It may be difficult to determine how a lot to avoid wasting for retirement. Beginning to save as quickly as doable improves the probability that you’ll obtain your retirement objectives.

NewRetirement helps you construct a custom-made retirement technique at no cost. Premium instruments are additionally out there for in-depth planning and personalised help.

This NewRetirement assessment can assist you determine if that is the retirement planning device to enhance your saving technique. We’re making an attempt out the options so you will get a firsthand look.

Abstract

NewRetirement gives free retirement planning instruments that may fulfill most customers. The premium plan and monetary advisor packages present personalised help.

Execs

- Largely free

- Fast setup

- In-depth retirement instruments

Cons

- Restricted account syncing

- Fundamental month-to-month funds instruments

- No cell app

What’s NewRetirement?

NewRetirement supplies free and paid retirement planning instruments that may provide extra perception than your dealer’s retirement calculator.

A few of the NewRetirement options embrace:

- Customizable retirement planner

- Customized teaching strategies

- Detailed graphs and charts

- Internet value tracker

- Monetary advisor packages

It takes lower than ten minutes to finish a primary questionnaire to venture your retirement progress. You may customise your responses after the preliminary assessment to fine-tune your plan.

The retirement planner is extra like a budgeting app than an funding monitoring app like Empower. Nevertheless, NewRetirement doesn’t hyperlink to monetary accounts until you improve to the paid PlannerPlus model.

The one-on-one monetary advisor periods additionally require a purchase order. That mentioned, many of the platform is on the market with their “perpetually free” membership.

Who Ought to Use NewRetirement?

The free platform generally is a good choice for anybody who’s not sure if they’re saving sufficient for retirement. You also needs to contemplate this platform if you would like a customizable retirement planner.

Upgrading to the NewRetirement PlannerPlus consists of real-time internet value monitoring and cash simulators.

You will get personalised strategies and rent an on-demand monetary advisor for one-on-one planning periods.

Is NewRetirement Secure?

NewRetirement makes use of bank-level safety to guard your knowledge. The corporate makes use of a third-party service (Plaid) to connect with financial institution and brokerage accounts with out storing the data on their server.

You additionally gained’t get annoying cellphone calls encouraging you to improve to the paid model like you’ll with different corporations. Should you solely wish to use the free model, you are able to do so hassle-free.

NewRetirement Pricing

NewRetirement gives 4 pricing choices, starting from free all the way in which as much as $999 yearly. Right here’s a breakdown of every choice.

Fundamental

Annual price: $0

The default account choice is the Fundamental stage. This tier is free, and there isn’t an obligation to pay for any providers until you need entry to further options.

Free retirement planning instruments embrace:

- Interactive retirement calculator

- Teaching strategies

- On-line Fb group neighborhood

This plan doesn’t hyperlink to monetary accounts or observe your internet value in real-time.

Nevertheless, it enables you to shortly venture how a lot cash you may have in retirement and what steps you may take to enhance your odds of success. You too can replace your monetary metrics and see the potential influence.

All new members begin with the free planner. You may see how a lot data this membership plan supplies and determine if you wish to improve for full performance.

I personally suppose this plan is ample if you would like of a tough thought of your present progress. Nevertheless, being unable to customise your assumptions for the assorted components generally is a delicate frustration. For instance, I personal funding property and wish the paid model to report this.

PlannerPlus

Annual price: $120

The PlannerPlus tier has a 14-day free trial and prices $120 per 12 months.

Upgrading unlocks extra interactive options, together with:

- Hyperlinks to financial institution and funding accounts

- Budgeting device (over 75 classes)

- Create customizable situations

- Add optimistic and pessimistic assumptions

- State-specific tax calculators

- Medicare simulators

- Actual property tracker

- Roth conversion modeling

- Printable and downloadable experiences

- “What if” situations

PlannerPlus doesn’t present human monetary advisor entry. Nevertheless, the superior planning instruments and simulators can reply most of your questions.

There are additionally dwell Q&A periods that can assist you navigate the planning course of. The webinar host can reply your questions as you enhance your plan.

It is best to select this plan if you wish to monitor your financial institution and monetary accounts in actual time. The service can observe your internet value and account balances.

PlannerPlus Academy

Annual price: $270

With PlannerPlus Academy, you get to entry month-to-month private finance lessons and precedence product help. These advantages are along with the digital retirement planner.

The in-depth lessons cowl matters together with:

- Asset allocation methods

- Funds and expense planning

- Constructing an earnings plan

- Medicare and Socail Safety advantages

- Tax planning

A number of lessons are pre-recorded and you’ll watch them on demand. Academy members even have entry to unique in-depth dwell Q&A periods.

It’s possible you’ll contemplate this membership tier if you wish to enhance your private finance abilities and hone your retirement planning information at a self-guided tempo. This stage supplies respectable hands-on help however nonetheless doesn’t provide monetary advisor entry for superior assist.

Advisor

Annual price: Varies ($1,500 common)

You get entry to a Licensed Monetary Planner (CFP) with the Advisor tier.

The associated fee varies relying on the variety of on-line planning periods you request. On common, the everyday person spends $1,500 per 12 months in advisory providers.

It’s doable to begin with a free discovery session to to determine if this service is useful. If that’s the case, you pay a flat charge as an alternative of a proportion as most advisors cost.

The plan consists of:

- Discovery name: Free session to debate your monetary objectives

- Plan overview: Preliminary seek the advice of to assessment to agree in your plan’s knowledge factors and assumptions

- Plan of motion: The CFP creates a customized monetary plan

- Annual check-in assembly: A yearly assessment of the plan progress and to make adjustments

- Ongoing help: Limitless advisor entry for recommendation on totally different retirement matters

The service recommends this plan if you happen to’re inside 5 years of retirement or looking for recommendation on a pending monetary choice. It’s the one pricing tier to supply personalised monetary planning periods.

What Options Does NewRetirement Supply?

Listed here are a number of of the digital advisor instruments the platform gives.

Retirement Planner

The customizable retirement planner device is the cornerstone of NewRetirement. It covers a number of monetary components that influence your retirement technique, no matter if you happen to plan to retire early or later in life.

It takes roughly ten minutes to make a primary plan. Then, you may add additional data on the “My Plan” menu.

You may add and modify your particulars afterward as mandatory. This flexibility is sweet if you happen to don’t have all of the solutions proper now or uncover ignored areas in the course of the setup course of.

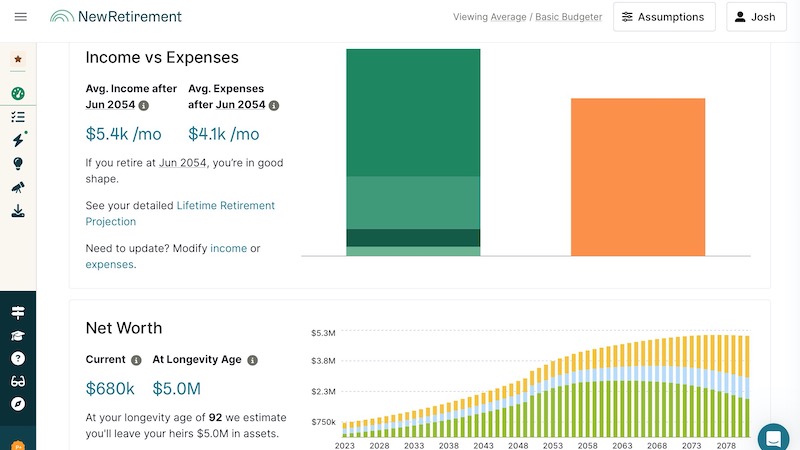

The projections show as a chart in your account dashboard. This chart initiatives your financial savings progress throughout your working years and annual retirement drawdowns.

The planner requests data for these matters:

- Present age

- Earnings

- Bills

- Financial savings stability

- Housing prices and residential fairness worth

- Medical bills

- Retirement advantages

- Property planning

General, the planner is simple to make use of. Here’s a take a look at essentially the most influential components.

Work and Different Earnings

This part calculates your annual earned earnings and passive earnings streams. The device also can ask the place you’ll retailer your extra earnings after paying your month-to-month payments.

Premium subscribers can venture annual wage will increase with an optimistic and pessimistic projection.

Bills and Inflation

The free model solely asks in your whole month-to-month bills, giant one-time bills and non-mortgage money owed. This calculation shortly compares your earnings to bills to venture your money movement and internet value.

PlannerPlus gives an in-depth budgeting device, however you should manually enter your bills for the 75+ classes.

You will have to make use of a full-fledged budgeting app to trace your precise spending in opposition to your month-to-month funds.

Paid subscribers also can use an inflation calculator to see how rising costs can probably cut back your spending energy in retirement. This device could be particularly useful with the current bout of generational-high inflation.

There’s a separate part for itemizing present debt funds. You may erase these as you get out of debt.

Financial savings and Belongings

Customers on the Planner tier can manually add the stability of their financial institution accounts and funding accounts, together with IRAs and 401ks. They will additionally add the worth of tangible property like automobiles.

Paid subscribers can hyperlink to their monetary accounts for easy monitoring.

NewRetirement makes use of this data to calculate your liquid internet value and venture future tax conditions.

Premium customers can add these particulars as effectively:

- Estimated annual return per account

- Tax therapy of funding beneficial properties

- Roth conversion calculator

Itemizing your present financial savings stability and financial savings fee makes it simpler to estimate your future nest egg measurement in your liquid property and various investments.

Social Safety

You may calculate your Social Safety advantages. PlannerPlus subscribers also can use a value of dwelling calculator.

The Social Safety Explorer device can run a number of situations to decide on one of the best age to begin drawing advantages. You too can see how this stipend performs into your overal technique to afford bills.

Annuities and Pension

Customers can add annuity and pension particulars, together with the profit quantity, cost-of-living adjustment and survivor advantages.

The service can observe month-to-month pensions and lump-sum pensions.

Should you don’t have an annuity but, NewRetirement gives a free session to find out if you happen to’re a great candidate for this account.

Withdrawals

How a lot of your retirement financial savings you withdraw annually could be as vital as saving in your golden years.

You may examine a number of withdrawal methods primarily based on:

- Spending wants

- Most spending

- Fastened proportion withdrawals

Solely the spending wants technique is on the market at no cost.

You would possibly improve to entry the fastened proportion withdrawal if you wish to observe the 4% rule. PlannerPlus subscribers also can mannequin transfers between accounts and see the influence on future withdrawals.

Dwelling and Actual Property

Your housing prices are one other vital consider estimating retirement prices. One of many onboarding questions is whether or not you personal or hire your major residence and the present month-to-month cost.

You too can embrace your present dwelling fairness in your major residence with the Fundamental plan. Upgrading is important to trace second houses, funding properties and venture future gross sales or acquistions.

PlannerPlus options embrace:

- Observe a number of actual property properties

- Mannequin future actual property purchases and gross sales

- Simulate mortgage refinancing or relocating

- Calculate property worth appreciation

It’s doable to run “what if” situations to forecast shopping for, promoting and refinancing properties.

Medical

All customers can enter present medical insurance coverage premiums and projected medical and long-term care bills in retirment.

Premium members can carry out these features:

- Estimate Medicare bills

- Lengthy-term care planning

- Mission medical therapy value inflation

It may be difficult to pinpoint medical prices throughout your retirement years when it’s nonetheless a number of many years away. I respect the overall assumptions and customizable situations to draft a practical plan and progress evaluation.

For instance, free customers can determine which Medicare plan they wish to use. They will additionally select how they plan on paying for long-term care, such specialty isnurance coverage or counting on a relative.

“What If” Eventualities

The “what if” simulator could be some of the priceless instruments as you may change many variables to estimate the potential influence in your retirement funds.

Some examples can embrace:

- Paying off debt or investing your additional earnings

- Early retirement vs. working till the usual age

- Property planning

- Monetary influence of relocating

- Switching asset allocation of investments

- Roth conversions

Contemplating a number of potentialities in the course of the planning course of can assist you select one of the best plan of action. Working these situations also can determine potential weak spots that may hinder attaining your objectives.

Insights

Inputting your data helps NewRetirement venture your financial savings progress. The outcomes show in a number of colourful graphs and charts.

These charts measure these matters:

- Projected age when financial savings will run out

- Complete financial savings wanted per 12 months

- Deliberate earnings and bills

- Internet value forecast

- Retirement withdrawals by account sort

The free charts make it straightforward to find out in case you are more likely to outlive your financial savings. If the service initiatives a deficit, chances are you’ll must contribute extra to a retirement account.

Premium subscribers can see superior charts that analyze particular accounts and venture estimated taxes utilizing the PlannerPlus Inspector device.

Monte Carlo Evaluation

Paid customers could benefit from the Monte Carlo simulator. This device runs 1,000 situations utilizing totally different funding, inflation and earned earnings assumptions to seek out the likelihood of getting sufficient cash for retirement.

This evaluation device supplies a extra in-depth glimpse on the optimistic and pessimistic conditions than the free insights.

Monetary planners sometimes run this evaluation when making your monetary plan. With NewRetirement, you may achieve comparable insights at an reasonably priced price by your self.

Improved Retirement Planning

Most retirement planning instruments solely calculate your present progress and suggest how a lot you need to save every month to realize your objectives.

NewRetirement gives a number of digital teaching choices to supply personalised steering.

Strengthen Your Plan

The Strengthen Your Plan device is a web-based schooling heart for various monetary and retirement matters.

A few of the matters embrace:

- Growing financial savings fee

- Maximizing Social Safety advantages

- Minimizing tax liabilities

- Opening a well being financial savings account

- Getting ready for recognized and unknown dangers

NewRetirement recommends related articles, methods and calculators all through the platform.

These matters can bolster your funds to keep away from outliving your money reserves and likewise to arrange for unknown bills and dangers.

Coach Options

The automated teaching device appears for gaps in your present technique. You will note strategies so as to add extra particulars for the service to evaluate your precise monetary scenario.

After getting into correct data, the teaching device could suggest further steps. Paid subscribers can have entry to extra suggestions.

Your retirement rating will increase as you full open strategies and as your financial savings trajectory improves. This rating is seen on the principle dashboard and different pages.

Communities

All free and premium members can be part of the NewRetirement Fb group. This on-line neighborhood lets customers work together with each other to speak in regards to the platform and basic finance matters.

Knowledgeable Assist

Customers can order a one-on-one session with a planning coach ensure their plan is ready up appropriately. You pay $175 and this isn’t an alternative choice to monetary planning however it might probably present peace of thoughts and take away errors and omissions.

The dwell Q&A periods at no cost and paid members are additionally useful for receiving detailed insights to enhance your plan and monetary information.

Buyer Help

You will get technical help by electronic mail and dwell chat. It’s vital to notice that it might probably take a number of hours to obtain a response by dwell chat.

NewRetirement gives an “Workplace Hours” video session on Thursdays the place customers can ask questions on navigating the platform.

The platform is simple to make use of. A number of video tutorials can be found that you would be able to strive earlier than contacting buyer help.

Customers should buy the Advisor bundle to get personalised monetary recommendation.

Positives and Negatives

As with every monetary service, you’ll need to pay attention to the advantages and drawbacks earlier than signing up. Listed here are the professionals and cons of NewRetirement.

Execs

- Free retirement planner

- Customizable assumptions for over 250 inputs

- A number of visible experiences

- Monetary advisor add-on packages

- No annoying cellphone solicitations

Cons

- A number of simulators require a paid subscription

- Solely PlannerPlus hyperlinks to financial institution accounts

- Budgeting device doesn’t observe transactions

The right way to Be a part of

Becoming a member of NewRetirement is simple and takes roughly eight minutes to make an in-depth plan or two minutes to finish a shorter registration course of.

The next steps are for finishing the in-depth registration. This selection extra correct and requires much less effort later.

1. Enter Private Info

After clicking “Create Free Account” on the NewRetirement homepage, you full a profile survey.

Enter your identify, age and deliberate life expectancy. There may be then a follow-up query to submit the identical particulars in your partner.

2. Enter Present and Estimated Earnings

The subsequent step is stating your present month-to-month earnings and estimated annual earnings till you attain retirement age.

You may fine-tune your lively and passive earnings streams after finishing the preliminary questionnaire. PlannerPlus members can outline a particular annual p.c change for a exact projection.

3. Mission Social Safety Advantages

The third part focuses in your estimated Social Safety advantages. NewRetirement initiatives your month-to-month cost primarily based in your age and earnings.

It’s doable to retrieve your data from the Social Safety Administration web site to acquire a extra correct calculation.

4. Enter Financial savings

Enter your whole present retirement financial savings and taxable financial savings balances. The service additionally asks in your month-to-month contribution quantity.

You will note a graph exhibiting your estimated financial savings earlier than answering the remaining questions.

5. Embody Pension Funds

Enter any pension funds you would possibly obtain in retirement.

6. Checklist Present Housing Prices and Dwelling Worth

Enter your present housing scenario and any dwelling fairness you could have in your major residence. You too can checklist your present month-to-month hire or mortgage cost.

7. Add Month-to-month Bills

The ultimate query asks in your month-to-month medical and family bills.

8. Go to the Dashboard

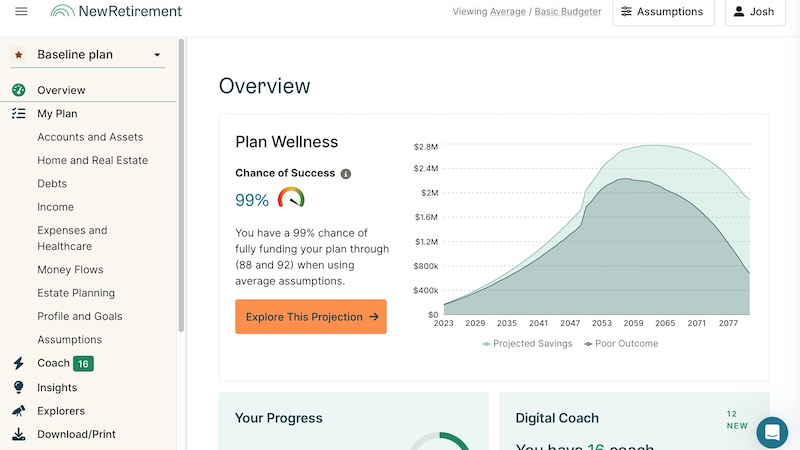

You’ll go to the dashboard after finishing the onboarding questions.

This web page shows the next particulars:

- Plan wellness rating

- Present internet value

- Estimated common month-to-month retirement earnings

- Estimated property worth

- Approximate age when financial savings will run out

It’s doable to extend your wellness rating by finishing coach strategies and bettering your monetary scenario to succeed in your objectives.

The dashboard stats will replace as you regulate the figures for the assorted matters.

Whereas some effort is important to foretell your retirement financial savings, this device can shortly recommend if you happen to’re on observe and spotlight areas which will want enchancment.

Abstract

NewRetirement is a strong retirement planning device. Its free options can shortly provide an in-depth take a look at your retirement technique and suggest useful adjustments.

These strategies could be notably useful as you’re determining when you may retire.

Upgrading to the PlannerPlus is reasonably priced and might present extra peace of thoughts. Most individuals will respect this tier’s customizable assumptions and state of affairs simulator The monetary advisor packages are additionally useful if you want hands-on steering.