Disclaimer: This isn’t funding recommendation, PLEASE DO YOUR OWN RESEARCH !!!!

For all readers that discovered my SFS write-up from February as too thrilling, I’ve excellent news: I’ve discovered a inventory that appears at the least as boring as SFS, perhaps much more so: Logistec, a maritime terminal operator from Canada.

Background/Intro:

That is the primary funding concept that I initially discovered on Twitter, an enormous Hat tip to Sutje who introduced this up on my radar and naturally to the creator of the unique write-up “Wintergem Shares”. The Wintergem Substack has a 3 half write-up that I can solely suggest to learn first:

Half 1 – Deep Dive Marine Section

Half 2 – Deep Dive Environmental Section

Half 3 – Is Logistec a compounder

Wintergem has additionally a latest replace on Logistec’s just lately launched 2022 report.

On this publish, I’ll simply deal with facets {that a} discovered particularly attention-grabbing on prime of the superb Wintergem write up.

To summarize Logistec’s enterprise in my very own phrases:

Logistec, a Canadian firm primarily based in Toronto, operates two divisions. The bigger one is known as “Maritime providers” and primarily includes numerous North American maritime terminals, that function something from containers to bulk and even “break bulk” cargo. In considered one of their earlier annual reportss they describe the primary cargo sorts as follows: “Cargoes dealt with sometimes include forest merchandise, metals, dry bulk, fruit, grain and bagged cargoes, containers, basic and venture cargoes”

The second division which is smaller and in addition much less proitable is Environmental providers, whcih includes a nuber of companies that supply completely different environmental providers like cleansing up hazardous waste or fixing water piping methods.

“Factsheet”

Listed here are some figures that I discovered attention-grabbing:

Maritime providers:

To my understanding, their ports largely cater to the North American financial system and are much less depending on worldwide commerce (Asia, or Europe) apart from the Tremont Joint Enterprise. Typical cargo sorts are as an illustration wooden pellets, grain (Bulk) or elements for wind generators (break Bulk). It is a image of a typical bulk terminal:

Ports/terminals are thought of to be a really engaging asset class particularly for long run buyers equivalent to pension funds. Ports of America, a big, unlisted Port operator as an illustration was purchased in 2021 by a Canadian Pension fund for ~4 bn uSD. The thought behind that is that ports are very sturdy belongings which have pure moats and are capable of present protected long run “actual returns” for buyers. The maritime providers companies is the core enterprise of Logistec.

As a result of Northern location of lots of the ports, the enterprise is seasonal with precise losses within the Winter season (first quarter) when the large Northern inland rivers and arctic waters are frozen. Right here is the map as of 2022 (orange dots are terminals):

One attention-grabbing a part of the Maritime servic is a minority (49%) JV participation in a bigger conatainer terminal in Montreal (“Termont”), extra on this later.

Environmental providers:

This segement is the youthful devision and was construct by way of a collection of acquistions. One in every of theri foremost merchandise can “improve” lead water pipes by coating them from the within. Lead water pipes are an enormous downside in sure areas of the US. One other attention-grabbing exercise is the elimination of PFAS or “endlessly chemical compounds” from soil. Total, this phase has been rising properly previously however appears to have extra of a “giant venture” character which makes it much less predictable.

Long run observe report:

One of many issues that really pulled me in direction of the corporate was the truth that they difficulty this 54 yr chart of gross sales and income on their web site (till 2021):

That progress was achieved each, by natural progress but additionally through acquisitions. Logistec retains most of their income with a purpose to develop their enterprise. Over the previous 10 years, they managed to develop EPS by ~13% p.a.

Trying again, the decline in revenue in 2016 was primarily attributed to low commodity costs within the mining sector which appears to be a significant component for his or her maritime phase.

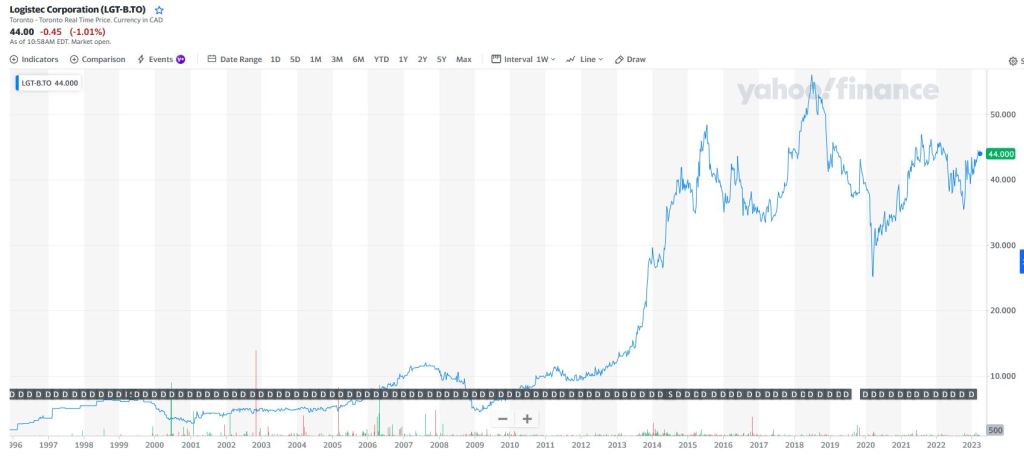

Share value

What I discover attention-grabbing taking a look at the long run inventory chart ist the actual fact, that for some motive, the share value went up ~4x from 2013 to 2015 and since then went sideways regardless of the very constructive fundametnal developement:

Buyers who purchased into Logistec in 2014 oder 2015 earned principally nothing since then because the dividend has been fairly low.

Administration:

Madeleine Paquin, the daughter of the founder joined the corporate in 1984 took over as CEO in 1996 when she was 33 years outdated, so she is now 59 years outdated which suggests in some unspecified time in the future in time, there could be a succession matter. The present administration group reveals no different member of the family as managers, her two sisters are a part of the Supervisory board however have been lively within the firm earlier than, however in much less senior roles.

Compensation for administration has elevated considerably in 2022 however remains to be OK for a North American firm

Sadly I didn’t discover a extra detailed cut up on salaries. I assume, the 9 mn covers the managment group as introduced on the internet web page.

Total, I like the mix of household possession and administration. Ms. Paquin appears to be very competent and underneath her management, the corporate has roughly 10x prime line and income.

Share construction: A/B construction

Beneath is an outline of Logistec’s share construction which consists of ~7,4 mn Class A shares and 5,7 mn B shares. The A shares, that are held largely by the three Paquin sisters, have 30 votes, the B-shares nevertheless have a proper to 1,1x the A shares dividend and a tag-along proper within the case of an organization sale-

The B shares do have a dividend desire over the A shares. Sumanic is the holding of the three sisters, every sisters holds 1/3 ofthe shares.

Professional’s & Cons

Primarily based on the Wintergem write-up and my very own analysis, as at all times a fast abstract of stuff that I like and stuff that I like much less:

I like:

+ household owned, household run

+ long run progress path with two “Platforms” to deploy capital

+ low-cost in absolute and relative phrases (“Additional asset”).

+ extra imply reversal potential (margins, a number of)

+ Publicity to attention-grabbing secotors (wind business, biomass, endlessly chemical compounds)

+ probably good Portfolio diversification (Canada, logistics)

Not so good

- capital intensive

- debt (not extreme however nonetheless)

- cyclical publicity particularly within the Environmental division, commodities publicity within the maritime phase

- probably much less engaging E&A phase

- succession matter in 5-10 (?) years

- A/B share construction (nevertheless much like Alimentation Couche-Tard)

Why is the inventory low-cost ?

As at all times, it is very important at the least strive suppose aboutwhy a inventory is affordable. That is what I got here up with:

- A/B share construction (Tremendous voting) may very well be a problem for some buyers

- there’s a sure consequence volatility, particularly within the Environmental phase

- Capital intensive enterprise

- It’s not a pure play (terminals)

- rising Rates of interest (infrastructure)

- zero analyst protection

- little freefloat, inventory is sort of illiquid

- low dividend yield particularly for infrastructure. Typical infrastructure buyers need yield, not progress

- no direct catalyst

- P&L not simple to learn (JVs, “Additional belongings”)

Total there appear to be fairly a number of explanation why the inventory low-cost. However in fact, Canada is way away and I might need missed another causes.

Valuation:

Prior to now, with decrease rates of interest, ports have been valued fairly excessive. It is a slide that reveals some M&A transaction within the ports sector within the yr 2019 with respective EV/EBITDA mutliples which might be generally used because the valuation measure for infrastructure belongings:

Again then, valuation ranges for Terminal/port belongings have been somwhere between 13-20x EV/EBITDA, which may very well be a, little bit decrease now ith increased rates of interest.

If we take a look at our “reality sheet” once more, we are able to see that Logistec trades far beneath this ranges however has traded a lot increased traditionally:

To be clear: I might not make investments into Logstec simply as a “imply reversion” play, however it reveals that in historic phrases, the present valuation appears low-cost.

“Additional Asset”: Tremont Terminal

Now we have to lastly sort out the “additional Asset”: Logistec owns a 49% stake in a JV known as TERMONT which is a container terminal in Montreal and handles enterprise on a long run contract with the world’s largest container shipper MSC. In 2022, dividend revenue from this JV has been 15 mn USD, the underlying revenue barely decrease. They appear to have doubled the capability over the latest years which explains the rise in income (from 2,5 mn in 2016 to 13,6 mn in 2022=.

When evaluating Logistec’s valuation at an EV/EBIT or EV/EBITDA foundation, which we did above, this revenue stream shouldn’t be included because it solely enters the P&L within the “I” part.

So when making EV/EBITDA comparisons, this worth must be subtracted from the EV. Why ? As a result of on may merely promote this asset for money and EBITDA and EBIT wouldn’t change, however EV would lower by the money obtained.

What’s the JV stake price ? If we use Logistec’s P/E of ~11, we might give you one thing like 140 mn CAD, which I believe is a really conservative estimate for a container terminal on a long run contract.

That is how valuation appears if we modify this asset:

So primarily based on on the adjustment, EV/EBITDA is a full poin decrease, EV/EBIT virtually 2 factors.

I additionally compiled an inventory of worldwide listed port operators, though because the outcomes present, this can be a very numerous lot and port belongings are typically very particular person belongings:

If I account for the “non pure play standing” and assume ” the common 10xEV/EBITDA valuation of those friends, Logistec must be roughly price 105 CAD per share primarily based on 2022 outcomes, nevertheless as I discussed above, this alone could be not sufficient.

What sort of progress could be anticipated ?

Logistec has grown as talked about by 10-15% p.a. over a really very long time, be reinvesting most of its money into natural and inorganic progress. Only in the near past, they have been capable of purchase a considerable competitor known as Federal Marine Terminals which was doing round 116 mn CAD in gross sales in 2022 . This alone will add 11 new Terminals and develop general gross sales by greater than 10%. I don’t know what number of different mid measurement operators in that space exist however to me it appears like that they’ve some runway to develop within the maritime sector.

The environmental phase is tougher to evaluate, however in principle there must be ample progress alternatives too.

Subsequently I believe it’s honest to imagine the historic progress charge of 10-15% as a superb estimate for the subsequent 5-10 years as properly.

At a present dividend yield of 1%, this may indicate a complete return of 11-16% p.a. with out assuming any a number of growth, which I believe is a extremely good return/threat proposition and a superb match for my boring portfolio.

Abstract:

Logistec ticks a lot of my test bins, like having a stable however boring enterprise mannequin, a long run orientation, Household possession, good progress alternatives and a really reasonable valuation . Though there may be clearly no brief time period catalyst, I do suppose that over a timeframe of 3-5+ years there’s a good likelihood of an honest return in the event that they proceed to execute like they did previously.

As that is Canada, which is way away and I’m not overly aware of the business, I made a decision to purchase “solely” a 3% place at this stage at a mean value of 44 CAD/share. To be trustworthy, apart from Alimentation Couche-Tard, my “far-off” investments up to now haven’t been too profitable and embody a number of “corridor of disgrace” investments like Cras.com and Silver Chef.

The financing comes largely from promoting some extra Meier & Tobler and dividends (Photo voltaic).

Disclaimer: This isn’t funding recommendation. PLEASE DO YOUR OWN RESEARCH.