Authorization and seize are two of the parts that make up cost processing. And whereas an automatic method is usually the default, typically it could be vital to make use of guide authorization and seize.

What’s at stake?

Getting paid.

As you’re about to see, in sure kinds of gross sales transactions, receiving the shopper’s cost isn’t all the time easy. Managing this course of correctly can make sure you’re in a position to correctly obtain what you’re owed whereas minimizing friction for purchasers.

This text will enable you decide whether or not automated or guide authorization and seize is greatest on your on-line enterprise, and learn how to use it. Let’s start by clarifying these phrases.

What’s authorization and seize?

These two distinct occasions happen at any time when a buyer initiates a web based cost utilizing a bank card. Most often, they occur on the identical time. However they don’t need to, and in some conditions, you because the service provider might need to separate them relying on the use case.

Authorization

Authorization occurs when the cost processor contacts the cardholder’s financial institution to confirm that they manage to pay for to cowl the costs owed, and that the cardboard is energetic.

At this level, the funds haven’t but transferred from the shopper’s financial institution to the enterprise, however they’re, in essence, reserved for that function.

Authorizations are momentary. Sometimes, they expire after seven days, which implies no cash modifications fingers if the seize course of doesn’t start earlier than expiration.

Seize

Seize, often known as the settlement of the cost, occurs when the cash really modifications fingers between the shopper’s financial institution and the service provider. Your financial institution instructs the cost processor to gather funds from the shopper’s financial institution and switch them to your account.

The place do authorization and seize sit inside the cost course of?

These processes sometimes start instantly after the shopper clicks the button to make a cost for his or her order. That is true whether or not you utilize WooCommerce Funds or another cost processor.

By default, these two processes occur on the identical time, and that’s greatest for many companies. However for sure use circumstances, as you’re about to see, it’s essential to separate them into distinct occasions.

Handbook vs. automated authorization and seize

Earlier than we take a look at separating them, let’s make sure you perceive your selections.

When authorization and seize occur on the identical time, they’ll all the time be automated.

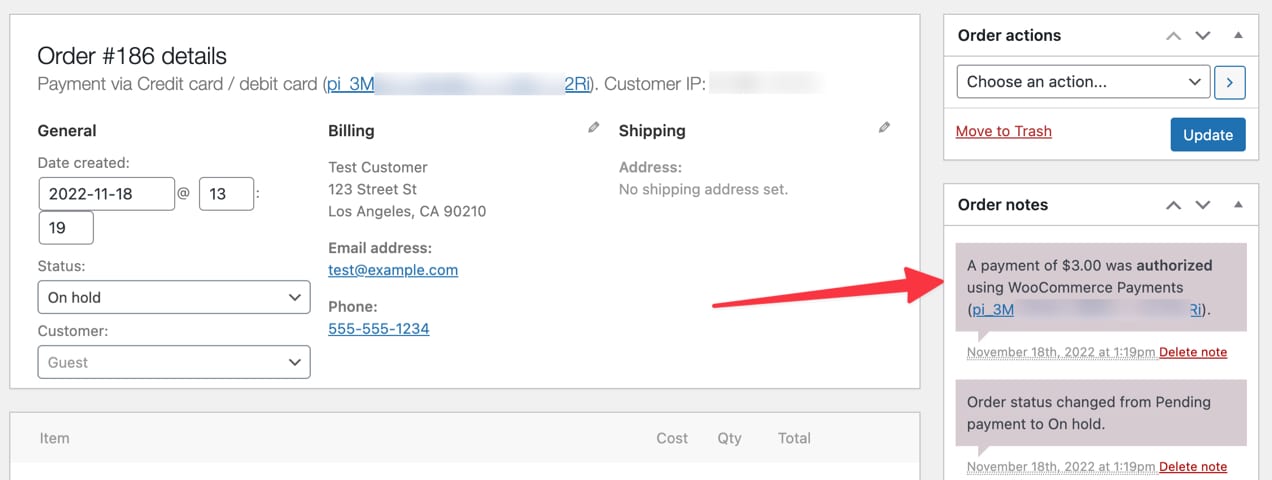

However if you wish to separate them into two distinct occasions, you can also make the seize course of guide. In that scenario, you would need to go into your cost processor and manually provoke the seize course of. For WooCommerce Funds, you may allow this inside the admin settings.

When is guide seize useful?

Let’s take a look at some situations that can assist you see when utilizing a guide seize course of may be a wise technique for what you are promoting.

Fuel or petrol

Whenever you replenish your fuel tank, the authorization course of occurs earlier than you will have pumped any fuel. The gas firm authorizes your card after which permits you to pump, but it surely doesn’t seize the costs but as a result of it doesn’t understand how a lot fuel you’ll purchase.

Motels

In most resort transactions, the visitor’s card will get approved earlier than or at check-in for an estimated quantity primarily based on the variety of days they’ve reserved the room. However the seize course of normally occurs at checkout, when the precise quantity owed is understood.

Gear rental companies

Particularly with costly tools, most corporations will authorize the shopper’s card earlier than giving them the merchandise to be rented. This ensures they’ll cowl the costs. Some companies authorize cost for the precise worth of the merchandise, not simply the rental price, in case it will get broken or stolen. Then, when the merchandise is returned, the precise quantity to be charged is captured.

Artisans

Many artisans do customized work and their costs range from job to job. Oftentimes, the ultimate quantity to be charged isn’t recognized till the work is accomplished, particularly if the labor is charged by the hour. Typically they might need to authorize and seize a part of the cost up entrance, after which do the remainder as soon as the job is full.

With these examples in thoughts, you may start to think about situations in your individual enterprise when separating seize from authorization could also be vital.

If you happen to’re simply filling on-line orders for merchandise after which delivery them, you sometimes gained’t must separate authorization and seize. However any time the ultimate quantity of cost isn’t recognized up entrance or the product is shipped at a later date, you could must authorize cost first, however not essentially seize it on the identical time.

Handbook seize disadvantages

There are some dangers with guide seize. Let’s overview a number of issues to be careful for.

First, you may’t seize greater than the quantity you authorize. You possibly can solely seize the identical or much less. So in case you’re unsure in regards to the remaining worth, authorizing up entrance places you susceptible to undercharging. So that you’d need to make a second cost, or cancel the primary one and restart the method with the upper quantity. Neither possibility will possible make the shopper joyful.

Second, the authorization expires after seven days. So, in conditions with longer wait instances between order placement and order success, in case you wait to seize cost till the order is fulfilled, you run the danger of the switch being declined. In that scenario, you could end up having shipped the product however unable to gather the funds.

Now, you’ll need to contact the shopper to restart the cost course of once more.

Because of this, except you will have a great cause to separate authorization from seize and perceive the dangers of doing so, you shouldn’t do it.

Lastly, guide seize is just potential with card funds, not native cost strategies or apps like Venmo.

Enhancing guide authorization and seize in WooCommerce Funds

Keep in mind, you may seize lower than you authorize, however no more. If you happen to’re doing the method manually, you’ll need to handle this inside your cost processor.

That’s one cause why WooCommerce Funds is simplifying the guide authorization and seize course of. Right here’s an entire person information for learn how to handle authorization and seize in WooCommerce Funds.

Greatest practices for managing guide authorization and seize

Listed below are a number of key tricks to keep in mind when utilizing the guide course of.

1. Don’t use guide authorization and seize with out a good cause

This provides friction to your website, will increase your workload, and places you susceptible to a few of the situations described above. If in case you have a great cause to make use of guide seize, then you definitely simply want to remain on high of it and also you’ll be high quality.

2. Authorize greater than you may must seize

As talked about, you may seize much less or the identical quantity, however no more than you authorize. So if the ultimate cost quantity isn’t recognized on the time of buy, authorize a better quantity than you suppose you’ll find yourself charging.

3. Don’t wait to terminate authorization of canceled orders

If the shopper cancels their order, don’t wait seven days for the authorization to run out. Cancel it instantly.

4. Examine your funds dashboard repeatedly

Particularly in increased transaction companies, you don’t need to miss capturing any cost in case you’re utilizing the guide method. So verify your dashboard constantly. Utilizing guide authorization and seize means you should construct this step into your routine.

And once more, in case you’re utilizing WooCommerce Funds, confer with this information for learn how to arrange and handle the authorization and seize steps within the cost course of.

WooCommerce Funds: streamlined flexibility on your retailer

A significant advantage of WooCommerce is your capability to connect with the applied sciences that greatest suit your retailer. With regards to getting paid, extra retailers than ever are turning to WooCommerce Funds for its ease of use and suppleness.

You possibly can take funds in 18 international locations and settle for greater than 135 currencies. Permit clients to make use of digital wallets like Apple Pay, lowering friction and boosting conversions. And lots of retailers can full transactions on the go along with the WooCommerce Cell App and card reader.

WooCommerce Funds integrates absolutely together with your retailer’s dashboard so you may handle the whole lot in a single place. No extra swapping tabs and logging out and in of accounts. Plus, it’s constructed and backed by the WooCommerce workforce and comes with precedence assist.