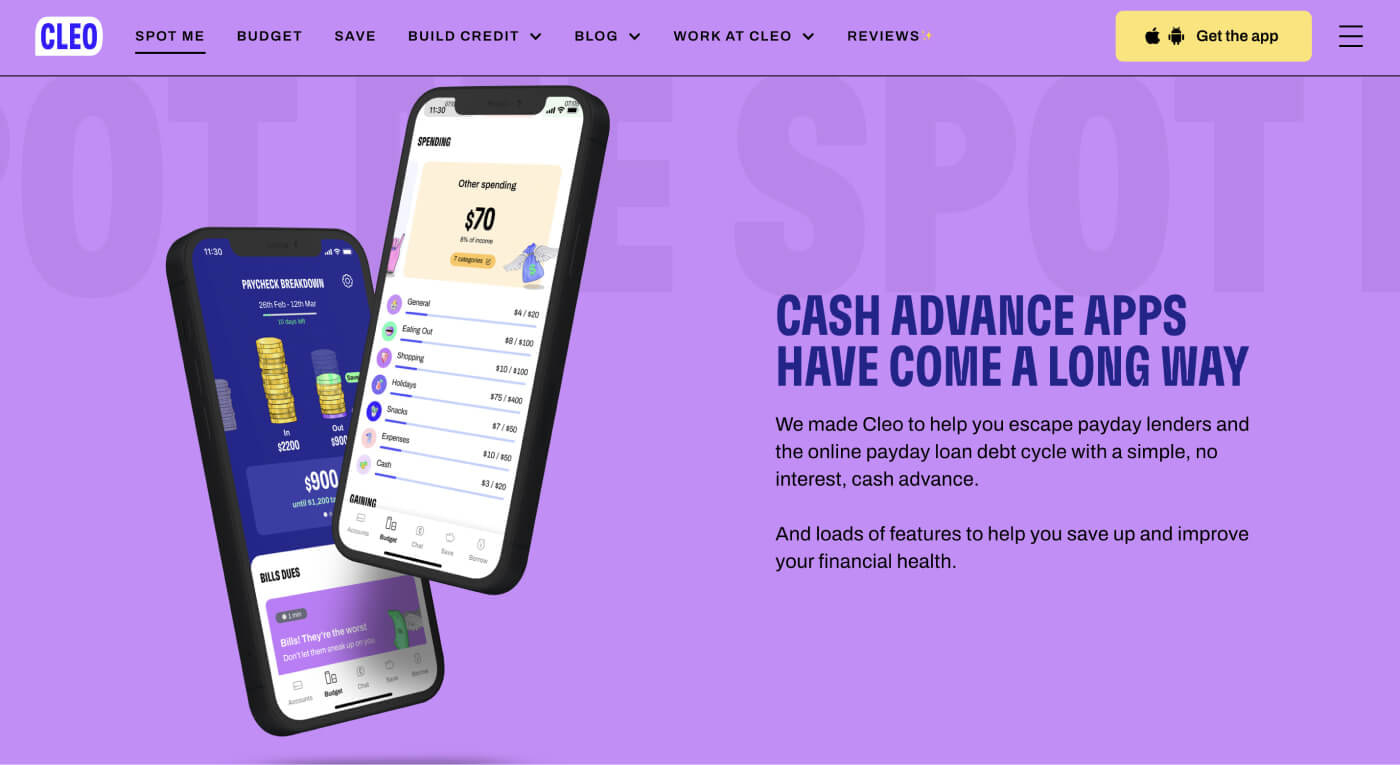

Cleo

Cleo allows you to borrow cash with out offering many paperwork. First-time debtors often qualify for a $20–$70 money advance. You may get as a lot as $200 after a profitable compensation.

This money advance app capabilities as a conversational chatbot. An in-built AI assistant screens your transactions, then proactively suggests when and methods to trim your spending to fulfill your saving objectives.

To qualify for an advance, you have to be a Cleo Plus person. The month-to-month membership price is $5, however for that value, you additionally get entry to different monetary merchandise like a helpful budgeting app and a free credit-building instrument.

To register a Cleo Plus account, you could present a replica of your ID and proof of deal with. As soon as these are verified, you’ll get entry to all account options: budgeting dashboards, spending tracker, cashback, and money advances. To get probably the most out of Cleo, you’ll must hyperlink a number of present financial institution accounts.

Cleo doesn’t ask for any employment historical past data or W2 kinds. However to get a better money advance, you’ll should actively use their product. Meaning connecting financial institution accounts, offering particulars about your earnings, and organising a minimum of one price range.

In different phrases, the app nudges you to train extra monetary diligence and construct good cash habits, which is a superb benefit.

➕ Professionals

- Enjoyable and fascinating budgeting instruments

- Witty and good private finance teaching

- Superb app design

- No employment data required

- Entry to credit score builder loans

- Automated round-ups for financial savings

➖ Cons

- A month-to-month membership price applies

- Low money advance restrict

- No free debit card provided

The Finest Money Advance Apps In contrast

| EarnIn | Empower | Dave | Albert | Cleo | |

|---|---|---|---|---|---|

| Eligibility standards | You need to be a payrolled worker whose paycheck is straight deposited right into a checking account. | It’s essential to have a US checking account, proof of deal with, and telephone quantity. Additionally, you could have two deposits in your checking account of over $200 within the final three months. |

It’s essential to hyperlink a checking account that’s a minimum of 60 days previous. It’s essential to have obtained a minimum of 3 recurring deposits in it. |

It’s essential to maintain a checking account with a US monetary establishment. Your steadiness have to be above $0 for a minimum of two months. The identical employer has paid you persistently for the previous two months. After receiving your final paycheck, funds stay accessible for a minimum of 24 hours |

It’s essential to have a US checking account, an SSN, and a current proof of deal with. |

| Money advance limits | $100 per day $750 per pay interval. |

$250 per pay interval. | $500 per pay interval. | $250 one-time advance As much as 3 occasions per pay interval. |

$100 per pay interval. |

| Credit score test | None | None | None | None | None |

| Supported OS | iOS and Android | iOS and Android | iOS and Android | iOS and Android | iOS and Android |

| Deposit velocity | 1-3 days for traditional transfers. Similar-day for Lightning Velocity transfers (value $0.99 to $3.99). |

1-3 days for traditional transfers. $1-$8 price for an immediate prime up. |

1-3 days for traditional transfers. $1.99-$9.99 categorical price for Dave checking account holders. $2.99-$13.99 for categorical transfers to different banks’ accounts. |

2-3 days for traditional transfers. $3.99-$6.99 for any advances made to a linked debit card. |

1-3 days for traditional transfers $3.99 for categorical (same-day) switch. |

| Subscription charges | No | Sure $8 month-to-month subscription price. |

Sure $1 month-to-month membership price. |

Sure From $8/month |

Sure $5.99 a month |

| Employment verification required | Sure | No | No | Sure | No |

| Compensation phrases | Withdraws money out of your checking account in your subsequent payday. | Mechanically takes cash out of your account based mostly on the pay cycle the app detected. | The default advance settlement date is about to both your subsequent payday or the closest Friday from whenever you took an advance. Customers can request an extension or enable partial settlements. |

Makes an attempt to withdraw compensation on the day of your direct paycheck deposit. In case your compensation is 15 days or extra overdue, Albert will droop your use of Instantaneous for 30–90 days. |

Versatile. You’ll be able to select a compensation date — wherever between 3 and 28 days. |

| Checking account necessities | Any US checking account in your identify with a related debit card Pay as you go and pay playing cards aren’t accepted. |

Any checking account with a U.S. monetary establishment. You may also withdraw funds to an Empower checking account with a linked debit card. |

Any US common checking account in your identify. Or you’ll be able to open a free checking account with Dave to profit from its budgeting instruments. |

Any US common checking account in your identify Or you’ll be able to open a free cash account with Albert to make use of different options. |

|

| Additional providers | None | Free debit card with cashback. Automated financial savings from every paycheck, deposited with Empower. Spending stories and alerts about upcoming payments. |

Free debit card with 15% cashback. Spending account with no minimal steadiness charges. Automated budgeting instruments. Earn additional money by taking part in surveys. |

Free checking account and no-fee debit card. Early entry to your paycheck (for salaried workers). AI-driven monetary advisor and entry to human consultants. Make investments from simply $1 into standard shares. |

Credit score historical past constructing product Personalised budgeting plan Month-to-month invoice funds tracker AI-driven saving instruments. |

| Does Your financial institution must be appropriate with Plaid? | Sure | Sure | Dave makes use of Plaid or Galileo. | Sure | Sure |

Ought to You Use an Advance App?

Money advance apps may be helpful. If a money advance app retains you from having to depend on a predatory payday mortgage or title mortgage, it’s completed its job, and also you’ve come out forward.

Money advances additionally carry dangers. Once you take a money advance, the app pays itself again out of your subsequent paycheck. That leaves you with much less cash in your subsequent pay interval and makes it extra possible that you simply’ll tackle one other mortgage.

Counting on a money advance every now and then when issues go incorrect will not be an issue. When you’re turning into depending on money advances and utilizing them each month, one thing is incorrect together with your cash administration, and you might want to do one thing about it.

Money advances are usually not an alternative to good cash administration. Efficient budgeting, dwelling inside your means, and constructing an emergency fund continues to be essential.

Most money advance apps include different instruments which might be designed that can assist you price range and handle cash. You’re paying for these instruments, so it’s best to use them!