Wanting again, I have to admit I by no means imagined reaching this sort of anniversary…however yeah, the Wexboy weblog turned 10 years-old earlier this month! A journey that kicked off with this Sirius Actual Property purchase (at an astonishing 0.31 P/B!) in Nov-2011. Which was clearly a stock-picking tour de pressure – noting SRE‘s been a 7-BAGGER+ since. Effectively, besides I by some means managed to distract/scare myself out of the place two years later…for a mere double-digit achieve! And possibly that’s the place this put up ought to abruptly finish, as a result of:

The one BIG lesson most traders nonetheless have to study is the best way to HODL!

However let me be clear up-front – that is not meant to be some lessons-learned victory-lap put up. As traders, we by no means actually know what’s coming down the street…subsequent yr might be a celebration, or a complete humiliation. And all of us make dumb errors, we repeat them, we stay with them & we lastly transfer on – nice traders simply make much less errors. And we are able to’t afford to get disheartened, or to relaxation on our laurels – nice traders (ought to) by no means cease studying & adapting ’til the day they lastly exit this nice recreation. To imagine/fake in any other case is to tempt the gods, which makes investing such a uniquely bizarre mixture of confidence…and humility.

That mentioned, this yr & final yr have been an accelerated studying expertise for me – as is presumably true for all traders (& everybody we all know). And sure, I do know I’ve promised to jot down about this – and hopefully share some optimistic learnings & helpful recommendation – notably in gentle of my precise FY-2020 & YTD-2021 efficiency. However I gotta admit, I preserve placing it off…as a result of now I desperately need & want it to be a closing epitaph for this (Zero-) COVID hell we’re nonetheless caught in. [Despite most of the world getting vaxxed since!?] So yeah, that’s clearly one thing I gotta work on…

However in the meantime, I’m thrilled I’ve truly managed to ship that distinctive & rarest of beasts…a public/auditable 10-year funding observe document through the weblog (& my Twitter account). I clearly don’t disclose the precise euros/cents of my portfolio, albeit my long-abandoned profession & my household’s safety/future clearly depend on it – which suggests return of principal is simply as vital to me as return on principal, in true family-office type – however readers & followers have at all times been in a position to assess my stage of conviction/danger tolerance through my particular % allocation in (disclosed) shares, and through (primarily real-time) monitoring of my (uncommon) incremental buys/sells in these shares.

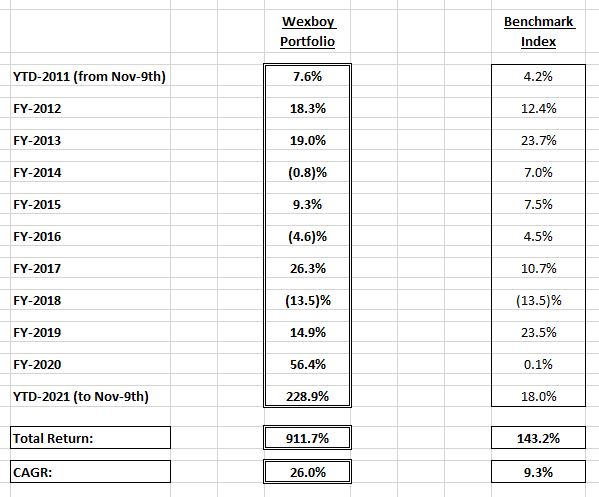

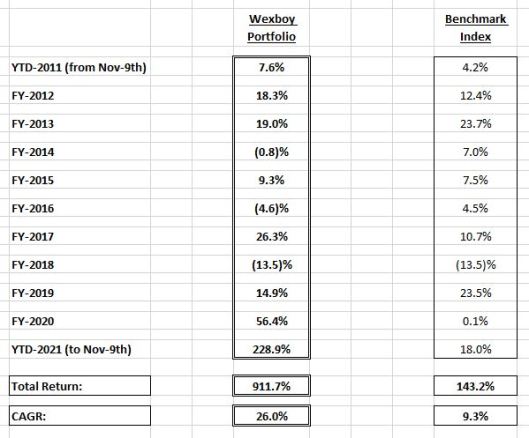

And in return, I’m way more proper now in seeing readers draw (& even share) their very own conclusions – privately, or publicly – from my stock-picking & funding observe document so far. To facilitate that, right here’s my annual returns…full with hyperlinks to my annual efficiency evaluation & precise stock-picks/funding write-ups for annually.

[NB: I should highlight this 2015 post, where I went back & scrubbed my 2011-2014 performance for consistency…but since it actually lowered my portfolio returns & raised my benchmark returns, we don’t need to rehash those adjustments here.]

[And for reference, this was my 5 year track record back in 2016.]

YTD-2011 (from Nov-Ninth): +7.6% Return

[Reduced from a +16.4% average return to reflect an actual weighted average return.]

FY-2012: +18.3% Return

[Reduced from a +20.2% return, primarily to reflect elimination of dividends.]

FY-2013: +19.0% Return

[Increased from a +18.4% return, to reflect corrected average stake sizes.]

FY-2014: (0.8)% Return

[Increased from a (1.3)% return, to reflect a return of capital.]

FY-2015: +9.3% Return

FY-2016: (4.6)% Return

FY-2017: +26.3% Return

FY-2018: (13.5)% Return

FY-2019: +14.9% Return

FY-2020: +56.4% Return

YTD-2021 (to Nov-Ninth): +228.9% Return

For reference, right here’s my H1-2021 efficiency put up:

Now let’s replace it to reach at a YTD-2021 (to Nov-Ninth) index benchmark return:

And right here’s my Wexboy YTD-2021 (to Nov-Ninth) Portfolio Efficiency, when it comes to particular person winners & losers:

[All gains based on average stake size & 09-Nov-2021 vs. end-2020 share prices. All dividends & FX gains/losses are excluded.]

That’s 33 disclosed portfolio buys over the past decade. Which can look fairly front-loaded (i.e. largely purchased again in 2011 & 2012), however that’s largely a operate of step by step introducing pre-existing holdings from my portfolio…to not point out, I’ve additionally purchased different new (undisclosed) holdings prior to now few years. So 33 buys over the course of a decade is pretty consultant of my investing (& low turnover) strategy – IRL, I usually joke my final ambition was at all times to remain house, veg out on my sofa, learn annual reviews & hopefully uncover a few nice corporations annually to purchase. So yeah, life is ideal…and yeah, I actually do imply that!

So right here’s my High 10 Winners:

[NB: *No longer quoted, or merged with another business/ticker. **Takeover, or liquidation.]

And my Subsequent 13 Winners:

Which leaves, exactly…my High 10 Losers:

KR1‘s the apparent #megamultibagger within the room. However that’s how markets & investing truly works…index/your web returns primarily come from a small fraction of shares, as Bessembinder reported some years again (& all VCs intuitively know!). And in case you’ve adopted me for some years, you’ll know I’ve at all times thought-about KR1 a #YOLO funding – i.e. a once-in-a-lifetime multi-bagger development alternative (at an absurd worth worth) in an rising foundational know-how/asset class – however NOT some YOLO wager, noting it was solely a 4.5% portfolio allocation for me initially of final yr. [Consistent with me recommending all investors should now consider a reasonable 3-5% allocation, via a diversified crypto investment company like KR1 (for example)].

Massive image although, I’m delighted I nonetheless personal 4 of my High 5 winners…I should be doing one thing proper, and eventually getting a little bit higher at this entire purchase & maintain factor! And even my different winner – Universe Group – was lastly acknowledged final week for its underlying M&A worth (thankfully, regardless of the astonishing 129% supply premium, I’d already extracted most of UNG’s worth again in 2015)! However this doesn’t change my underlying philosophy…whereas I’ve clearly centered on owner-operator high-quality development corporations extra not too long ago, paying a worth worth has constantly remained the important thing to my winners. This was even true of Google again in 2017 – simply after it grew to become Alphabet & simply earlier than it grew to become a SOTP play for everybody – I estimated the core search enterprise was on an underlying 15.5 P/E a number of (& continues to be low cost in the present day)! And the identical was true (for instance) of Apple, which I purchased (& posted about) forward of Buffett, however alas by no means formally disclosed as a Wexboy portfolio holding – ‘cos who wished to take care of the fan-boys, not to mention the haters on the time – I purchased it on an ex-cash 10 P/FCF a number of & it’s a 5-BAGGER since!

My win-loss ratio’s helped too – 23 out of 33 shares have been winners, a 70% win ratio, on the higher finish of the vary I’ve seen with {most professional} fund managers. Something greater is uncommon & would influence returns (presumably, through an arbitrage/event-driven technique), however I’d argue a decrease win ratio wouldn’t essentially restrict returns in the identical means…the truth is, perversely, concentrating on & accepting a a lot decrease win ratio might truly be the important thing to superior/best-in-class returns (once more, as any VC would argue)!? And in the meantime…they weren’t essentially multi-baggers, however I’ve additionally loved & exited shut to three in 10 shares through takeovers (primarily) & liquidations (that’s 8 winners & 1 loser out of 33 shares).

As for the wall of disgrace…all of us have losers, however the reply guys will like it anyway (& ignore the large winners), so knock yourselves out! My solely excuse (or lesson), is how troublesome it may be to combat world sector/macro tides – rising markets have been a (relative) misplaced trigger for the previous decade, however that didn’t cease me in search of out rising market losers. [Fortunately, my ‘New China’ bet via the VinaCapital Vietnam Opportunity Fund was a huge/winning exception – a reminder cherry-picking‘s long been the only viable alternative to increasingly absurd emerging/BRIC-type bucket investing]. For many of the final decade, the identical was true of useful resource shares…although clearly my quixotic (however small) tilt at micro-cap explorers/producers was remarkably silly in its personal proper! And total, my losers are a reminder how troublesome investing in small/micro-cap corporations with poor and/or intransigent administration might be, no matter worth/worth. The one saving grace is that I personal simply 2 of my losers in the present day – which possibly flip money-good with an precise sale/takeover, albeit that is by no means an amazing thesis to depend on – and looking out again at my exit costs (vs. the chance to take a position elsewhere), I undoubtedly don’t remorse promoting the remainder of my losers!

OK, let’s transfer on to the grand finale – however first, right here’s my benchmark index returns for the final decade. Observe my benchmark’s a easy common of the ISEQ, Bloomberg Euro 500, FTSE 100 & S&P 500 – which greatest represents my total portfolio – so I’ll escape these part indices too. No surprises there…the UK’s been dreadful, Europe was mediocre, whereas Eire truly made a powerful try and sustain with the US (albeit, a lot of its positive factors got here earlier within the decade):

And now, lastly, it’s an important desk of all of them…my Wexboy Portfolio returns over the past decade (vs. my benchmark index return):

And what an unimaginable journey & decade it’s been…ending up with a 10-BAGGER portfolio & a 26.0% pa funding observe document!

And that’s not even counting dividends, that’s an extra couple of % pa. After all, you possibly can argue my current/distinctive KR1 positive factors are diluted total…i.e. a 13.8% KR1 stake in 2020 is clearly extra impactful to my presently disclosed portfolio, than my total portfolio. However hey, when it comes to its real-world pound/greenback/euro influence, you possibly can wager I’m not sweating that distinction! And thankfully, I’ve loved different undisclosed multi-baggers in my portfolio – notably within the final two years – in Apple (per above), in luxurious & even in (crikey, a distinct segment/alpha-generating) property inventory!? To not point out, cellular/e-commerce shares – as referred to (obliquely) in my H1-2020 evaluation – one in all which turned out to be my third takeover inventory in simply 9 months & even (briefly) surpassed Alphabet in my portfolio!

So sure, total, I feel it’s truthful to contemplate this public/auditable observe document as fairly consultant of my precise whole (disclosed & undisclosed) portfolio returns over the past decade.

And right here’s to an amazing Xmas season – regardless of the lingering COVID angst – and the last decade forward! Might the street rise as much as meet you…