Sculptor Capital Administration (SCU) (~$500MM market cap) might be extra acquainted to most by their previous title, Och-Ziff (OZM was the previous ticker) or OZ Administration, however the storied hedge fund supervisor (one of many first different managers to publicly checklist pre-GFC) has run into robust occasions in recent times. There was a bribery scandal within the mid-2010s that noticed the agency pay over $400MM in fines and in newer years a public succession spat between founder Daniel Och and present CEO/CIO Jimmy Levin over Levin’s pay package deal.

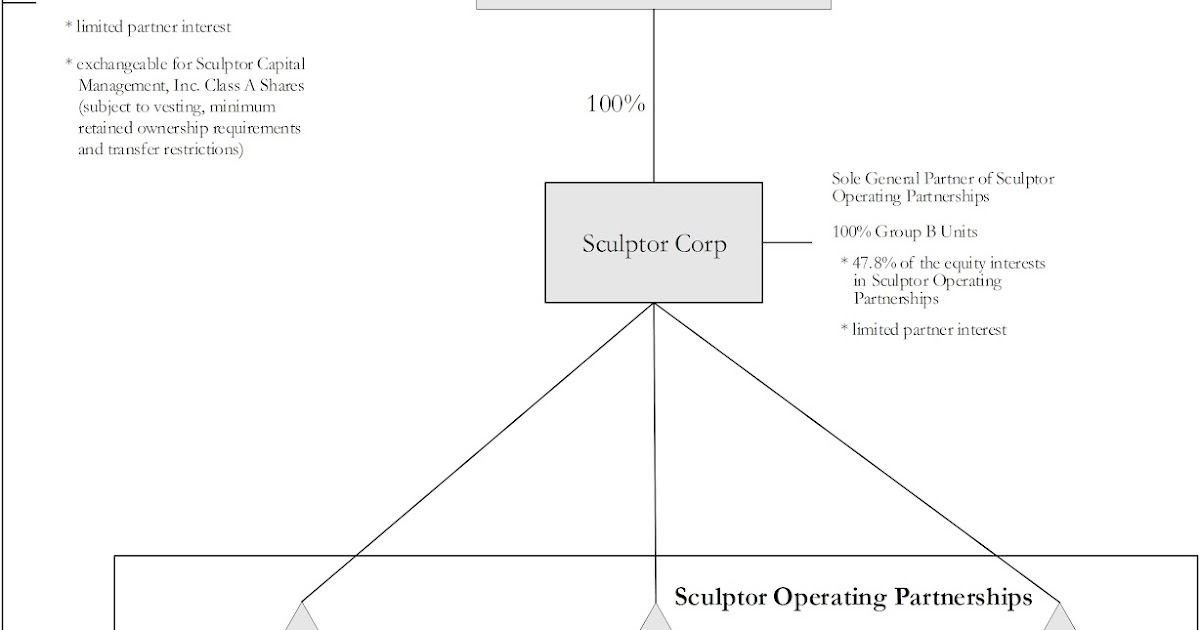

Sculptor at this time has roughly ~$36B in belongings beneath administration, roughly half of which is in CLOs which have decrease administration charges, with the remaining in a mixture of their flagship hedge fund, actual property and different methods. The publicly traded entity is a holding firm that owns partnership models within the working partnership (see the under diagram) which creates confusion across the share rely and possession percentages of the events concerned.

Och left the corporate in 2018, however continues to personal a chunk of the working partnerships and controls ~12% of the vote (Levin has ~20% of the vote) by the B shares. B shares have no financial curiosity within the publicly traded holding firm, however are supposed to match the financial curiosity within the working partnership (in the event you squint, its one share one vote), in the event you see it reported that Och owns lower than 1% of the corporate, that is simply the publicly traded SCU shares. He is presumably nonetheless a big proprietor of the enterprise, which makes the present scenario awkward and definitely would not assist capital elevating efforts. Och would not need Levin operating what he views has his firm, and Levin would not need Och proudly owning a chunk of what he views as his firm.

In October, Och despatched a letter to the board, the important thing excerpt:

I, in addition to different founding companions, have been contacted by a number of third events who’ve requested us whether or not the Firm could be open to a strategic transaction that will not contain present senior administration persevering with to run the Firm. It’s not stunning that third events would see the potential for such a transaction on condition that exterior analysts have beforehand recognized the Firm’s administration points and concluded that, at its present buying and selling value, the Firm could also be value lower than the sum of its elements.

Shortly after, Sculptor’s board responded that they are at all times open to 3rd celebration affords. The forwards and backwards went on from there, on 11/18 the board fashioned a particular committee, presumably there’s an effort being made to both promote the administration firm in entire to a 3rd celebration or Levin taking it non-public and out of Och’s palms, or presumably some mixture the place the CLO enterprise will get offered to a 3rd celebration and the remaining enterprise is taken non-public.

What may it’s value? The financials are fairly complicated right here, there’s quite a lot of working leverage within the enterprise, excessive fastened prices within the type of giant minimal bonuses, the enterprise is not one you’d contemplate being run for the shareholders first. Final yr was a tricky yr, the flagship fund completed down mid-teens, however a few quarters again, Levin outlined the next “run-rate” expectations for the enterprise:

At this time, we have now significant earnings energy, and we usually take into consideration this in 2 buckets. First bucket, administration charges much less fastened bills or, stated otherwise, earnings with out the impression of incentive earnings and the variable bonus expense towards that incentive earnings. And the second is inclusive of that incentive earnings and that variable bonus expense towards it.

So within the first bucket, we have a look at it as administration charges much less fastened expense, and this went from a meaningfully destructive quantity to what’s now a meaningfully constructive quantity, and that is the easy results of a few issues. It is rising administration charges whereas lowering or sustaining fastened bills. And the expansion within the administration charges comes from the circulate dynamic we mentioned, and it comes from compounding capital inside our evergreen funds. And so the place that leaves us at this time is simply shy of $1 of earnings per share from our administration charges much less fastened bills.

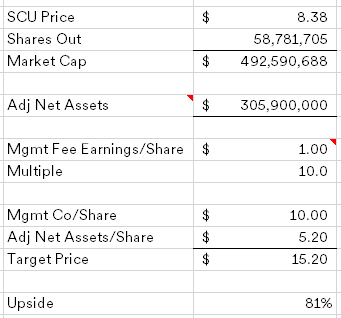

Various managers are sometimes valued on base administration charges, incentive charges are sometimes lumpy and shared closely with the funding staff. If we’re attempting to derive a non-public market worth, $1/share of administration charges is a pleasant spherical quantity to make use of. Most different managers commerce for a high-teens a number of of administration price earnings, however we’ll low cost SCU right here to 10x to account for the hair and previous status. Additionally a third-party could be fearful that belongings would flee with out Levin within the CEO/CIO seat.

Sculptor’s stability sheet is in pretty fine condition, with $250MM in money and ~$150MM in investments of their funds, backing out the remaining $95MM time period mortgage will get you to $306MM of internet belongings. Placing all of it collectively, I get one thing round $15/share for SCU versus a present value under $8.50.

I am over simplifying issues right here, I may very well be making an apparent error, however the present construction would not appear to work for Och, Levin or the enterprise. Some company motion must occur and there is loads of candidates that will have an interest on this enterprise. If the established order prevails for some cause, the inventory appears low-cost anyway, the corporate appears to agree as effectively, they’ve spent $28.2MM of a $100MM inventory repurchase authorization (vital in comparison with the Class A float) as of their Q3 earnings.

Disclosure: I personal shares of SCU