Verify-Cap (CHEK) (~$12MM nano cap) is an Israeli based mostly clinical-stage medical gadget firm that’s buying and selling properly beneath money and not too long ago introduced that it employed Ladenburg Thalman (they’ve generated a couple of buzzy reverse mergers previously) to run a strategic alternate options course of. The corporate beforehand was growing a colon most cancers screening take a look at however these efforts failed and alongside the strategic assessment announcement, Verify-Cap additionally introduced they’re shedding 90% of their workforce, totally elevating the give up flag.

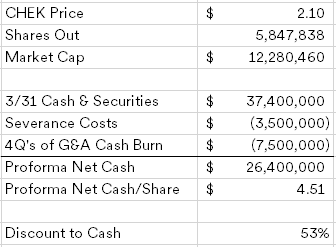

Operating it via a very fundamental liquidation evaluation (it ought to be famous the corporate did not embrace a liquidation within the listing of strategic various choices, however slightly they’re taking a look at a sale, licensing settlement or reverse merger):

The severance prices for the 90% discount in drive weren’t disclosed, in order that’s a guess, together with the G&A, however this one nonetheless trades at a large low cost to what it may distribute in a liquidation. Now there are some purple flags, I do not see a big shareholder to guard shareholder pursuits and the international firm itemizing and elevating cash within the U.S. danger is current right here, though not solely unusual for biotech/bio medical gadget corporations to be based mostly in Israel.

Observe this can be a tiny firm, do not use market orders, however the low cost right here is vast sufficient for me so as to add a small place to my rising basket of damaged biotech liquidation candidates.

Disclosure: I personal shares of CHEK