With apologies to John Lennon and the Plastic Ono Band for the title of the article on VXN and QQQ places.

The latest red-hot rally in shares, particularly the NASDAQ 100 names, has introduced the bulls again charging and put the bears in hibernation. Whether or not the momentum will proceed or not is definitely unsure.

One factor that’s sure, although, is that some inventory measures are positively getting extra excessive, which warrants warning. Defending or enjoying for some potential draw back is one thing to noticeably take into account.

Fairly than merely exiting or shorting shares, utilizing possibility methods makes extra sense within the present atmosphere.

Listed below are three large the explanation why now may be an opportune time to be shopping for bearish places, both as a portfolio safety or a short-term speculative commerce.

Implied Volatility

Most of you’re most likely aware of the VIX, generally known as the Concern Gauge. It’s a measure of possibility costs within the S&P 500. What number of of you recognize that the NASDAQ 100 has an analogous instrument to measure implied volatility -VXN- or “Vixen”. Under is the definition from the Chicago Board Choices Trade (CBOE) for the VXN. For our functions, we’re substituting QQQ for NDX since QQQ is rather more closely traded.

The Cboe NASDAQ-100 Volatility IndexSM (VXN) is a key measure of market expectations of near-term volatility conveyed by NASDAQ-100® Index (NDX) possibility costs. It measures the market’s expectation of 30-day volatility implicit within the costs of near-term NASDAQ-100 choices. VXN is quoted in share factors.

The VIX has dropped sharply not too long ago as shares have rallied previously month. VIX closed simply above the bottom ranges of the 12 months on Friday because the S&P 500 rallied, albeit nicely shy of yearly highs.

VXN, nevertheless, did shut at a brand new yearly low on Friday because the NASDAQ 100 (QQQ) closed at a brand new yearly excessive. Additionally, VXN closed on the lowest degree since January 2022.

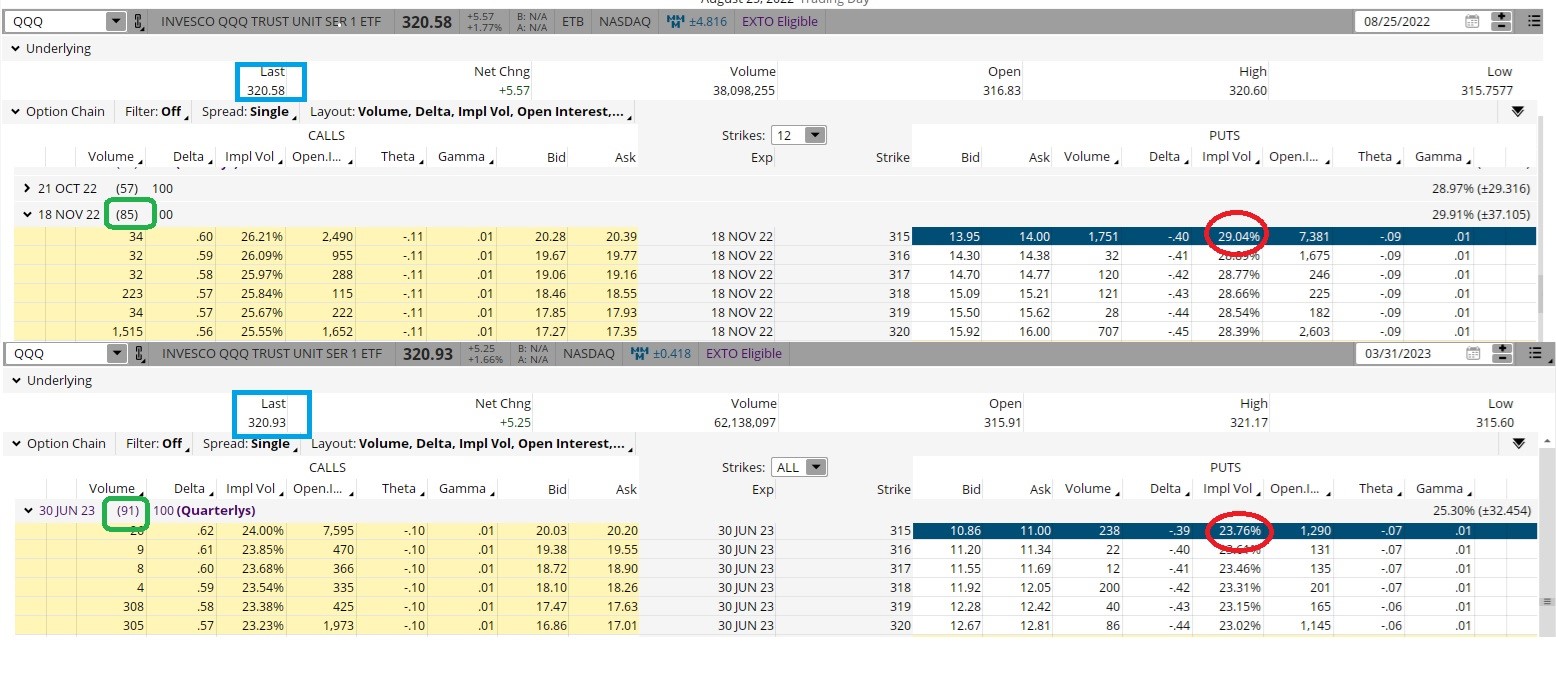

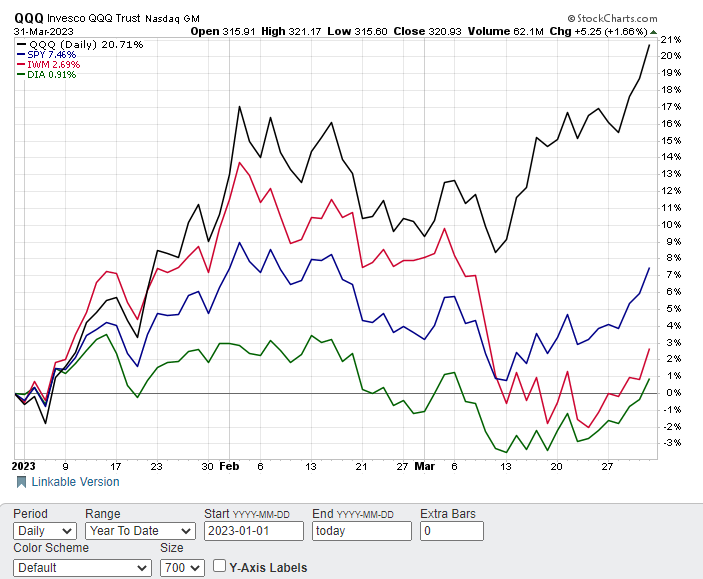

A fast comparability of the final time QQQ was at comparable pricing will present how a lot the drop in VXN cheapens the worth of places. The comparative possibility montages are proven beneath.

On August 25 of final 12 months, QQQ closed at $320.58. The November 18th $315 places had 85 days till expiration and had been priced at $14.00. IV was simply over 29.

Quick ahead to Friday, and QQQ closed at $320.93, so solely 38 cents increased than again in August. The June thirtieth expiration $315 places had 91 days to expiration, so a number of extra days longer than the same November 18th expiration places from again in August. The June 30th places had been priced at $11.00. IV was just below 24.

Placing all of it collectively, the marginally out of the cash $315 places from final August had been buying and selling $3.00 cheaper than the just about comparable places are buying and selling now.

One other approach to take a look at it, the places again in August price 4.37% the worth of QQQ in comparison with simply 3.43% now. All as a result of IV dropped from 29.04 to 23.76. To me, shopping for places at a less expensive value (and the most cost effective value in fairly some time) isn’t a foul factor.

VXN can also be a dependable market timing device, very very similar to the VIX in that regard. Drops to comparatively low ranges of VXN nearly invariably coincide with short-term tops in QQQ, because the chart beneath reveals. Is the QQQ close to a high$ The VXN is implying so.

Technicals

The NASDAQ 100 (QQQ) is getting overbought on a technical foundation. 9-day RSI is now over 70. Bollinger % B simply broke previous 100. MACD hit an excessive. Shares are buying and selling at an enormous premium to the 20-day shifting common. Final instances these indicators all aligned similarly marked a short-term high in QQQ.

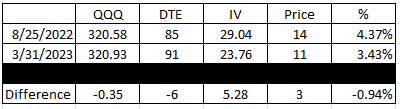

NASDAQ 100 (QQQ) is getting a bit of out over the skis on a comparative foundation when in comparison with the opposite three main indices. The Nazzy is exhibiting a spectacular acquire of over 20% to this point in 2023. Evaluate that to the nonetheless very respectable acquire of virtually 7.5% for the S&P 500 (SPY) and it’s simple to see simply how a lot QQQ has rallied versus different shares in Q1. In the event you examine the positive aspects of QQQ to these of both IWM (Russell 2000) or DIA (Dow Jones Industrials) the out-performance is much more astounding.

Definitely, some outperformance by the NASDAQ 100 is warranted given it was the worst performing index of the massive 4 in 2022. That outperformance, nevertheless, is now attending to an excessive. Search for QQQ to be an underperformer over the approaching months because the comparative unfold converges again in direction of the extra conventional relationship.

Fundamentals

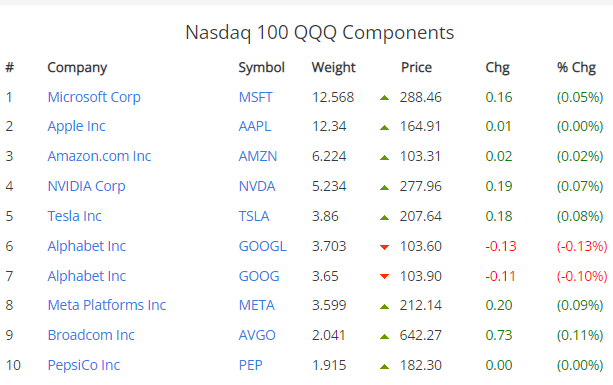

Two shares, Microsoft (MSFT) and Apple (AAPL), account for over 25% of the NASDAQ 100 Index weighting. In addition they comprise over 13% of the S&P 500-the first time two shares had been this highly effective since IBM and AT&T within the late Nineteen Seventies. Plus, they’re the one shares with a $2 trillion plus market cap.

To a big diploma, as go these two shares so goes the NASDAQ 100 and shares usually. Trying on the valuations of those two mega cap names will present perception into valuations usually for QQQ.

The Worth/Gross sales ratio for high weighted Microsoft (MSFT) is now again nicely over 10 and on the highest a number of since August of 2022 when the QQQ peaked.

Quantity two Apple paints an analogous image.

Worth/Earnings ratio in MSFT is much more excessive, now at a better degree than again on the earlier QQQ peak in value. All this even with rates of interest growing sharply in that point frame-which ought to trigger multiples to contract.

Choice costs are low-cost. The NASDAQ 100 is overbought technically and overvalued essentially. Combining these two statements collectively means buying places now on QQQ is less expensive and rather more smart than anytime this 12 months. All we want is the market to return to some semblance of sensibility to revenue on a put play.

POWR Choices

What To Do Subsequent?

In the event you’re searching for one of the best choices trades for in the present day’s market, you must try our newest presentation The best way to Commerce Choices with the POWR Scores. Right here we present you the way to constantly discover the highest choices trades, whereas minimizing danger.

If that appeals to you, and also you wish to be taught extra about this highly effective new choices technique, then click on beneath to get entry to this well timed funding presentation now:

The best way to Commerce Choices with the POWR Scores

All of the Greatest!

Tim Biggam

Editor, POWR Choices E-newsletter

QQQ shares closed at $320.93 on Friday, up $5.25 (+1.66%). 12 months-to-date, QQQ has gained 20.71%, versus a 7.46% rise within the benchmark S&P 500 index throughout the identical interval.

In regards to the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Commerce Stay”. His overriding ardour is to make the complicated world of choices extra comprehensible and subsequently extra helpful to the on a regular basis dealer. Tim is the editor of the POWR Choices e-newsletter. Be taught extra about Tim’s background, together with hyperlinks to his most up-to-date articles.

The submit Three Legitimate Causes To Say “Give Places A Probability” appeared first on StockNews.com