Freshly motivated by Rob Vinall’s form reference, let’s kiss extra frogs within the Norwegian share market to see if we discover a princess or two.. I expanded the quantity of randomly chosen firms to twenty per publish as this enables me to complete the serieswith 4 posts total. This time solely two shares made it on the preliminary watch listing. Take pleasure in.

196. Attain Subsea

Attain Subsea is a 95 mn EUR market cap marine service firm that appears to focus on “subsea providers”, resembling pipeline expections, reservoir monitoring and so forth. So far as I undestand, these providers are largely geared in the direction of the oil and gasoline business.

The inventory has carried out very nicely since a close to loss of life expertise early 2020 and has made 5x since then:

The corporate appears to supply a few specialist vesssels and the most important shareholder is Wilhelmsen. 2023 to this point appears to be like vey sturdy and as web revenue additionally went up a lto, the inventory appears to be like nonetheless low-cost. Major negaitve level is that the enterprise appears to be very quick time period and the order e-book solely covers one quarter of gross sales. Navertheless, onte to probably “watch”.

197. Capsol Applied sciences

Capsol is a 60 mn EUR market cap firm that appears to have developed a know-how for “finish of pipe” carbon seize, the place CO2 is captured immediately from the exhaust pipes of a Biomass thermal energy plant.

They appear to make use of a know-how that’s completely different from opponents however have already got not less than a plant working and a few gross sales. The inventory has been IPOed into the hypi in October 2021 however solely misplaced -50% since then and gross sales have been rising (from a low degree) lately:

They do have a really complete quarterly report. Regardless of making losses, that is soemthing I wish to have a better lok at. “Watch”.

198. Aker Biomarine

Aker Biomarine is a 330 mn EUR market cap member of the Aker Group (78% owned by Aker) that accoring to Euornext is ” a biotech innovator and Antarctic krill-harvesting firm, creating krill-based elements for nutraceutical, aquaculture, and animal feed purposes. The corporate’s absolutely clear worth chain stretches from sustainable krill harvesting in pristine Antarctic waters via its Montevideo logistics hub, Houston manufacturing plant, and all the best way to clients around the globe. The corporate is devoted to enhancing human and planetary Well being.”

The corporate was IPOed in 2020 and has misplaced greater than -50% since then. The corporate in 2023 to this point is loss making.

I’ve to say that the enterprise mannequin assuch is so unique that I truly prefer it, alternatively it doesn’t sound like such an ideal enterprise mannequin as such. Due to this fact, I’ll “Go”.

199. Norwegian Air Shuttle

Norwegian Air shuttle is a 780 mn EUR market cap quick haul finances airline that’s the successor of bankrupt Norwegian Airways. It appears to be teh Nr. 4 budgest airline in Europe behin Ryanair, Easyjet and Wizzair. I don’t like airways as such and I’m not positive if being the No 4 in a crowded market will ever be a worth proposition, subsequently I’ll “cross”.

200, Hofseth Biocare

Hofseth is a 87 mn EUR market firm that “operates as a client and pet well being ingredient provider in Norway and internationally”. From waht I perceive they promote fish/salmon primarily based merchandise and have been loss making for a few years. “Go”.

201. Sparebank 1 Ostlandet

Sparebanken 1 Ostlandet is a 1,3 bn EUR market cap native financial savings financial institution, that similarily to different Norwegian financial savings banks is kind of low-cost and has performed fairly nicely over the previous few years. It’s majority owned by one other Sparebanken Organisation. Nothing for me, “cross”.

202. Lokotech

Lokotech is a 15 mn EUR market cap inventory, that simply modified its identify from “Harmonychain” and appears to be a disruptive microchip firm that intends to disrupt every and everybody with the assistance of AI. “Go”.

203. Polaris Media

Polaris is a 216 mn EU market cap media firm that owns conventional and digital media belongings. Schibsted appears to be a big shareholder, nonetheless in 2023 the corporate was loss making, is kind of indebted and the share worth appears to be like uninspiring. No angle right here for me, “Go”.

204. Baltic Sea Properties

Because the identify signifies, this 27 mn EUR market cap firm is aciv in Industrial actual property within the Baltics. Not precisely my space of experience, subsequently I’ll “cross”.

205. Scatec

Scatec is a 850 mn EUR market cap that develops and operates Renewable Power energy vegetation globally. The inventory chart appears to be like like if thery had on the facet developed a Covid Vaccine(which they after all didn’t):

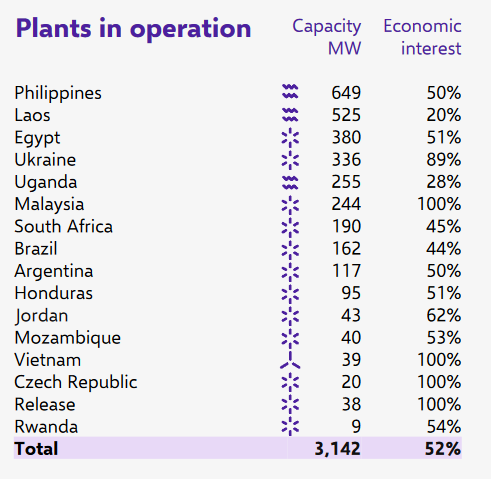

At first sight, Scatec appears to be like fairly low-cost, with a ahead EV/EBITDA of 9x. However, Scatec has loads of debt (20 bn NOKs or ~7x EBITDA. In addtion, the working belongings are in unique areas like Uganda, Philipies; Pakistan and so forth. That is the listing of working belongings:

As to e anticipated, operations in these international locations may be very risky, this yr the Philipine belongings carry out worse than anticipated. Though I do like Renewable Power builders, Scatec appears a little bit bit too “spicy” for me, subsequently I’ll “cross”.

206. Western Bulk Chartering

Western Bulk is a 68 mn EUR dry bulk perator that solely appears to constitution ships, not proudly owning them. Trailing KPIs appear to be very low-cost, however based on their final quarterly launch, outcomes appear to be roughly random. “Go”.

207. Nordic Unmanned

Nordic Unmanned is a 9 mn EUR market cap drone firm that truly has some gross sales however appears to urgently want capital. Because it’s IPO in Decmeber 2020, the inventory misplaced .95% of its worth. “Go”.

208. Univid

Univid is a 4 mn EUR nanocap that has simply modified its identify from DLTX and based on Euronext “wish to venture a way of unity, dedication, and shared dedication to a standard purpose”. That’s very humorous however nonetheless, “cross”.

209. Interoil Exploration and Manufacturing

Interoil, with a market cap of 15 mn EUR is, shock an oil firm and “engaged in acquisition, exploration, improvement and operation of oil and gasoline properties, and serves as operator and energetic license companion in a number of manufacturing and exploration areas in Argentina and Colombia”. Thanks, “cross”.

210. BW Ideol

BW Ideol is a 32 mn EUR market cap firm that’s in some way energetic in floating offshore wind. Evidently money is working out however lcukily a companion made a suggestion at 12 NOK per share which it appears will shut quickly. Sharehodler who purchased this within the 2021 IPO misplaced -75%. “Go”.

211. Var Power

Var Power is a 8 bn EUR market cap oil upstream firm that’s majority owned by ENI and was spun-off/Ipoed in 2022. The inventory appears to be like fairly low-cost. For individuals focused on Skandinavian oil firms, this may very well be fascinating, for me it’s a “cross”.

212. Elkem

Elkem is a 970 mn EUR firm that “develops silicones, silicon merchandise and carbon options, serving to its clients create and enhance electrical mobility, digital communications, well being and private care in addition to smarter and extra sustainable cities.”.

That sounds nice however the inventory has misplaced -50% within the final 8 months or so:

Elkem had 2 excellent years in 2021 and 2022 however 2023 appears to be like much less good. Generally the enterprise appears to be very cyclical and power intensive. The corporate is majority owned by a HoldCo. “Go”.

213. GC Rieber Delivery

Because the identify says, this 67 mn EUR market cap firm is energetic in transport. On the time of writing, the 92% majority holder simply made a voluntary provide for the rest of the shares. “Go”.

214. Totens Sparebank

Totens is a 100 mn EUR market cap “unbiased native financial institution established in 1854, and has its main marked within the area round Mjøsa”. Because it’s Norwegian friends, it appears to be like low-cost and pays a excessive dividend. However, I’ll “cross”.

215. Biofish Holding

Biofish is a 8 mn EUR microcap that focuses on “small fish” or “smolt – juvenile fish destined for aquaculture services”. The corporate has been IPOed in 2021 and as a lot of its vinatage friends, misplaced round -95% since then. “Go”.