Disclaimer: This isn’t funding recommendation. PLEASE DO YOU OWN RESEARCH !!!

Some days in the past, I made the case for a major improve in demand for insulation in Europe for the following a number of years. On this publish, I need to dig somewhat bit deeper into the primary listed gamers and which I discover extra fascinating. Generally, even just for the German talking area there are numerous firms that supply insulation, amongst them very massive, diversified teams equivalent to BASF, Dow Chemical and St. Gobain.

Nevertheless, the next listed firms are those that do nearly all of gross sales in insulation to my data:

Kingspan, Irleand/UK

Rockwool, Denmark

Recticel, Belgium

Steico, Germany

Sto SE, Germany

Sto, Rockwool and Recticel are already in my portfolio with comparatively small weights.

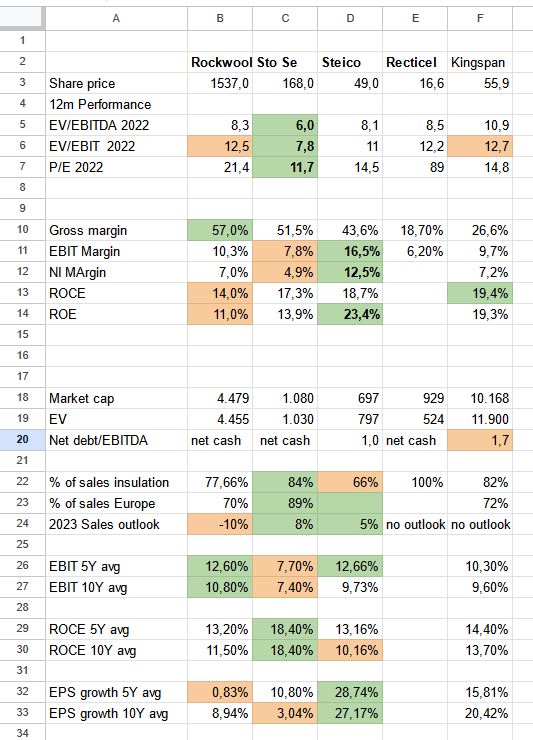

Earlier than leaping into the businesses, I’ve compiled a desk with just a few KPIs that i discover fascinating. One fast coment upfront: As Recticel is present process a signifcant transformation, their numbers are curently not comparable.

Possibly one reminder: These firms are all comparatively capital intensive manufacturing firms. These usually are not SaaS firms or “Razor and blade” companies. As well as, the general cycle within the development trade appears to point a recession in 2023 and doubtlessly past.

Nevertheless, even commoditiy firms can do very properly if the beginning valuation is low sufficient and demand is greater than capability for an extended time frame. And making an attempt to time a cycle in a cyclical trade will not be straightforward.

- Kingspan

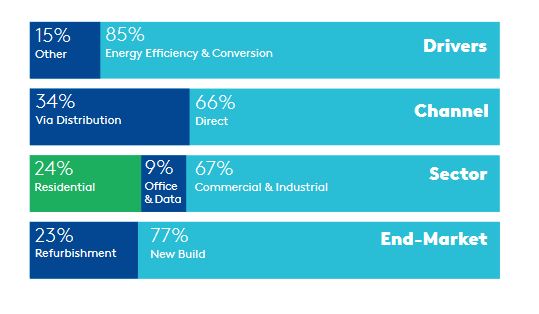

Kingspan is clearly the “Massive Kahuna” among the many European insulation specialists. It has the biggest market cap, the best ROCE and the perfect progress charges over 5 and 10 years. The primary cause why I feel it won’t be the only option for why I’m on the lookout for is that this graph from their annual report:

Kingspan Has 76% industrial publicity and 77% publicity to new construct. As my thesis largely facilities round refurbishment of residential dwellings, Kingspan doesn’t give me the publicity I’m on the lookout for. General, I do assume that Kingspan is an excellent firm and has a extremely cool emblem, however for me it’s a “cross”.

2. Rockwool

Rockwool is the second largest participant on this area. Apparently, Rockwool has the best Gross margin, however the lowest returns on funding and capital. It seems to be like, that melting rock is kind of capital intensive. What I like about Rockwool is that they appear to be properly managed and have “finest at school” investor communication.

Alternatively, they’re fairly pesimistic for 2023 and count on -10% gross sales in comparison with 2022.

Apparently, the inventory trades at a premium which I don’t take into account as absolutely justified, particularly because the “non insulation” segement is extra porfitable than insulation and may get hit more durable from a decline in new development.

As a consequence, I made a decision to truly promote the ~1% stake in Rockwool because it seems to be rather a lot much less engaging on a number of dimensions than its rivals.

3. Recticel

Recticel, the Belgian participant is an fascinating mixture of Particular State of affairs and future Insulation pure play. Recticel was once a diversified group, doing foam matraces, automobile supllier and insulation. The final step of this refocusing was supposed to be the sale of the engineered foam enterprise for 685 mn UER in money to US Group Carpenter.

The transaction was supposed to shut in 2022, however then delayed to 2023. A couple of days in the past, Recticel talked about that Carpernter desires to “renegotiate” the deal. They tried to “cover” it within the Q1 buying and selling replace:

With regard to the primary transaction, Carpenter has not too long ago requested a considerable value adjustment to the acquisition value, invoking the present total buying and selling evolution. Recticel is contemplating all its choices on this regard.

The share value received hammered by -25% (or -250 mn market cap) by this announcement as we are able to see within the chart:

Recticel is clearly fascinating as a particular scenario, however for now, for simply getting publicity to European insulation, it won’t be the perfect candidate. I subsequently determined to additionally promote my Recticel shares however will preserve them on shut “watch”.

4. Sto Se

Now we come to the primary German competor, Sto SE. Sto is a household owned firm that reveals first rate returns on capital however comparatively low margins. On the plus aspect, the corporate could be very moderately valued, has vital publicity to European (and German insulation) and had “okay” progress within the final 5 years. In addtion, profitability is according to long run averages.

Apparently, aside from Rockwool, Sto is kind of assured to have the ability to develop “mid single digits” in 2023 That is particularly outstanding as historically, they’re recognized to be fairly conservative. I haven’t seen numbers from Sto instantly, but it surely appears to be that round 70% of Sto’s enterprise is linked to renovation which may clarify their optimism.

What I discover fascinating is the truth that they’ve set themselves a fairly clear goal for 2025:

“The Sto Group is aiming for a turnover of EUR 2.1 billion and a return on gross sales of 10% in relation to EBT by 2025.”

This 210 mn EBT goal in 2025 compares to 128 mn EUR in 2022 or a rise of round +70%. Contemplating that Sto, a minimum of in my statement, guides quite conervatively, that is fairly astonishing however perhaps not unrealistic.

Simply once I was penning this publish, Sto has launched Q1 numbers for 2023. General, they had been weaker than 2022, however this may be attributed to the actually dangerous climate in Q1 and Sto upheld its 2023 outlook.

Wanting on the numbers, what’s outstanding that Sto has the bottom margins of all of the rivals. Why is that ? To my unerstanding the primary cause is that Sto, which sells “Facade insulation techniques” solely partially manufactures its personal insulation panels, but in addition sources panels from different producers. I discovered just a few articles that Sto began to provide personal panels solely in 2008 or 2010. Apparently, this permits Sto to supply all completely different sorts of insulations panels to prospects, though the bulk (60% or so) is polystyrol primarily based.

One other fascinating facet is that Sto appears to have their very own distribution community and solely partially promote through distributors. That is clearly tougher to start with, however as soon as it’s in place, an personal distribution system is commonly a bonus.

In a nutshell, Sto for me presents a extremely compelling threat/return profile: It has ample publicity to probably the most fascinating section, it has an already engaging valuation and considering their targets, Sto seems to be like a reallying compelling alternative to me. Due to this fact it justifies an a rise to a 4% place at present costs in my view.

5. Steico

Now to the second German participant, Steico. Steico is a participant that makes a speciality of wooden primarily based merchandise. Based mostly on 2022 numbers, Steico seems to be spectacular: they’ve the best margins and the perfect returns on capital. As well as, EPS progress over 5 and 10 years has been phenominal, even higher than Kingspan.

Nevertheless, historic numbers, particularly the final 2 years stand out as being far more worthwhile than up to now. As well as, Steico has extra publicity to common development than for example Sto, with Insulation solely at round 2/3 of gross sales, and even inside insulation, new builts play a job.

Wanting on the share prcie it’s also fairly apparent that Steico had actual issues following the monetary disaster earlier than it lastly took off like a rocket in 2020/21:

Alternatively, Steico managed to realize all of that progress organically by constructing vegetation and promoting extra stuff which, within the section of excessive investments, leads virtually routinely to decrease returns on capital. So one may moderately assume that perhaps the long run returns on capital are someplace between the expansion section and the 2020-2022 increase section.

Steico targets 650 mn of gross sales in 2026, which might be a 9% CAGR.

So total, Steico is clearly much less an insulation play than for example Sto, however however it’s also clear that it’s wooden primarily based merchandise are clearly gaining market share.

I subsequently determined to allocate 2% of the portfolio into Steico at present value. I admit, that there may be some dwelling bias at work, as Steico’s HQ is simply ~25 kilometers away from the place I reside.

Replace: Simply earlier than pushing the “Ship” button on this publish, a hearsay surfaced that the founder intends to promote his majority stake in Steico. This comes after a giant decline and simply earlier than the deliberate launch of the Q1 numbers. I’ve to say that this made me very nervous and determined to not make investments below these circumstances.

Abstract:

On the finish of the day, the insulation basket is now decreased to Sto with a 4% stake. Recticel is on watch in addition to Steico, which dropped out as a consequence of this final minute hearsay.