Apple is upping the rate of interest ante by giving its prospects the power to increase their monetary footing whereas on the identical time conserving them inside its ecosystem.

The corporate on Monday introduced a high-yield financial savings account from Goldman Sachs that provides Apple Card customers an APY of 4.15% for his or her Day by day Money rewards cash robotically deposited into this new account. Goldman Sachs additionally gives the Apple Card.

The brand new banking plan comes on the heels of the Apple Pay Later debut that lets American customers cut up on-line purchases into interest-free funds. Each providers appear to be half of a bigger technique to carry extra monetary providers beneath Apple’s management.

That is yet one more constructing block in Apple’s long-term advertising and marketing technique to increase favorable “rewards” packages to assist preserve Apple prospects firmly ensconced in its ecosystem by including financing and credit score component functionality to its bag of promoting instruments, recommended Mark N. Vena, CEO and principal analyst at SmartTech Analysis.

“This system just isn’t a shock as Apple has been signaling it might be obtainable within the coming months,” he advised The E-Commerce Occasions.

Selling Monetary Wellness

Apple’s purpose is to construct instruments that assist customers lead more healthy monetary lives, in response to Jennifer Bailey, Apple’s vp of Apple Pay and Apple Pockets, in a press release saying the checking account deal.

“Financial savings helps our customers get much more worth out of their favourite Apple Card profit — Day by day Money — whereas offering them with a simple approach to save cash every single day,” she stated. “Constructing Financial savings into Apple Card in Pockets allows them to spend, ship, and save Day by day Money instantly and seamlessly — all from one place.”

That may be a important alternative as the speed is greater than 10 instances the nationwide common, Apple boasted. It primarily based its declare on the FDIC’s printed Nationwide Charges and Charge Caps for financial savings deposit merchandise, which it stated was correct on March 20, 2023.

“So far as rates of interest go, the 4.15% price is center of the pack. Increased and decrease charges can be found elsewhere,” Charles King, principal analyst at Pund-IT, advised the E-Commerce Occasions.

Apple Financial savings Highlights

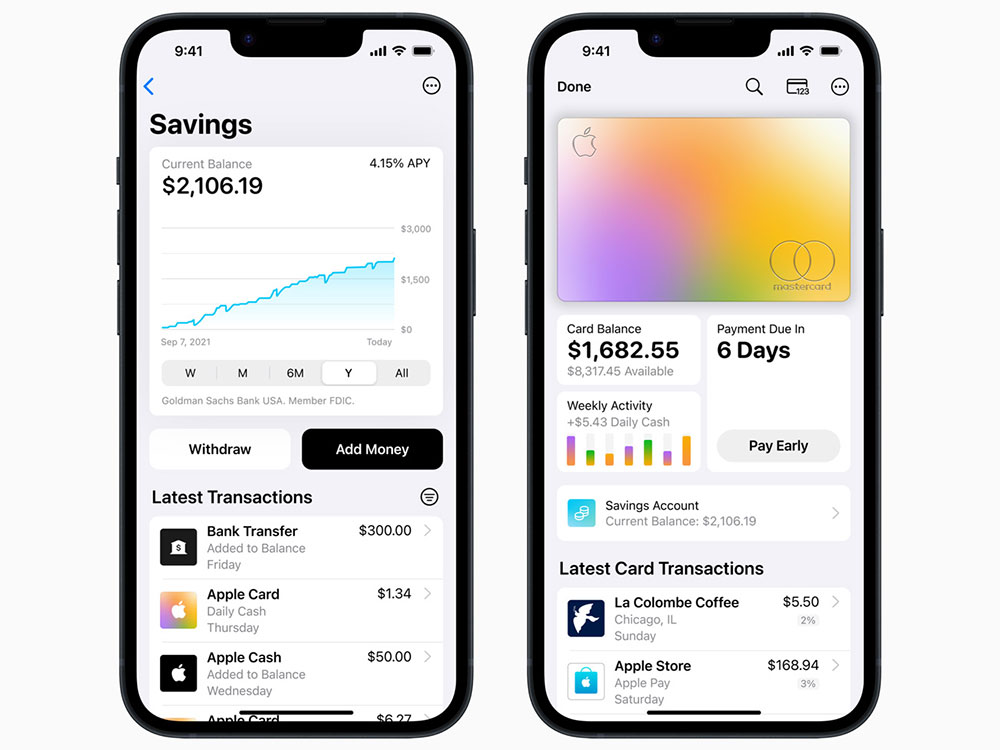

The account, which is tied to the consumer’s Pockets app, comes with no charges, minimal deposits, or minimal steadiness necessities. Establishing the account and managing financial savings is on the market instantly from Apple Card in Pockets.

Apple Card customers can robotically deposit their Day by day Money right into a high-yield financial savings account from Goldman Sachs. (Picture Credit score: Apple)

For comparability, the financial savings account idea resembles the Goldman Sachs Marcus account, which provides a 3.9% yield with comparable flexibility.

All future Day by day Money that customers earn can be robotically deposited into the account. Account holders can change that vacation spot time.

They’ll deposit further funds into their financial savings account by a linked checking account or from their Apple Money steadiness. There isn’t a restrict on how a lot Day by day Money customers can earn.

A financial savings dashboard within the Pockets lets customers observe their account steadiness and earned curiosity. The dashboard additionally gives entry to withdrawing funds at any time by transferring them to a linked checking account or their Apple Money card.

The financial savings account requires not less than iOS 16.4 and comes with a number of limitations. For example, a cap of $250,000 exists, and cash transfers to or from Apple Money have to be between $1 and $10,000. Additionally, there’s a weekly restrict of not more than $20,000 on transfers.

Little Disruption to Banking Business

Apple’s present monetary advertising and marketing efforts appear to pose little fear for rivals, famous King. He doesn’t see the Goldman Sachs/Apple deal having a lot of an influence on the banking trade as a complete.

“Total, SVB’s [Silicon Valley Bank’s] failure was largely resulting from its executives’ incapacity to handle danger correctly. That stated, the deal could give Goldman Sachs some respiration room after the embarrassing losses from its Marcus on-line client banking providing earlier this 12 months,” he provided.

King famous that the extra important deal influence would most definitely be with avid Apple followers and may additionally attraction to some youthful customers who’ve little curiosity in or use for standard banks.

“It’s price noting that the service solely works with the most recent model of Apple’s iOS. If an iPhone improve is required, I count on many potential prospects will ignore it and get on with their lives,” he noticed.

Goldman Sachs Losses

Apple’s relationship with Goldman Sachs might be extra in play, in response to Vena. That banking partnership started with Apple’s preliminary card launch a number of years in the past.

“It has been considerably tenuous, presumably over the very powerful phrases that Apple demanded,” he famous.

Goldman Sachs had posted over $1.2 billion in losses within the first 9 months of final 12 months, primarily pushed by the mortgage loss provisions over the Apple Card, defined Vena. This new program might exacerbate these losses for Goldman Sachs because the financial savings account portion provides a sexy 4.15% yield.

Apple’s means to draw extra customers will seemingly strengthen as a result of this system’s financial savings account portion has a sexy rate of interest, and it’ll most likely give Apple further ammunition to fund promotions and particular provides, he added.

“[That] might be notably compelling for Apple given a possible upcoming recession, to not point out that Mac gross sales have dramatically slowed like the remainder of the PC market,” Vena noticed.

Cybercrime Goal, Safety Measures in Place

Cybercriminals are likely to pursue engaging targets, together with customers’ financial institution accounts. So Apple prospects making an attempt this newest monetary providing ought to preserve their eyes on hacking indicators in addition to greenback indicators.

“It’s seemingly that these accounts will make engaging targets,” warned King.

Nonetheless, Vena sees that as much less seemingly as Apple’s current safety procedures and equipment on its bank card are best-in-class.

“I don’t see any publicity for Apple or its customers any extra important than different banks,” he stated.

Market Share Win Uncertain

King doubts that this service will considerably influence Apple’s total market share.

“It’s, at greatest, an ancillary enterprise that might enhance the stickiness of Apple’s relationships with some prospects,” he stated.

Vena considerably agrees. Apple’s new financial savings account deal will seemingly shield the corporate’s share. Nonetheless, he isn’t positive it’s going to assist dramatically improve its total market share given the corporate’s premium value technique throughout most of its merchandise and options, particularly in difficult financial instances.

“Having stated that, this program might be a significant benefit if it elects to get extra aggressive with its pricing,” he predicted.