And on we go, one other 15 randomly chosen shares from Norway. This time, 4 of them made it into the preliminary watch checklist. Solely 80 shares extra to go….

181. Circio Holding

Circio Holding is a 6 mn EUR market cap Biotech that’s loss making and has renamed itself lately from Targovax. “Move”.

182. Borgestad

Borgestad is a 17 mn EUR market cap firm that manufactures and distributes refractory merchandise and likewise owns a shopping mall. The corporate appears to have seen higher days and is very leveraged. “Move”.

183. Pexip Holding

Pexip, with a market cap of 160 mn EUR, is a video conferencing know-how firm that was IPOed 2 monhts into the Covid lockdown 2020. The corporate was worthwhile till 2019, however loss making since 2020 which helps to elucidate that the inventory misplaced -80% for the reason that IPO. “Move”.

184. Yara

With round 8,9 bn EUR market cap, Yara is among the massive Norwegian Industrial teams and one of many largest ammonia fertilizer producers globally.

Usually, this can be a low margin, low return on capital enterprise, however with the Ukraine conflict, fertilizer bacame a scarce commodity final 12 months and Yara was nearly printing cash. Nvertheless, wanting on the chart, Yara appears to be a long run regular grower:

Issues appears to normalize in 2023 and in Q2 they really confirmed a loss on account of investory write-downs. Understanding that Ammonia manufacturing is among the largest CO2 emitters globally, it’s clear that Yara is dealing with challenges, nonetheless this additionally may flip into a possibility if the handle to be forward of the group. For me a inventory to “watch”.

185. Aurora Eiendom

Aurora is a 220 mn EUR market cap actual property firm that has been created and IPOed in 2021. They appear to personal principally procuring middle, which, shock, appears to not be a lot in favor proper now. The corporate is very leveraged as effectively. “Move”.

186. MPC Container Ships

Because the nam signifies, MPC is “a number one container tonnage supplier with a concentrate on small to mid-size containerships. Its major exercise is to personal and function a portfolio of container ships serving intra-regional commerce lanes on fixed-rate charters”. With a market cap of 700 mn EUR it isn’t small and has solely a small quantity of debt. In response to TIKR, the inventory trades at 2,3x P/E and a 35% dividend yield, which form of signifies that the ggod days in container delivery would possibly come to an finish. The inventory did greater than 10x since 2020. Not my space of experience, “move”.

187. VOW Inexperienced Metals

VOW Inexperienced Metals, with a market cap of 40 mn EUR, appears to be a Spin off of VOW ASA and focuses on the manufacturing of “biocarbon”. From what I perceive, this can be a CO2 impartial replacment to metallurgical coal used as an illustration in metal manufacturing. This seems like an attractive “local weather” story, nonetheless profuction hasn’t but begun, so it’s extra a enterprise case.

I additionally doubt slightly however the scalability, as competitors for Biomass feedstock is excessive and Hydrogen primarily based Inexperienced Metal manufacturing appears to be the extra scalable method. “Move”.

188. Eidesvik Offshore

Eidesvik is a 89 mn EUR market cap firm that “operates a contemporary fleet of extremely specialised offshore help vessels.” The corporate is worthwhile proper now, however has been loss making for 7 out of the final 10 years. “Move”.

189. Masoval

Masoval is a 260 mn EUR market cap Salmon farmer which nonetheless appears to be majority owned by a household and went public in 2021. The corporate made an enormous revenue in 2022 however appears to be loss making in 2023. As talked about earlier than, that sector appears “too exhausting” fro me, “move”.

190. Byggma

Byggma is a 100 mn EUR market cap firm “manufacturing and promoting constructing materials merchandise. The Group consists of 12 manufacturing vegetation and 4 gross sales comp. in Norway, Sweden, Finland, UK and US.”

Even in tremendous wealthy Norway, buildig is struggling and Byggma’s margin have been dropping in 2023. The chart seems extra like a provider of Covid exams than a builing supplies firm:

Byggma appears to supply principally wooden primarily based merchandise reminiscent of beams and home windows, but in addition lamps. The corporate appears to be managed by it’s CEO who owns nearly 90%. The debt load is kind of excessive and has elevated yoy considerably. “Move”.

191. Edda Wind

Edda Wind is a 220 mn EUR market cap firm that went public in 2021 and principally gives companies to the offshore wind trade. The corporate owns 6 ships and has comissioned extra that primarily function an off shore base for service private that’s required to keep up and restore off shore windfarms. In idea, the sector ought to develop for a while and enterprise needs to be nice because the vessels are in excessive deman. Income is rising, however the variety of shares is even rising quicker as capital will increase are required to finance the brand new ships, which meaybe explains why the shares are down ~-20% from the IPO.

Rising debt prices is clearly additionally a difficulty, however total this seems like one of many few delivery associated shares that might be attention-grabbing. In response to TIKR, the share value is ~0,75x tangible guide worth. “Watch”.

192. Magnora

Magnora is a 185 mn EUR market cap firm that “operates as a renewable vitality improvement firm. It primarily focuses on creating wind and photo voltaic photovoltaic (PV) initiatives.”

A primary have a look at the numbers present an odd image with a single digit P/E however a excessive 10x a number of on gross sales. The answer for that is that as a developer, they had been in a position to promote a mission with a big revenue in 2023. Overal, Magnora has a pipeline of round 6,7 GW with the bulk in PV initiatives. Up unitl 2018, they appear to have serviced additionally the oil trade however then centered totally on renewable vitality. Taking a look at he share value, this was a optimistic transfer:

In distinction to many different builders, Magnora has internet money which I discover attention-grabbing. As I just like the developer mannequin basically, I’ll put hem on “watch”.

193. Ayfie Group

Ayfie is a 8 mn EUR market cap nano cap providing “distinctive AI options” that appear to be so successfull that they simply needed to do a capital enhance. “Move”.

194. Odfjell SE

Odfjell is a 600 mn EUR market cap that “engages within the transportation and storage of bulk liquid chemical substances, acids, edible oils, and different particular merchandise.”

So that they principally personal ships and terminals which is an attention-grabbing mixture. The long run chart seems REALLY attention-grabbing:

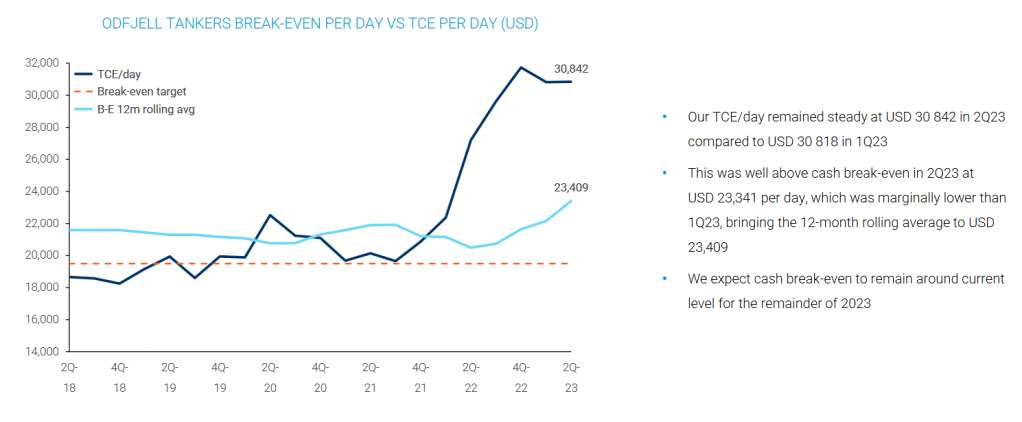

After a peak in 2005, the inventory did nothing for 13-14 years earlier than rising considerably simply prior to now few months. It appears that evidently costs have instantly elevated so much and translated into so much larger earnings for Odfjell. Nonetheless, I do not know how sustanable that’s:

I assume that this enterprise is once more “too exhausting” for me, so I’ll “move” depite the at present low valuation.

195. Selvaag Bolig

Selvvag Bolig is a 210 mn EUR market cap firm that develops residential properties in Norway. Growing residential properties in Norway is simlar tough proper now than elsewhere on this planet, which exhibits inthe share value:

Superficially, the inventory seems low-cost with a 6x P/E in accordance with TIKR. The bsuiness mannequin appears to be that they really purchase the land, however solely after 60% of the items have been pre bought. The corporate has fairly good reporting and a formidable monitor report:

The corporate appears to be nonetheless majority owned by the founding Selvaag household. General this might be an intersting guess on a housing restoration within the Nordics, subsequently I’ll “watch”.