Disclaimer: This isn’t funding recommendation. PLEASE DO YOUR OWN RESEARCH !!!

- Introduction

- “Catalyst”: Lowball bid from Majority shareholder

- Delisting in Denmark – what I discovered to this point

- Majority Shareholder Thornico

- What’s Thornico’s final purpose ?

- State of affairs Evaluation, Dangers & Abstract

- Introduction

Broeder. Hartmann (to not mistake with Paul Hartmann AG) is an organization I checked out throughout my All Danish Shares sequence in final July. I feel it might be truthful to name it a “hidden champion”. Their enterprise mannequin is targeted nearly 100% on egg packaging which as such is already one thing I like loads. Their essential product appears like this (solely the field, not the content material):

Or this:

Extraordinarily attractive product, isn’t it ? In actuality, in addition they appear to supply paper primarily based apple packaging in Brazil and India, however egg cartons are their essential product.

In Mid 2022, after I checked out them first, the corporate was nonetheless struggling. That is what I wrote then:

From the basic aspect, issues appear to look loads higher lately. In 2023, they’ve up to date the steerage already 2 instances as may be seen on this desk from the half yr report:

The share worth has principally not reacted to this and remains to be ~-50% in comparison with the height:

As of now, they commerce at a 6,7x EV/EBIT (2023) which is sort of low cost for a enterprise that has respectable margins and returns of capital and is globally diversified regardless of its small measurement. Right here a fast overview on some indicators:

TIKR to this point has not up to date estimates for 2023, so in TIKR the inventory appears dearer for 2023 than the up to date Steerage signifies..

Money Circulate has additionally recovered properly. It’s onerous to foretell this however taking a look at this chart from the 6M report, I might guess that at present they commerce at no less than 10% FCF/EV yield:

I’m not positive if that stage is sustainable. By the best way, reporting is sort of good for a small firm.

- “Catalyst”: Lowball bid from Majority shareholder:

The bulk investor (Thornico Holdings, 69%) simply has launched an opportunistic low ball bid at DKK 300 and needs to delist and squeeze out minority shareholders. This has been preceded by one other particular board assembly, the place Thornico exchanged a couple of of its board members with a view to “align higher with the Technique” of Hartmann. Just a few weeks later, Hartmann’s CFO resigned and was changed.

To present credit score the place it’s due: I used to be alerted to this by a Twitter thread from a younger (native ?) investor:

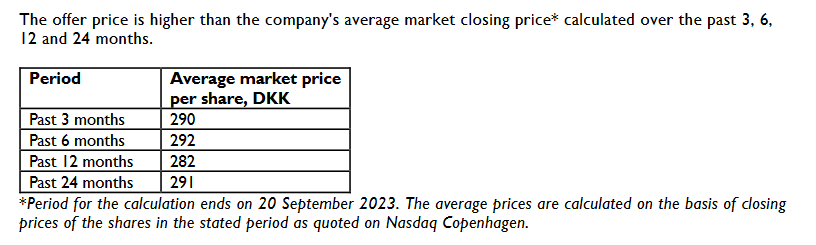

Though I might not see it as a “scandal”, it’s clearly an opportunistic lowball bid. They justify the quantity within the provide by stating that that is above the typical as lined out within the firm communication:

3) Delisting in Denmark – what I discovered to this point

In accordance with a number of sources, a Delisting in Denmark must be permitted by 90% of all shareholders. This appears to have been applied solely in 2020, earlier than it was simpler to delist (solely ⅔ vote required).

It appears to be that the Inventory alternate (not the regulator) is allowed to resolve if a proposal is cheap or not. Nonetheless, based on the unique doc, they’d not decide the valuation, simply whether it is completely unreasonable or not:

With their present 69%, there appears to be little probability that they may get even near the 90% required. A variety of buyers could be anchored on the upper costs from 2-3 years in the past and may (rightfully) take into account this as a lowball bid.

The particular shareholder assembly is scheduled October sixteenth. If 90% of the shareholders settle for and the inventory alternate doesn’t reject the provide, sharholder may have 4 weeks to promote the shares to Thornico at 300 DKK.

4) Majority Shareholder Thornico

The principle shareholder, Thornico is a holding firm owned by Father (Thor) and son (Nicholas) Stadil. Here’s a image of those 2 Gents:

The Group is energetic in Meals, packaging, Sports activities gear and actual property. Inside packaging, there are two different corporations, one in China and one in Malaysia.

Nonetheless, essentially the most related Group firm that pertains to Hartmann is Sanovo, an organization that gives each possible expertise round egg manufacturing, together with packing machines. I might think about that combining Hartmann and Sanovo might make a whole lot of sense. Curiously, Hartmann purchased a packaging firm from Sanovo known as Sanovo Greenpack in 2014.

Lately, there appeared to have some troubles within the empire, particularly within the now discontinued transport phase the place they needed to endure a chapter.

Thornico has purchased its first stake in 2011 based on the annual report and again then supplied to purchase all shares at DKK 95:

In 2012 then, Thornico elevated its stake to 68,5% after buying the shares from the opposite two large shareholders:

In 2013, Thonrico barely elevated their stake to 68,6%, however since then the stake has remained fixed, though based on TIKR they’ve elevated their stake to 69% (Half yr report nonetheless says 68,6%).

In accordance with an article, D/S Norden paid ~60 mn USD to Thonrico for the transport actions, that means that they may have some money mendacity round to fund a rise within the Hartmann stake.

Christian Stadil curiously has his personal private web site the place he presents himself as a mix of visionary, artist and martial arts knowledgeable. He additionally appears to have created a Champagne label that ought to be drunk straight from the bottle.

General, they appear to be fairly shrewed capital allocators.They purchased the preliminary stake in B. Hartmann at a really attention-grabbing time limit at round 100 DKK/Share and have recovered most of this already by dividend funds. I don’t assume that they’re evil guys, however in addition they don’t appear to throw round cash both.

5. What’s Thornico’s final purpose ?

- In the event that they actually need to delist, they have to know that 300 is just too low as there is no such thing as a premium. So with a view to get extra shares they have to make a better bid

- Possibly they need to scare buyers and simply need to improve their shares for reasonable

- Possibly it was a really opportunistic transfer they usually gained’t pursue it additional if it fails

My present impression is that they actually need to do away with minorities, particularly as a result of they began with a board reshuffle. Hartmann can also be their solely listed holding, so I suppose they like to have every little thing non-public. As well as, I feel they may need to hyperlink Hartmann nearer to their different “egg associated” actions as I suppose that clients do overlap loads.

My guess is that they’re possibly afraid that the inventory will get too costly if the turnaround is confirmed and Hartmann would present an incredible FY 2023 end result. 300 DKK per share could be the bottom worth they will bid as a starter, in any other case the inventory alternate may instantly name this unreasonable. Shrewd as they’re, possibly they thought: I’ve to extend the bid anyway, so let’s begin with the bottom doable quantity to anchor folks on this.

If that’s true, I suppose they might want to provide you with a proposal that’s clearly greater than the present 300 DkK at a later time limit.

6. State of affairs Evaluation & Abstract:

So in precept we’ve 3 base situations:

- Provide will get accepted at 300 DKK by greater than 90%, Inventory will get delisted.

- Most shareholders don’t settle for and life goes on as earlier than

- Thornico will increase its provide to get above 90% after which delists subsequently

Personally, I feel 1) could be very unlikely. 2) is clearly extra seemingly. For 3) one might assume totally different costs at totally different possibilities.

That is my first try at modeling the case primarily based on a share worth of 310 DKK for a time of 6 months:

For a lapse of the provide, I assumed that the share worth goes right down to the bottom worth YTD 2023 which was 269 DKK, which I feel is conservative.

Summarized over my assumed situations, the anticipated return is ~18,3%. After all, all or any of my assumptions may very well be utterly improper, however I do assume that that is attention-grabbing as a particular state of affairs.

Personally, I do assume the draw back is sort of restricted because the inventory actually appears low cost and enticing stand-alone, however one by no means is aware of. In concept, Hartmann would even be a superb funding in the event that they don’t improve the bid, however for now I solely see it as a Particular state of affairs with a time horizon of 6-12 months.

There are clearly dangers, as all the time. The worst case situation could be that the free float will get smaller, let’s say to twenty% and subsequently, the financial state of affairs once more will get dangerous for one motive or the opposite. In such a situation, there may very well be clearly a draw back to the inventory which I attempt to seize within the “provide lapses” situation. Possibly the likelihood is greater than 20%, however who is aware of ?

I due to this fact allotted ~2,5% of the portfolio into this Particular state of affairs. I’ve funded this through additional gross sales of Schaffner.

The sport plan is to revisit the case no less than after 6 and 12 months until one thing occur like a better bid or so.

Disclaimer: This isn’t funding recommendation. PLEASE DO YOUR OWN RESEARCH !!!

P.S.: I might be very grateful for extra details about Danish regulation with regard to delisting

P.S.2: Though it doesn’t relate on to Hartmann, a put up about egg packaging should include this Video snippet from German purpose keeper legend Oli “The Titan” Kahn:

Oliver Kahn finest second: Eier wir brauchen Eier!

P.S. 3: I additionally appeared on the Hafen Hamburg State of affairs. Nonetheless I Like this one significantly better.