Tax season comes on the identical time yearly, however many are caught off guard when federal and state returns come due. Tax kinds and reporting schedules do look intimidating, however tax submitting is a should.

Many individuals search skilled tax help, however utilizing tax prep software program is an efficient various, particularly in the event you’re submitting a comparatively easy return.

Can You File Your Taxes On Your Personal?

Sure. You may self-prepare your tax returns and submit them on-line via the IRS e-file system.

Each choices are common. Based on the IRS submitting season statistics database, about 45% of submitted tax declarations in 2022 had been self-prepared, and 55% had been finished by tax professionals.

The actual query is: Must you do your personal taxes?

You may safely put together your tax return utilizing free tax software program in case you have one predominant revenue stream (a salaried job), few money owed, and funding property. However extra complicated tax conditions like self-employment, rental property possession, or a number of funding revenue streams warrant paying for premium instruments and recommendation.

Fashionable tax software program packages supply entry to each DIY and managed tax prep choices.

Finest Tax Software program of 2023

Choosing tax software program could be as time-consuming as doing the returns. To save lots of you the trouble, we analyzed a dozen common on-line tax submitting ups and rounded up the 6 greatest tax software program firms.

BEST FOR SMALL BUSINESS OWNERS

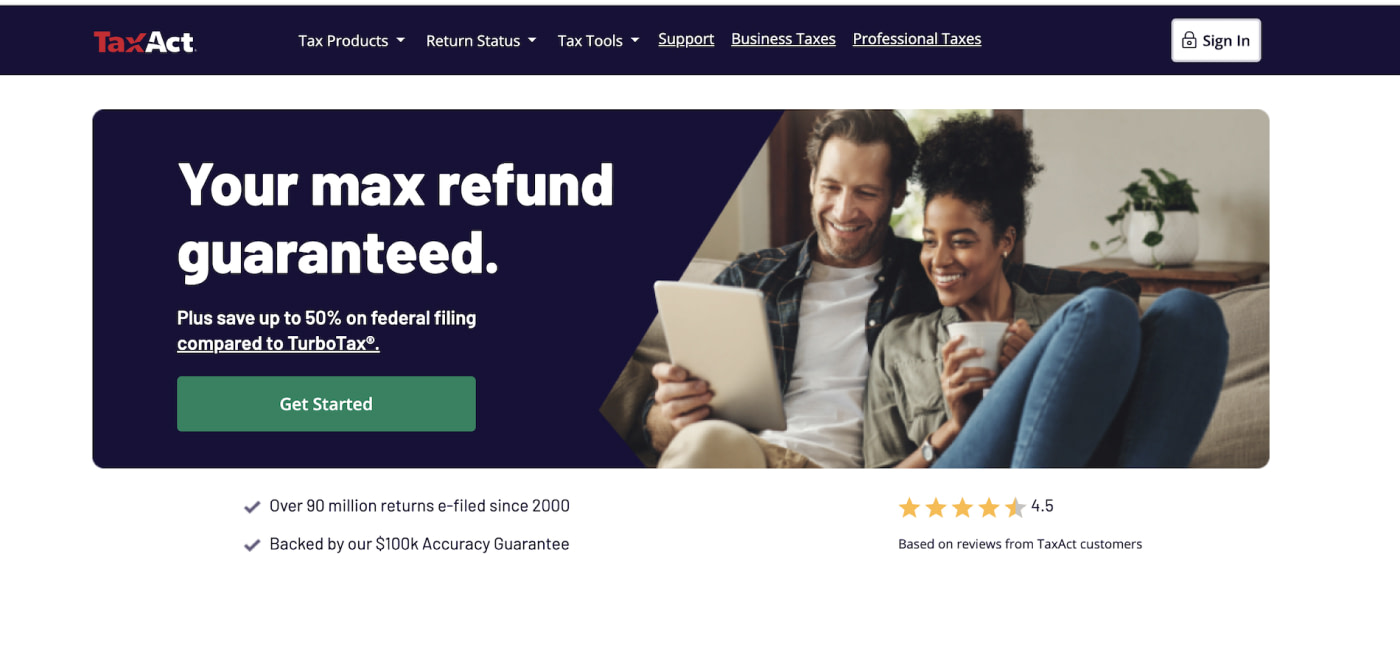

TaxAct

TaxAct is a nationwide tax software program supplier that first launched an app for skilled tax preparers. They later launched a shopper model for submitting federal and state returns electronically. The web tax software program guides you thru all relevant tax kinds with a handy questionnaire to arrange your tax returns.

💵 Pricing: Free model obtainable. Then, from $19.55.

- $100K submitting accuracy assure

- Handy enterprise bills filings

- Submit a number of tax returns for a similar 12 months from one account

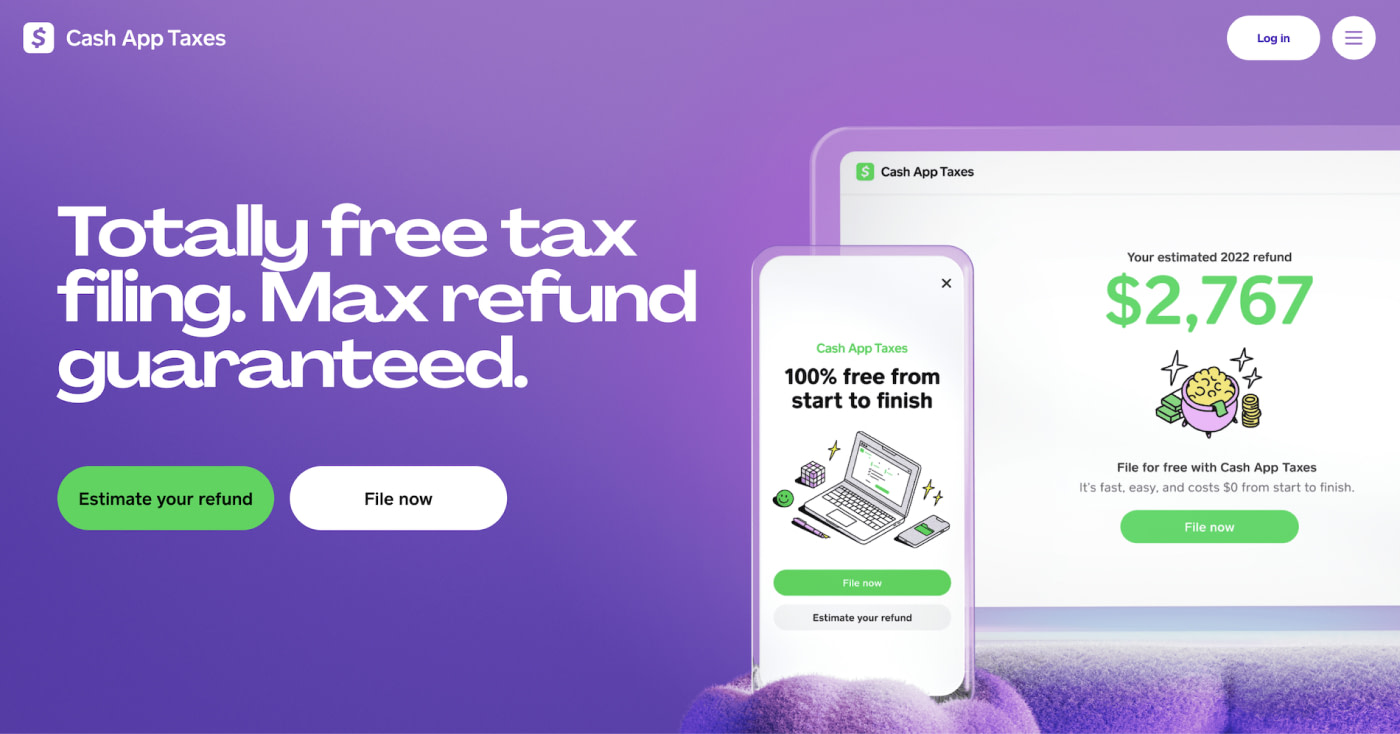

BEST FREE TAX SOFTWARE

Money App Taxes

Money App Taxes is a free tax-prep function obtainable in Money App’s digital pockets. Nice for DIY tax submitting, Money App determines which tax kinds you have to fill in and pulls collectively the required information. Although there’s some handbook typing to do, you may get finished along with your federal and state taxes in little or no time. Then you may observe your tax refund on-line.

💵 Pricing: Free.

- All main IRS kinds and schedules supported

- Quick, handy tax prep in below quarter-hour

- Free submitting of enterprise or freelance revenue

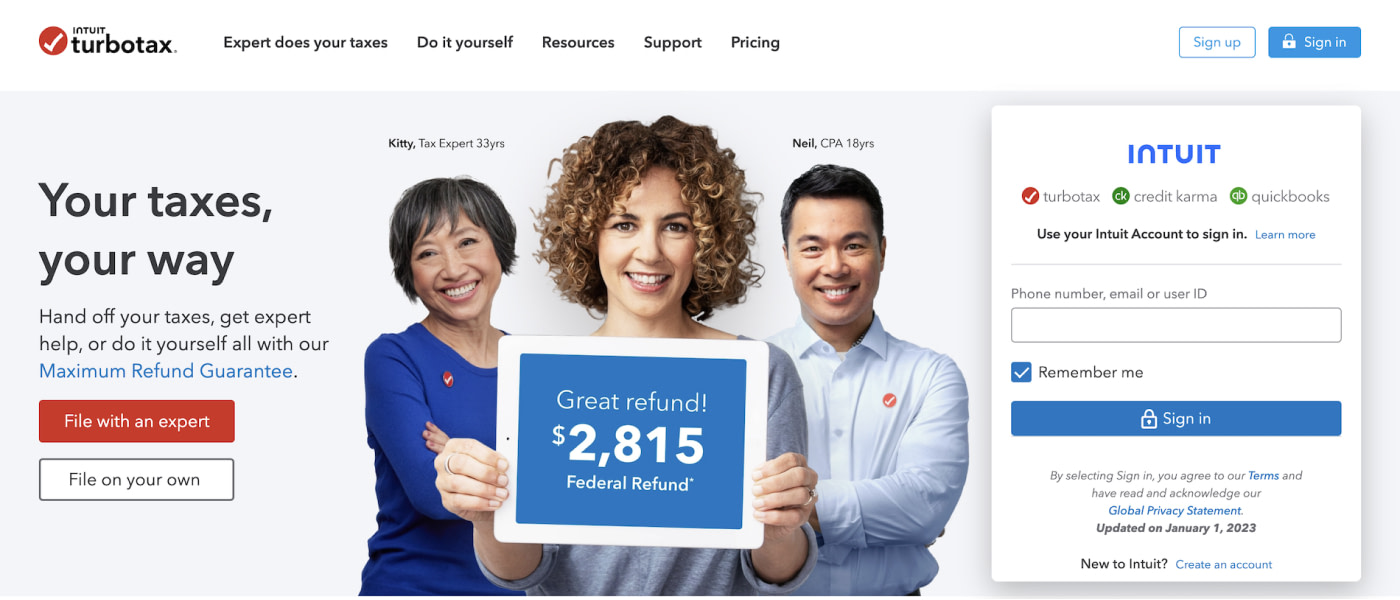

BEST FOR PROFESSIONAL TAX ASSISTANCE

TurboTax

TurboTax is the most important title within the tax software program house, and for good causes. Impeccable consumer expertise, on-demand tax recommendation, and guided tax submitting expertise have earned TurboTax a 4.6 score from 200K+ critiques. It will not be the most cost effective tax software program, but it surely is likely one of the most complete ones.

💵 Pricing: Free plan obtainable. Then, from $39.

- DIY or done-for-you federal and state tax filings

- All tax kinds, deductions, and tax credit supported

- A refund in the event you get an even bigger state refund from one other supplier

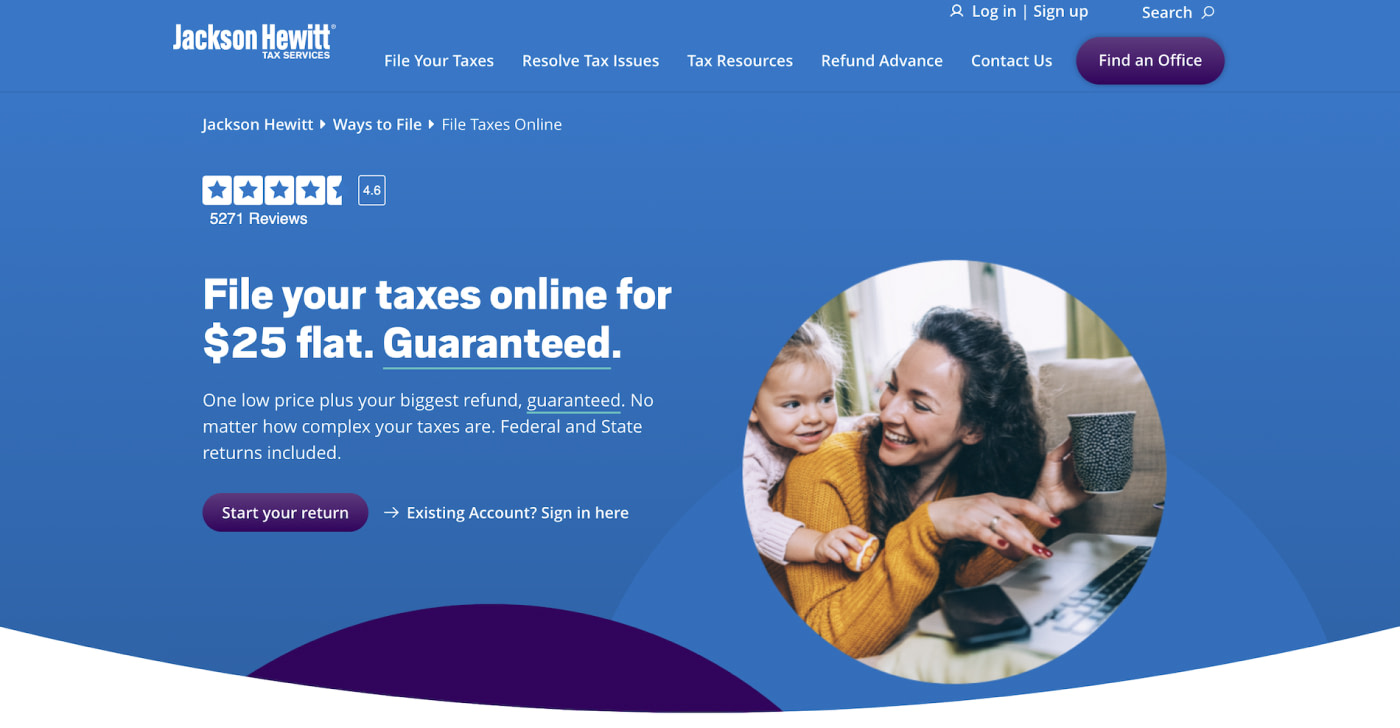

BEST VALUE FOR MONEY

Jackson Hewitt

Jackson Hewitt operates over 6,000 tax prep providers places across the nation (together with 3,000 in Walmart shops). In 2022, it debuted a $25 flat-free on-line tax submitting service for federal and limitless state tax returns. The service covers all frequent tax conditions and helps you whizz via each kinds with automated calculations.

💵 Pricing: $25 flat charge.

- A number of methods to submit tax paperwork on-line or in-person

- Advance loans for early entry to tax refunds

- Additional tax providers at an inexpensive value

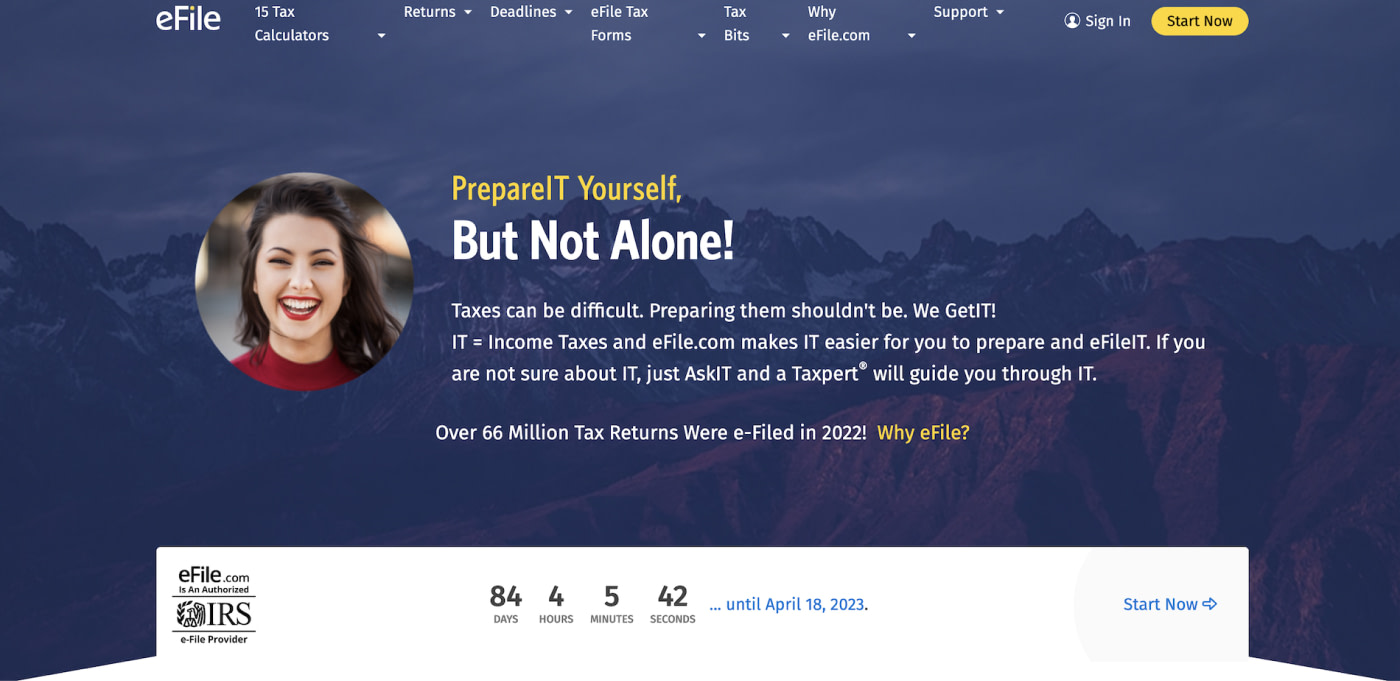

BEST FOR STATE TAX FILINGS

eFile

eFile is a Florida-based tax software program supplier providing a preparation platform for self-filing. The app helps you acquire all the required tax paperwork, run a preliminary tax invoice estimate utilizing one of many 15+ calculators, after which sit all the way down to do your return. You get began without spending a dime and pay solely whenever you e-file the ultimate return.

💵 Pricing: Free plan obtainable. Then, from $25.

- All state revenue tax returns for under $32

- No sneaky upgrades to larger tiers

- High self-service instruments and sources

BEST PERSONALIZED SUPPORT

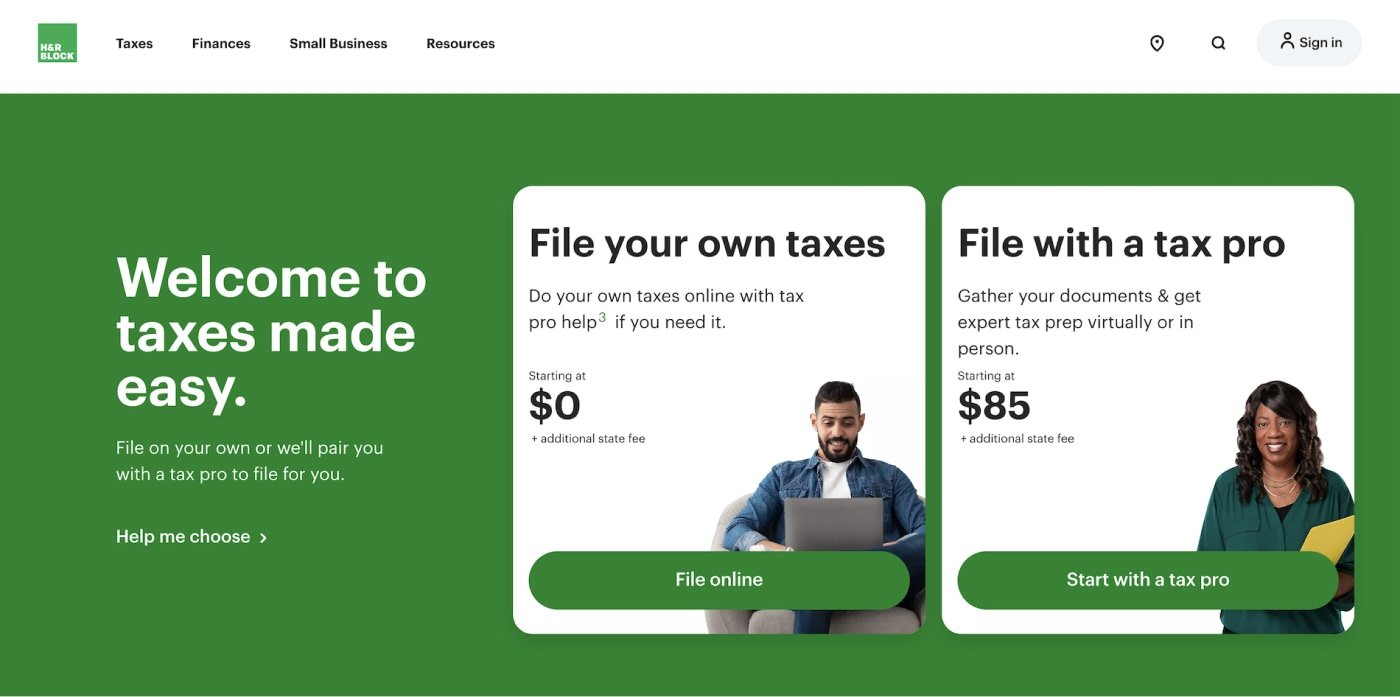

H&R Block

H&R Block gives a protracted listing of monetary and tax prep providers. The corporate operates a community of 8,900+ retail tax workplaces throughout the nation and gives on-line DIY or managed tax preparation and submitting providers. H&R Block is likely one of the world’s largest and oldest tax preparation firms and has been in enterprise since 1955.

💵 Pricing: Free plan obtainable. Then, from $19.95.

- Upfront, clear pricing plans

- Digital tax prep + desktop tax software program

- Additional banking and lending providers

TaxAct

TaxAct is a extremely regarded nationwide tax preparation software program launched in 2000. Since then, the corporate has precisely processed over 90 million tax returns (federal and state). In 2022, TaxAct was bought by Cinven, a worldwide non-public fairness agency, for $720 million due to its excessive Web Promoter Scores (a measure of buyer expertise) and buyer retention charges.

With TaxAct, you may kind out your taxes on-line or obtain a desktop app (Home windows/macOS) to work offline in your tax submitting. A cellular app can also be obtainable.

On the free plan, you may report W-2 revenue, unemployment revenue, and retirement revenue. Plus, declare little one tax credit, earned revenue credit, and your stimulus credit score.

For different tax conditions, go for one of many three premium plans: Deluxe, Premier, or Self-Employed.

Plans are based mostly on the variety of supported IRS kinds. Deluxe permits extra deductions for dependents, scholar mortgage curiosity, mortgage, HSA contributions, and extra. Premier consists of assist of funding revenue filings, rental revenue, royalties, and international revenue filings.

Self-employment revenue filings can be found on the best tier, however the plan is properly definitely worth the cash. That’s as a result of you may also entry a deductions maximizer instrument, year-round assist, and real-time tax alerts.

In case you additionally need assistance with enterprise taxes, TaxAct has inexpensive plans for Partnerships, S-Corps, C-Corps, Estates & Trusts, and Nonprofits. Each could be bundled with private tax return prep to save lots of on charges.

TaxAct plans are cheaper than different tax software program suppliers like TurboTax and eFile. State submitting charges, nonetheless, are steeper. When you’ve got tax returns due in a number of states, look into different tax software program firms.

➕ Execs:

- Inexpensive self-employment plans

- Personalised tax planning ideas for enterprise house owners

- Computerized W-2, 1040, and 1099 tax kind imports

- Most refund assure

- On-demand, on-line entry to tax professionals

- Pay TaxAct’s charge out of your federal refund

➖ Cons:

- Increased charges for state returns

- Clunky cellular app

- No dwell chat assist

- Persistent service upsell

| Pricing | |

|---|---|

| Deluxe | $19.95 federal, $44.95 per state |

| Premier | $34.95 federal, $44.95 per state |

| Self-Employed | $44.95 federal, $44.95 per state |

| Enterprise | $124.95 federal, $54.95 per state |

Money App Taxes

Money App Taxes software program was initially launched as Credit score Karma Tax however rebranded to ‘Money App Taxes’ in 2020 post-acquisition. The principle promoting level is simplicity: Customers can view their transactional pockets historical past and export the information for tax functions in a single click on to arrange a federal submitting, then a state tax return.

To get began, navigate to the “Taxes” tab within the Money App. Then reply a few fast questions and enter the lacking information. You may report wage, self-employment revenue, curiosity, and investments (on Type 1099).

Money App helps W-2 imports — as uploads or cellular footage — however the information processing expertise could be inconsistent. On the professional facet, you may add the previous 12 months’s tax returns created with TurboTax, H&R Block, or TaxAct to pre-populate some kinds. On the draw back, you may’t import 1099 kinds from banks and brokerages.

You can even file enterprise taxes with Money App in the event you report as a Sole Dealer, Partnership, S-Corp, or C-Corp. Nonetheless, this tax supplier doesn’t assist sure enterprise tax credit (e.g., Credit score for Small Employer Well being Insurance coverage Premiums) and Schedule Ok-1 filings.

State tax filings are extra nuanced. As of January 2023, Money App solely helps e-filings in 17 states. Although they promise to start out supporting a complete of 40 states and Washington DC by the tip of the 12 months. Additionally, you may solely file one state return with Money App. Multi-state, part-year state and non-resident state filings aren’t supported.

Money App Taxes has restricted buyer assist. The official dwell chat hours are 8:00 a.m. to eight:00 p.m., however responses could be delayed. You can even attain the workforce by electronic mail (in the event you handle to search out the right tackle). No telephone assist is out there, although. However that’s how issues are with most free tax submitting providers.

Money App Taxes is a good choice for tax self-preparation in the event you dwell within the supported state, have fairly good tax literacy, and have a comparatively easy tax state of affairs.

➕ Execs:

- 100% free federal and state tax filings

- Modern smartphone app

- Snap an image to import a kind

- Free audit protection, supplied by Tax Safety Plus

- Multi-factor authentication and strong information safety

➖ Cons:

- Solely obtainable for US residents

- You will have to enroll in a free Money App account

- Solely 17 state tax returns supported

- A number of state filings or part-year state filings will not be allowed

- Restricted buyer assist choices

- Doesn’t apply for sure enterprise credit

- No skilled tax advisory providers

Pricing: free, however you will want to open a Money App account.

TurboTax by Intui

TurboTax has been round since 1984 and has been owned by Intuit since 1993. This tax software program has been via a number of updates, so it has a contemporary UX really feel and compliance with the most recent editions of the US tax code.

You may have two choices with TurboTax:

- DIY tax submitting (with a free plan obtainable)

- Achieved-for-you private and enterprise tax prep

If you wish to put together taxes your self, TurboTax helps estimate your adjusted gross revenue (AGI) through a useful questionnaire.

You can even auto-upload all monetary and tax paperwork as PDFs or pictures. An in-built scanning instrument sweeps all the data to make sure 100% accuracy. TurboTax guarantees to pay for federal or state tax penalties or pursuits if the app makes a calculation error.

The app additionally gives ideas for tax financial savings, resembling claiming all above-the-line deductions like scholar mortgage rates of interest, IRA contributions, or alimony payouts. Then, you may submit itemized deductions for varied bills (which should not exceed 7.5% of your AGI) to optimize your tax invoice.

In case you get caught at any stage, contextual prompts can be found. You can even request assist from a tax skilled for a separate charge or go for a full-service tax prep package deal, beginning at $169.

TurboTax Full Service consists of entry to an authorized CPA who’ll work in your filings in actual time. You may talk about completely different tax optimization methods, undergo all of your deductions, and faucet them for every other tax questions year-round. The above options make TurboTax the perfect total tax software program for many who can afford it.

For cash-strapped people, TurboTax gives a free tax submitting service for certified taxpayers. It consists of Type 1040, submitting just for W-2 revenue with some deductions (IRS normal deduction, EIC, little one tax credit score, and scholar mortgage curiosity deduction).

In any other case, TurboTax will mechanically apply the suitable paid plan for e-filing your taxes.

➕ Execs:

- Pay solely whenever you file federal and state returns

- Efficient doc auto-import and kind pre-filling

- Context-sensitive help throughout tax prep

- Offline/downloadable app model obtainable

- Limitless tax recommendation on managed plans

- A number of buyer assist choices (chat, electronic mail, telephone, video conferencing)

- Simply swap from one other tax program

➖ Cons:

- Increased costs in comparison with most tax software program

- Laborious to downgrade to a lower-tiered package deal

- Audit safety & assist prices additional

| Pricing | Do It Your self | TurboTax Stay | Full-Service |

|---|---|---|---|

| Fundamental | ❌ | $89 (state & federal) | $209 federal $49 per state |

| Deluxe | $59 federal $39 per state |

$129 federal $49 per state |

$259 federal $49 per state |

| Premier | $89 federal $39 per state |

$179 federal $49 per state |

$369 federal $49 per state |

| Self-Employed | $119 federal $39 per state |

$209 federal $49 per state |

$399 federal $49 per state |

Jackson Hewitt

Jackson Hewitt has a large bodily footprint of inexpensive in-person tax providers. You may drop your paperwork at a Walmart with a tax professional and get all the pieces sorted. Affordable costs and glorious service make JH a strong selection for first-time tax filers.

In case you already know the chops, the $25 flat charge on-line service is a greater choice, particularly whenever you’re submitting in a number of states. The worth doesn’t change.

Jackson Hewitt’s on-line tax service covers all 1040 kinds, plus reporting on Schedule A to Ok-1. The app guides you thru all of the filling sections utilizing a self-paced interview. You may skip one if it doesn’t apply to your tax state of affairs, which saves time.

When something is unclear, click on an embedded hyperlink to get a brief rationalization or navigate to a pop-up display with additional particulars. In case you’re nonetheless struggling, Jackson Hewitt has an in depth information base. Or you may contact assist through telephone, electronic mail, or dwell chat. Be aware: Help solely offers with product-related or troubleshooting questions — you shouldn’t anticipate tax recommendation.

You can even apply common tax credit and itemized deductions. Though, you’ll must enter many of the data manually. Jackson Hewitt’s tax software program doesn’t assist import kinds. Watch out with the numbers as a result of there’s no skilled backup. You may’t request a tax return evaluate by knowledgeable filer on-line.

On the professional facet, you get different ensures like 100% calculation accuracy. If there’s any number-crunching error, Jackson Hewitt will compensate for any tax penalties from the IRS. Likewise, the workforce ensures a most refund. In case you show them in any other case, the corporate will refund your $25 charge and pay an additional $100.

For extra peace of thoughts, you should buy a Safety Plus package deal for $29.95. It consists of:

- Audit Assurance — an choice to have Jackson Hewitt tax professionals liaison with the IRS or State tax authorities in case you’re flagged for an audit.

- ID Theft Restoration — Jackson Hewitt will work with the credit score reporting companies to treatment an id theft incident, plus present six months of credit score monitoring providers.

Identification theft is dear, and restoration can take time. Having additional assist is a sound concept.

➕ Execs:

- Limitless state tax return filings

- No annoying upsells or cross-sells

- Clear, easy consumer interface

- Helpful doc guidelines

- Three-year storage of tax returns

- Inexpensive offline tax providers

➖ Cons:

- No free account tier

- Type imports not supported

- No tax advisory choices

- Restricted buyer assist

| Pricing | |

|---|---|

| On-line fillings | $25 |

| Safety Plus package deal | $29.95 |

eFile

eFile extends a complete set of DIY tax prep options for a extra inexpensive value than TurboTax and H&R Block. Not like the 2, eFile auto-downgrades you to a decrease plan after you’re finished declaring taxes. In case you don’t use premium options, you’re not paying for them.

When you’ve got a W-2 revenue beneath $100K (joint or single) with no dependents and declare restricted tax credit, you may qualify for a free federal tax return submission.

Alternatively, the paid tiers are solely $25/$35+ $32 for limitless state tax filings. For comparability, state tax returns price $44.95 every with TaxAct. eFile operates in 41 states plus Washington DC, that means it can save you quite a bit in the event you draw revenue from a number of locations (e.g., have funding properties in a number of states).

eFile covers many frequent tax conditions, together with:

- Self-employment, freelance, enterprise, farming, or clergy revenue

- Family employment taxes

- Capital good points and losses

- Unemployment revenue

- Normal and itemized deductions

- Schooling credit and deductions

- Enterprise credit and deductions

As a part of your plan, you get assigned a Taxpert®: a devoted assist skilled, obtainable to reply any queries you have got through your private assist web page. Most replies arrive inside a day or sooner.

On the draw back, eFile doesn’t supply any additional advisory providers or return critiques by certified tax professionals.

➕ Execs:

- Entry to important tax prep options for a low value

- Limitless state tax returns for a flat charge

- Free tax kind amendments at any time

- IRS audit safety included with every plan

- Auto-downgrade for the perfect value

- Instruments for estimating tax legal responsibility

- Updates on all submitting statuses

➖ Con:

- No desktop or cellular app is out there

- No dwell tax advisory or managed tax providers

- Considerably clunky internet interfaces

- No telephone assist

| Pricing | |

|---|---|

| Fundamental | $0 federal, $32 for all states |

| Deluxe | $25 federal, $32 for all states |

| Premier | $35 federal, $32 for all states |

H&R Block

H&R Block, based by Henry and Richard Bloch, has been within the tax enterprise for nearly 60 years. Not like different legacy firms, H&R Block efficiently transitioned into the digital period. Aside from in-person tax help, the corporate gives:

- DIY on-line tax submitting

- Guided on-line tax preparation

- Managed tax e-filings

- Desktop tax software program

Every choice has a number of paid tiers and a Fundamental (free) plan for on-line tax submitting. The free tax service consists of capped W-2, unemployment, curiosity/dividend revenue, schooling and scholar mortgage deductions, little one tax credit score, and earned revenue tax credit. That’s extra options than TaxAct or TurboTax offers away without spending a dime.

With a paid plan, you may deal with extra superior eventualities like:

- HSA or retirement plan contributions

- Baby and dependent care deductions

- Cryptocurrency revenue reporting

- Rental revenue declaration

- Freelance and self-employed revenue reporting

- And extra

If you wish to work with a tax professional, plans begin at $85 for digital, in-person, or drop-off submissions. You can begin with a technique and swap to a different at no additional price. On this case, you obtain personalised recommendation, additional steerage, and a professional sweep by a tax skilled with a minimum of 10 years of expertise (as H&R Block advertises).

In flip, customers with excessive monetary literacy can get monetary savings through the use of a downloadable H&R Block tax app (beginning at $19.95). The desktop software program helps private and enterprise tax filings, regionally and with the IRS. On this case, nonetheless, additional $19.95 state e-filing charges apply.

That mentioned, a digital tax submitting service is extra handy. This fashion, you may auto-import a few of your tax kinds, together with W-2 and completely different variations of 1099s. Then e-file your return straight out of your account.

On the assist facet, you may both use self-help sources or the Stay Chat function on-site. Or go for an add-on On-line Help service (beginning at $40) to get limitless on-demand chat or video screen-casting classes with a CPA or a tax prep skilled. That’s an inexpensive solution to get additional assist with out leaving your property.

The appointed skilled gained’t evaluate or e-file full tax returns. If that’s what you need, look into one of many “File with the Tax Professional” plans beginning at $85 + state charges.

➕ Execs:

- Simple tax doc imports and uploads

- Stellar interface design and app navigation

- Step-by-step steerage and academic sources

- The free package deal has extra options included

- As much as $3,500 in tax refund advances after submitting a tax return

- Additional monetary providers for small companies (bookkeeping, payroll, advisory)

- Topmost information safety and processing accuracy

➖ Cons:

- Increased priced digital tax submitting service in comparison with others

- Advanced pricing tiers with a number of add-ons

- Fees an additional $37 per every state submitting

- Desktop tax software program is costlier than internet tax service

| Pricing | Do It Your self | Desktop tax software program |

|---|---|---|

| Fundamental | $0 federal $32 per every state |

$29.95 license + $39.95 for every state $19.99 e-file charge |

| Deluxe | $55 federal $32 per every state |

❌ |

| Deluxe + State | ❌ | $54.95 license + $39.95 for a couple of state submission $19.99 e-file charge |

| Premium | $75 federal $32 per every state |

$74.95 license + $39.95 for a couple of state submission $19.99 e-file charge |

| Premium & Enterprise | ❌ | $89.95 license + $39.95 for a couple of state submission $19.99 e-file charge |

| Self-employed | $110 federal $32 per every state |

❌ |

Finest Tax Software program Comparisons Desk

| TaxAct | Money App | TurboTax | Jackson Hewitt | eFile.com | H&R Block | |

|---|---|---|---|---|---|---|

| Federal and state tax returns prep | ✔️ | ✔ | ✔️ | ✔️ | ✔️ | ✔️ |

| A number of state submissions | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ✔️ |

| Joint fillings for married {couples} | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Self-employment revenue filings | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Enterprise tax submitting | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Overseas-sourced revenue filings | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ✔️ |

| Funding revenue filings | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Supported OS | Home windows macOS Net |

Cellular-only | Home windows macOS iOS Android Chromebook Net |

Net solely | Net solely | Home windows macOS Net |

| Offline app model | ✔️ | ❌ | ✔️ | ❌ | ❌ | ✔️ |

| Tax kind imports | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| Tax refund tracker | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Tax credit and deductions | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Audit assist | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Tax advisory | ✔️ | ❌ | ✔️ | ❌ | ❌ | ✔️ |

| Tax extension submitting | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| In-person tax submitting help | ❌ | ❌ | ❌ | ✔️ | ❌ | ✔️ |

| Stay on-line tax submitting help | ✔️ | ❌ | ✔️ | ❌ | ❌ | ✔️ |

| Pricing | From $19.95 | Free | From $39 | $25 flat charge | From $25 | From $19.95 |

What Occurs If You Fail to File Taxes?

In case you missed the primary tax deadline (April 18, 2023), you may request an extension and submit your return till Oct 16, 2023. However don’t drag your ft any additional. Taxes aren’t enjoyable, however failure to report your revenue results in worse penalties.

Take into consideration tax submitting as going to the dentist. The longer you delay your go to, the extra painful and costly the entire ordeal will get. File to your taxes even in case you are unable to pay the entire quantity due proper now. The penalties for not submitting taxes are worse than these for not paying them.

What Occurs if You Don’t Pay Your Taxes?

If you don’t pay your taxes, you’ll obtain a discover from the IRS explaining your invoice, collected penalties, and curiosity, together with directions for resolving the issue. The authorities will enable you organize a fee plan in the event you can’t pay the stability instantly.

No motion in your half will create extra issues. The IRS will forcefully acquire the excellent fee through wage garnishment, financial institution levies, or the seizure of property and automobiles. Tax authorities have ten years to gather unpaid tax funds and can use all obtainable means.

If cash is tight, search skilled credit score counseling. Many non-profits assist cash-strapped people arrange a tax reimbursement plan without spending a dime.

When Ought to You Rent a Tax Skilled?

A tax return is a ledger. It accommodates an in depth listing of all the cash you’ve earned and spent on deductible bills. Tax software program helps consolidate the numbers and streamline the entire calculations and takes benefit of the IRS free file program to electronically submit your federal return (and e-file state return when relevant).

Many apps additionally direct you in the direction of additional deductibles and tax credit up for grabs, however they’ll by no means examine to a tax skilled’s information, particularly relating to enterprise deductions.

Working with a tax skilled is best for folks with a number of revenue streams: a conventional job, a number of facet hustles, and plenty of funding property. A certified tax professional can counsel varied tax ideas for legally optimizing your tax invoice for this 12 months (and the approaching ones).

Lastly, in the event you really feel you don’t perceive how taxes work, what your tax liabilities are, and once they come up, working with knowledgeable a minimum of as soon as is a wonderful solution to fill this data hole. By paying for professional recommendation as soon as, you may keep away from expensive errors sooner or later, like tax penalties and arrears.