Are you searching for a strategy to make investments with out placing your whole cash into the inventory market?

Worthy Bonds will be the choice funding you’re searching for. You put money into small enterprise loans that earn 5.5% annual curiosity, and also you solely want to take a position $10 at a time.

The 5.5% annual yield is greater than the present financial savings account and financial institution yields.

Abstract

Worthy Bonds enables you to earn a pretty 5.5% annual return by investing in enterprise loans (together with to actual property builders) and solely requires a $10 funding. That is a simple manner so as to add to your mounted earnings.

Professionals

- Can put money into small quantities

- No early withdrawal penalties

- Non-accredited traders

Cons

- Taxed as peculiar earnings

- Not FDIC Insured

What’s a Bond?

A bond is a mortgage the place a enterprise or authorities is the borrower. Most traders put money into particular person bonds and bond funds by means of their on-line brokerage or 401k plan.

Additionally, some select to purchase financial savings bonds from the U.S. Treasury.

Every month, your bond funding will pay mounted curiosity funds till both the bond matures otherwise you promote the bond.

Worthy Property Bonds enables you to put money into small enterprise loans. Every bond prices $10 every and doesn’t have a minimal funding time period or maturity date. Subsequently, you possibly can redeem your bonds as quickly as you want the money for different priorities.

Every bond earns 5.5% annual curiosity though you obtain each day curiosity funds.

How Does Worthy Bonds Work?

Worthy is an investing platform and cellular app that began in 2016. They let traders profit from investing in loans to rising companies and actual property with out utilizing a financial institution.

This investing choice (into non-public credit score) was beforehand solely out there to “accredited traders” with a excessive annual earnings or liquid internet value. Worthy Property Bonds are open to all U.S. traders at the very least 18 years outdated (however bonds not at the moment provided or offered in Florida).

Investing into a personal credit score product will be riskier than a financial institution financial savings account. However your potential funding return is greater.

That’s how Worthy Bonds can supply a 5.5% annual yield.

In distinction, the best saving account yields are nearer to three%. Worthy Bonds will be riskier than the financial institution however remains to be a legit strategy to earn extra curiosity in your financial savings.

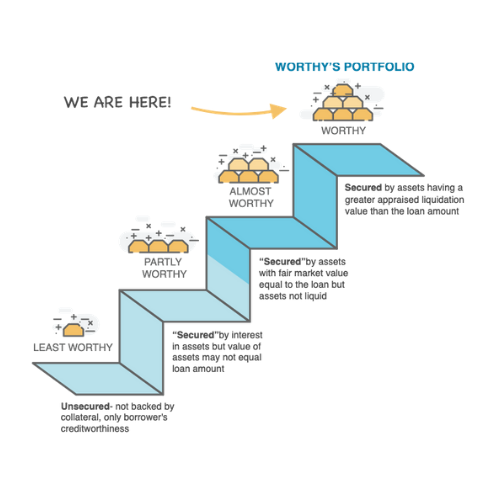

You put money into enterprise and actual property loans secured by belongings which are value greater than the mortgage worth.

In different phrases, Worthy ought to have the ability to entry the borrower’s money belongings to recoup the remaining mortgage principal, so your bonds don’t lose cash.

How Worthy Bonds works:

- You hyperlink a checking account and purchase bonds in $10 increments

- Worthy invests in enterprise loans (together with actual property) and expenses debtors an rate of interest greater than 5%

- You earn mounted each day curiosity funds with a 5.5% annual yield

No Preset Funding Time period

Not like most fixed-income investments, Worthy doesn’t have maturity dates or early redemption penalties. So, it’s doable to earn a set 5.5% curiosity yield to your complete funding interval.

This characteristic is a technique Worthy differs from financial institution CDs and peer-to-peer lending platforms that cost an early withdrawal price.

Observe: For those who’re a long-time Worthy Bonds investor, earlier choices had a 36-month maturity date however penalty-free early redemptions. The present providing of Worthy Property Bonds has an open-ended maturity date for max flexibility.

Are Worthy Bonds FDIC-Insured?

One other notable distinction between Worthy and your native or on-line financial institution is that Worthy isn’t FDIC-insured.

So in case your Worthy Bonds investments default, you possibly can lose your complete funding and by no means obtain reimbursement. Because of this, this funding choices shouldn’t exchange your federally-insured financial savings account.

However, regardless of this, Worthy Bonds is a legit firm. The bond choices are SEC reviewed and certified and the corporate is publicly reporting and independently audited yearly.

Account Sorts

Worthy Bonds solely gives taxable accounts.

Worthy Bonds solely gives taxable accounts. (Bonds can be held in an IRA) It’s essential to report your funding earnings in your federal and state tax return.

On a constructive observe, Worthy Bonds solely requires a $10 preliminary buy to your first bond.

You’ll obtain a Kind 1099-INT every year reporting your curiosity earnings. This way is just like those you obtain out of your financial institution, and different investing platforms.

Charges

There are zero charges to purchase or promote Worthy Bonds. Not paying an early withdrawal penalty makes Worthy Bonds distinctive. Different investing platforms we’ve seen cost a 1% early withdrawal price.

Who Can Make investments?

All U.S. residents and everlasting residents at the very least 18 years outdated with a U.S. checking account can put money into Worthy Bonds. Though at the moment no bonds are at the moment being provided or offered in Florida.

Investing Limits

Though Worthy Bonds is open to all U.S. traders, there are income-based investing limits. Resulting from securities rules, Worthy Bonds has completely different investing limits for accredited and non-accredited traders.

You’re an accredited investor for those who earn $200,000 yearly ($300,000 for married traders). Or when you’ve got a minimal $1 million internet value, not together with your house worth.

Most U.S. traders are non-accredited traders as a result of they don’t meet the earnings or internet value necessities.

The present Worthy Bonds investing limits are as follows:

- Non-accredited traders can make investments as much as 10% of their annual earnings or internet value, whichever is bigger.

- Accredited traders can make investments as much as $50,000 (5,000 bonds) on-line.

How one can Make investments

You must hyperlink your checking account to fund your funding account. Worthy solely lets you purchase bonds in $10 increments.

It takes between 4 and 6 enterprise days for Worthy’s fee processor to switch the funds out of your checking account and purchase bonds.

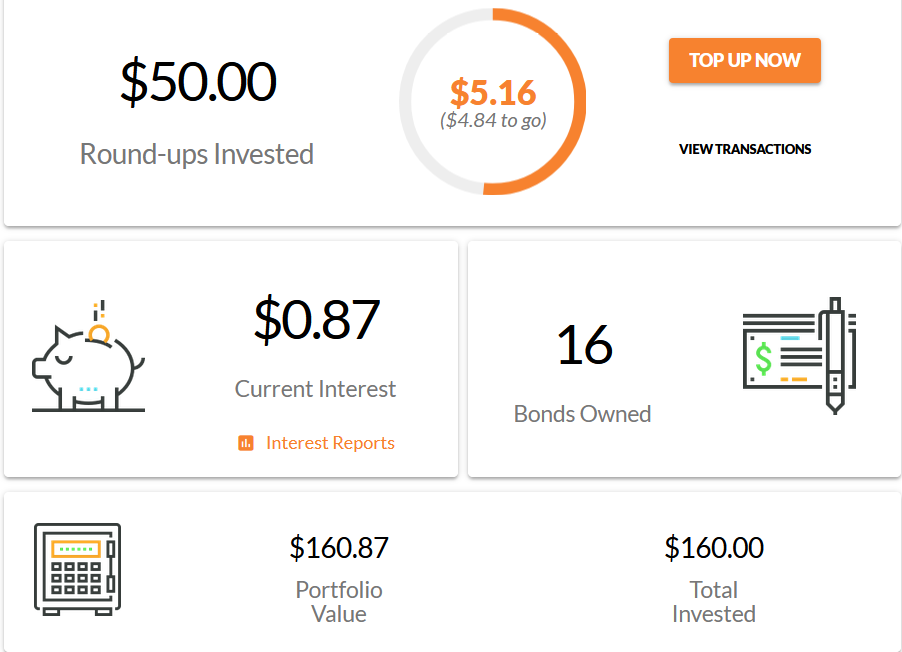

Worthy enables you to make one-time and recurring month-to-month contributions. You can too make investments small quantities of cash with the spending roundups out of your credit score and debit purchases.

Recurring Contributions

You can too schedule recurring weekly or month-to-month contributions in $10 increments. All withdrawals come out of your linked checking account.

Spending Roundups

Worthy Bonds may monitor your bank card and debit card purchases to trace the “spare change” from these transactions. For those who select this characteristic, they spherical every buy as much as the following greenback. then a brand new bond buy is triggered when your spare change round-up steadiness reaches $10.

As an illustration, Worthy rounds a $23.30 buy to $24 and invests the 70-cent round-up. A full-dollar transaction, like $15.00, would add a $1 round-up to the overall.

All money withdrawals come out of your linked checking account and by no means out of your credit score or debit card.

This round-up choice will be a simple strategy to make investments every time you spend cash. Plus, it will increase your investing frequency.

Incomes Curiosity

All Worthy Bonds earn 5.5% compound curiosity with mounted each day curiosity funds.

Associated: What Occurs When You Double a Penny On a regular basis For 30 Days?

Withdrawing Bonds

Worthy Bonds enables you to promote bonds at any time penalty-free. Moreover, prospects can entry and withdraw their curiosity at any time, penalty-free.

To entry your money, you have to promote the unique funding. An alternative choice is ready for the curiosity to reinvest and you may promote the brand new “curiosity bond” for a $10 withdrawal.

It’s essential to withdraw your complete principal quantity when redeeming, your bond so that is a technique Worthy Bonds are extra like a financial institution CD.

If it is a hindrance, a financial savings account or a bond ETF generally is a higher choice. With these varieties, you may make interest-only withdrawals with out touching your principal. (you possibly can with Worthy too – you simply mentioned this within the first sentence of this part?)

You promote your bonds in $10 increments. Then Worthy deposits the unique funding and uninvested curiosity into your checking account inside 4 to 6 enterprise days.

Are Worthy Bonds Protected?

There’s a component of threat to any funding. As an illustration, companies can go bankrupt. Inventory share costs can drop to $0.

Usually, Worthy Bonds are riskier than banks financial savings accounts and financial institution CDs.

Nonetheless, they are often safer than investing in shares whose share costs are extra risky and may even take years to get better from a steep worth decline.

With a 5.5% annual yield, Worthy Bonds will be thought of a much less dangerous funding. They’re a great choice if you wish to put money into bonds that don’t commerce on the inventory market.

Why Worthy Bonds Are Protected

The next causes present how Worthy Bonds are probably safer and riskier than different funding choices.

Asset-Backed Loans

Worthy states they solely put money into small enterprise loans which are “totally secured.” The mortgage quantity doesn’t exceed two-thirds of the enterprise’ internet value. These loans require asset and inventory-backed collateral.

If a enterprise stops making funds, Worthy can entry the borrower’s enterprise and private belongings to get better the remaining mortgage steadiness.

If these loans weren’t secured, then Worthy couldn’t use the borrower’s collateral to get better the mortgage steadiness. (traders will not be tied to particular person loans/debtors)

Regrettably, mortgage defaults are positive to occur. And Worthy could not have the ability to get better sufficient collateral to offset unpaid balances if a big variety of loans in a given portfolio default.

Put money into A number of Loans

Worthy invests in a number of small enterprise loans. Investing in as many loans as doable helps reduce threat to create a diversified portfolio.

Worthy Bonds are SEC Certified

Having their bond choices reviewed and certified by the U.S. Securities and Trade Fee means Worthy Bonds is a legit firm that should adjust to securities rules. Any credible crowdfund platform or inventory investing brokerage is SEC-registered.

Being SEC-qualified isn’t the identical factor as being FDIC-insured. Worthy isn’t a financial institution. If the bonds default and Worthy can’t recoup your authentic funding, you lose your remaining steadiness.

Potential Dangers

Like something, there are some potential dangers to contemplate.

Debtors Might Default

Worthy Bonds inherent market threat is that if too many debtors default on their mortgage funds. Default charges can enhance throughout a recession or if Worthy makes poor funding choices.

However this is similar threat you face for those who put money into small enterprise loans with one other crowdfund platform.

Can not See Funding Portfolio

Buyers can’t see the loans through which they’re investing.

Worthy solely states every mortgage is totally secured and doesn’t exceed two-thirds of the enterprise internet value. Additionally, Worthy expenses an rate of interest to borrower’s greater than 5.5%.

Though the shortage of transparency generally is a threat, banks don’t disclose specifics of their mortgage particulars to financial savings and CD account holders both.

Solely in Operation Since 2016

Whereas Worthy didn’t pioneer small enterprise mortgage investing, they’ve solely been issuing bonds since 2016.

Is Worthy Bonds Legit?

Sure. Worthy Bonds is a legit group that’s regulated by the SEC and has a 4.1 out of 5 rating on Trustpilot with 75 opinions.

Like all funding, Worthy isn’t risk-free. Worthy has solely been round since 2016 and hasn’t been “recession-tested.” Nonetheless it has been examined by means of the pandemic and faired effectively.

Carry out your due diligence and solely make investments cash in Worthy Bonds for those who really feel snug investing in enterprise or actual property lending.

Buyer Opinions

Listed here are a pair opinions from Trustpilot:

This has been a stable 5 % platform to date and I’ve not had any issues. I take advantage of this account to diversify my funding portfolio and it’s been exercise out to date. Nice buyer communication as effectively. They ship you month-to-month updates concerning the firm’s progress.

Mr. P

Their assist has been responsive, they’re making an attempt to be clear, however I imagine there must be a 30-60-90 day replace to traders. This was not marketed as a threat free funding, however was promoted as a secure strategy to construct your financial savings by means of “bonds”.

Jason C

Professionals

- Can put money into $10 increments

- No early withdrawal penalties

- All notes earn 5.5% annual curiosity

- Non-accredited traders can be part of

- Doubtlessly much less dangerous than inventory investments

Cons

- Curiosity taxed as “peculiar earnings” as a substitute of capital good points

- No retirement plans that reduce taxable earnings

- Worthy remains to be a comparatively new funding choice

- Default dangers enhance throughout a recession

Abstract

Worthy Bonds is a legit and reasonably priced strategy to earn mounted earnings. The 5.5% annual yield is best than the present financial savings account and financial institution CD charges.

It can be a great way to diversify your funding portfolio with out relying solely on the inventory market to earn passive earnings.

You shouldn’t put all of your cash into small enterprise loans. Nonetheless, Worthy Bonds generally is a pivotal passive earnings concept to diversify your funding portfolio and save for retirement.