We’re in very fascinating occasions at present. It’s uncommon to see so many tectonic shifts taking place in actual time: Excessive rates of interest, declining fairness values, SVB and different banks failing with a continued contagion danger and a recession looming.

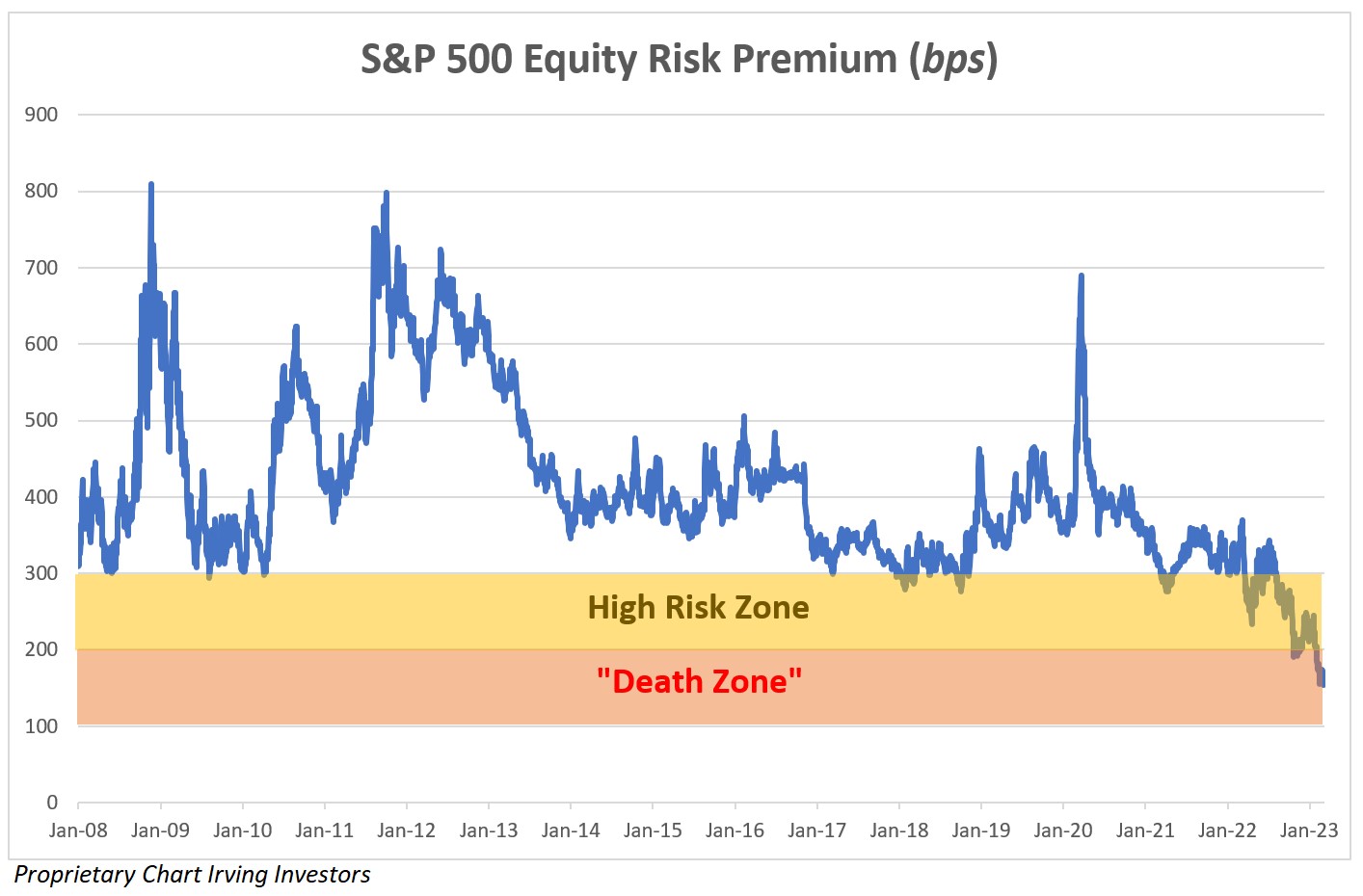

There was an aggressive shift in assumed fairness returns in comparison with mounted earnings returns. The info tells a transparent and excessive story.

Merely put, fairness danger premiums (ERPs) have damaged down nicely beneath the ranges that have been established since 2008. The ERP calculates the projected S&P returns versus the returns of 10-year treasury payments (knowledge from Morgan Stanley).

The beneath chart is necessary to the startup viewers as a result of it speaks to why fundraising is extraordinarily difficult proper now and why valuations are coming down so dramatically. Alternative price is highly effective certainly.

For the enterprise world particularly, this dynamic is compounded by the enterprise debt markets cooling, which in flip makes fairness probably the most viable possibility for many.

Picture Credit: Irving Buyers

The components at play

Ready for a rebound in public market multiples to protect earlier valuations has not confirmed to be an excellent technique.

Enterprise capital exercise has declined

Deployment of VC capital continues to decelerate. SVB measured the influx and outflow of deposits by a metric referred to as whole shopper funds (TCF), which has been unfavourable because the first quarter of 2022 (5 straight quarters now).

This pattern is continuous in 2023: VC capital deployment declined one other 60%, and deal rely has dropped about 25% from a 12 months earlier.

Declining enterprise exercise mixed with dropping ERPs is a transparent sign that there must be a cloth correction in personal tech firm valuations. Nevertheless, anecdotally, we’ve seen that personal firm valuation expectations have remained lofty relative to apparent public comparables.