Russia’s invasion of Ukraine and rising rates of interest dampened merger & acquisition (M&A) offers within the first half of 2022, however whilst firm valuations fall, the scale of transactions is rising in accordance with William Buck’s annual Dealmaking Insights Report 2023.

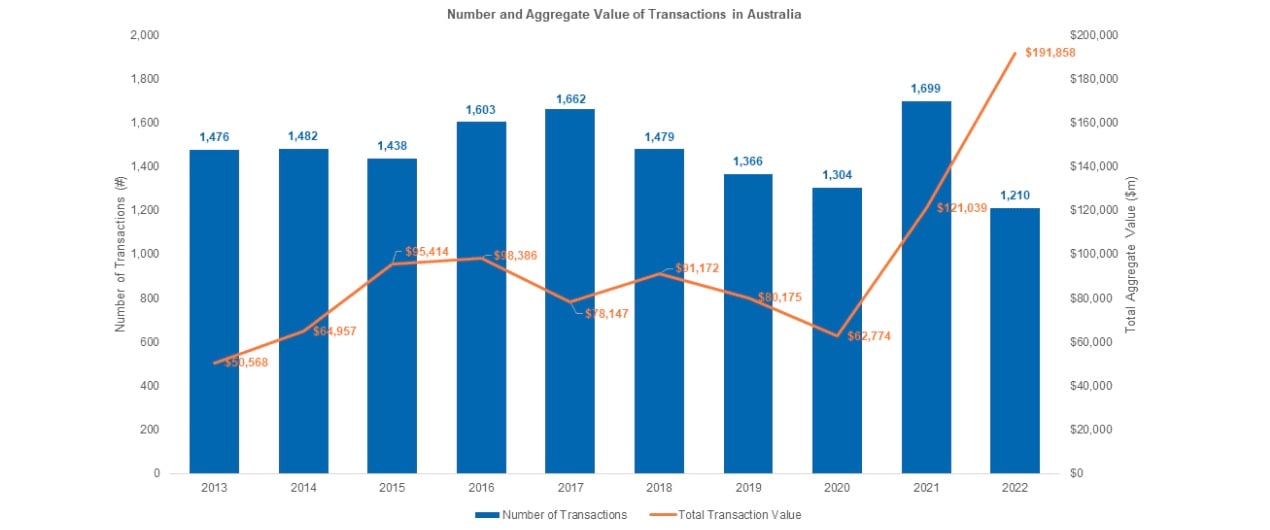

Australian M&A developments over the previous decade. Supply: William Buck

In 2022, the mixture worth of M&A offers in Australia elevated 59% on 2021 to $191.9 billion, the most important worth since 2007, regardless of quantity reducing 29%. The accountancy and advisory agency discovered, with extra above $250 million. However that file got here amid the bottom variety of transactions, at 1210, recorded over the ten years William Buck has been charting M&A exercise.

Australian enterprise capital funding fell by 41% year-on-year to US$4.5 billion, regardless of deal volumes remaining in line with 2021 ranges.

Mark Calvetti, head of company finance at William Buck stated the decline could be attributed to a tough adjustment interval as traders reset what they’re ready to pay for riskier firms on this macroeconomic setting.

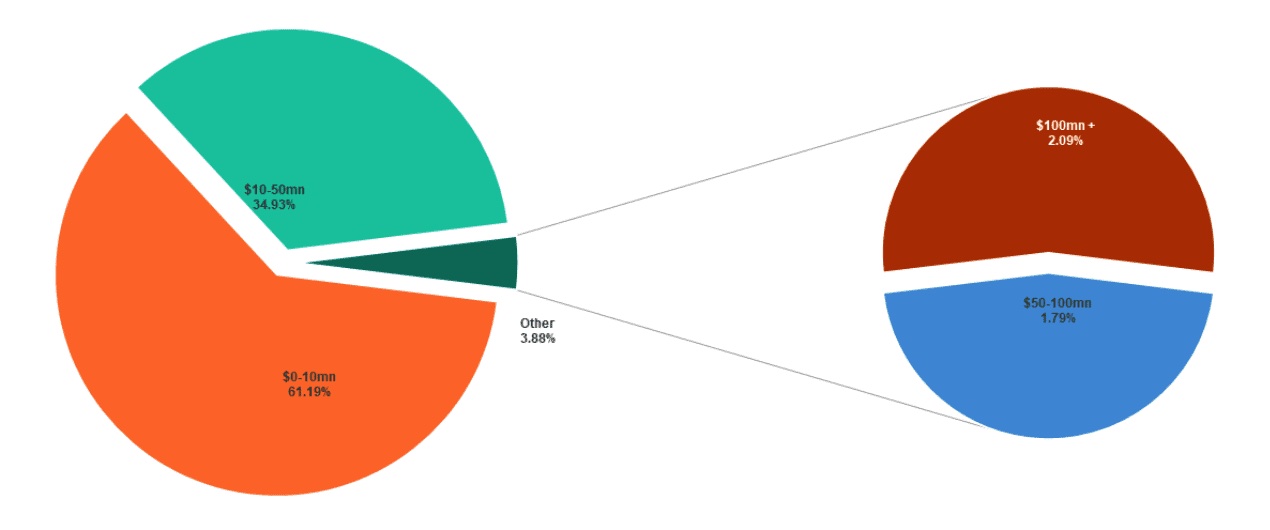

Of the 374 VC offers in Australia in 2022, 61% fell inside the US$0-10m deal band, indicating early stage is changing into extra favoured, as this space might carry out higher than different methods, with longer incubation durations offering an extended runway till the exit setting picks up once more. (

The strongest performing sector each in deal depend and worth was Info Know-how which accounted for 47% of the offers and had an combination deal worth of US$2.27 billion. IT far surpassed another sector in each deal depend and worth.

Australian enterprise capital developments in 2022 – the variety of offers by deal worth band. Supply: William Buck

Whereas elevated volatility final 12 months suppressed exercise within the share and IPO markets, with solely 79 IPOs accomplished and their combination worth dropping a whopping 91% from 2021 ranges to $1 billion. Weakened inventory markets and the underwhelming efficiency of many 2021 listings additionally deterred traders.

Whereas M&A exercise slowed from a frenzied 2021, it was nonetheless above pre-pandemic ranges – significantly within the first half of the 12 months by which 87% of the mixture worth of transactions occurred.

Many of the motion occurred forward of rising charges and struggle, with a lot of the offers already underway – Afterpay’s $39 billion acquisition by US fintech Sq. was the largest, having been introduced in late 2021.

William Buck’s Mark Calvetti stated he expects the worth of M&A transactions in ustralia this 12 months to lower from the file ranges achieved in earlier years.

“As the price of debt rises, the variety of ‘mega offers’ with a price of $250m+ will decline, resulting in a discount in combination worth,” he stated.

“Nevertheless, these transactions within the SME area with deal worth as much as $50m ought to stay regular and may even see a hike in quantity, particularly as many firms will depend on development by acquisition to complement softer natural development.”

After firms hoping to listing in 2022 as a substitute popped the prospectus again within the backside draw, Calvetti expects potential IPO firms to attend for funding in a decent market and listing within the second half of 2023.

“As a consequence of the frozen IPO exercise skilled in 2022, there are lots of potential firms ready to enter the market and entry funding,” he stated.

“If situations enhance within the second half of 2023, IPO exercise is anticipated to expertise a optimistic swing.”

Conversely, he expects the personal fairness (PE) market, which noticed a number of ‘mega offers’ above $250 million final 12 months, to stay comparatively resilient as PE companies transfer to focus on distressed belongings.

The complete Dealmaking Insights Report is accessible right here.