The Federal Reserve, which last cut interest rates in December 2024, lowered interest rates .25% on Wednesday.

Officials implied that there would be two more cuts to follow later this year. The committee meets in two months, on October 28 and 29. “In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook,” the committee wrote in a press release.

EY-Parthenon Chief Economist Gregory Daco told Entrepreneur in a statement that, although inflation is picking back up, “economic activity and employment are simultaneously slowing,” causing the balance to tilt toward more rate cuts. He also predicted that there would be two more rate cuts to follow this year.

Here’s how the interest rate cut could impact your wallet.

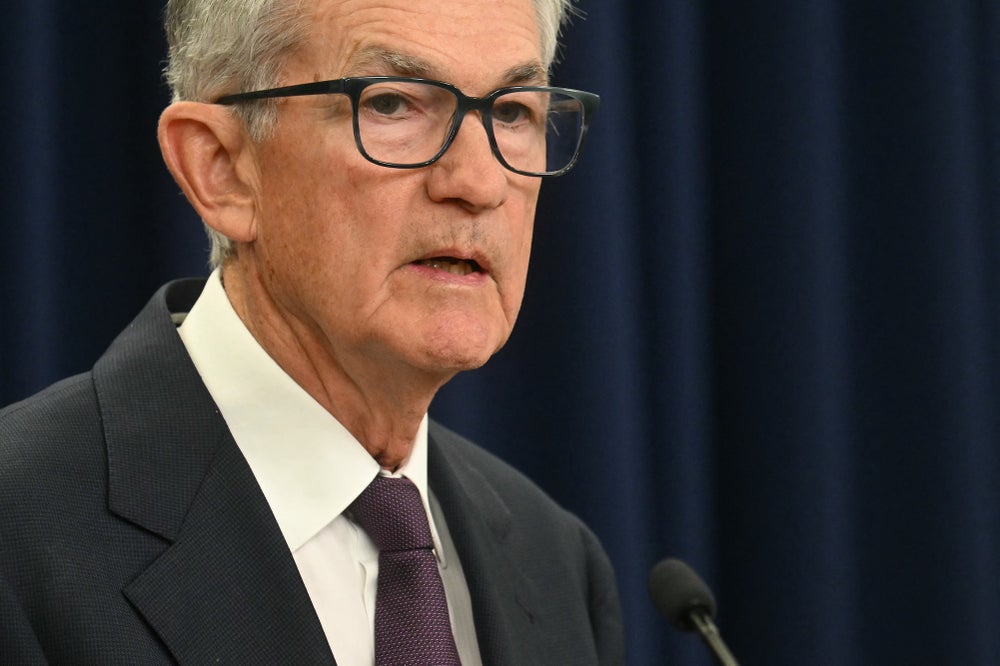

U.S. Federal Reserve Chair Jerome Powell speaks at a news conference at the Federal Reserve headquarters, following the Federal Open Market Committee (FOMC) meeting in Washington, DC, on September 17, 2025. JIM WATSON/AFP via Getty Images

U.S. Federal Reserve Chair Jerome Powell speaks at a news conference at the Federal Reserve headquarters, following the Federal Open Market Committee (FOMC) meeting in Washington, DC, on September 17, 2025. JIM WATSON/AFP via Getty Images

Why did the Fed cut rates by a quarter percentage point?

Economists and industry experts predicted a 94% chance of a quarter percentage point (0.25%) cut, following data released earlier this month that showed that hiring was slowing, and inflation was 2.9% in August, an increase from July’s 2.7% and higher than the Fed’s preferred 2% target.

The central bank’s rate-setting committee, the Federal Open Market Committee (FOMC), has kept interest rates within the 4.25% to 4.5% range for the past nine months as its members analyzed economic activity. The FOMC decides on rate cuts based on two broad goals: minimizing inflation and maximizing economic activity in the labor market. Wednesday’s rate cut now lowers the range to 4% to 4.25%.

Related: Here’s What a Federal Rate Cut Means for Small Businesses, According to Analysts

When is the next Fed meeting, and what is expected?

The Fed meets eight times a year in regularly scheduled meetings to set U.S. monetary policy. The FOMC sets the target range for the federal funds rate, the interest rate banks use to lend to each other, which influences broader rates that affect consumers, like credit card interest rates.

The committee meets two more times in 2025: October 28-29 and December 9-10, according to the official calendar.

Officials indicated two more possible rate cuts this year.

How does the Fed affect mortgage rates?

The Federal Reserve’s decision does not directly affect mortgage rates because mortgage rates are tied to 10-year Treasury bonds. So, a lower federal funds rate does not necessarily mean lower mortgage rates, Melissa Cohn, Regional Vice President of William Raveis Mortgage, told Entrepreneur.

“The Fed cut will not cause mortgage rates to change,” Cohn said in an emailed statement.

Instead, “how the bond market reacts to the Fed cut will determine the direction of mortgage rates,” and what Powell says during the press conference will “be key to market reactions,” she wrote.

When faced with market uncertainty, investors buy Treasury bonds, driving mortgage rates down.

However, the bond market has already recently responded to news of a possible rate cut, with mortgage rates dropping to a three-year low on Tuesday ahead of the Fed meeting. As of Wednesday morning, the average interest rate for a 30-year fixed-rate mortgage was 6.24%, one of its lowest levels since early October of last year.

How does a rate cut affect credit cards?

Credit card interest rates tend to move in alignment with the federal funds rate, per Bankrate. So the 0.25% cut could have an impact on credit cardholders with a reduction of 0.25% to their interest rates.

Other market conditions, like inflation and the demand and supply of credit, affect the basis for most credit card interest rates. That’s why interest rates for credit cards as a whole have been increasing, from 15% in 2021 to more than 21% in 2025, despite rate cuts last year.

Credit card companies are charging higher interest rates than four years ago, per Bankrate.