The S&P 500 (SPY) is flirting with a break beneath the 200 day transferring common. A part of the story you already know…that in regards to the current speedy rise in bond charges. Sadly there may be an much more ominous a part of this story that must be informed at the moment. That’s the reason 43 yr funding veteran tries to simplify the dynamics behind the doubtless looming Debt Supercycle. Learn on beneath for the total story.

Generally the investing panorama is extremely easy. Like 85% of your lifetime the financial system has been increasing and the inventory market is bullish. After which from that interval of extra a recession comes alongside making a bear market the opposite 15% of the time.

Every is simple to see when you’re in the midst of that part. Sadly, it’s slightly harder to know which it’s for positive on the cusp of the place the 2 durations meet. And that’s the place we discover ourselves at the moment.

On high of that we now have an financial boogeyman that has been swept below the rug time after time that has reared its ugly head as soon as once more. Sooner or later we should pay the piper for this with a long run interval of beneath development progress and weak inventory costs.

Has that dreadful time arrived?

That and extra shall be on the coronary heart of this week’s Reitmeister Complete Return commentary.

Market Commentary

Let’s begin our dialog at the moment with the precariousness of the technical image for the inventory market.

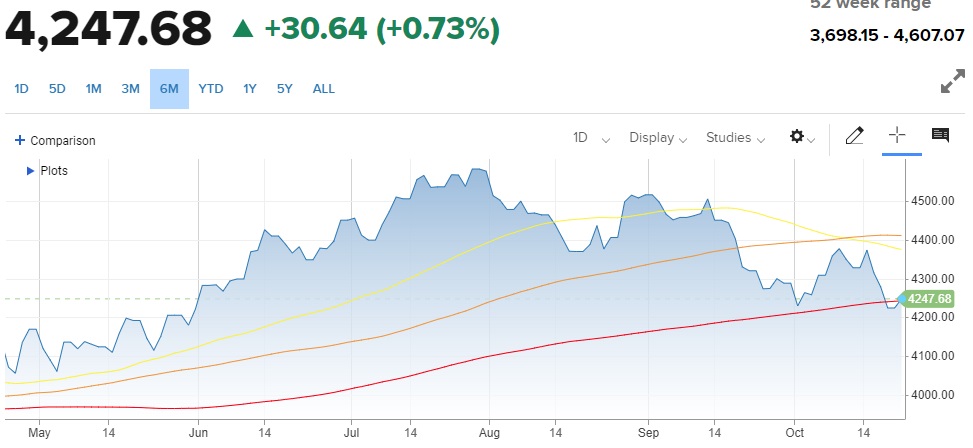

Transferring Averages: 50 Day (yellow), 100 Day (orange), 200 Day (pink)

The 200 day transferring common for the S&P 500 (SPY) is essentially the most very important of the long run development strains. It common pays to be extra aggressive above that stage…and conversely, to be extra defensive below that mark. That’s the reason this week’s tangle with this essential technical stage at 4,237 deserves all of our consideration.

Monday we closed beneath for the primary time in a number of months. After which Tuesday we climbed again above. That is the second such take a look at of this key stage and as most of unhealthy issues usually are available in teams of three. Which means I doubt that is our final dialog about doubtlessly breaking beneath.

Due to the above battle and elevated odds we spend a while beneath this key stage, I’ve moved the Reitmeister Complete Return portfolio all the way down to 74.5% invested. Arduous to name that bearish by any stretch.

Slightly it’s an acceptable dose of warning due to the elemental dynamics happening. A few of it has already mentioned in earlier commentaries about how bond charges are “normalizing” again to traditionally common ranges from artificially suppressed ranges.

If that’s the solely issues at play, then doubtless we’re fairly near the peaks in these bond ranges and bull market ought to resume from right here. (Learn extra about this dynamic in my current commentary right here)

BUT WHAT IF THIS TIME IS DIFFERENT?

That’s the most harmful expression in all of investing…however all the time one value considering. Particularly as we digest this subsequent matter.

Maybe this isn’t about fee normalization, however slightly the oncoming of the Debt Supercycle.

John Mauldin goes in depth on this matter as soon as once more in his very provocative weekend commentary. Actually a should learn you will see right here.

I’ll attempt my finest to simplify the dialogue with the next.

Far too most of the world’s governments are overextended with debt. Check out this nation by nation listing with america coming in with the 9th worst Debt to GDP ratio.

Everyone knows its unsustainable. Sooner or later it can should be paid again But amazingly yr after yr…and decade after decade we sweep it below the rug. Sooner or later the piper will should be paid.

Solely 2 methods to pay it down. And each are horrible for inventory traders.

Deficit Discount: First, it will by no means occur. Actually unhappy however each political events within the US are so beholden to particular pursuits with their arms out, that neither has confirmed any fiscal self-discipline in DECADES. And simply since you stability the finances for a yr or two…would not actually do something to chop down the $33.63 trillion in debt already accrued. And the price of serving that debt is simply going greater by the minute (particularly on this greater fee atmosphere).

However pushing again the laughter, lets think about some different universe the place we elect politicians disciplined sufficient to drag this off. WELL that could be a recipe for recession because the Authorities presently represents 25% of GDP. So even a modest 5% discount in authorities spending would tilt the financial system into recession. And by the way in which…5% ain’t gonna reduce it to make the wanted dent in our mountain of debt.

Once you add up the above you admire that this most popular path to debt discount continues to be a recipe for catastrophe. So, let’s transfer on to the even worse consequence…

Debt Disaster: Think about the Greece state of affairs from a decade in the past…and now make it about 50X worse. As a result of if the US or Japan begin coming below stress it doubtless can have a domino impact to wipe out the remainder of the weaklings….which is most everybody. That’s the reason some name this the Debt Tsunami.

The 16 yr interval of ultralow charges we’re rising from was very useful to those governments to maintain piling on the debt as a result of its fairly straightforward to pay again at long run charges of 0 to 2%. That occasion is unravelling proper now as famous above.

The principle query is whether or not charges are simply “normalizing” again to extra real looking historic ranges…or is that this a extra painful strategy of world debtors saying its “time to pay up”.

Sure, we now have been very lucky that we preserve avoiding that day of reckoning. However once more…this time may very well be completely different. In that regard, let me share with you the important thing part from Mauldin’s article on the subject of confidence:

“Maybe greater than the rest, failure to acknowledge the precariousness and fickleness of confidence—particularly in circumstances by which giant short-term money owed should be rolled over constantly—is the important thing issue that provides rise to the this-time-is-different syndrome. Extremely indebted governments, banks, or companies can appear to be merrily rolling alongside for an prolonged interval, when bang! — confidence collapses, lenders disappear, and a disaster hits.”

Reity, this can be a scary thought…are you saying that is what is occurring now?

In all probability not…but it surely’s not out of the query. Which is why it is acceptable to take a extra conservative strategy with our investing proper now. Additionally sensible to eliminate our positions most tied to greater charges (which we did this morning).

This can be a exhausting matter for me personally. I completely HATE owing individuals cash. All the time did.

Thus, I might keep away from borrowing except completely vital. After which would completely pay again earlier than anybody requested for the cash.

Now why I am not a politician 😉

The purpose being that I’m very delicate on this topic. Nevertheless, it would not actually take a fiscally accountable individual like myself…or a rocket scientist, to understand that this case is untenable in the long term.

The troublesome half is saying if that disaster of confidence is beginning now. Or we get to kick that may down the street as soon as once more. However due to the large query mark lingering on the market, it appears solely acceptable to be extra conservative/defensive in our strategy.

Do take into account this…the US continues to be one of many higher bets for debtors and sure the primary cracks would happen elsewhere…with different extremely indebted nations.

(See chart beneath…2nd column is % of debt to nationwide GDP)

My sense is {that a} smaller, extremely indebted participant like Singapore or Italy would present cracks first of their debt. If that occurred, then just like the Greece state of affairs it might be sensible for all of us to honker down in rather more defensive portfolios postures in case the dominos preserve falling to different nations just like the US.

Sure, it might create a recession. And sure shares would tumble right into a nasty recession. And it might keep darkish for fairly some time to work its approach out.

Gladly we know how to make income in that atmosphere:

Promote all shares > purchase inverse ETFs to rise in worth because the market declines.

However once more…possibly that’s not taking place. And we’re simply coping with the extra benign fee normalization points. In that case, we must always really feel good that charges have peeled again a notch this week as 2 of the most important bond merchants, Invoice Ackman and Invoice Gross, are each now betting on charges happening from right here.

Simply so as to add yet another wrinkle to the story. It is usually potential that charges have normalized and that the discount in charges from right here is from elevated concern {that a} recession is coming.

Which means the rationale that the Fed is now anticipated to sit down on their arms for the following two conferences is as a result of the rising of charges outdoors of their efforts is little doubt going to gradual the financial system from the 4% tempo that doubtless will get introduced on Thursday.

Gladly slowing from 4% provides quite a lot of cushion to not tip over into recession. Simply moderating to 1-2% progress would nonetheless doubtless be ample backdrop to remain bullish. Sadly historical past reveals many recessions forming proper after a strong financial studying.

A slowing financial system shouldn’t be essentially like a automotive that’s pumping its breaks to slowly ease right into a pink mild. Typically it’s like slamming the brakes with everybody flying via the windshield into the following recession.

Sure, I’m fairly the ray of sunshine at the moment 😉

Nevertheless, I believed it was very important to get all of the real looking prospects on the desk. And that we’re in wait and see mode for what comes subsequent.

If simply one other in an extended line of false alarms with charges leveling out and financial system rolling ahead, then we are going to get again to 100% bullish quickly sufficient.

Alternatively, if odds of recession, and even worse, whiffs of a debt disaster choose up, then we are going to at first turn out to be extra defensive and finally bearish with inverse ETFs.

The purpose is that we have to see what occurs after which react in variety. Gladly we all know what to do and can react shortly to make one of the best of the state of affairs.

What To Do Subsequent?

Uncover my present portfolio of 6 shares packed to the brim with the outperforming advantages present in our POWR Scores mannequin.

Plus I’ve added 3 ETFs which can be all in sectors nicely positioned to outpace the market within the weeks and months forward.

That is all primarily based on my 43 years of investing expertise seeing bull markets…bear markets…and every part between.

In case you are curious to study extra, and wish to see these 9 hand chosen trades, and all of the market commentary and trades to come back….then please click on the hyperlink beneath to get began now.

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares fell $0.63 (-0.15%) in after-hours buying and selling Tuesday. Yr-to-date, SPY has gained 12.00%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Writer: Steve Reitmeister

Steve is healthier recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Study extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

The submit Bear Market Warning from the Bond Market? appeared first on StockNews.com