On November 30 2022, OpenAI launched the AI chatbot ChatGTP, making the newest technology of AI applied sciences broadly obtainable.

Within the few months since then, we’ve got seen Italy ban ChatGTP over privateness issues, main know-how luminaries calling for a pause on AI programs improvement, and even outstanding researchers saying we must be ready to launch airstrikes on knowledge centres related to rogue AI.

The speedy deployment of AI and its potential impacts on human society and economies is now clearly within the highlight.

What is going to AI imply for productiveness and financial development? Will it usher in an age of automated luxurious for all, or just intensify present inequalities? And what does it imply for the function of people?

Economists have been finding out these questions for a few years. My colleague Yixiao Zhou and I surveyed their outcomes in 2021, and located we’re nonetheless a great distance from definitive solutions.

The large financial image

Over the previous half-century or so, employees world wide have been getting a smaller fraction of their nation’s complete revenue.

On the identical time, development in productiveness – how a lot output might be produced with a given quantity of inputs similar to labour and supplies – has slowed down. This era has additionally seen large developments within the creation and implementation of data applied sciences and automation.

Higher know-how is meant to extend productiveness. The obvious failure of the pc revolution to ship these beneficial properties is a puzzle economists name the Solow paradox.

Will AI rescue international productiveness from its lengthy droop? And in that case, who will reap the beneficial properties? Many individuals are interested by these questions.

Whereas consulting companies have usually painted AI as an financial panacea, policymakers are extra involved about potential job losses. Economists, maybe unsurprisingly, take a extra cautious view.

Radical change at a speedy tempo

Maybe the only biggest supply of warning is the large uncertainty across the future trajectory of AI know-how.

In comparison with earlier technological leaps – similar to railways, motorised transport and, extra just lately, the gradual integration of computer systems into all elements of our lives – AI can unfold a lot quicker. And it may do that with a lot decrease capital funding.

It’s because the appliance of AI is essentially a revolution in software program. A lot of the infrastructure it requires, similar to computing units, networks and cloud providers, is already in place. There isn’t any want for the gradual means of constructing out a bodily railway or broadband community – you need to use ChatGPT and the quickly proliferating horde of comparable software program proper now out of your telephone.

Additionally it is comparatively low-cost to utilize AI, which drastically decreases the obstacles to entry. This hyperlinks to a different main uncertainty round AI: the scope and area of the impacts.

AI appears seemingly to seriously change the best way we do issues in lots of areas, from schooling and privateness to the construction of worldwide commerce. AI could not simply change discrete parts of the economic system however fairly its broader construction.

Ample modelling of such advanced and radical change could be difficult within the excessive, and no person has but finished it. But with out such modelling, economists can’t present clear statements about seemingly impacts on the economic system total.

Extra inequality, weaker establishments

Though economists have totally different opinions on the influence of AI, there’s normal settlement amongst financial research that AI will enhance inequality.

One doable instance of this might be an additional shift within the benefit from labour to capital, weakening labour establishments alongside the best way. On the identical time, it might additionally cut back tax bases, weakening the federal government’s capability for redistribution.

Most empirical research discover that AI know-how won’t cut back total employment. Nonetheless, it’s more likely to cut back the relative quantity of revenue going to low-skilled labour, which can enhance inequality throughout society.

Furthermore, AI-induced productiveness development would trigger employment redistribution and commerce restructuring, which might are inclined to additional enhance inequality each inside international locations and between them.

As a consequence, controlling the speed at which AI know-how is adopted is more likely to decelerate the tempo of societal and financial restructuring. This may present an extended window for adjustment between relative losers and beneficiaries.

Within the face of the rise of robotics and AI, there’s chance for governments to alleviate revenue inequality and its damaging impacts with insurance policies that goal to scale back inequality of alternative.

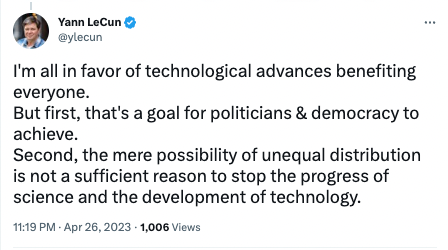

Yann LeCun, Meta’s Chief AI Scientist, had some views on the best way ahead for AI on Twitter this week.

What’s left for people?

The well-known economist Jeffrey Sachs as soon as mentioned

What people can do within the AI period is simply to be human beings, as a result of that is what robots or AI can’t do.

However what does that imply, precisely? At the least in financial phrases?

In conventional financial modelling, people are sometimes synonymous with “labour”, and likewise being an optimising agent on the identical time. If machines cannot solely carry out labour, but additionally make selections and even create concepts, what’s left for people?

The rise of AI challenges economists to develop extra advanced representations of people and the “financial brokers” which inhabit their fashions.

As American economists David Parkes and Michael Wellman have famous, a world of AI brokers may very well behave extra like financial principle than the human world does. In comparison with people, AIs “higher respect idealised assumptions of rationality than folks, interacting via novel guidelines and incentive programs fairly distinct from these tailor-made for folks”.

Importantly, having a greater idea of what’s “human” in economics must also assist us assume via what new traits AI will convey into an economic system.

Will AI convey us some sort of basically new manufacturing know-how, or will it tinker with present manufacturing applied sciences? Is AI merely an alternative to labour or human capital, or is it an unbiased financial agent within the financial system?

Answering these questions is significant for economists – and for understanding how the world will change within the coming years.![]()

- Yingying Lu, Analysis Affiliate, Centre for Utilized Macroeconomic Evaluation, Crawford College of Public Coverage, and Financial Modeller, CSIRO

This text is republished from The Dialog beneath a Artistic Commons license. Learn the authentic article.